The new Middle Kingdom – Why Banyantree thinks India is like China in 2006

Pic: Getty Images

- Banyantree Investment Group growth says India has all the elements for long-term growth

- India has just hit that US$2000 GDP per capita mark, typically an inflection point for any economy

- For strong growth fiscal and monetary policy must support prosperity flowing through entire population

For many Australians, India conjures images of a land steeped in ancient history and vibrant culture, while the two nations share a long history of cricketing rivalries and camaraderie.

Indian cuisine has made a significant impact on Australian palates, while India has also been growing its strategic position in the Indo-Pacific region and becoming more known for its economic and political clout. It is a founding member of the BRICS bloc of developing nations and is current chair of the G20.

According to the World Economic Forum (WEF) 2023 saw India overtake China as the country with the world’s largest population and was this month represented at Davos 2024, the annual meeting of the WEF in Switzerland.

Furthermore, the United Nations Development Programme says India saw a “remarkable reduction in poverty, with 415 million people exiting poverty within a span of just 15 years (2005/6–19/21)”.

Banyantree Investment Group investment manager and director Zach Riaz has been bullish on the emerging nation for several years.

“Emerging markets are so big and vast with different economic and growth drivers, monetary and fiscal policies, nuances and different levels of risks,” he says.

Riaz says emerging markets are always touted for their potential growth and return on equities but over the long-term have tended to lag developed market returns.

“You have to break down emerging markets and very specifically which emerging market to go in picking out the best,” he says.

India was one that the research and investment house flagged along with Brazil and China.

“India is one of the biggest markets from a population perspective and back then it wasn’t one of the biggest drivers of the emerging markets index and it was more China,” he says.

“But we saw India as having all the growth elements that are likely to see multiple years, even decades of growth.

“In recent years geopolitical issues and China–US tensions have pushed a lot of investors towards India.”

India where China was in 2006

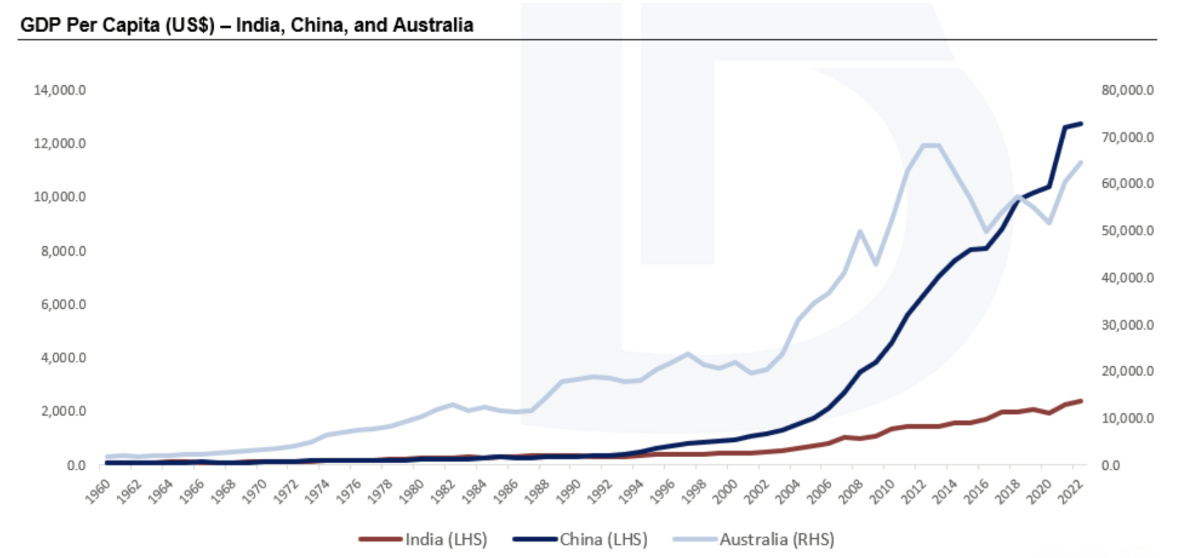

Riaz says one of the key statistics for investors to examine when investing in a country is GDP per capita, which is a good measure of economic performance and indicator of average living standards and economic well-being.

He says according to historical trends, the US$2,000 GDP per capita level has typically been an inflection point for any economy.

“When China started to invite companies to take up the country’s manufacturing capabilities in 2006 that’s when its GDP per capita exceeded the US$2000 mark,” Riaz says.

“That’s when China started having internal consumption growth, middle, rural and obviously upper class growth and broad-based prosperity throughout the economy that led to where it is today.”

Riaz says fast forward to today and India has just hit that US$2000 GDP per capita mark.

“India is where China was in 2006,” he says.

Riaz says major global companies like Apple and Google’s parent company Alphabet are starting to invest in India and look for diversification away from China.

He says the policies are focused on internal consumption growth and there’s government stability with Prime Minister Narendra Modi likely to get another term at the upcoming national elections in April.

“You’ve got a lot of support from external companies looking to invest and set up in India,” Riaz says.

Middle income status aim to boost economy

India aims to reach high middle income status by 2047, the centenary of Indian independence and is also committed to ensuring that its continued growth path is equipped to deal with climate change challenges and reach net-zero emissions by 2070.

“If they can fire up the middle class and lower income earners – so the rural areas – you could see GDP per capita and consumption growth, which will lead to sectors like consumer staples, discretionary expenditure, luxury goods, automobiles and financial services give double digit growth,” Riaz says.

He says there is a push to move away from India’s underground black economy through various measures such as ensuring all classes have greater access to banking services, while also improving housing for lower income earners.

“It’s probably got a lot to do with the Indian election coming up in April,” he says.

Riaz says there’s been really good growth in middle and high end housing but a real supply slump in low end housing.

“So with a focus on equality we expect the Indian Government to introduce a lot more housing measures that not only support the top end but also increases supply of quality housing for low income earners,” he says.

“All these kind of measures will go towards further increasing GDP per capita.”

He says India already has strong economic growth supported by a young population. The Indian economy is forecast to grow ~7.3% in the current financial year after growing 7.2% in FY23, which Riaz says is the best among major economies.

“The point is despite all this excitement around India there is still a long growth runway ahead,” he says.

Prosperity must flow through whole economy

Riaz says the risks for investors and what they must be mindful of when investing in India is that fiscal and monetary policy must support equality, with prosperity flowing through the entire population.

“It cannot be the top 20 to 30% because then you are not going to get that growth everyone is looking for,” he says.

“That is where the risk is as domestic spending will all come from better higher-quality paying jobs for middle and lower income earners.”

Riaz says ensuring growth flows through the whole population and not just the top end will come down to government policy.

“If that happens you really are sitting on a really attractive market for the next decade frankly,” he says.

Coming up: Riaz’s top three investment picks for India

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead. Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.