SUNDAY ROAST: The stocks that lit a fire under our experts this week

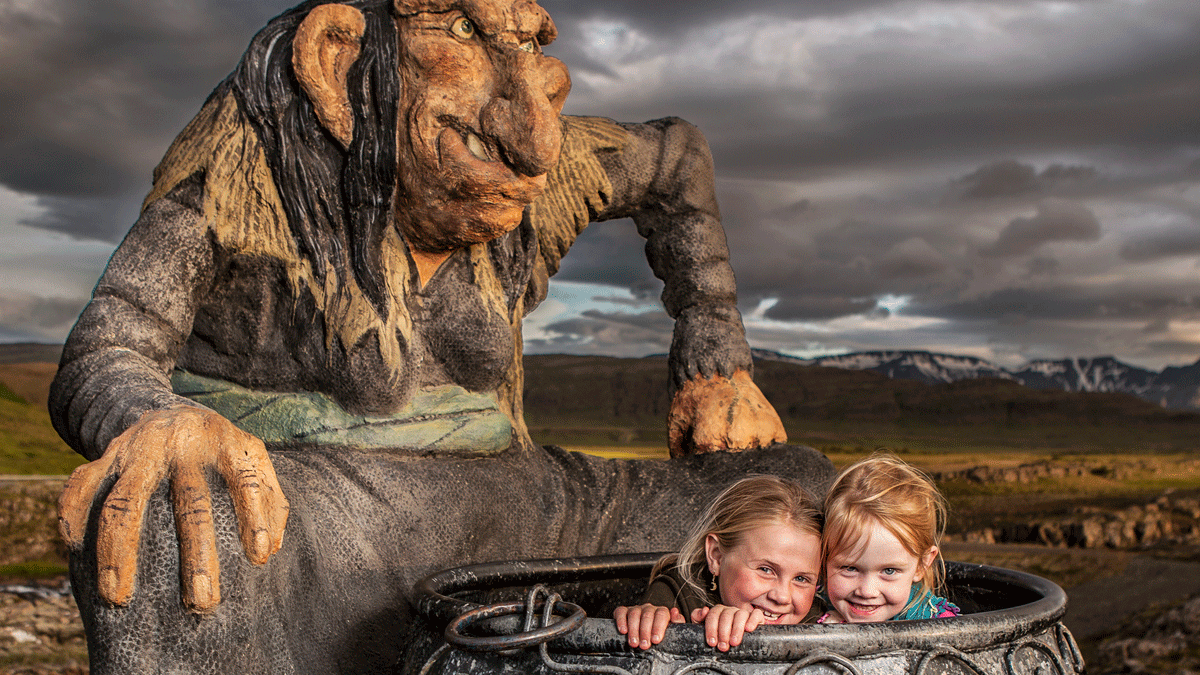

'Looks like everyone's kicked a goal.' Picture: Getty Images

Barry FitzGerald

Feeling brave? It’s come to Garimpeiro’s attention that nickel stocks are now trading at give-away prices – explorers, developers and producers alike.

No surprise really, given half the global industry is making a loss at current prices.

Blame that on a flood of Chinese-backed Indonesian upgraded nickel from laterite sources (Twiggy would say “dirty”) on to the Chinese-owned London Metal Exchange platforms.

Suddenly it seemed the world was awash with nickel suitable for use in the high-growth battery market. Even BHP is thinking about shuttering its 80,000tpa Nickel West operation.

Garimpeiro, ever the optimist (it’s all a Bombers fans has to hang onto), believes it’s always darkest before the dawn. And here we are, with the nickel price picking itself up to climb 13% higher since its February low.

BHP’s view is the nickel market could be over-supplied to the end of the decade. But it also agrees with Twiggy, saying the LME has to lift its game if its Responsible Sourcing of LME-Listed Brands policy is to be taken seriously.

So this is a conversation about “clean” battery metals, and surely nickel is one such with an unchallenged growth in demand profile.

“’Clean’ nickel”, Garimperio says, is not in a positionl to command a premium – yet. “But there is a real chance that governments in Europe and North America will seek to protect their nickel miners through tariffs and the like, in the name of good ESG policy of course.”

He prefers the view of Macquarie’s veteran nickel watcher Jim Lennon who’s revised surplus estimate actually points to a supply deficit in 2024.

“A major change from our recent forecasts,’’ Lennon said.

Garimpeiro prefers the Macquarie take. Surely the only way is up? (How long can an AFL team go between flags?)

These four ASX juniors that “all have big nickel resources under their belt and will be called on eventually to get in to production”.

A couple have even moved nicely higher since their early February lows.

Centaurus (ASX:CTM): Trading mid-week at 26.5c for a market cap of $133m. Was a 28c stock at the start of February and is long way off its 52-week high of 98c.

Alliance (ASX:AXN): Trading mid-week at 3.7c for a market cap of $25m. Has come up from 3.2c at the start of February but remains well short of is 52-week high of 15c.

Ardea (ASX:ARL): Trading mid-week at 51.5c for a market cap of $97.5m. Has come up from 37c at the start of February. Still, it is down from a 12-month high of 75c last August.

Aston (ASX:ASO): Trading mid-week at 1.6c for a market cap of $20m. It is steady on its market price at the start of February and remains well short of its 52-week high of 14c.

Dale Gillham

Chief analyst, Wealth Within

“Whether you do or don’t like or use artificial intelligence technology, we can all agree that it’s here to stay.”

Dale Gillham is bullish on all things AI. Well, three things at least – Appen, NextDC and BrainChip. We’ll get to them in a minute.

First of all… why, Dale?

“According to projections, AI spending in Australia is expected to reach US6.4 billion by 2026, contributing to an estimated AU$22.7 trillion boost to the global economy by 2030.

“From an investment viewpoint, if this sector can perform in Australia even remotely close to its American neighbour, then we might well be staring at a future goldmine for early investors.”

Okay, our ears are on Dale. Who’s on your radar?

Appen (ASX:APX – 63c, $140m MC): APX provides data tools and services to global market players to aid with such things as workflow management, data organisation, performance analysis and A/B testing.

FY23 wasn’t great, with revenue falling to $US273, while new markets revenue of US$81.5 million was down 7.8% which the company put down to a $46.5m drop from global product.

New CEO and managing director Ryan Kolln prefers to see 2023 as “transitional”.

“The mainstream availability of generative AI created huge interest for our customers but also resulted in many reevaluating their AI investments,” he says.

However, Kolln says FY24 is looking up for APX with “new products … focused on generative AI applications”.

Gillham admits it’s “just too early right now to invest” in APX, but if you’re confident in Kolln’s belief that revenue will “stabilise” in 2024, you’ll pick APX up at an all-time low.

“The potential upside for investors in this stock is astronomical if Appen can get things right,” Gillham says.

NextDC (ASX:NXT – $16.85, $8.6bn MC): Rack spaces, private cages, private suites and remote hands – who said data wasn’t sexy?

NXT is Australia’s leading data centre company, with 13 centres across several countries and a partnership with Microsoft.

Its H1 FY24 saw total revenue increase by 31% to $209.1m. Underlying EBITDA was up by 5% to $102m.

The company says it remains well capitalised to take advantage of its strong forward sales pipeline, as well as to continue to build its forward sales and earnings outlook.

With a share price currently trading at an all-time high, this is another AI stock Gillham’s not ready to jump into right now, but “will be watching it like a hawk, waiting for the next opportunity”.

BrainChip Holdings (ASX:BRN): Gillham says BRN is at the forefront of AI reasoning and analysis and most notably, is known for its Akida Neuromorphic Processor.

Tthe company is forecasting it will be operating in a market worth over US$1 trillion by 2030.

“To add further good news, it has posted one of its best months in recent history, up over 150% for the month of February.

“Unlike NXT, however, which is trading at its all-time high, I believe BRN has plenty more upside potential in the short to medium term; therefore, this is one to watch very closely.”

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.