Trading with Focus — Anatomy of an overnight success

Pic: d3sign / Moment via Getty Images

Well, this has certainly proven to be an interesting year.

Going in, I already had my doubts. Markets were a bit too strong for the backdrop. Monetary policy was exhausted. There were growing issues with China and the US and Europe and I thought we would probably see some weakness.

Then, hold the phone… (You know what happened next, so let’s skip straight past all that.)

…but, by March, like Christmas coming early, we had a global money-printing extravaganza, a massive influx of retail investors, a tailwind behind all physical commodities and precious metals and it was the start of a speculators dream run with multi-bag payouts as far as the eye can see!

Forget stimulus cheques and lower interest rates, anyone that held or bought some speccy stock with half a sniff of value has seen their net worth increase significantly, with the last 5 months proving to be most lucrative.

I have had many a party over the years and many a hangover, but unlike Ruben (from Rick & Morty) I won’t have to have a theme park built inside me to make ends meet. I have a set of my own trading rules that I try to respect, that have kept me out of an asylum and off the streets. So far.

The general rule for me at a speccy stockmarket party, like any party I suppose, is that I should be gone before the lights come on. I might really want to stay. As the night goes on and the champagne continues to flow I might start thinking I can dance, I might even think I can sing – but that’s usually when the fights start. And worse, in stockmarket parties, like this one we are in now, no-one tells you the time so you’ll never know that it’s too late until it is.

Recently, one of my investments did the old 10-bag trick. I would love to report that I bought it at the low and sold it at the high, but I would be lying.

This particular story started at the end of the last mining boom, so it’s been a 7-year-long overnight success for me. I never heard the clock strike 2am back then, and it wasn’t so much of a sell-off as a death by a thousand cuts. By the time I knew for sure that the party was over I decided that I may as well keep dancing until the next party started.

(Just a quick reminder for the first-time reader. This diatribe isn’t advice, this isn’t a ‘how-to trade’ column. Mostly this is an explainer for why Marketech’s feature set is so important, for anyone trading the market that wants to stay on the right side of the poverty/mental health line.)

Stage 1 – The bold entry

Well, at the time, mining was booming and had been for a long time so this was the last of an extended multi-year commodities trade. In hindsight, I shouldn’t have been betting so much on an explorer at the end of a commodities boom, but I was pretty greedy after all those good times. I respected the management, liked the project, even went to see it in some far-flung country with a quick trip to Ibiza on the way home. The initial drilling had already driven the stock up 400% and it was (in my mind) going to the moon. Yes, it was mostly business class back then. Not now, though, obviously…

As the weakness slowly set in I decided to stick it out. I believed the underlying value of the project was sufficient to support the share price even with the growing headwinds. But I was completely wrong. The share price collapsed, the project was effectively wound up and the hunt for new projects began.

The stock ended up dropping >90% from peak to trough. It hurt a bit at the time and some expensive toys were sold off, but after a few tears I decided that management were sufficiently capable of keeping us afloat through the tough times and I would learn from the whole incident.

The whole sector was in the toilet but the best thing about commodity cycles are that there are commodity cycles. We would (possibly) rise again! Some day…

When commodities are weak, and speculators are nowhere to be found, that is when the best bargains can be had. Some of the best projects come up for sale in weak markets, and for cents on the dollar.

That’s why strong management is important. They need to understand the cycles, take advantage of the weak sector and have the foresight to buy the next big thing to explore or develop, and the ability to raise money when there’s no money around.

It’s easy for battle weary mining execs to be too cautious in a weak market, and too bullish in a strong one. As it is with traders too.

So check out the Annual Report, see what they’ve done before. Compare their wages to the industry standard. Did they invest any of their own money in the company?

While you’re there, check out the share register and try to gauge whether you’re in with the good crowd. Look for deep pockets, they’ll need them to support the company through a series of capital calls.

Like a true desperado, each time the stock went back to shell value I’d load up some more. The stock usually rallied mid-year-ish, so each time there was a drill campaign and a bit of market support I’d let a few go into the rally.

Never enough bought at the low, never enough sold at the high, but it was enough to make me feel a little better each time. I knew in my heart that eventually the project (that was actually coming along quite nicely) would be recognized.

And although I did not know what would be the catalyst, I certainly thought that one day there would be a catalyst. Turns out we were all waiting for a global pandemic.

So, again, in March we found ourselves back at the bottom.

Then, using the live charts, live depth and live alerts from Marketech Focus (only $45 a month!) I traded it like a champion and my brokerage on each trade was the cost of a cup of coffee. I was back, baby! So, let me throw open my playbook.

Stage 2 – Entry. Again. And the Battle with Fear.

I knew it had bounced at or around a certain value after each sell-off, regardless of how bad the markets were. “Strong support”, they call that.

Even though there were a lot more shares on issue each year as they funded the ongoing drill campaign, for some reason buyers always thought it was value at a certain minimum price point.

COVID-19 created a lot more fear, so it fell a couple of ticks lower this time, but by this stage the selling volume was weakening.

The last few weak hands…they call that capitulation and it happens at the bottom as the last lot throw in the towel to get the missus off their back. It’s the best!

You could see it in the depth – buyers only taking what was offered on the screen, obviously sitting back trying to get the shares cheaper, not putting big orders on the buy side.

Then, a slow reversal over a period of a week or two. Initially it was just a few more buyers than sellers on the screen, and then the buyers had to start paying up.

A few big buy lines knocked out some important price tiers that had been capping the upside.

First big point: You need to watch the depth, and monitor the buyers and sellers and what they are doing. If you aren’t, you’re driving with your eyes closed.

The bidders and sellers jostle around and try and keep their cards close to their chest. Except for the amateurs who just dump their whole line in the market, like going all-in on a high pocket pair and smiling like an idiot.

But I guess they are trying to keep their brokerage to a minimum (not a problem for Marketech traders, who can place up to 5 trades for the price of one of the big banks!).

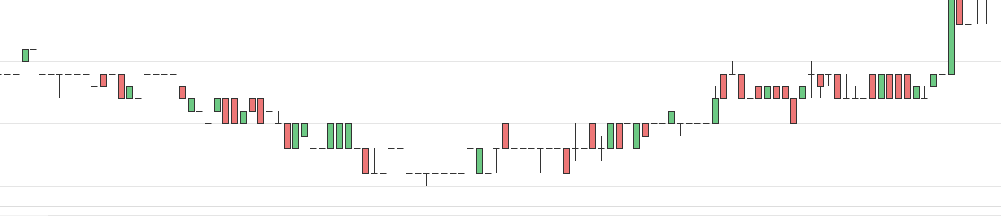

This is the chart from January to June:

Although the stock was theoretically too small to be traded technically, it was still respecting the patterns. A nice little ‘cup and handle’ formation was the first sign.

Note the first little breakout there at the end. That is the handle, and can often be the beginning of a very big run, but at the time I had no way of knowing it (except I sort-of thought it might be, as the charts and the volume were telling me the story that I so desperately wanted to hear!).

Stage 3 – The Staged Exit, and the Battle with Greed.

But the world was in a terrible place, the markets could easily have another collapse; so I let the first few go to reduce my overall risk.

I’d bought a lot near the bottom, and that first break was still more than doubling my dough (on those lot, anyway). And if it dropped again, I would be able to buy them back.

I try to be greedy when others are fearful, and fearful when others are greedy which means accumulating when there is no volume, and selling when there is.

This is a terribly risky strategy, as you can get trapped with large holdings in thin-volume stocks for extended periods of time.

So I need to have an intimate understanding of the patterns in the charts, and volumes in the depth, and trust the management. (Or you can buy Afterpay because you read about it on Facebook last week and you’re afraid it’ll keep going up – that’s a much better strategy!)

But it didn’t pull back. It formed some very decent (and surprising) support over the next few days and then broke-out again.

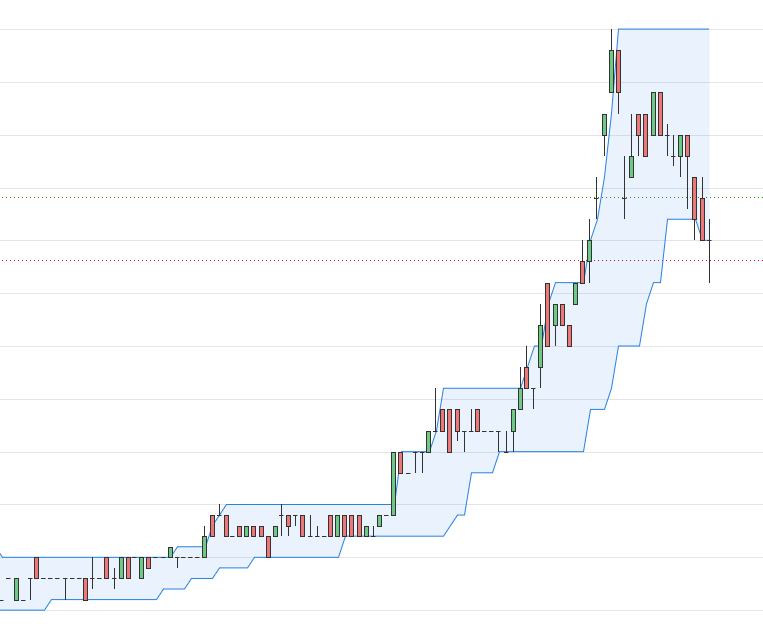

Here you see it in the Donchian channels, which should start to form a staircase in a real bull run, which it did. Higher highs, higher lows:

By this point I was starting to get excited. The underlying commodity price was going berserk, the online chatter was heating up and people were starting to talk about this ‘hidden gem’ and its potential for massive returns. No price target was too outlandish!

Now if you have a look at the RSI, you can see it’s a blue line at the bottom (but you can even change the colour of it with the new Marketech Focus, such is the power).

The RSI, or Relative Strength Index, is supposed to indicate if a stock is oversold or overbought, but in a big move like this you can also see that it was ‘overbought’ for quite a while.

So use it as a reference point, but in a wildly volatile market don’t take it as gospel.

The next couple of price stops were historically peaks, before the next sell off began. So — and don’t judge me — I also sold a few at each of these points, just in case she sold off again. But again, I was wrong. Lucky I had so many after 7 years of accumulation!

So, we have now had a fully-fledged parabolic move. My own personal trading rule has always been to sell all of my holding during a move of this scale, so around the very top there I sold the last lot.

I am a trader, not an investor. I’d been on this ride now for 7 years. And for most of those years I thought I was toast and had lost the knack, whilst telling myself each night that eventually it would come good.

Now, after pre-empting a selloff 3 times and being completely wrong each time (and leaving quite a few bundles on the table for the next guy) the stock peaked after breaking through to a new five-year high.

Psychologically this is very important, as it means that apart from idiots like me who were just trying to get their money back, the majority of the current holders would be well into profit and bullish – not underwater and looking for any bounce to sell into.

So generally, a good set-up for a decent sell-off that bounces hard too.

But, also, going back to that Donchian chart above, it would appear that there is a lot of consolidation to be done before it starts walking back up them stairs again.

Kenny Rogers, the stockmarket commentator, once said; “Never count your money when you’re sitting at the table”. But he did not say, “you got lucky, run away and buy an investment property”. So:

Stage 4 – The Bounce Trade, aka Being greedy because money

I still think this company has a bright future, and are well advanced enough to thrive in a weaker market. But I also think their underlying commodity’s price is going up, and the speculators will follow the commodity action.

I think they will be able to secure the funding they need, now that their share price is (much) higher. That mine will likely get built, and eventually it will spit out cash.

In short, it’s a company I’d be comfortable re-entering, but equally, it’s not the last company on the stock exchange so I won’t lose sleep if it keeps running and I’m in cash.

I don’t have to be fully invested all the time, or chase shiny things.

On average there’s a massive market pullback every year, and I also think there’s a day of reckoning in the wings. The Euro crisis came after the GFC, and there’s no way in Hell/Donald Trump’s America that we won’t see some catalyst for a sell-off in the near future. (If it’s not underway already as I write this…)

This stock had a massive run, and a healthy pullback, but there’ll be a lot of traders in there now, thinking similar thoughts to me. With volume to shift. So buying a pullback is inherently riskier, and you need the time to watch live prices and depth to monitor the change in direction.

That’s why Marketech has an app with all the same functions as the PC (so I can watch it when I’m out ‘getting my hair and nails did’).

So in this case, I used the Fibonacci sequence as my first guide. Fibonacci was a math nerd who is best known for designing shells and flowers and something about bees, and for some reason this pattern is everywhere.

Even in a lot of share market sell-offs. As I may have said before, the best thing about technical analysis is that if enough people believe it, it’ll happen. And mostly, selloff-bounces are about a herd of people squinting at the same stock and thinking “yeah, it’s sold off enough, I’ll dip back in”. Humans are so predictable.

Now, as you can see, the sell-off pushed through the 38.2% Fibonacci retracement, but — and this is where you need to watch the market — after it pushed through you could see the last of the panicked traders sell out around the peak of the previous break (just above the 50% mark).

And buyers from off-screen were starting to line up for the cheap stock. Like me, a lot of traders would have been looking for the right re-entry point, watching the ‘Fib’, watching the depth and trying to buy the last of those cheap shares before the rebound.

So, I loaded up on a bunch at the very bottom of that sell-off (mostly pure luck!), waited for the bounce…and then rolled them back out again for a very tidy intraday win. Baller!

(But if I’d got it wrong, I’d probably have loaded up a few more at lower prices, and then told people I was back in for the next leg up, thereby potentially setting myself up for another 7-year trap. I have learned nothing.)

Did I get it right? Yeah, but also nah. The stock was up another couple of ticks the next morning. Will I cry about it? Nope, good luck to those people. I made great money, and now they are, so good for them. I’ll take it back off them some other time…

Could I have done it without a good set of technical indicators and live charts? Nope. Could I have done it without live depth? Not even an outside chance. Could I have done it with 20-minute delayed pricing? Nope, and as an aside, do you ever hear a rally co-driver describing the road they’d already gone past to the driver?!? GET LIVE PRICING!

So go on, check us out (marketech.com.au). It’s a free 2-week trial with live pricing. You might think it looks the same as what you’re using, but it isn’t. It’s better.

Trade Up to Marketech Focus — a high-function trading platform from $45 per month. Instant trading capability for both PC and mobile to keep you on the move.

As a subscriber you will have access to brokerage starting at $5, and then 0.02 per cent for trades over $25k. Go to www.marketech.com.au to set up a free trial.

This article was developed in collaboration with Marketech Stockbroking Pty Ltd (AFSL 486148), a Stockhead advertiser at the time of publishing. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.