Trading with Focus – breaching the ASX rules (and blaming the robot)

Pic: Rommel Gonzalez / EyeEm / EyeEm via Getty Images

Although Stanley Kubrick’s movie version of ‘2001: A Space Odyssey’ was very good for its time, you probably needed to have read the book for a lot of it to make sense.

Unless you had already understood that the obelisk was an alien technology that was designed to kickstart intelligence amongst the local primate population, it would have appeared to the casual observer that a bunch of monkeys were just jumping around smashing things. For what seemed like a good half an hour.

So there’s a lot of parallels I could draw here. A bunch of sub-intelligent apes running around investment markets breaking things? That someone needs to find a new ‘intelligence obelisk’, and quick?

No, I’m going to go with Hal, the robot running the ship in ‘2001 etc’. Nice guy for an AI. Pretty damn helpful too, keeping the space craft on track, monitoring threats, probably making a mean cappuccino, being a bro.

But it didn’t all work out as planned. From memory it became a bit too smart for its own good and ended up throwing the whole thing into some sort of interdimensional wormhole.

The robot in Alien, bad. The robot in Aliens, good. Most of the Terminators, bad. Autonomous collision avoidance systems, good, but don’t work in every situation, bad. Too much reliance on technology and automation can be dangerous, so you need to monitor that it is working correctly and make sue you use it in the right circumstances.

A few weeks back we introduced our stop-loss orders for our clients, and as expected there were a lot of questions. Now I’ve never used stop-loss orders and probably never will, but I understand their use and potential value to someone who can’t watch the screen during the day. But I worry about people’s reliance upon them.

So what can go wrong with stop losses?

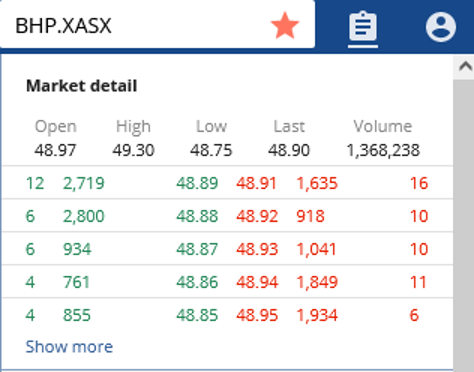

Firstly, there are certain stocks that they are completely appropriate to use them in. Large, high volume stocks that regularly have significantly more volume at each price point than you hold in your portfolio.

If you were holding $100k of BHP and put a sell order in at $1 less than the last traded price, there is a good chance that you will get filled in by the bid.

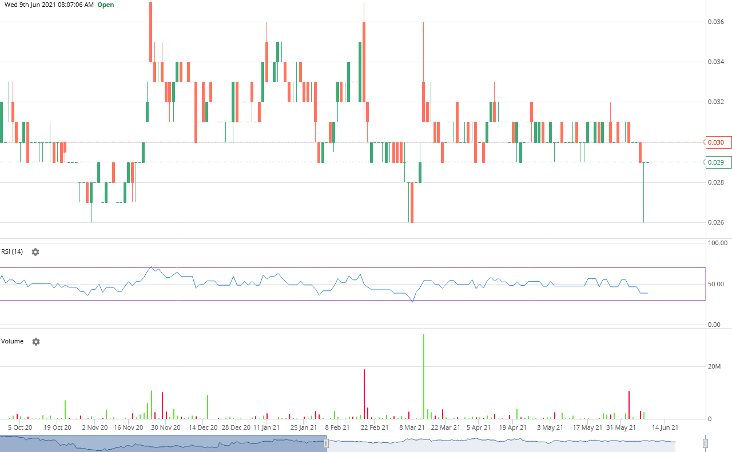

But if you were holding $100k worth of a smaller, thinly traded stock, there is a good chance you will crush the share price down significantly. I saw this happen yesterday, looks like it dipped down a tick in thin volume after a lengthy sideways period, then got slammed down 10% to their lowest level in months by a mere 1 million shares, or approx. $30k of stock. So, one seller made a $30m company worth $3m less with less than $30 grand.

Immediately that the offscreen buyers noticed the thing was getting slammed, (probably using our price alerts function), they jumped back in and it last traded for the day at the price it opened at. So if that was an automated stop loss, someone just lost a few grand unnecessarily.

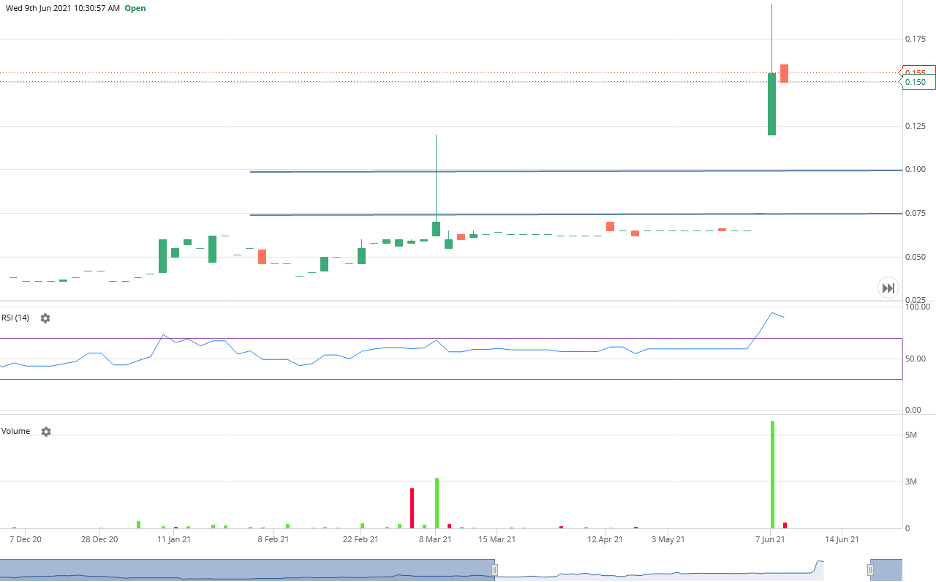

Then there is this bad boy. Came out with some sort of announcement yesterday and opened well above the last traded price.

Let’s pretend you thought it was appropriate to put in an automated buy order. You figured that if the price was above the recent ‘closing highs’ that maybe it was due for a run. So you popped in a trigger at 7.5c, and a ‘buy up to 10c’ order.

Then, because you didn’t set a news alert, you didn’t pay any attention when the stock opened at much higher than your ‘buy up to’ price, and now you’re still sitting in the queue, hoping it will retrace to you.

Stocks don’t trade at every price. Sometimes the stock goes into a trading halt and good (or bad) news happens, or sometimes the volumes are so light that there is daylight between the buys and the sells, and sometimes the market closes and reopens in a different spot.

The last biggie is that there is no guarantee that the order you trigger will be accepted by your broker, and even if it is, that it gets investigated for some reason or another, then denied. This entitled society of ours will argue that they are a ‘customer’ and therefore should be allowed to buy and sell whatever they damn want!

Well (K-word) you can’t. Apart from the usual issues of technology that can scarper your plans, or even just what we will politely call ‘user-error’, sometimes your order will be rejected for ‘potential breaches of the ASX rules’. So what are they?

This is a little trickier to define (and remember that I’m not a lawyer and this isn’t advice). The basis of the rules are that the ‘market participant’, in our case OpenMarkets, who are placing your trade into the market for you, are required by the ASX and ASIC to ensure they do not allow any orders that may breach the ‘Market Integrity’ rules. And the definitions are a little beige, to say the least.

In relation to stop-loss or conditional orders, this is the section of the ‘ASIC Market Integrity Rules (Securities Markets) 2017’ that refers to a ‘fair and orderly’ market:

“5.9.1 Market must remain fair and orderly

A Market Participant must not do anything which results in a market for a financial product not being both fair and orderly, or fail to do anything where that failure has that effect.

Maximum penalty: $1,000,000”

That’s it. I mean, without knowing the legal ins and outs of the legislation of having read it from beginning to end and without chasing up all the ASX Guidance Notes; if OpenMarkets allow you to place an order that ‘potentially’ damages the fairness and orderliness of the market, BAM, One Big Cheque. No court of appeal. And you know that anyone looking down the barrel of a $1,000,000 fine is going to be pointing fingers…

So this ‘fair and orderly’ stuff can take a few forms and different participants read that paragraph differently, but it is up to each Market Participant to define that short paragraph and apply the rules to the acceptance of your orders with their clients.

It might mean ‘don’t slam down $100k into a stock that doesn’t trade that sort of volume and crush the share price’. It might mean ‘don’t pay 50% above the last traded price just because there’s no sellers between 10c and 15c, put it in at 11c and then slowly move it up so that people can see that there is now a buyer above 10c’.

It definitely means ‘don’t put in fake bids and offers to make people think the stock is stronger of weaker’.

But after all of that, the biggest risk of all… something can go wrong. It may seem in this day and age that we should be able to rely on technology, but remember Hal. Remember the ASX itself was out of action for quite a while.

There are quite a few different individual pieces of technology between your finger and the ASX. Your phone or your PC knows that hitting a certain key or button in a certain location on a screen sends a message via some sort of invisible radio waves or cables to a server farm somewhere in the Eastern States run by a faceless corporation that then communicates it to OpenMarkets electronically that runs through an order router that has probably millions of messages running through it a day and it checks you have cash or shares then checks it against their version of pre-set ‘market integrity rules’ before then sending it to Chi-X, then the centrepoint, then the ASX, then the return message comes all the way back to your phone or PC before you can blink.

AKA, things can go wrong.

Because our platform is built for busy people on-the-go, the good news is that you can take the market with you anywhere that has phone reception. All of the features and tools are in both the PC and the app, meaning that you have a number of different ways of keeping an eye on things.

Maybe use the alerts function instead of a stop-loss if you aren’t a daytrader, maybe put your order higher or lower than your target price when you have the time to do so, and then when you get your alert ‘ping’ just flick open your phone, drag the line on the chart (that represents your order) up to market and hit accept. Some pre-planning and a couple of clicks might save you a lot of heartache!

So use our technology to its fullest, but understand its limitations. Remember that the ASX rules are there to protect you from others. Use stop-loss orders, but please, please, don’t ever swear at my client service team, they are still humans… (for now).

At Marketech our platform is about technology, providing you the tools and technology to trade. We encourage our high-function trading platform to get you live pricing, live charts, live market depth to ensure you have the tools and trading capability at your fingertips, and on your mobile phone or PC.

You trade your own stock on your individual HIN. It is your cash in your own Macquarie account where you keep the competitive interest you earn.

Our subscribers get access to brokerage starting at $5, and then 0.02 per cent for trades over $25k. If you want to trade the market you need immediate access wherever you are and the seamless Marketech mobile app means you are live anywhere anytime.

For more information, visit www.marketech.com.au. Any queries regarding Marketech should be directed to Marketech and not to Stockhead.

This article was developed in collaboration with Marketech Stockbroking Pty Ltd (AFSL 486148), a Stockhead advertiser at the time of publishing. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.