MoneyTalks: Why James Gerrish thinks Aussie equities could soon Trump runaway US stocks

Don't toughen up, it's time to be (rate) sensitive. Re: Getty

MoneyTalks is Stockhead’s regular recap of the ASX stocks, sectors and trends that fund managers and analysts are looking at right now.

Today we check in on recent tips from Market Matters’ James Gerrish.

The game’s afoot

US equities have been extraordinary in recent times, powered by the growing profitability of its tech leaders. But our expert-in-residence thinks the equation could be about to change.

“We believe the risk/reward is now favouring Australian equities over their US peers,” James Gerrish said this week.

With Fed Chair Jerome Powell flagging rate cuts before inflation hits 2%, Gerrish reckons that barring a surprising uptick in inflation, US equities will enjoy the 2-3 cuts into 2025 (“although a fourth does feel too hopeful”).

“There’s a logical old saying in financial markets: Don’t fight the Fed,” James says. “We believe interest rates are set to fall, with the Fed likely to pivot sooner rather than later.”

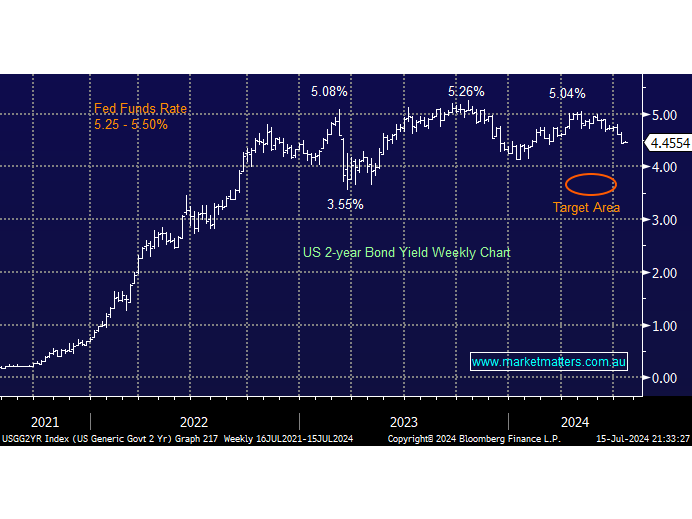

Bond markets are optimistic towards Fed cuts, but as the chart below illustrates, they were far more cautious than in January and the first half of 2023.

Ticker: The ASX has some left

The ASX200 made history on Monday, trading and closing above 8000 for the first time, following global equities higher as the recurring dream of interest rate cuts suddenly becomes reality.

“The US is on the cusp, with the futures market factoring in at least three cuts by January,” Gerrish says.

That’s in contrast with local markets which are still absorbing the renewed potential for rate hikes here. In Martin Place, cuts aren’t being factored in until mid-2025.

“We believe that three cuts by the Fed over the next 6-months are optimistic, leaving room for disappointment, especially with the Presidential Election on November 5th while Trump’s policies will equate to more debt. And we believe the RBA’s next move will be a rate cut, although it’s unlikely before 2025 is well underway.

“Either way, we anticipate ongoing volatility on the stock/sector levels as investors second-guess the timing of future central bank rate cuts.

These are just three of the interest rate-sensitive stocks we like over the next 12 months as central banks’ tight monetary policy starts to weigh on economic growth, leading to rate cuts moving through 2024/5.

“While the ASX200 holds above 7900, technical and momentum traders have no reason to doubt the ASX’s internal strength.”

Try to be more rate-sensitive

Evolution Mining (ASX:EVN)

Gold is positively correlated to US bonds and the $US, Gerrish says.

“If we are correct, yields should fall, and gold should rise over the coming months.

“However, as we’ve witnessed over the last eighteen months, gold stocks find it very easy to correct 20-30% when gold consolidates its gains.”

It’s a volatile, cyclical, low-yielding sector, Gerrish says.

“If we increase our exposure to high-yielding rate-sensitive stocks over the coming weeks, our gold exposure will most likely sold into strength when we believe the thematic is due a “rest”.

“We will revaluate our gold exposure if/when the precious metal trades above $US2500.”

Mirvac (ASX:MGR)

“We have been a touch slow in jumping MGR, but we continue to like this property group.

“In today’s cautious market, we would rather jump on board a stock that’s shown its bullish hand.

“The stock’s valuation is below other A-REITs despite the prospect for above sector growth, underpinned by an uptick in residential and commercial developments coming online over the next 3 years.

“We like the risk/reward towards MGR around $2,” Gerrish adds.

“If we press the “Buy button” on MGR, we need a funding vehicle, and, Ramsay Health Care (ASX:RHC) is the most likely candidate. The sector is in a funk, with Healthscope’s current debt restructuring following Brookfield’s buy-out in 2019 casting a big shadow over the sector, while they continue to experience issues with their French operation.

“We have given this position too much room as it failed to embrace interest rate optimism and a generally firm stock market. As we all know, cutting losses is as important to portfolio performance as picking winners. At this stage of the cycle, it’s a lot easier to be patient with a stock yielding ~5% as opposed to 2%.”

APA Group (ASX:APA)

While not in the real-estate sector, this infrastructure company has been weighed down by some stock-specific factors, but rising bond yields have also been a major impediment.

APA’s energy infrastructure business has been underperforming since it peaked in 2022.

We see solid value in APA as a defensive stock when we combine our bullish view on bonds (lower yields) and the company’s sustainable and growing yield in the 7% region, i.e. when markets become confident that the RBA has finally got inflation under control we should see a bullish re-rating in its share price.

“However, at this stage, the threat of an RBA hike in the coming months is likely to weigh on APA, although if such a move caused the energy infrastructure business to fall, the risk/reward would look attractive.”

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.