The best ASX IPOs are probably happening right now

Pic: DKosig / iStock / Getty Images Plus via Getty Images

IPO activity is starting to surge.

It’s right now — at the start of a cycle — that the higher quality companies usually list, says Steve Black, co-manager of the Pengana Emerging Companies Fund.

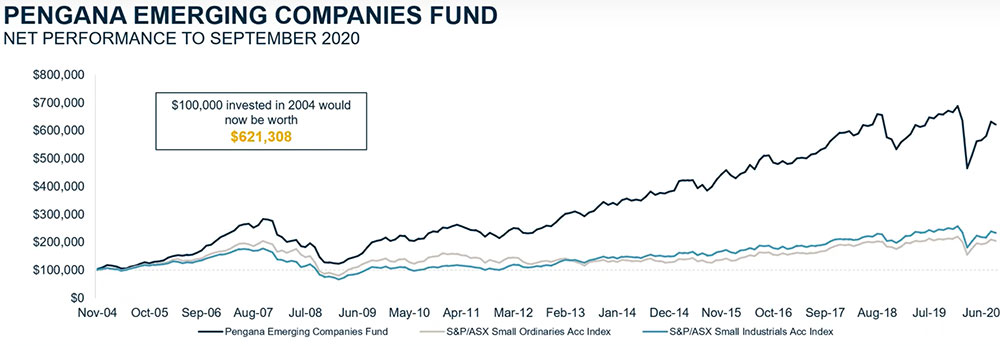

The Pengana Emerging Companies Fund benchmarks itself against the S&P/ASX Small Ordinaries Accumulation Index, which it has consistently outperformed since launch.

$100,000 invested in 2004 would have grown over six-fold to $621,300 by September 31, Black says.

The fund is currently busier with IPOs than it has been for over three years.

“While we always treat IPOs with a higher level of caution given their lack of track record, there have been a small number of highly promising, high growth businesses which we have made initial investments in,” Black said on a September 30 reporting season update.

“In the last two weeks we would have met up with 12, 13 IPOs or companies looking to be listed on the stock market.

“Not all of those will get up, but probably the key point that I would make here is that at the start of an IPO window, or cycle, is usually when you get the higher quality companies coming through.

“Companies like Aussie Broadband (ASX:ABB), Adore Beauty (ASX:ABY), certainly are a couple of stocks we’re having a long hard look at at the moment.”

Aussie Broadband immediately ripped higher when it hit the ASX boards on October 16.

Playing defensive

The Emerging Companies Fund had large holdings in companies like AUB Group (ASX:AUB), Charter Hall Group (ASX:CHC), EQT Holdings (ASX:EQT), Integral Diagnostics (ASX:IDX) , Johns Lyng Group (ASX:JLG) , Lifestyle Communities (ASX:LIC), NZ-listed Mainfreight, OptiComm (ASX:OPC), Steadfast (ASX:SDF) and Uniti Wireless (ASX:UWL).

“It’s a fund where the type of risks we’re taking … are not going to present us with a ‘blow up’ situation,” Black says.

“We don’t own those types of stocks.”

‘Blow up’ is jargon for the complete failure of a hedge fund or individual trading account.

“We really do play the long game in how we think about investing, which is paramount in this market which is getting a bit excited,” Black says.

“Currently, the small cap market feels quite buoyant notwithstanding the global uncertainty.

“There are signs of speculation, a bit of froth in the valuations of some of these companies. It’s something we are mindful of.”

The fund has about two-thirds in ‘defensive’ companies, where there is very little exposure to the economy or markets.

“They are to a large degree master of their own domain in terms of the growth prospects,” Black says.

“We are spoilt for choice. We have 800-900 stocks to build a 60 stock portfolio from.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.