SUNDAY ROAST: The stocks that lit a fire under our experts this week

Really running out of 'roast pics' ideas now. Picture: Getty Images

Emanuel Datt

Founder, CIO Datt Capital

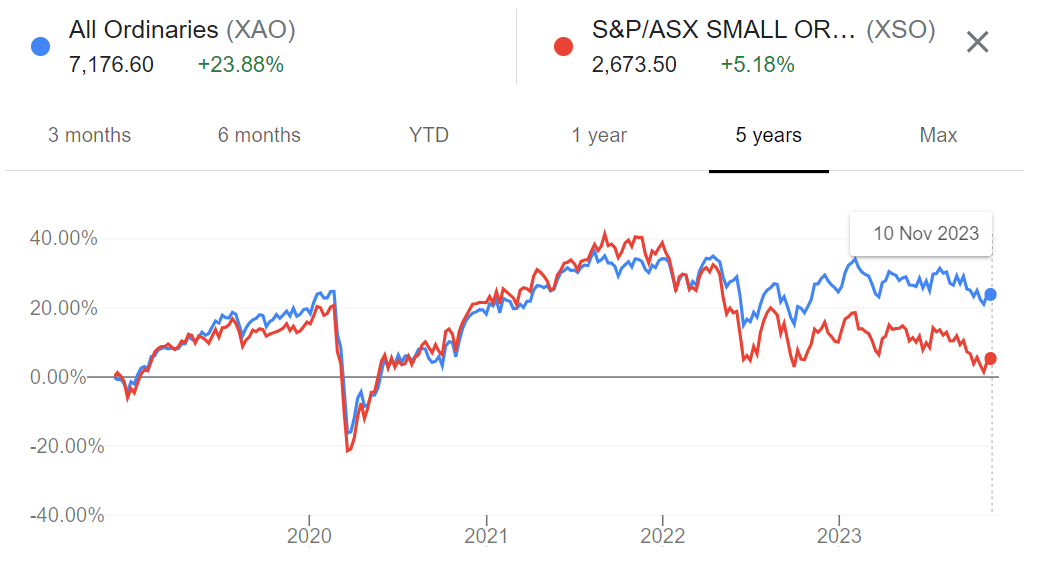

It’s been a rough 18 months for the ASX small cap sector. How rough? This rough:

It’s not entirely coincidental, given that time frame coordinates very neatly with the “higher for longer” rate rise thematic that’s kept markets guessing for well past long enough now.

“Small caps” and “flight to safety” generally don’t play well together. And right now, according to Emanual Datt, the ASX small cap index is trading “at a substantial divergence from the broader All Ords market index.”

That’s about a 30% discount. Historically, the small cap index has typically traded at a premium of circa 20%. So in Datt’s view, you might consider that a beard-stroking “50% divergence from the historical norm”.

What we’re looking at here is the impact of the rising cost of capital. The small cappers that have survived best have been those that have also suddenly learnt a lot about cost efficiency.

That’s a good place to start looking for “hidden gems”, Datt says. Top and bottom line are crucial.

“Primary research is critical,” Datt says… but he’s happy to get you started with these three unloved ASX gems with bonus Value Catalysts:

Adriatic Metals (ASX:ADT – $3.17, MC $650m): The base and precious metals developer starts production from its 100%-owned, Vares high-grade silver project in Bosnia in two months.

The project is expected to generate circa $200 million in free cash flow in each of the first five years of production. Current life-of-mine is 20 years, with scope to extend.

The Paul Cronin managed ADT has a resource upgrade for Vares scheduled this quarter, ongoing metallurgical test work and new mining studies.

It also has two other targets within the Vares footprint, with assays from one expected this quarter.

Cash balances were US$68 million at the end of September.

Value Catalyst – derisking from first production in January.

Eroad (ASX:ERD – 64c, $125m MC): Road fleet technology provider with operations in Australia, New Zealand and the US. Recently recapitalised, and subject to M&A interest from its major shareholder, Canadian-based Volaris, run by billionaire Mark Leonard.

Eroad specialises in making paper-systems redundant with digital for road, tax, health and safety compliance for transport.

The company has a US business based in Portland, Oregon that serves customers operating in every US mainland state.

In 2009, it introduced the world’s first nationwide electronic road user charging system in New Zealand. Now more than 50pc of heavy transport RUC is collected electronically.

Value Catalyst – improvement in cash flow generation from operations, firming in M&A interest.

Pacific Current Group (ASX:PAC – $8.09, $500m MC): Funds management conglomerate undervalued on Net Tangible Assets. As recently as November 2, GQG Partners confirmed its amended, non-binding indicative proposal of $11.00 in cash consideration per PAC share, saying it was “an attractive outcome for all PAC shareholders”.

With a portfolio of 16 specialist boutiques across Australia, India, Luxembourg, the US, and the UK, the PAC group is a multi-boutique asset management business which partners with ‘exceptional’ investment managers. PAC secures capital through ‘bespoke’ economic structures and combines it with strategic business development to help build businesses.

Value Catalyst – a potential exit at a higher price closer to Net Tangible Assets, or corporate restructure where embedded value is distributed to shareholders.

Broker upgrades

Goldman Sachs

Goldman Sachs has upgraded its rating on Webjet (ASX:WEB – $6.43, 2.48bn MC) from Neutral to Buy, and revised its 12-month target price from $7.70 to $8.30.

Webjet has two main businesses: hotel bed B2B provider WebBeds (wholesaler), and Australian online travel agent business with leading domestic online market share of ~40%.

Goldman says it’s now demonstrating strong cash generation as the travel market recovers, while the current share price continues to be impacted by macro concerns.

It’s note an acceleration in international air flight figures, robust hotel demand, and an expectation for corporate travel to recover to 100% pre-COVID by 2024.

According to Goldman, its WebBeds business places it better compared to Flight Centre (ASX:FLT), and Corporate Travel (ASX:CTD), and sees the recent fall in Webjet’s share price as an attractive entry point.

Goldman also re-iterated its Buy rating on Life360 (ASX:360 – $8.44c, 1.7bn MC), with a 12-month price target of $10.50 (versus current price of $7.96).

Life360 is a global family safety service that aims to keep families, partners, and friends connected and safe. The apps can be used to locate someone traveling, receive notifications when a loved one requires your assistance, and detect car crashes on impact.

Goldman says Life360 is exposed to the US$12bn global addressable market with a large opportunity to expand its product suite.

The company is currently raising prices for its existing iOS US subscriber base, which demonstrates its pricing power with its more than 50 million global users. Goldman’s research indicates Life360’s subscription business currently trades at a discount to global subscription app peers when adjusting for its superior growth outlook.

Further, Goldman says Life360’s cost base and customer acquisition economics compare favourably relative to its US peers.

In terms of valuations, Life360’s shares “screen cheaply compared to peers when accounting for its robust growth outlook – particularly now that it is moving from the pre-profit to profitable tech basket”, says Goldman.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.