MoneyTalks: The Greatest Wealth is Health, says Morningstar’s Shane Ponraj and Virgil

Picture: Getty Images, The Stockhead Television Workshop

MoneyTalks is Stockhead’s regular recap of the ASX stocks, sectors and trends that fund managers and analysts are looking at right now.

Today we hear from Morningstar equity analyst Shane Ponraj.

Stockhead: Welcome Shane Ponraj! Let’s cut to the chase – are you tracking any ASX themes or sectors right now?

Shane: We’re looking at local health care stocks…

The ASX Healthcare Sector has been underperforming the index for a large part of 2023, mainly due to sector heavyweights not satisfying market expectations, but we think that leaves a lot of value on the table.

S&P/ASX200 Healthcare (XHJ) Vs. S&P/ASX200 (XJO) index

(Six Months)

Stockhead: What are some of the key trends and influences in the sector right now?

Shane: About half of the healthcare stocks in our coverage are still lagging pre-pandemic margins.

But the big drivers including supply disruption, abnormal demand, surgical backlogs, and challenges in hospital staffing, are all largely behind us.

That said however, the healthcare sector is not immune from current cost inflation, so companies with a high fixed cost base, such as pathology providers, are facing more pressure on earnings.

Stockhead: And which stocks do you feel can take best advantage of the current environment?

Shane: The three names in healthcare we think are particularly undervalued are ResMed, Ramsay, and Ansell. We view all three as high-quality companies with a narrow moat.

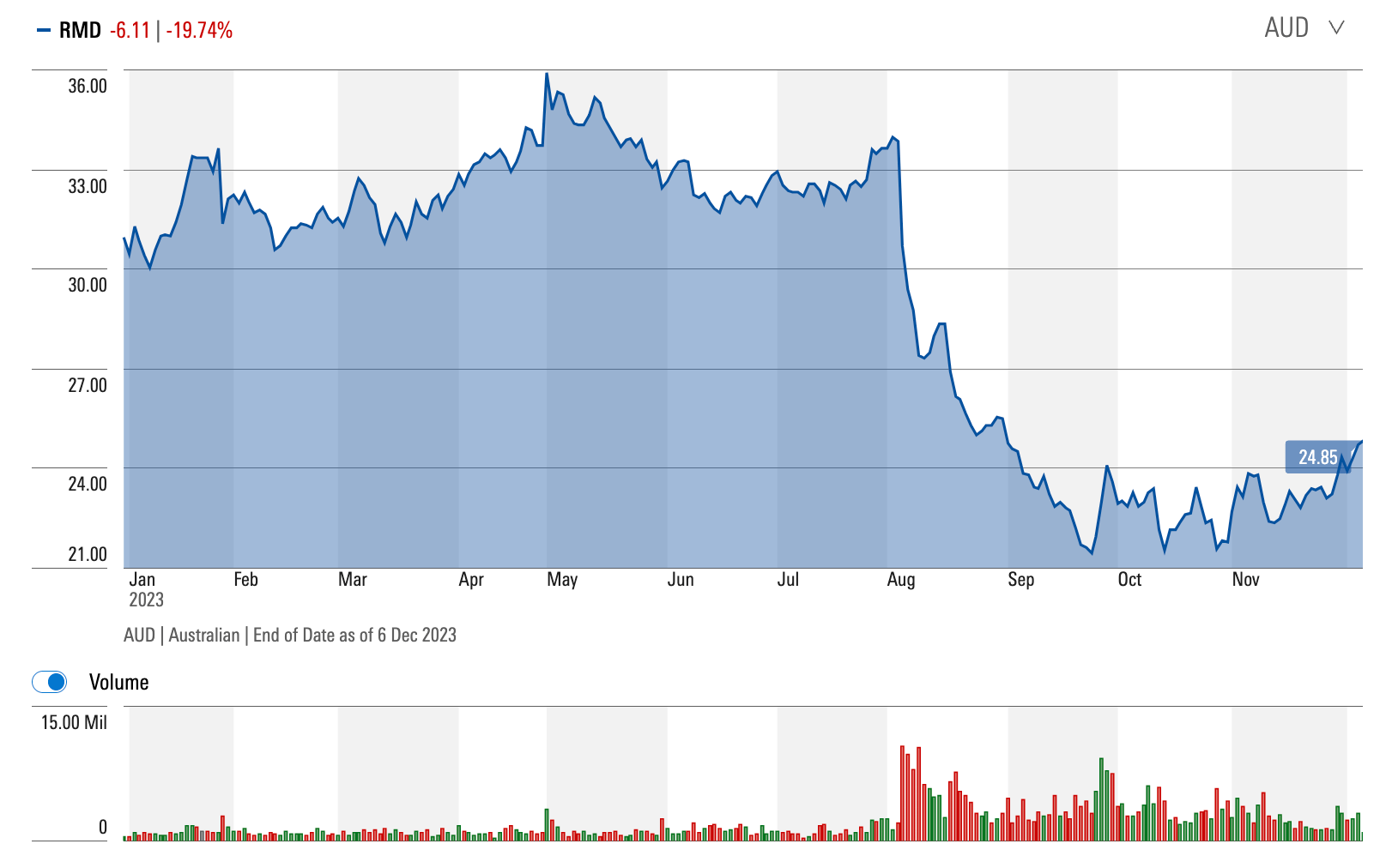

ResMed (ASX:RMD)

Shane says ResMed has been sold off on concerns that Novo Nordisk’s superstar weight loss drug Wegovy and other weight loss drugs like it will disrupt the sleep apnea industry, which to be fair, has been happening.

Year-to-Date RMD share price & volumes:

“RMD is one of the largest respiratory care device companies globally, primarily developing and supplying flow generators, masks and accessories for the treatment of sleep apnea,” Ponraj says.

However, he adds that widespread adoption of the drugs will take significant time’ given the high cost, limited supply, and variety of side effects.

“Obesity is also just one risk factor for sleep apnea, and many sleep apnea patients who experience weight loss are still obese. In most cases, they will likely still benefit from a CPAP device.

“We think the global sleep apnea market is under-penetrated and large enough for CPAP machines to remain a key treatment.

“Increasing diagnosis of sleep apnea combined with ageing populations and increasing prevalence of obesity is resulting in a structurally growing market.

“The company earns roughly two-thirds of its revenue in the Americas and the balance across other regions dominated by Europe, Japan and Australia.

“Recent developments and acquisitions have focused on digital health as ResMed is aiming to differentiate itself through the provision of clinical data for use by the patient, medical care advisor and payer in the out-of-hospital setting.”

Meanwhile, the healthcare research team at UBS was among the first to jump to the defence of ResMed when US hedge funds and traders talked down RMD stock because of how much the GLP-1 drugs developed by Novo Nordisk and Eli Lilly were supposed to take a bite out of the company’s revenue outlook.

But that was then – August – and this is now and UBS says that while positive news flow from ongoing GLP-1 trials seem poised to dominate investor sentiment towards RMD stock and although GLP-1 will indeed probably trim RMD’s total addressable market, the impact will not be felt until years into the future.

Ramsay Health Care (ASX:RHC)

“Ramsay’s June quarter 2023 showed solid margin improvement but profitability was constrained by inflationary pressures and accelerated investment in digital and cyber security,” Shane says.

However, Shane says Morningstar is ‘optimistic for margin expansion.’

Year-to-Date RHC share price & volumes:

“Importantly, labor shortages are easing with immigration recovering, and Ramsay continues to invest in recruiting and training programs. We expect margins to expand as Ramsay uses less agency staff, as case mix and volumes normalise for nonsurgical services, as capacity utilisation improves, and as digital investment efficiencies are realised,” Ponraj says.

“RHC is one of the largest private healthcare providers in the world, it offers private hospital services and it has about 460 facilities of varying size across 10 countries. There, the company owns, operates, and handles the health care needs across day surgery to surgery, as well as psychiatric care and the popular growth market of rehab, with its high return customer rates.

“RHC’s go-to markets are lucrative including Australia, France, the UK, and Sweden. In fact, it’s the largest private hospital group in each of these markets except for the U.K. where it ranks fifth,” he says. “Ramsay Sante, which operates around the EU, is also a 52.5%-owned subsidiary of Ramsay Health Care.”

“The company typically earns about 60% of consolidated earnings in Australia and 30% in France.

“Ramsay Health Care undertakes both private and publicly funded healthcare. (It) offers private hospital services … owns, operates, and manages health care facilities, which includes health care needs from day surgery procedures to surgery, as well as psychiatric care and rehabilitation.”

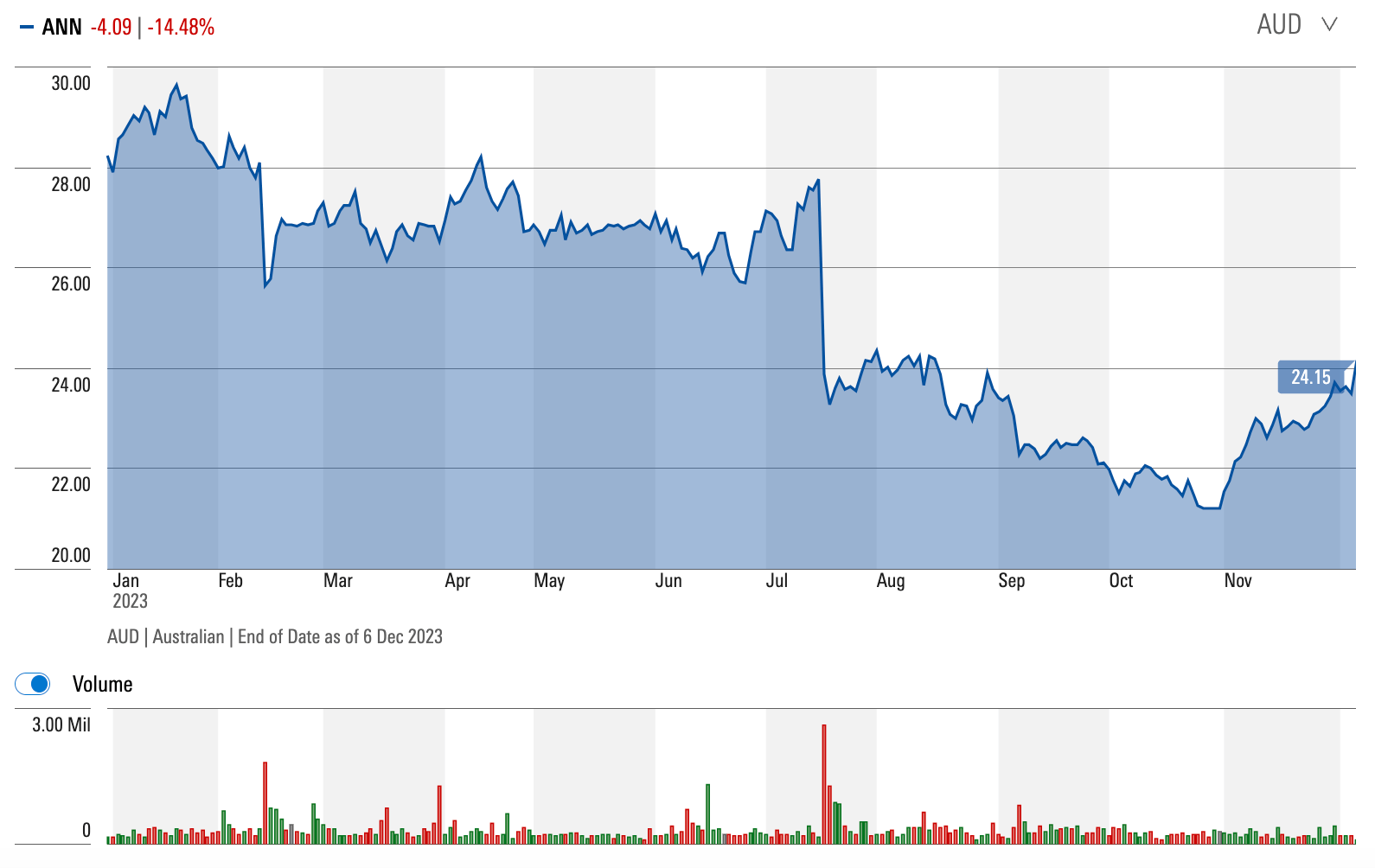

Ansell (ASX:ANN)

We also expect Ansell’s margin pressures to abate, Shane says.

“Ansell is a leading supplier of protective gloves for use in healthcare and industrial settings, earning approximately 60% of revenue and 70% of operating profit from the healthcare segment and the remainder from the industrial segment.

“The company holds a large number of patents and the majority of sales come from its key branded product ranges. Ansell has a global manufacturing and distribution footprint and distributes via key partners as well as directly across more than 100 countries,” Shane says.

Year-to-Date ANN share price & volumes:

In fiscal 2023, Ansell earned 45% of revenue in North America, 33% from Europe, Middle East and Africa, 14% across Asia-Pacific and the remaining 8% in Latin America.

“Pricing for undifferentiated single-use exam gloves has stabilised and a productivity program is set to deliver over US$45 million of cost savings by fiscal 2026, a fifth of current group EBIT. Employee expenses are falling through automation and reducing duplication of leadership responsibilities.

“We forecast gross margin expansion as Ansell insources more manufacturing, better utilises its facilities, and improves the sales mix,” he says.

The views, information, or opinions expressed in the interview in this article are solely those of the broker and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.