Morningstar: Rough seas ahead for markets haunted by high rates, weak demand and bleak corporate earnings

Pic: Getty Images

- Morningstar: minimal capital returns for global investors in 2023, likely income yield at ~4%

- Interest rate tightening cycle forecast to have an adverse effect on consumer demand and corporate earnings

- Despite a sombre market outlook, Morningstar expects opportunities to emerge

The crystal balls are coming out as we come to the end of a tumultuous year on global equity markets and we look to what might be the 2023 market performance.

Morningstar has released its forecast for next year and it’s not particularly optimistic after what has been a volatile 2022 with geopolitical uncertainty with the war in Ukraine and global central banks hiking rates to curb what was originally termed as “transitory inflation”.

“Expect a mediocre 2023 market performance, with minimal capital returns and an income yield ~4%,” said Morningstar head of equities research Peter Warnes.

“The interest rate hiking cycle is nearing an end, but quantitative tightening by the northern hemisphere central banks is in its infancy.

“The impact of the draining of the punchbowl is difficult to predict, however it is unlikely to be supportive of risk asset prices.”

Prepare for a hard landing

So now what?

Basically, the message is don’t tune out till the flight attendants are done pointing out the nearest safety exit.

“The unravelling of bloated balance sheets and the impact of the prolonged and still unfinished interest rate tightening cycle will have an adverse effect on consumer demand and corporate earnings,” Warnes said.

“A hard landing looks increasingly more difficult to avoid in 2023.”

Warnes said the interest rate hiking cycle is nearing an end, but quantitative tightening by the northern hemisphere central banks is in its infancy.

“The impact of the draining of the punchbowl is difficult to predict, however it is unlikely to be supportive of risk asset prices,” he said.

On Tuesday, the Bank of Japan (BOJ) announced it would expand the range of 10-year government bond yield fluctuations from its +/- 0.25 percentage points to +/- 0.5 percentage points on the back of global market volatility, which had in turn affected its markets. .

Japan has been the developed world’s most recent country to hold out on raising ultra low interest rates but the announcement is a signal that its central bank is on edge and may change its policy course.

A little energy left to burn

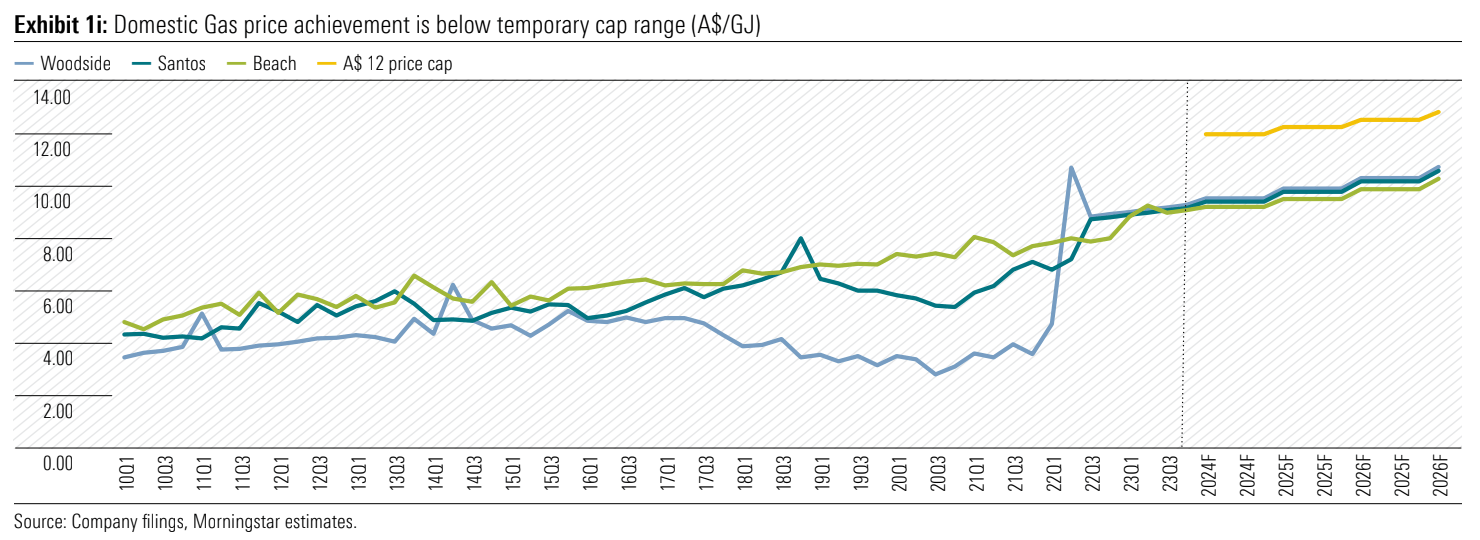

On the upside, Morningstar analyst Mark Taylor remains bullish on both the Energy Sector and its major constituents.

Woodside Energy (ASX:WDS), Santos (ASX:STO), and Beach Energy (ASX:BPT) have all benefited from rising oil and gas prices, he says.

“Energy prices are still above our mid-cycle forecasts but share prices don’t reflect mid-cycle levels yet.

“However, despite share price appreciation, we think value still exists. And if energy prices remain elevated for longer than expected, value may be even greater. That is possible given the energy crisis in Europe,” according to Taylor.

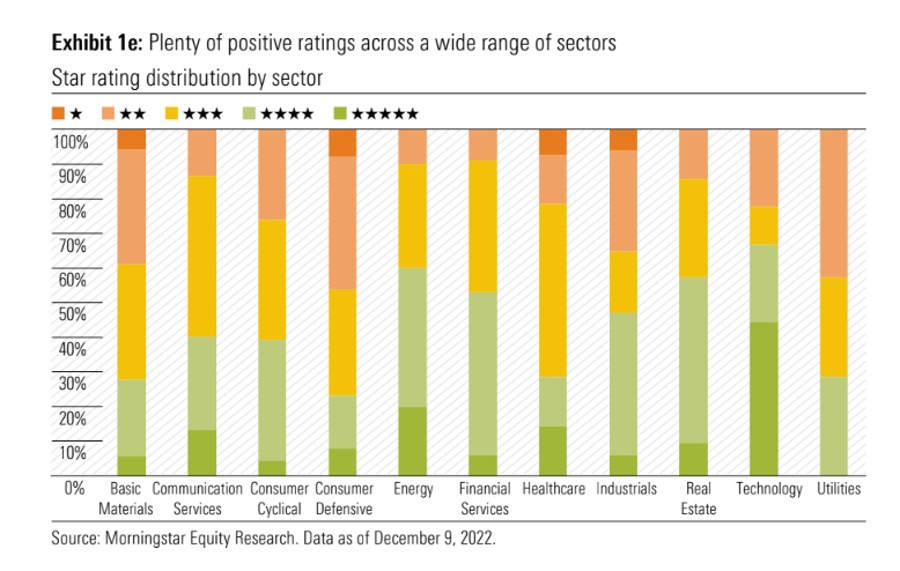

In a quick dive around the sectors the key highlights of the Morningstar 2023 forecast include:

- Energy – prices still above Morningstar mid-cycle forecasts but share prices don’t reflect mid-cycle levels yet

- Basic Materials – expectations of interest rate rises to moderate and China reopen could boost commodity prices with miners fairly valued

- Communication Services – telecom pricing is improving while recession worries are a potential headwind for media earnings

- Consumer Cyclical – all eyes on the RBA as it slows the economy but some cyclicals represent still good value

- Consumer Defensive – relatively stable dividend streams could lose their appeal as bond yields increase

- Financial Services – better bank margins expected despite intense competition

- Healthcare – buying opportunities remain in healthcare despite recent market rally

- Industrials – could maintain margins by passing on costs to customers

- Real Estate – some of Australia’s best property plays now look attractively valued

- Technology – a renewed focus on profitability in the technology sector

- Utilities – high wholesale electricity prices paint a favourable picture for utilities

Central banks & transitory inflation

“Central banks had a major influence over economies and financial markets in 2022,” Warnes said.

He said despite clear signs inflation was not transitory, by maintaining zero-bound interest rate settings and continuing quantitative easing through the first quarter, central banks magnified the potential problem.

Furthermore, he said the “fiscal largesse of 2021” fanned global consumer demand and disrupted global supply chains and exacerbated the impact on prices.

“Despite being unable to affect supply, central bank policies continued to support and encourage demand with abundant financial liquidity at an extraordinarily low price,” Warnes said.

“Follow the leader was the game, which ultimately led to an aggressive monetary policy tightening which should have been avoidable.”

GDP growth to at least halve in 2023

While 2022 will finish on a relatively strong note with year-on-year GDP growth around 3%, the landscape is set to change meaningfully in 2023.

Almost unbridled household spending, which was the main driver of GDP growth in 2022, will be restricted by the delayed impact of eight interest rate hikes totalling 300 bp (3%).

Warnes said given the subdued GDP forecasts over the next two years, growth stocks are likely to be de-rated further and unprofitable companies should be avoided.

He said despite the unemployment rate at a 48-year low of 3.4% and solid wages growth, household disposable income will come under increasing pressure as mortgage repayments spike.

“Savings buffers continue to deplete as the household savings-to- income ratio retreats to pre-pandemic levels,” he said.

“Household spending growth is expected to decline from 4% in 2022 to between 1% and 1.5% in 2023.”

He said the Australian economy is better placed than most with a substantially lower debt to GDP ratio than larger northern hemisphere developed economies.

“However, the interest on government debt is forecast to be the fastest growing expense item over the next decade and deficits will persist for many years.

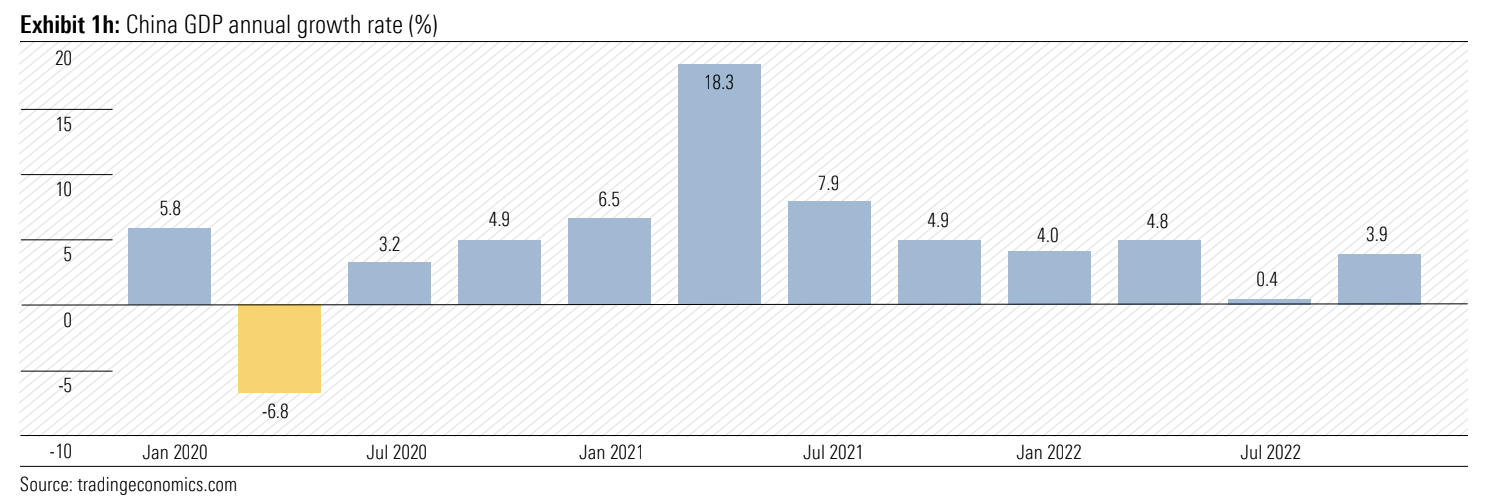

China’s stimulus will help to only a certain extent

Warnes said while China’s stimulus policies to revive its depressed real estate/property sector will be beneficial to Australia’s resources sector, particularly iron ore, net exports can’t replace house hold consumption as the main influencer of GDP growth.

“Where household consumption and private sector expenditure goes, so will the economy,” he said.

He also said despite an encouraging fall in the October CPI, care should be taken with the monthly data, and it should not be extrapolated into an ‘inflation has peaked’ scenario.

“Further rate hikes are likely in 2023 as inflation remains elevated through the March quarter,” he said.

“The RBA is likely to then pause and stay on the sidelines until 2024, when with economic activity at a low ebb, cuts could be initiated.”

But behind the clouds of a grim 2023 market performance forecast the sun is shining.

“Despite a sombre market outlook, as always, opportunities will present,” Warnes said.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.