Trading with Focus – 90% Perspiration

Pic: Rommel Gonzalez / EyeEm / EyeEm via Getty Images

In my very early childhood, my Mum sat me down in front of the piano and told me I was going to start taking lessons.

I was her precious little angel so the bubble-wrap was tight – and I had to wear glasses from the age of three. The combo of the restrictive bubble wrap and glasses took contact sport out of the equation.

So I did piano lessons for years.

By the end I was pretty good too, seven years of practicing anything twice a day will do that I guess.

Obviously I was terrible at it to start. Wouldn’t pay attention, yelled at my teacher from time to time, couldn’t see the point of it. Mozart and all that other weird old European music was not that cool to a primary school kid, and even though Mum said it would be valuable as an adult all I could see were the future beatings at the boarding school that I was going to be packed off to.

So I quit. It wasn’t cool and it was hard, and I’d have to keep working at it.

My eyeballs eventually stabilized around Year 8, and off came the glasses. I was six-foot tall already, so my house-masters thought it would be a good idea to stick me in the ruck. Sadly, I hadn’t played footy in primary school, so I wasn’t immediately good at it. I threw that in too.

I learned a lot of very valuable lessons from these childhood events. Eventually. Many, many years later.

- Just because you’re good at things doesn’t mean you’ll be good at everything immediately.

- You have to practice and learn every day, for years and years, to be really good at something.

- Most people won’t do the above and will quit once it gets hard, or stops being cool.

- Have the right tools. You can’t play piano without a piano.

A lot of people have rushed into the market in the last 18 months. At least 700,000 first-time share investors just to online trading, to quote the last set of ASX numbers I saw. That has doubled the number of people trading online, but there’d be more punting CFDs and investing into managed funds and all that cash goes into pumping up the market prices.

And the markets have been very kindly indeed. Sure, there’ll have been hundreds of individual blow-ups in speculative shares in any given week, and a lot of the meme-stocks got found out and crushed around March, but the All Ordinaries has marched on.

And the combo of funky new ways of trading shares on your phone, chat-rooms, insta-fabulous founders of tech stocks, fintockers, and the associated media gushery has made shares cool. Like Jamie Durie made investing and renovating property cool back in the 2000s, if you can remember back that far.

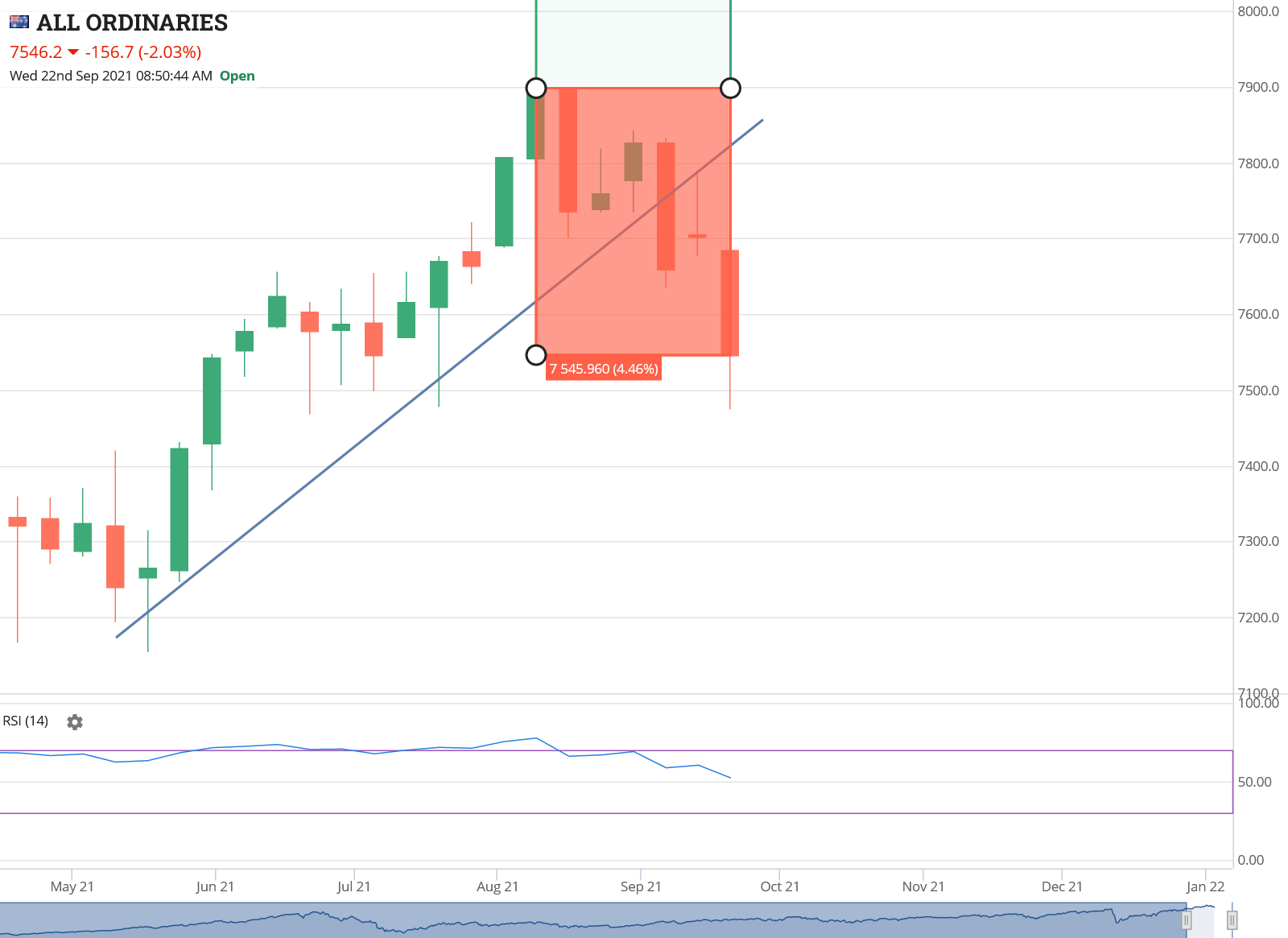

If you’re not just a gambler, and look at the market as a whole to judge its direction, the All Ords is as good a place to start as any. But if you were to only look at the amount of panic being reported in the world financial press about China and debt-ceilings you’d be forgiven for thinking we’d just been through another massive collapse.

But we’re down, on average over all of the ordinary stocks, about 5% from all time highs. So if you only started buying an index in May, you’d still be in profit, but your profit would be a little half what it was. Let’s pretend you invested $10,000, you’d be up about $500 instead of $1000.

So if your goal was to punt the market for a few months to make 5%, then you’re still winning. You’ve beaten interest rates by a wide margin, and as any professional money manager would tell you, a 10% annualised rate of return over the long term – plus any dividends – would be the stuff dreams are made of.

But to enter the market for the first time, with no knowledge, and no training, for such a short time and not be willing to lose 5% – well, that’s madness.

Like putting me in the ruck, just because I’m tall. You better believe I got hurt!

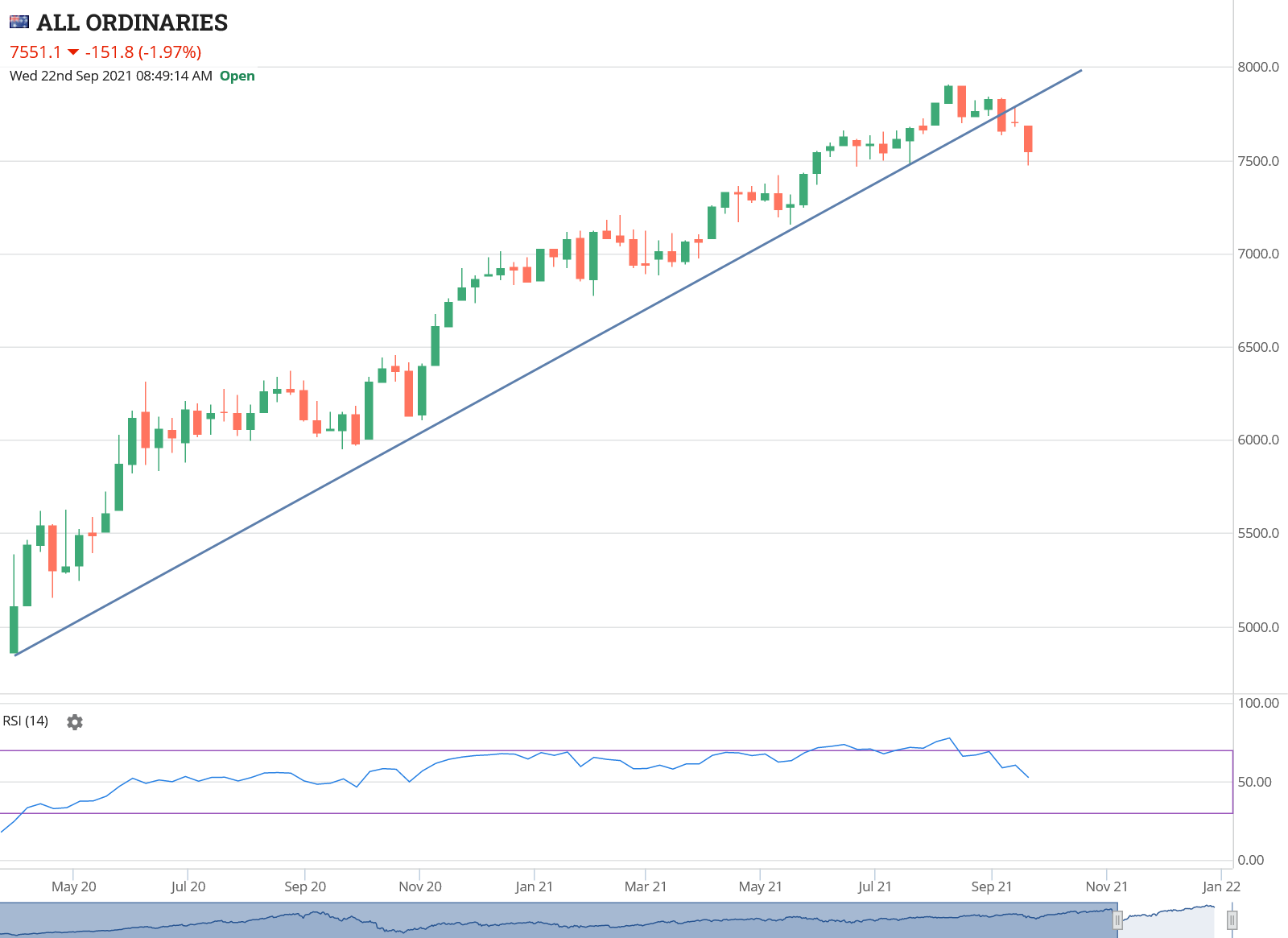

But what about a longer chart – let’s rollout to the start of the rebound from Covid. Keep in mind that there are at least 700,000 people who only know this part of history.

Depending on when you invested, or what you invested in, you could be pretty chuffed with yourself.

If your goal was to get into the market, for 18 months, make 50% and and turn your $10,000 into $15,000 – then you’ve nailed it! You could be a natural!

So… will you take that money out, pat yourself on the back and reduce your mortgage, or are you going to keep holding forever, because you think at this rate that you’ll be up another 50% by next Xmas?

Let’s scroll out a bit further.

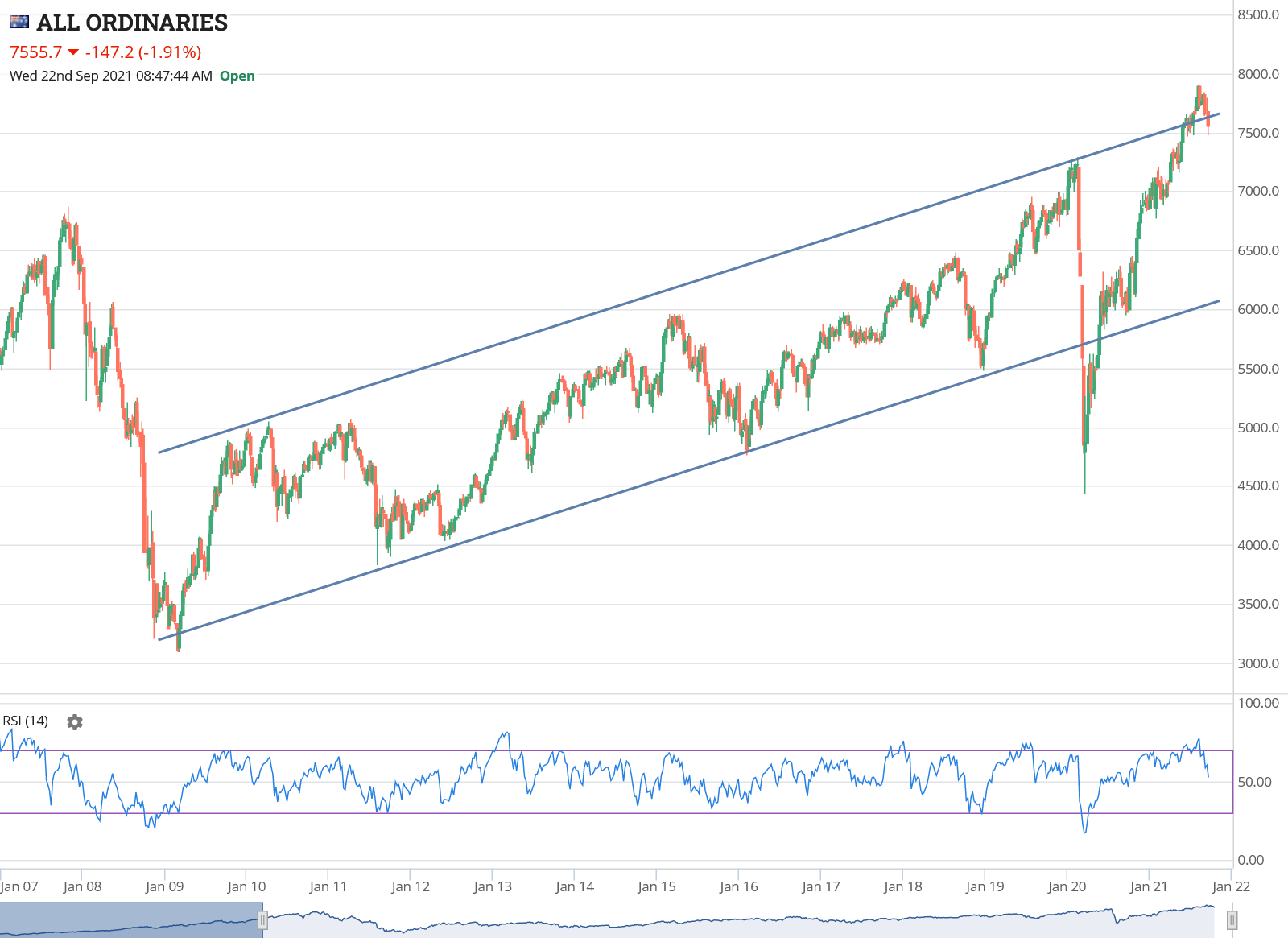

So this is the same All Ordinaries since the top of the greatest mining boom showing the GFC and the Covid sell-off.

A couple of big questions come to mind here.

Have you even got good charts?

Have you looked at this chart?

Have you looked at this chart, and does it have any meaning, give you any insight?

Have you looked at this chart and considered how your financial wellbeing would have been affected if you bought into the 2007 mining boom when it was all the rage – when stocks were on every person’s lips, when it was front page news, when traders were buying Ferraris and mining company execs were the new movie-stars – and then lost 50%?

Would you have topped up blue-chip stocks like Wesfarmers when they had dropped 50%, or been paralyzed by the doomsday scenarios of the end of the financial system and bank failures, would you have panicked and sold at the lows?

Would you have read all of the research from reputable sources and formed a balanced opinion – or would you have relied on your friend’s advice who was recommending you buy canned food and guns? Or the front page of the newspaper, whose job it is to get eyes on page so they can sell advertising, not to give you sound investing advice, and who were screaming about sharemarket wipe-outs?

Alright, enough about that chart. We eventually recovered from the GFC, it only took 11 years from peak to peak. But if it were to happen again you could wait 11 years from now, right?

Luckily Covid was a little different and so far we haven’t seen any repercussions that would affect the market as much as the post-GFC threat of major European countries defaulting on their debts and dragging the whole world back into a Great Depression, which would ultimately allow China to take global power as the weak US and weak EU couldn’t afford to fight back.

That was a bit of a dampener on returns at the time, to say the least. Only took a few more years to get over that.

But that’s not to say they won’t happen.

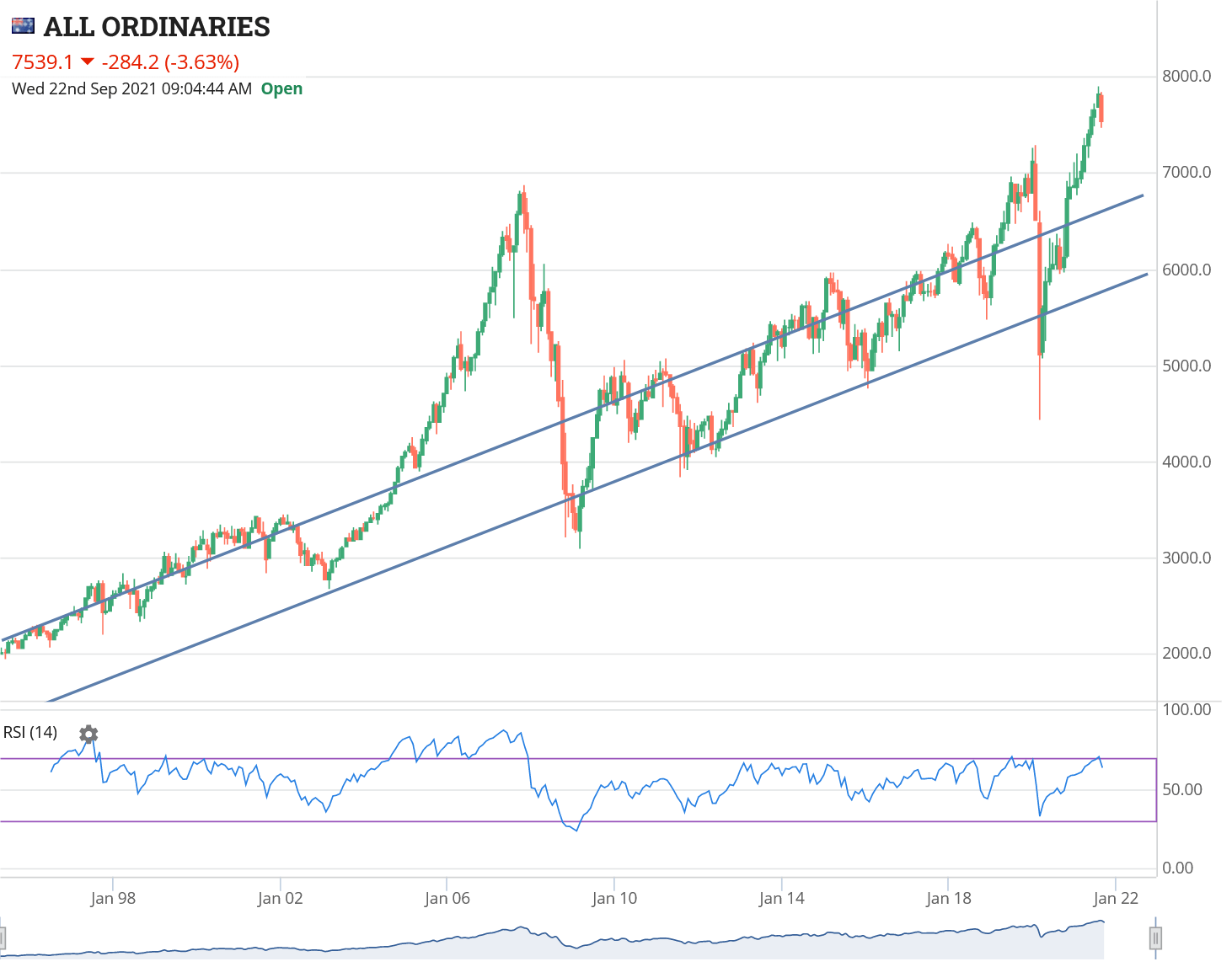

One last chart though is also pretty interesting. This next dataset starts the day that the ASX went from chalkboards to computers, until now, some 25 or 26 years ago. Puts a few things in perspective…

- I should have seen the GFC coming, or at least some massive correction for some reason, as the market got well above long term rates of return and was due a statistical return to trend

- Although I didn’t see Covid as the reason, some 12 years later, with a total of 17 years of market experience, I had the feeling that the market was due for a decent sell off, as it was right up at the top of the long-term trend, and was due a statistical return to trend

- Every year or so there is a pretty serious whack to the market. There’s a few smaller ones on a more regular basis, but there’s also a few really big ones

- We haven’t had one for 18 months

- Historically speaking, we could drop 25% and still be in a long-term uptrend…

- I oversimplify things

I’m not trying to put the fear into anyone. I’m not giving any advice. All I’m doing is showing you charts over different time-frames and talking about what has happened. One thing the market will do is make a fool of you time and time again, and just when you are starting to feel that you are good at it, it will make a fool of you again. It lulls you into a false sense of security, then pulls out the rug!

So getting back to my lessons from the beginning.

- Just because the markets have been strong and haven’t sold off in 18 mths doesn’t mean they won’t. And it probably won’t be something as simple as the price of iron ore dropping. The GFC wasn’t simple, and neither is Covid. It’s the things you don’t see coming that punch you in the face the hardest. Also doesn’t mean they will, as the markets don’t respect your opinion even if you’re getting ‘likes’ in chatrooms.

- Protecting your capital is hard in a rougher market and it’s easier to let fear keep you from buying good opportunities. You’ll have to learn from the past and read between the media articles. Is a 5% sell-off the bottom, or is it the beginning of ‘the big one’.

You can’t trade a rough market the same way you’ve been trading the last 18 months of fully blown bullmarket – so you’ll need to make time to learn some new skills.

- If this market gets harder (or even more boring) there are 700,000 tourists who jumped into the sharemarket on the promise of big wins – many of whom will dump and run at the first sight of blood. When the market stops being interesting or ‘cool’ you’ll stop hearing about shares on the news, you won’t see articles about the best ways to make money with shares, old Aunt Beryl will warn against the dangers of the sharemarket and all these new insta-fab storylines will move back to property. That’s when you’ll know the bottom is in!

- If you aren’t using the old expensive IRESS-type products or the brand-new low-cost state-of-the-art Marketech Focus, you aren’t using a trading platform. You may not have needed one up until now, but trust me, you can’t be good at the piano without having a piano and you can’t be truly good at trading without a truly good trading platform.

At Marketech our platform is about technology, providing you the tools and technology to trade. We encourage our high-function trading platform to get you live pricing, live charts, live market depth to ensure you have the tools and trading capability at your fingertips, and on your mobile phone or PC.

You trade your own stock on your individual HIN. It is your cash in your own Macquarie account where you keep the competitive interest you earn.

Our subscribers get access to brokerage starting at $5, and then 0.02 per cent for trades over $25k. If you want to trade the market you need immediate access wherever you are and the seamless Marketech mobile app means you are live anywhere anytime.

For more information, visit www.marketech.com.au. Any queries regarding Marketech should be directed to Marketech and not to Stockhead.

This article was developed in collaboration with Marketech Stockbroking Pty Ltd (AFSL 486148), a Stockhead advertiser at the time of publishing. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.