The Secret Broker: Investors are long on self-belief and short on experience, so here’s a vintage lesson from 1987

Via Getty

After 35 years of stockbroking for some of the biggest houses and investors in Australia and the UK, the Secret Broker is regaling Stockhead readers with his colourful war stories — from the trading floor to the dealer’s desk.

A request came in this week to write about the crash of 1987, as this week on the 19th October it was the 35th anniversary since it happened.

It is something deeply etched in my memory, as these days we have computer trading, so you will never see that same look of absolute fear in the traders eyes we did that day.

The recent absolute mayhem that occurred in the UK gilts market and led to the UK’s Prime Minister resigning after just 44 days in office didn’t really come through in any newspaper images. There was absolute chaos, though.

As the gilt market went into meltdown, everything would be conducted over office/mobile phones and computer screens. No floor, so no pictures of the horrors of all of the trading blood spilling out onto the selling tickets.

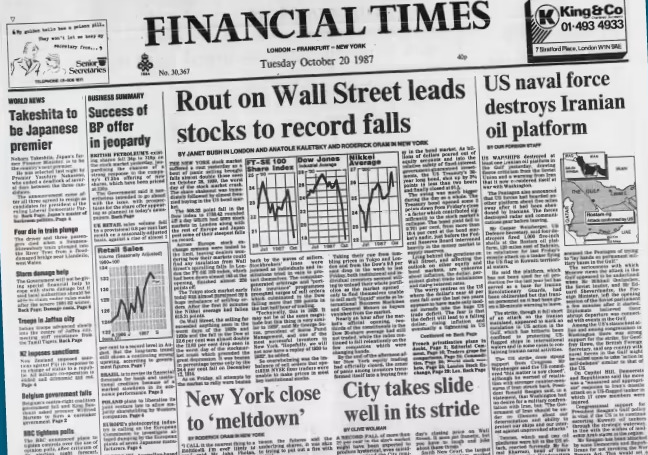

At least in 1987, pictures from all around the world were attached to the headlines, after the US market fell 22% in one day.

But, if your financial advisor is 45 years old today, they would have been 10 years old and reading the Beano comic book – not the Financial Times.

It’s only us old war-torn brokers that remember how and why it came about and caused the biggest stock market in the world to fall 22% on a record doubling of volume.

Most would now be in nursing homes with dementia setting in because of the long term effects of PTSD – Post Traumatic Stock Declines.

We never received any mental health support at the time and the cancellation of your corporate AMEX card, to save on expenses, only exaggerated the pain.

Having to buy drinks on your own credit card was very traumatic and it took 2 years to trickle down into the real economy and have ordinary people feel the same pain, as UK house prices collapsed in 1989.

This time the face of real estate agents would show the pain of the market after they explained to sellers that house valuations had fallen off the cliff.

Few people in today’s market remember the lessons of 1987. Most people are long on self-belief and short on experience as one veteran hedge fund recently put it.

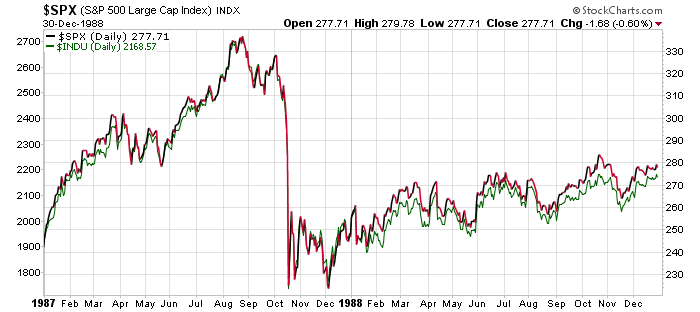

In the 2 years before Black Monday, markets were reaching all time highs and any fool was able to make money.

Even following the likes of my old bathing chum Alan Bond could make you money until, as Warren puts it, the tide goes out and now you can see all of those without swimmers on, as they can’t afford them.

So how did it all come about and why did the UK weather play such a large part in the US market record one day fall.

In the year till August 1987 markets had risen 44% and computer trading, which some people suspected may have been a reason for the price decline on October 19, was in its infancy.

The London markets closed early on Friday, October 16, because of a very severe weather event.

On that Friday, winds were so strong that power lines were cut and fallen trees on railway lines meant traders could not get to their desks.

My alarm didn’t go off because we had suffered a power cut, so when I did wake up, the clock was just flashing at me. ‘Christ’ I shouted and then as I drove to the office, I had to drive around trees before finally getting to my desk 3 hours late.

I would say out of the 500 odd traders that occupied two floors of the office, only about 10 of us made it to work.

Those who commuted from their country mansions couldn’t get any trains and by midday, all UK trading was suspended.

To give you some background on how bad this storm was, Seven Oaks became One Oaks as six of the ancient trees got blown over.

But it gets better.

The BBC had a weatherman called Michael Fish and old ladies would knit him jumpers, which he would wear when giving out the daily weather predictions.

Well, one of those ladies rang the BBC and this is what Mr. Fish said live on TV.

He told viewers on the BBC: “Earlier on today, apparently, a woman rang the BBC and said she heard there was a hurricane on the way… well, if you’re watching, don’t worry, there isn’t!”

What a kipper!

Hours later, there was devastation across the UK, as winds reached speeds of 115mph, with the South East worst hit. The storm claimed 18 lives.

Now I will try and explain this in the best way possible.

When I reached the office on that Friday, insurance stocks had collapsed because of the claims they would be hit with.

In the option market, put option prices in Insurance stocks, which were trading at 1/2p, opened up at £2.00.

So, young spotty faced traders who had sold these puts at 1/2p thought that they would expire worthless and they would just pocket the premium.

On Monday morning they were trading at £4.00 each and I got a call very early from my New York floor trader to say that they can’t open the market as over 200 stocks had no buyers and they were limit down.

These were big named stocks and there were no buyers! A two year bull market was over in one day and the UK weather had exaggerated the fall, as insurance companies tried to sell equities to cover their claim payouts.

We were just shorting anything we could in the UK market as when they eventually did open up the American markets, it was a total meltdown.

One guy ended the day down £10m on his ‘totally hedged book’ and him and his boss had fisty cuffs in the wine bar as one of them had forgotten to put on the third leg of their hedging strategy.

They had blown up their and our bonuses in one day.

The markets around the world the next day followed suit, with New Zealand being the first one to open ,followed by Australia – and it was the start of the death spiral for the Bond’s and Skase’s as their deck of cards began to tumble.

On Tuesday, we were all in early even after a night of drinking, shouting, crying and fighting as we were shifting everyone into government bonds and it was dog eat dog.

A flight to quality was in action as everyone tried to trade out of equity positions and into safety.

Cash was king, followed by AAA+ bonds and then if you had to hold shares, it was quality blue chips and now, all of a sudden, everyone wanted your advice. Even cab drivers wanted your advice.

I find it ironic that everyone wanted Boris out and Truss in and 44 days later they want Truss out and Boris back in.

And that was like leading up to Black Monday. Speculative, highly geared stocks were in and boring old blue chips were out. Then it all turned around very quickly. Like in 44 hours.

Just make sure that you have a nice balance of quality assets with the occasional speculative one just to keep your heart beating and not the other way around.

But what would I know?

The Secret Broker can be found on Twitter here @SecretBrokerAU or on email at [email protected].

Feel free to contact him with your best stock tips and ideas.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.