The Ethical Investor: How ESG investing could beat inflation, and expert tips from eInvest’s Jodi Pettersen

Picture: Getty Images

The Ethical Investor is Stockhead’s weekly look at ESG moves on the ASX. This week’s special guest is eInvest’s Jodi Pettersen.

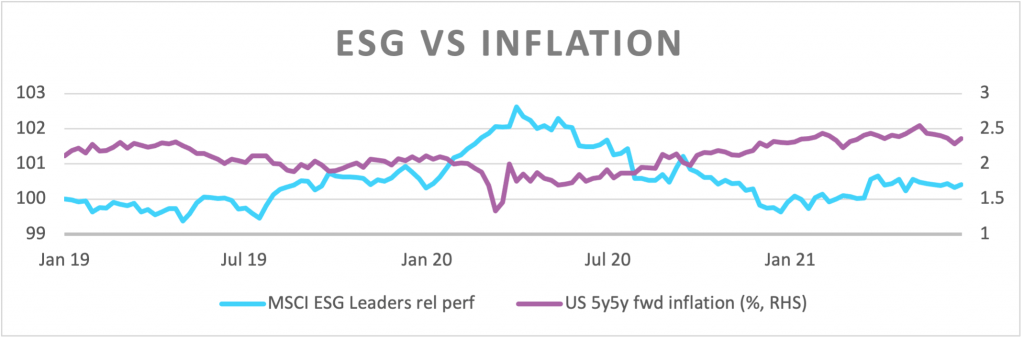

Inflation is front and centre on investors’ minds, and has arguably become more of a concern than the virus itself.

How much could rates increase from here, and what would be the impact on asset valuation?

For Deborah Debas, a Responsible Investment portfolio manager at Desjardins Funds, inflation isn’t a factor that should worry long term investors.

“Whether inflation is transitory or not, investors should maintain a long-term focus,” Debas told BNN Bloomberg.

She believes companies that maintain a long term focus are well positioned to navigate an inflationary world.

“It’s a myth that if you invest sustainably, you’re leaving some returns on the table,” said Debas.

“Being invested in the market is the best way to beat inflation—and if you invest with a focus on ESG factors, you’re investing in strategies that may potentially help you outperform.”

Ark Invest founder and CEO Cathy Wood agrees, saying that disruptive innovation in technology will exert deflationary pressures over the long term.

“Technologically enabled innovation is deflationary, and the most potent source,” she tweeted.

Wood’s Ark fund has just launched a new ETF into the market this week called the ARK Transparency ETF (CTRU), tapping into the demand for ESG focused investors.

The ARK ETFs will have a theme of “disruptive innovation”, and will be targeting 100 companies that it defines as “most transparent” in their ESG credentials.

ESG interview with eInvest’s Jodi Pettersen

This week’s guest is Jodi Pettersen of eInvest, a managed fund run by Perennial Partners.

It’s no secret that ESG ETFs and Active ETFs have grown in popularity over recent years. But how can investors pick the best ESG ETF?

Below are some tips to help.

What social issues should investors look into?

“Many ESG portfolios contain companies that are intended to reduce carbon emission and ease the energy transition, like renewable energy companies,” Pettersen said.

“While these investments are vital, ESG portfolios are more than just carbon.”

“Issues that can also be considered ESG issues include cyber security, social inclusion, financial literacy, employee safety and satisfaction and modern slavery.”

What guides their inclusions into an ESG portfolio ?

“Well, that varies from portfolio to portfolio.”

“For example, the eInvest Better Fund (Managed Fund) (ASX:IMPQ) focuses on what companies and technologies contribute to what we consider will shape a better future.”

“Some other portfolios simply exclude tobacco and gambling. How to tell the difference? You have to do your own research.”

But how does an investor do their own research?

“In Australia, ETF and Active ETF providers have to disclose the holdings of their portfolio.”

“You can look these up on their website or on the stock exchange announcements, and decide if the companies held in the portfolio fit your definition of ESG.”

“Another useful tool is ETF Tracker, which allows you to look through portfolios in a helpful tool.”

Is looking at the market cap also important?

“The market capitalisation of a company is an important consideration.”

“New technologies, solutions and ideas often come from smaller companies so look at the average market capitalisation of the ETF portfolio you are considering.”

“Smaller cap companies can also be higher return and higher volatility, and open to important ESG engagement. The future is theirs.”

What’s happening in Australia

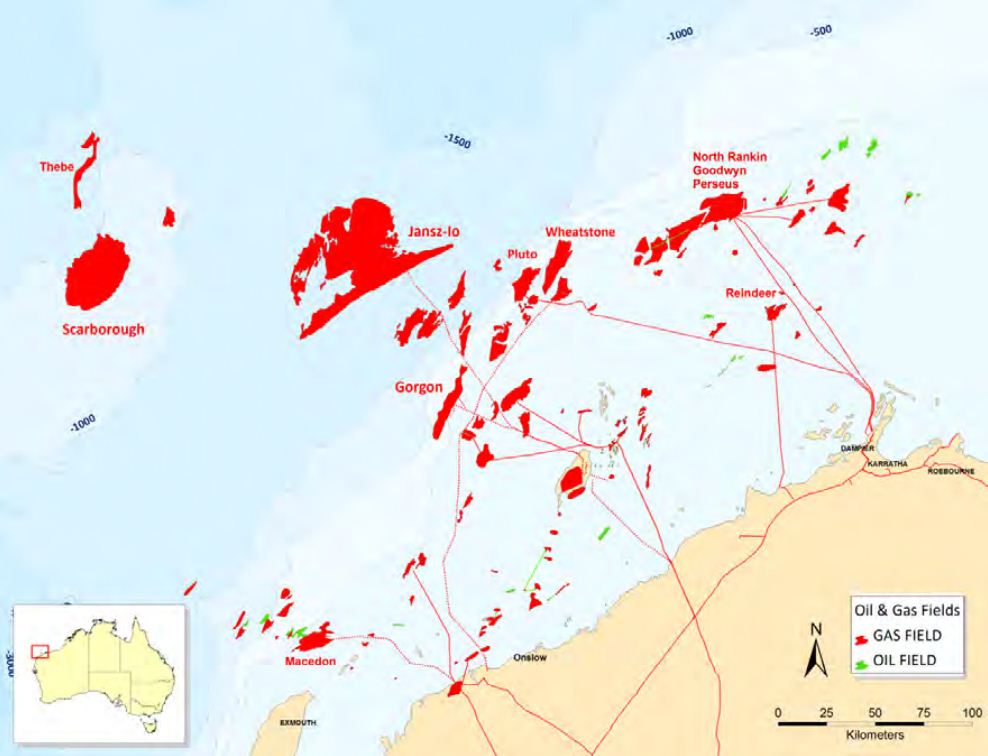

Woodside Petroleum (ASX:WPL)’s Scarborough gas project off WA has been described as Australia’s biggest new fossil fuel investment in nearly a decade.

But a new report by Climate Analytics estimated that total emissions from the project is far higher than what Woodside claims.

The report estimates that Scarborough-Pluto and its associated projects will emit around 1.37 billion tonnes of greenhouse gases by 2055, far more than the 878 million tonnes reported by Woodside.

In an interview with The Conversation, a Woodside spokeswoman said its emissions figure was “correct and has been accepted by the federal regulator NOPSEMA”.

But as reported by Stockheader Bevis Yeo earlier this week, the project has angered environmentalists, with Conservation Council of Western Australia launching a legal challenge on the state government’s decision to approve the project.

The green lobby, an avowed opponent of Scarborough, claimed the approval for the Pluto facility was unlawful, as it failed to properly consider and control the environmental harm.

Woodside meanwhile has loudly proclaimed that the ultra-low (0.1%) carbon dioxide content of Scarborough supports its goal of achieving net zero emissions by 2050.

Other notable ASX ESG stock news this week

Industrial Minerals (ASX:IND) has this week commenced disclosing its ESG metrics.

The company said it has deployed Socialsuite’s ESG Go technology platform to set its initial ESG baseline. IND has a primary focus on the mining of high purity silica sands in projects across WA.

Security Matters (ASX:SMX) – a company focused on marking and digitising objects to facilitate the development of the global circular economy – has become a member of the Global Platform for Sustainable Natural Rubber (GPSNR).

GPSNR is a voluntary membership organisation that brings together organisations and government agencies to help foster improvements that have socio-economic and environmental benefits across the natural rubber supply chain.

And earlier today, Fortescue (ASX:FMG) CEO Elizabeth Gaines stepped down as leader, with the company set to commence its search for a new CEO amid a green energy push being led by major shareholder Andrew Forrest.

At Stockhead we tell it like it is. While Security Matters is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.