Tax time giving you a documentation downer? Enter Sharesight

It’s tax time again and if you’re lodging your own tax return, you need to lodge it by 31 October each year.

If you choose to use the services of a registered tax agent, they’ll generally have special lodgement schedules and can lodge returns for you later than 31 October. But you still need to engage them before 31 October.

When you own shares, as 9 million of us Aussies do, it’s critical that you keep all your records intact for the ATO (Australian Taxation Office).

Whether you trade directly, or use the services of a financial advisor or even a robo-advisor, the person responsible for keeping up-to-date and accurate records of your shareholdings is… you.

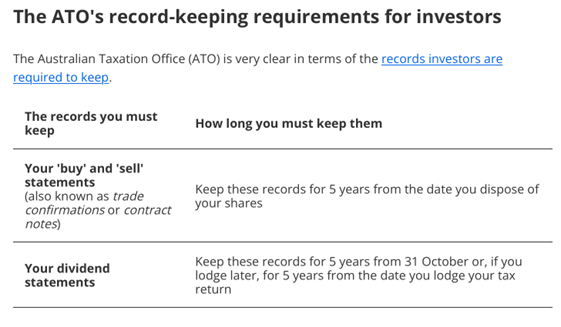

The ATO’s record-keeping requirements for investors are actually pretty clear:

Although they sound simple, it does take a lot of work to keep up with this throughout the year and more often than not, investors are left scrambling towards the end of the tax deadline.

Even for the most organised, trying to gather all these receipts at once to do their own return, or send it all to their accountant when tax time rolls around involves a lot of effort and time.

Part of the problem is that the records you need to keep come from many different sources – the company you invested in, your stockbroker, multiple share registries and your bank – adding to the clutter and complexity.

Fortunately there is a platform out there that allows you to save time by automatically storing and organising all the paperwork for you.

A platform that does everything come tax time

Recording all your ‘buy’ and ‘sell’ statements from your broker

Sharesight’s online portfolio tracker automates this by auto tracking your trades and dividends as they come through.

It records all of your investment trading activity by keeping all your ‘buy’ and ‘sell’ statements from your broker.

To make sure all your trades are automatically tracked, all you need to do is ask your broker to email your trade confirmations to your portfolio, or automatically forward these emails to Sharesight.

This allows your trade confirmations to be recorded in real-time with no additional effort on your part.

For tax purposes, you can also store your broker’s statements by simply attaching your official trade confirmation statements to the trade records within your Sharesight portfolio.

You can also securely share all this data with your accountant with the click of a button.

Recording your dividend income statements

When you add a trade to Sharesight, the system will automatically backfill past dividends (and continue to add new ones as they are announced).

You have the ability to edit any of the suggested data, and attach your official dividend statements to the respective dividend entry.

This ensures that all your dividend records are safely stored and organised in one place (instead of across your email, filing cabinet, shoe box, etc.)

Tracking the impact of dividend reinvestments on your investment cost base

As per the ATO, if you opt into a dividend reinvestment plan (DRP), you need to remember that the ATO considers reinvested dividends to be trades.

Therefore they can be subject to capital gains tax (CGT), and so it’s important to understand the cost base of these trades.

The rule says that your dividends must be declared as income in your tax return because that will be used by the ATO to be your acquisition cost of buying the new shares.

This can be very tedious to track manually, but Sharesight can do all this automatically.

Sharesight’s dividend reinvestment feature allows you to activate a DRP for a particular holding, and automatically track the reinvested dividends.

Sharing your records with your accountant

While making sure all your records are correct is a great start, when it comes to filing your taxes many investors still use an accountant.

Sharesight lets you easily share secure portfolio access with anyone you wish, with a click of a button.

So if an accountant does file your taxes, they’ll have everything they need in one place, which means no more paper chasing or lost email attachments.

Calculating and reporting capital gains tax (CGT)

Finally, it’s crucial to understand and keep track of your CGT obligations as it can become complicated and tedious to calculate, especially when you have many trades.

This gets even more complicated as CGT is treated differently by the ATO for certain corporate actions like mergers and acquisitions.

Sharesight has a powerful Australian CGT report that functions as a CGT calculator, determining capital gains made on sold shares as per the ATO rules.

You can run the CGT report over any period to see the CGT position for all your holdings sold within the period, broken up into short and long term holdings as well as losses.

Speaking of losses, it’s important to remember the ATO allows you to offset your CGT losses against your gains.

But calculating CGT implications and strategising in terms of sale allocation methods can quickly become complicated and overwhelming.

With Sharesight, you can do this easily using their Unrealised CGT Report, which is designed to give you a hypothetical view on what your final CGT would look like if you were to sell certain holdings.

This article was developed in collaboration with Sharesight, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.