MoneyTalks: This ESG fund manager (and Olympic gold medallist) sees a better investment than EVs and renewables

Pic: DKosig / iStock / Getty Images Plus via Getty Images

MoneyTalks is Stockhead’s regular recap of the stocks, sectors and trends that fund managers and analysts are looking at right now and in this edition we’re looking at some of the more niche ESG opportunities.

Today we hear from Tom King, chief investment officer at Nanuk Asset Management.

Yes, the same Tom King that won an Olympic gold medal for sailing back in Sydney 2000.

But you may not know that he studied engineering at university, then eventually became a fundie.

“I quickly worked out that whilst I wanted to change the world in a positive way, an industrial consultant wasn’t the way that gave me the most leverage and it led me into funds management,” King explained.

How Nanuk began

King was one of the co-founders of Nanuk back in 2009, when the markets were emerging from the GFC.

The founders believed there would be long term opportunities arising from the dislocation they saw coming.

“The thesis of the firm that we’ve had since before we started is that large parts of the economy are going to change significantly over coming decades, in order to reconcile population growth, economic growth and rising consumption with the environmental constraints that are becoming obvious to everyone else now – climate change, water scarcity, land degradation, air and water pollution and resource scarcity,” King told Stockhead.

“And we’ve always believed one way or another, like it or not, these changes are going to happen.

“They’re going to happen either because we see apocalyptic climate events or disastrous environmental outcomes causing massive knee-jerk reactions to respond to them, or hopefully more considered proactive action on the part of governments, businesses and consumers to move the economy in that direction.

“And as you see those things happen there’ll be a set of industries and technologies that benefit from those shifts and a very large part of the global economy that’ll be negatively affected by accommodating new investments, higher costs or having businesses displaced by new, more sustainable alternatives.

“We started the business because we thought there’s a huge transition that’s going to happen. Its investment implications were not well understood but very significant and the opportunities they would present is likely to be enduring ones that good research based fundamental investment should be able to take advantage of.

“We run one fund at the moment, it’s a listed global equities fund and the proposition of that is very simple – we aim to outperform traditional global equity indices over the long term.

“And if we do a half-decent job at selecting stocks in our remit – which is in a simple way the parts of economy benefiting from transition – then we’re likely to achieve that.”

ESG opportunities need to be pervasive and help with efficiency

While many industries and technologies that will help with environmental or resource efficiency may be obvious, King says not all will be equally compelling ESG opportunities, and even those that are compelling may not stay that way forever.

“When you look at what’s likely to happen in terms of changes, they need to be pervasive and they need to deal with making industries more efficient, more environmentally sustainable and resource efficient over time,” he said.

“And the shape of the portfolio as you see it in the top 10 today is not what it has always looked like. The way we invest: we are bottom-up stock pickers, we are opportunistic in nature, the shape of portfolio shifts dependant on where we see better opportunities.

“If you look at the things that’ve paid off for us they’re quite varied in nature [and sector] but ultimately the performance, where it’s happened for the right reasons, is because we’ve been able to identify rudimentary economic drivers of businesses or industries that haven’t been properly understood, appreciated and priced in.”

The shift is on

But in the past few years investors have begun to understand and appreciate some of these shifts.

“There’s been awareness in community globally going back over last 3-4 years as people can start to see some these sustainable technologies in their own lives,” King said.

“People can see solar on rooftops, Teslas driving on the streets, people are buying energy efficient light globes, people are buying smart energy controls for their houses and so on.

“Then you had in Australia the bushfires two years ago which spurred a significantly greater degree of interest in advisers with clients who felt the need to invest in a way more sympathetic for the environment.

“On top of that, you had COVID and COVID has done two things – it’s accelerated global policy momentum around climate change because it’s been tied into the stimulus and recovery packages and how governments think they’ll aid economies to recover and want to promote more of that.

“And I think it’s done a lot to encourage people to think collaborative global action is actually possible and that’s coincided with much more visibility around things like renewables and electric vehicles and attracted interested.

“That’s presented a challenge for us because a lot of things we’d like to own from a theoretical perspective, because they’re sustainable technologies and are growing, have become very expensive and we don’t think will become good long term investments.”

Which ESG opportunities will win?

Nonetheless, King says there are multiple incrementally positive developments that represent ESG opportunities.

“It’s things like rail transport, organic food and sustainable packaging and sustainable materials that are more interesting to us,” he said.

“Because there you’ve got in most cases mature consolidated industries with some good businesses in them that have been for a long time pretty boring, low growth parts of economy but where inevitably structural change will mean those areas are likely to see higher growth rates than what they’ve seen.

“That’s likely to be a source of investment performance over time.”

Packaging

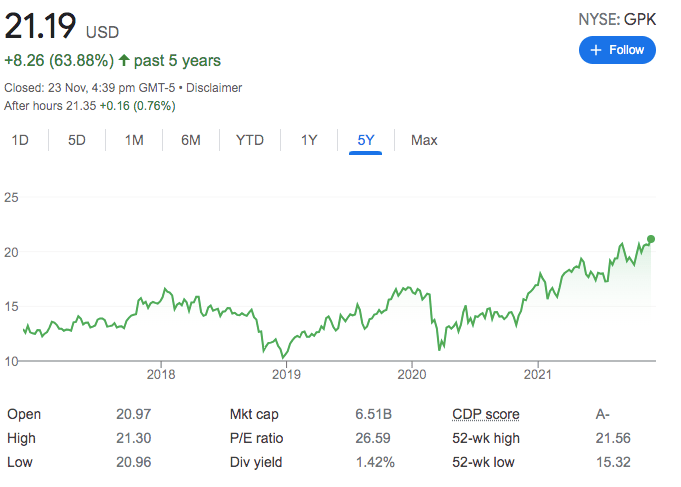

“So in packaging space we have a number of investments in things like SIG Combibloc (SWX:SIGN) which is a competitor to Tetra Pak, and Graphic Packaging Corporation (NYSE:GPK) in the US,” King continued.

“GPK make the paper seal packaging where you buy your meat in supermarket now and it doesn’t sit on polystyrene tray. It sits on a cardboard-backed tray with 80% less plastic than historical alternatives.

“[With] governments regulating plastic waste and businesses like Woolworths (ASX:WOW) committing to eliminating plastic packaging, they’re going to benefit as they’re starting to see from people wanting to use more of their product and less plastic packaging.

“And it’s still trading at around 12 times PE, it sits in consolidated global industry, it generates 20%+ return on equity and is invested heavily in products with capacity to meet demand. And it’s likely you’ll see businesses like that and its peers benefit from incrementally growth rates than they have historically.

“From our perspective they’ll re-rate significantly as the community recognises there’s growth there.”

Graphic Packaging Corporation (NYSE:GPK) share price chart

Building efficiency

King named building efficiency as another ESG opportunity, noting it was an interesting space over the medium to long term.

“Historically energy efficient products have focused on new construction. That’s great, but building five-, six- and seven-star buildings isn’t going to make the existing stock energy efficient,” he said.

“And if you want to get real about hitting the 2030-2050 targets you need to renovate on a massive scale to upgrade building stock, much of which was built 30-40-50 years ago before building standards existed at all.

“Once again you’re dealing with industry that historically hasn’t been attractive but is likely to see higher growth rates and returns going forward.

“If you look at the top holdings in the fund, Carlisle (NYSE:CSL) is a good example of that, a not well-known mid-cap US industrial conglomerate, but its main business is in materials and products are focused on efficiency.

“And in addition to having that tailwind behind its business it has a management team that’s been rationalising its portfolio over a period of 3-4 years and focusing on higher growth, higher return parts of the business that are likely to see return and growth rates improve.

“And again you’re dealing with a business that is not expensive on conventional metrics and if it can deliver on that in the current market environment it looks relatively attractive.”

Carlisle Companies (NYSE:CSL) share price chart

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.