MoneyTalks: These 5 global infrastructure stocks could stay above the water in a rising rate environment

Pic: Ben Welsh/ The Image Bank/ Via Getty Images

MoneyTalks is Stockhead’s regular drill down into what stocks investors are looking at right now. We’ll tap our extensive list of experts to hear what’s hot, their top picks, and what they’re looking out for.

Today we hear from Delft Partners CEO and portfolio manager Robert Swift.

What’s hot right now?

“Over the past few years investors that owned the much-coveted ‘FAANG’ stocks would have been amongst the most popular people in the room,” Swift said.

“Fast-forward to today and the NASDAQ is down -26% YTD; Facebook, now known as Meta Platforms (FB.NASDAQ) is down more than 40% YTD.”

He says growth stocks went on a tremendous rise to the top post-Covid, however in the current environment where fear is winning the arm wrestle against greed, those same growth stocks are being sold off heavily.

“With rate hikes being implemented across the globe and even more expected over the remainder of the year, growth stocks are worth materially less than they were under lower interest rates.

“Their cash flows, which are further out in the future, are being discounted at a higher rate.

“On the other side, the stocks that already have strong cash flows and are paying steady dividends are holding up far better.”

While the FAANG stocks have had their day in the sun, the stocks Delft Partners have on their watch go by the the mnemonic QUAKE.

“QUAKE is predominantly made up of infrastructure stocks which provide investors with exposure to cash flow generating assets, high earnings visibility and strong dividends,” Swift said.

“Critical infrastructure – the likes of railroads, utilities, ports and airports – typically have natural built in protection from inflation and fare well in a rising interest rate environment.

“They are often also seen as safe haven assets or bond proxies; this attribute could see a lot of investor capital enter the sector given the pessimistic outlook on markets today.”

Top picks

Quanta Services (PWR.NYSE)

Quanta is well positioned to benefit from the energy transition toward a carbon neutral economy.

“They offer investors exposure to favourable long-term trends such as utility grid modernisation system hardening, renewable generation expansion and integration, electric vehicles (EV) electrification and communications/5G,” Swift says.

“On the back of energy transition tailwinds, we continue to see strong earnings and revenue growth for Quanta.

“The company will be a significant player in America’s move towards renewable energy and the utility industry’s heavy spending programs on grid hardening.”

Union Pacific (UNP.NYSE)

Union Pacific Corporation, through subsidiary Union Pacific Railroad Company, operates in the railroad business in the United States.

Union Pacific is the second-largest railroad in the US after BNSF Railway.

“The company offers transportation services for grain and grain products, fertilisers, food and refrigerated products, as well as coal and petroleum products (amongst others),” Swift says.

UNP also holds an effective duopoly over railway shipping in the Western US, this gives them pricing power in an inflationary environment.

“These railroad businesses may be mature, but it doesn’t mean they aren’t also putting out spectacular numbers,” he continues.

“In FY21, UNP’s return on equity (ROE) was sitting at 41.9%! For context, Amazon’s (AMZN.NASDAQ) ROE in FY21 was 28.8%.

“The company still has room to grow through providing more channels for distribution to other geographies.”

Amada Co (6113.TYO)

Amada is a large Japanese manufacturer of metal processing equipment and machinery based in Kanagawa.

They serve an array of markets, including construction, mining, aerospace and defence, automotive, agriculture, oil and gas, electronics/electrical components, industrial equipment, and the general consumer.

“The tailwind driving growth of the company is automation, which will increase efficiency and lower labour costs in turn, while development of the latest and innovative products will drive growth in the days ahead,” Swift explains.

“Amada are currently trading at an EV/EBITDA of 5.4x, they are also forecast to grow their EBITDA by +63% in FY22 – Japanese companies have been notoriously overlooked by investors and are sitting on rock-solid balance sheets.”

The manufacturer is sitting on a net cash position of ¥85m and as governance improves across the board in Japan, Swift expects companies like these to get more attention.

KLA Corp (KLAC.NASDAQ)

KLA is the leading supplier of process control equipment used in the fabrication of integrated circuits.

Integrated circuits are small chips that perform functions in the digital world like memory storage, timers for automated processes, amplifiers etc.

In FY22, Swift says KLA is forecast to grow revenue and EBITDA by +36% and +44% respectively.

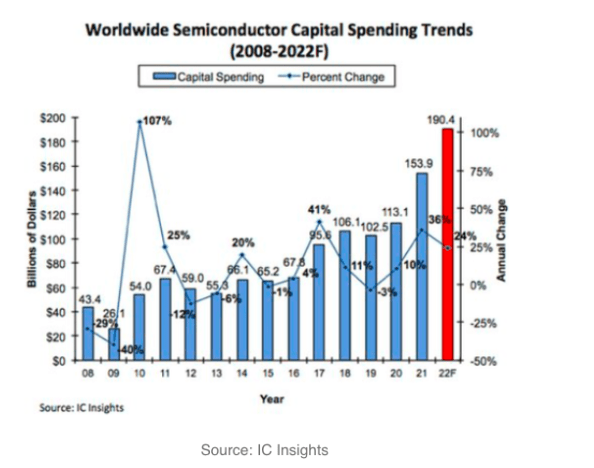

“As capex from semiconductor companies continues to accelerate in an attempt to close the supply deficit, companies like KLA will continue to benefit.”

Enbridge (ENB.TSE)

Enbridge owns and operates the largest footprint of crude oil and liquid hydrocarbon systems in North America.

The company is currently responsible for transporting about 25% of crude oil produced in North America and almost 20% of natural gas consumed in the US.

“ENB operates the world’s longest crude oil and liquids transportation system, spanning 17,809 miles and is the only energy infrastructure company that operates a massive pipeline network while also having its own gas utility company and large renewable energy portfolio,” Swift explains.

“The continuing conflict in Ukraine has put energy in the spotlight and, as much as society wants to move away from fossil fuels, we are finally starting to accept how critical oil and gas is (at least in the transition period).

“Enbridge is a secure, high-yielding dividend icon with 27 years of consecutive increases, the current dividend yield being 6.2% and is also investing in renewable power projects, primarily wind and hydrogen, which is positioning them with a strong portfolio of critical energy infrastructure to service the world’s evolving energy needs.”

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.