MoneyTalks: What are the real assets you really need when volatility takes a toll

Via Getty

MoneyTalks is Stockhead’s way of saying thank you! to you, our legion of unpaying readers, and you too – our legion of unpaid experts.

In just about the time it takes to eat a Twinkie or chug a man-shake, we drill down with a remorselessness that is shocking into what stocks investors are looking at right now.

Recorded live and commercial free in front of an unpaid studio audience plucked unwarily off the street, we put the hard word on our analysts to find out what’s hot, what’s not, and what’s worth sticking your neck out for in these uncertain and slightly bewildering, hyperbole-rich times.

Today we’re thrilled to be joined by Ashton Reid, Portfolio Manager, Martin Currie Real Income Fund.

What’s hot right now, Ashton?

Well, first of all it’s just great to be here Christian.

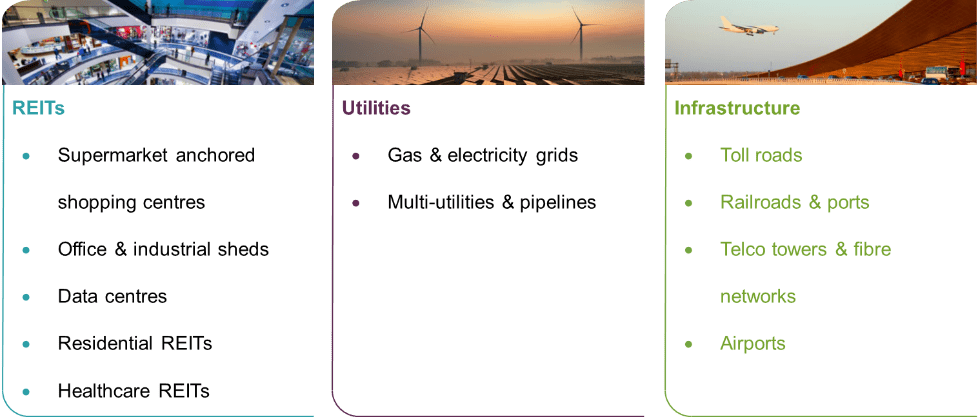

So. High-quality “Real Assets” – such as REITs, utilities and other essential infrastructure – are the tangible building blocks of the economy that most of us use every day.

As such, our longstanding belief at Martin Currie is that the growth of high-quality listed Real Asset securities is driven mainly by demographic themes.

The everyday use nature of these assets makes their demand profile relatively inelastic, and therefore not pegged to the business or economic cycle.

Quite simply: the more a population grows, the higher the volume of demand for Real Assets serving their everyday needs.

We also specifically avoid volatile, economic-sensitive and lower-income Real Assets such as listed commodities, gold or resource securities, timberlands, agriculture investments, property developers, and inflation linked bonds. And by focusing only on listed securities, we can also avoid the common problems that direct-investing or unlisted investments in property, utilities and infrastructure face such as concentration risk, low liquidity, poor pricing transparency and high cost.

For the MCA Real Income strategy, the universe reflects a blend of listed Real Asset securities such as listed REITs, infrastructure and utilities.

The hot space right now is to own Real Assets with built in inflation buffers, and portfolio wise we’ve been well placed in this regard.

As early inflationary signs began to emerge around the globe, we moved quickly to focus on owning the right Real Assets. Our focus was on Real Assets that had the ability to accelerate cash flows to match or in some cases outpace inflation; in simple terms Real Assets that have pricing power and can prosper in inflationary times.

In contrast, Real Assets that have long-term, fixed cash-flows at lower growth levels will struggle to keep up and will lag in performance terms.

With this mindset, we were active through late 2020 and into mid-2021 to position the Real Income Fund for accelerated income growth as both inflation and higher bond rates came at us. We shifted portfolios away from CBD office names, offshore retail and energy generation.

With an eye firmly on looming inflationary risks and Real Asset pricing power we increased weights in energy transition network winners, toll roads, industrial sheds, suburban office, storage, daily needs retail and childcare. The appeal of strong end-user demand, support from rising land prices, increased grid spend from energy transition and great underlying customer affordability were all major themes in these positions.

How does population growth and urbanisation impact the valuation of real assets?

As I mentioned earlier, the more a population grows, the higher the volume of demand for Real Assets serving their everyday needs.

To name a few of the increased demands, there will be more people:

- Cooking, cleaning living and heating (via gas, electricity and water grids i.e listed utilities)

- Driving, driving and driving (toll roads, listed infrastructure)

- Doing the daily: shop at supermarket-anchored shopping centres (listed REITs);

- Nesting, making use of online living ie: delivery services – which benefit data centres, distribution sheds (listed REITs), warehousing and ports & rail (listed infrastructure).

We’ve built a very refined blend of listed REITs, infrastructure and utilities is designed to capture the upside from the megatrend of urbanisation and population growth, whilst avoiding the ups and downs driven by the business cycle. We believe that the longer-term nature and breadth of Real Assets so defined to be integral in continuing to satisfy every day needs of the ever-growing population today and tomorrow.

In-turn, the fundamentals of strong population growth as a backdrop are supportive of a Real Asset universe with stronger cashflows, superior growth and appealing valuations. The dominant industry positions that quality Real Assets typically have in their key catchments gives them an in-built ability to raise their prices over time. This pricing structure, inelastic demand, high recurring cash flows and less exposure to business cycle risk, helps to protect income against inflation and provide income growth.

Ash, how will rising inflation and rising interest rates hit the Real Asset universe?

Despite what might be perceived as a challenging landscape for Real Assets as inflation increases and bond rates rise, we believe that the MCA Real Income strategy provides an attractive inflation-protected investment opportunity, as well as meaningful income upside potential.

Our portfolio focus for some time has been on Real Assets with pricing power. As early inflationary signs began to emerge around the globe, we have moved the portfolio to focus on owning the ‘right’ Real Assets for the environment.

To us, Real Assets that have pricing power which can prosper in inflationary times.

We are looking for Real Assets that can accelerate cash flows to match, or in some cases outpace, inflation due to CPI inflation escalators, but also do so in a way that the pass through is affordable/acceptable to underlying users without impacting demand.

Real Assets, such as shopping centres, toll roads and regulated utilities, can benefit from inflation pass-through mechanisms.

Some examples, please?

Ok. Many Real Assets have rents, tolls or charges that directly reference CPI, or have rents that are closely correlated to tenants’ sales. This means they are less impacted in the long run by rising inflation as they will also see higher cashflows as prices rise and revenues are boosted. As inflation increases, they can thus grow the dividends they can pay to investors.

As a consequence, we see our Real Income strategy’s focus on growing the long-term dollar value of its income stream as well-placed to deliver benefits from inflation, while being well-shielded from the negative impacts of the more inflationary outlook.

Ashton’s ASX Real Asset favourites:

In the toll road space, Transurban Group’s (ASX:TCL) tolling mechanism is a great example of strong inflation protection that is linked with both the concept of CPI escalation and affordability.

Every time that drivers hear their tolling transponder beep, that toll will have at least risen by CPI, if not more, from the year prior. But, when you couple this with how much time is saved avoiding traffic congestion on alternate routes, and toll levels relative to the hourly cost of truck drivers for commercial users or relative to private passenger incomes, the travel time saved is good value for users.

So, looking forward, Transurban is very well placed to continue to benefit from accelerating inflation.

The ASX listed global toll road operator Atlas Arteria’s (ASX:ALX) toll price regime also benefits from inflation.

The company’s European toll roads have seen significant traffic and mobility improvement recently and this augers well for cashflow and dividends. Earlier this month Stockhead’s Eddy Sunarto rightly noted the toll roads developer’s 16% vault after the IFM Global Infrastructure Fund (IFM) acquired 15% of ALX in an after market deal priced at $8.10 per security.

Atlas says it hasn’t yet received any proposal from IFM to acquire additional stake in the company. But worth watching very, very closely.

Finally, pipeline owner APA Group (ASX:APA) is also an inflationary beneficiary. APA Group’s long-term contracts escalate prices with inflation (mix of Australian and USA CPI); therefore, APA has strong pricing power and stronger revenue and cashflow growth in a more inflationary environment.

Additionally, the company is benefitting from Russian bans given they create new volume opportunities for Australia. Another aspect is that their drawn debt is currently all fixed, with no material refinancing due until 2025, so they are well protected from interest rate rises.

Generally, Infrastructure and Utilities names will typically fare better with accelerating inflation than REITs, however we note that some REIT segments, such as Retail, can provide solid inflation protection, highlighting the importance of searching for the ‘right’ Real Assets to invest in.

For example, accelerating inflation has been positive for Scentre Group’s (ASX:SCG) regional and super-regional shopping centres. Strong tenant demand/occupancy trends have translated into the power to push up retail rents as tenant sales grow.

Reopening post-COVID is expected to see further acceleration of rental and cashflow growth ahead.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.