MoneyTalks: Three little bigs – the undervalued ASX miners hiding in plain sight, with Jon Mills

Via Getty

MoneyTalks is Stockhead’s regular recap of the ASX stocks, sectors and trends that fund managers and analysts are looking at right now.

Today we hear from Morningstar equity analyst Jon Mills, who looks at where the value is in ASX mining stocks right now.

Jon doesn’t muck around, so let’s begin.

Undervalued ASX Miners

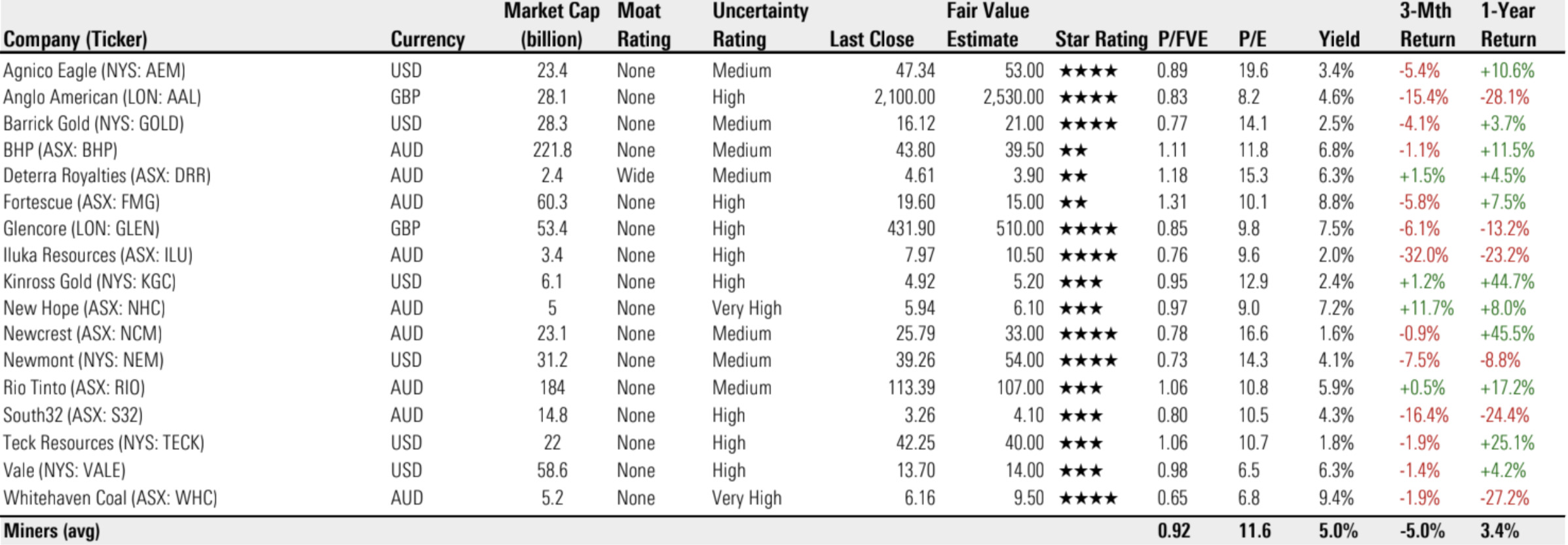

While there is a wide dispersion in valuations between the various miners, Jon says commodity prices are supportive.

“The sector as a whole is modestly undervalued.”

OK.

The broad view

“Miners’ earnings are under pressure from increasing labour, fuel, logistics and other expenses, although inflation appears to be moderating.

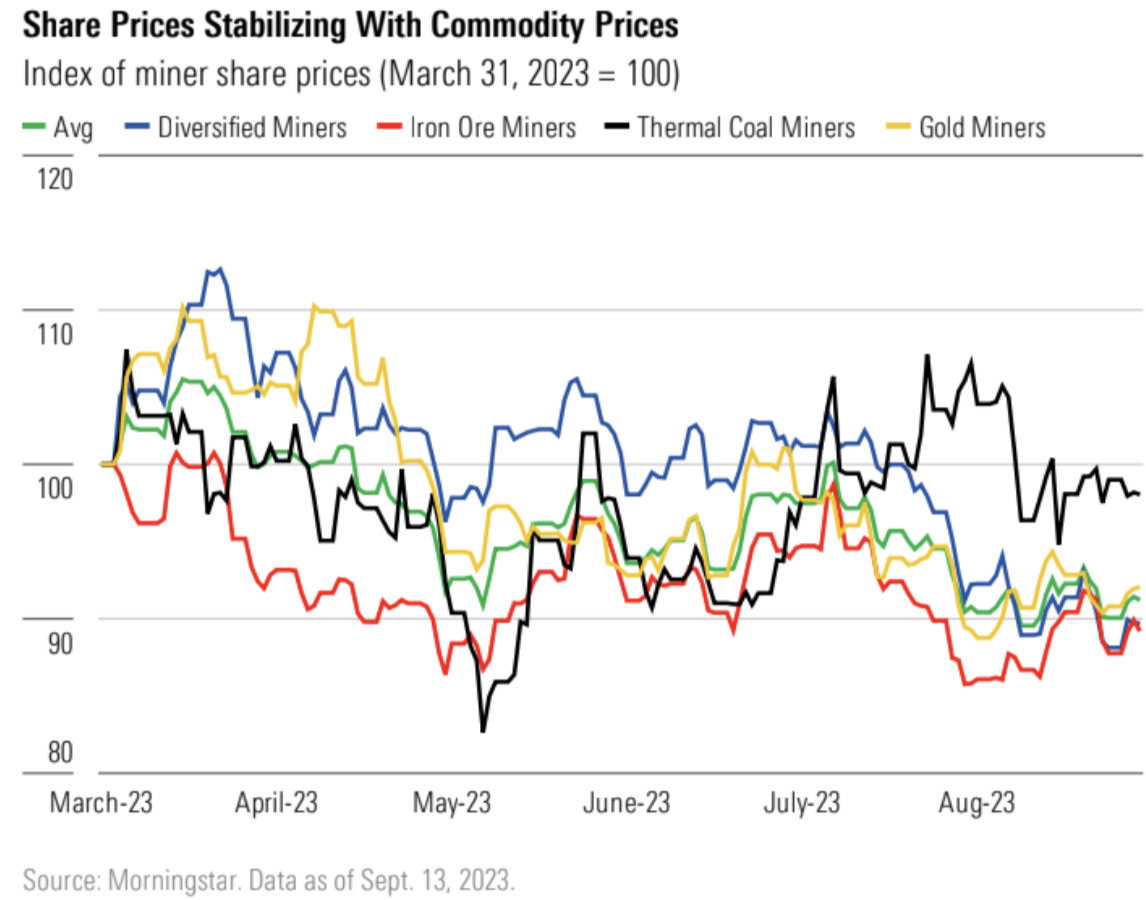

“And while commodity prices are generally lower than earlier in 2023, they have broadly stabilised after falling on concerns that China’s reopening would underwhelm, along with worries over a Western recession.

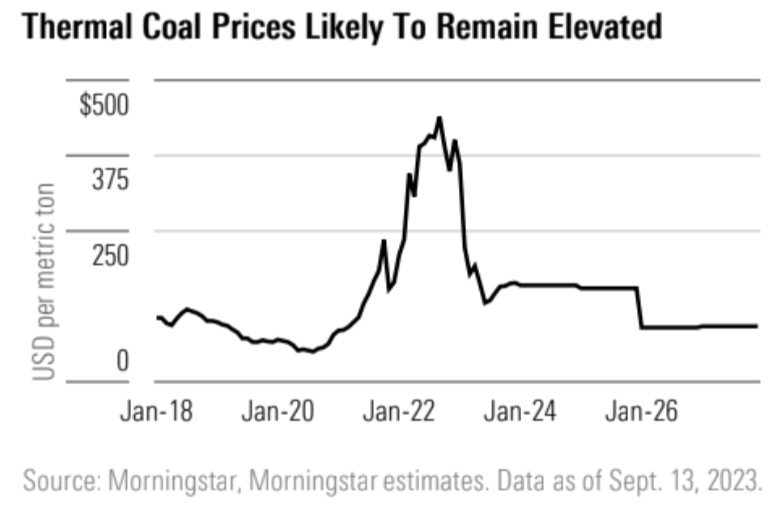

“Thermal coal prices remain higher compared with historical values and cost support as the Russia-Ukraine war reinforces the importance of energy security.

Based on the futures curve, Morningstar now forecasts thermal coal averages at around US$175 per metric ton from 2023 to 2025, up from about US$165.

“We raised our mid-cycle thermal coal price to US$100 from our prior estimate of roughly US$90 per metric ton… we also raised our assumed average metallurgical coal prices from 2023 to 2025 to around US$285 per metric ton, up from about US$250 prior, based again on the latest futures curve.

“However, we maintain our assumed mid-cycle price of about US$150 per metric ton from 2027, which is also based on our estimate of the marginal cost of production.”

Though volatile, Jon says most miners’ share prices changed little in the last quarter, with thermal coal miner Whitehaven “materially undervalued”.

And the transition?

Jon says green steelmaking technologies are “unlikely to be economic for the foreseeable future”, with metallurgical coal likely to remain in demand for blast furnace/blast oxygen steelmaking “for many years”.

“On the supply side, ESG investors lump metallurgical coal in with its dirtier cousin thermal coal, with none of the major miners keen to buck ESG concerns and expand their metallurgical coal production.

“Queensland’s royalty hike is also likely to increase the price required to incentivise new supply, also supporting long-term prices in our view.

“Balance sheets remain strong and elevated commodity prices are incentivising miners to tilt to growth, with higher M&A activity.

“BHP (ASX:BHP) bought OZ Minerals, Newcrest Mining (ASX:NCM) looks likely to be acquired by Newmont Goldcorp Corporation (ASX:NEM) while M&A activity is also heating up in the lithium sector. Many miners are also increasing production through extensions or expansions of existing mines driven by optimism over higher demand for copper and nickel from decarbonisation and electrification.”

As such, Jon says both capital and exploration spend is rising.

Whitehaven Coal (ASX:WHC)

“Whitehaven Coal is a large Australian independent thermal and semisoft metallurgical coal miner with several mines in the Gunnedah Basin, New South Wales. It also owns the large Vickery and Winchester South deposits in New South Wales and Queensland, respectively. Coal is railed to ports in Newcastle for export to Asian customers.

“The Maules Creek and Narrabri mines should be the key driver of an expansion in Whitehaven’s share of salable coal production to approach 19 million metric tons from fiscal 2028, from about 14 million metric tons in fiscal 2021.

“Development of the Vickery deposit could see around 7 million metric tons of additional equity production, with first output likely in our view from around 2025.

“Whitehaven is still benefiting from above-average thermal coal prices. Cash flows are strong with excess cash likely to be returned to shareholders via dividends and share repurchases,” Jon says. The company is also considering growth options.

“While down on historical highs reached in 2022, thermal coal prices remain elevated as the Russia Ukraine war reinforces the importance of energy security.

“The company is generating torrents of cash and with a very strong balance sheet, is returning much of its excess cash to shareholders via fully franked dividends and buybacks, though it recently paused its buybacks while it considers growth options including bidding for two coal mines BHP is selling.

“Our updated fair value estimates for Whitehaven also reflect a weaker AUD/USD exchange rate The decline in currencies versus the US dollar provides a modest tailwind.

“We think it is undervalued due to many investors preferring to avoid investing in coal. It is well-placed to benefit from continued strong demand for high-quality thermal coal over at least the next decade.”

Newcrest Mining (ASX:NCM)

“Newcrest is an Australia-based gold and, to a lesser extent, copper miner. Operations are mainly in Australia and Papua New Guinea. The company also owns a 32% stake in the Fruta Del Norte gold mine in Ecuador, while the acquisition of Brucejack in 2022 adds to its 70% stake in the Red Chris mine in Canada.

“The company is likely to produce around 2 million ounces of gold per year over the next decade, making it one of the larger global gold producers but still only accounting for less than 2% of total supply. Cash costs are below the industry average, underpinned by improvements at Lihir and Cadia. Organic growth options include its Havieron prospect, the Red Chris underground mine, and the high-grade Wafi-Golpu copper-gold prospect in PNG.

“Newcrest Mining is engaged in exploration, mine development, mine operations and sale of gold and copper concentrate. It has operations in Australia and Papua New Guinea, with smaller mines in Indonesia and Cote d’Ivoire

“We think the proposed acquisition of Newcrest by larger competitor Newmont is likely to occur. Newmont is undervalued in our view: its first half sales were weak and costs elevated but we think sales will improve and help margins.

“Commodity prices have generally stabilized after falling on concerns that China’s reopening would underwhelm, along with worries over a recession in the West. Even so, they remain elevated versus history and cost-curve support. The Russian invasion of Ukraine and subsequent sanctions on Russia support energy prices and reinforce the importance of energy security.

“As Newcrest shareholders will receive 0.40 shares in Newmont for each Newcrest share, they own along with a USD 1.10 (AUD 1.72) fully franked dividend assuming the deal closes, we think this in turn means Newcrest is undervalued.”

South32 (ASX:S32)

“South32’s strategy is to transition its portfolio to metals such as aluminium, alumina, copper, and zinc that are more likely to benefit from decarbonisation and electrification. As such, while elevated metallurgical coal prices saw the division comprise around one-third of fiscal 2023 EBITDA, we forecast metallurgical coal to be less than 10% of EBITDA at the end of our forecast period in fiscal 2028.

“A 2023 result that was weaker than expectations and concerns over lower near-term commodity prices drive its 20% discount to fair value in our view.

“The balance sheet also remains strong.

“South32 was born of the demerger of noncore assets from BHP in 2015.

“Its major operations include alumina businesses in Australia and Brazil, aluminium in Brazil, South Africa, and Mozambique, manganese businesses in Australia and South Africa, and New South Wales metallurgical coal. It also owns the Cannington silver/lead/zinc mine in northwest Queensland and the Cerro Matoso nickel mine in Colombia.

“The Cannington silver mine and manganese operations deliver high returns, but have relatively short reserve life.

“The company acquired Arizona Mining, which brings with it the high-grade and likely low-cost Taylor deposit in the US, and also entered the copper business in 2022 via the purchase of a 45% stake in the Sierra Gorda mine in Chile.South32 Ltd is a metals and mining company.

“S32 also has a portfolio of assets producing alumina, coal, manganese, nickel, silver, lead and zinc. The business activity is functioned through the region of Australia, South America, and Southern Africa.

“The company is benefitting from high metallurgical coal prices but because ESG investors don’t recognise the difference, these earnings aren’t being appropriately valued in the market.

“Along with a 2023 result that was lower than expected and lower near-term prices for the company’s other commodities (such as aluminium, manganese, nickel, zinc and copper), we think it is undervalued. It also has a strong balance sheet.”

ASX Miners: Modestly Undervalued

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.