MoneyTalks: Mirova’s Amber Fairbanks says the shift to ESG practices is happening because they ‘just make sense’

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

MoneyTalks is Stockhead’s regular recap of the stocks, sectors and trends that fund managers and analysts are looking at right now and in this edition we’re looking at the ESG shift.

Today we hear from Amber Fairbanks, from Mirova, co-portfolio manager of its Global Sustainable Equity Fund.

Speaking with Stockhead from Boston yesterday, she says while the ESG shift has accelerated in the past couple of years, Mirova has a long history of sustainable investing having been at it since 1994.

“We think there’s a strong link between positive impact and financial outperformance. For us, it’s intuitive and logical that companies that create a positive impact increase in value over time,” she said.

“When I started three years ago, the global sustainable equity was $500 million; it’s now about US$10 billion so we’ve seen substantial growth.

“It’s really driven by the strong performance the strategy has seen, but also more and more people are becoming interested in ESG.

“And I think as they look under the hood of ESG managers they really see Mirova integrates ESG into the [investment] process that is both intentional and material. I think we’ve defined ourselves as a leader in the ESG space.”

Fairbanks says Mirova looks for two trends. First, if the market underestimates the growth opportunities from secular trends, naming demographics, technology, the environment and governance.

And the second was the market underestimating the risk of poor ESG practices.

“We’ve built our entire process to exploit these inefficiencies to drive outperformance and create a portfolio with positive ESG impact,” she said.

Economics mean ESG shift just makes sense

The COP26 climate conference may have left some disappointed with coal-reliant countries stopping a binding agreement to phase it out.

But Fairbanks says the shift to ESG friendly practices is happening anyway – and it’s not just virtue signalling.

“I think if you look at alternative energy, the economics make sense and that’s been driving the growth more than anything,” she said.

“There’s been rhetoric and concrete actions by governments but I think at the end of the day it’s the economics that drives them more so than government policies.

“Similar with electric vehicles, they’re better cars and there’s interest in that perspective as opposed to the virtuous ‘saving the environment’ perspective.”

Mirova’s top holdings

When asked for some of the fund’s top holdings, the first one Fairbanks named was Ørsted.

She explained this Danish listed firm used to be an oil and gas company but shifted its entire business to become an offshore wind power company. And it is now the largest pure-play company of its kind.

“It’s a really solid company; we think wind power is set to grow 20% CAGR between now and 2030 and the company is well placed to address that,” she said.

Ørsted (CPH:ORSTED) share price chart

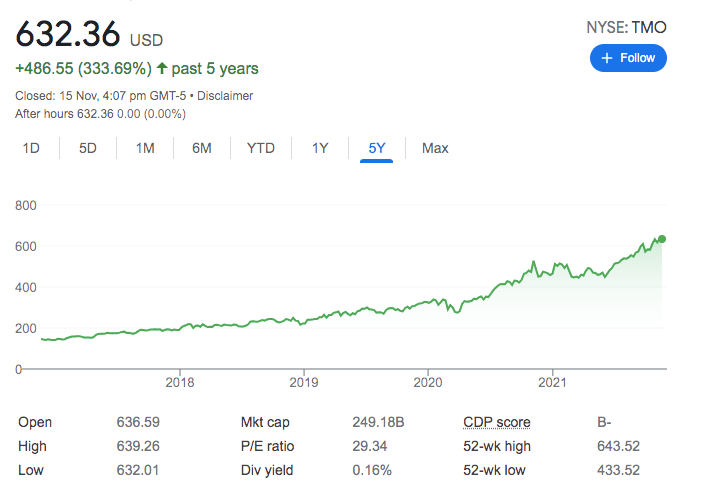

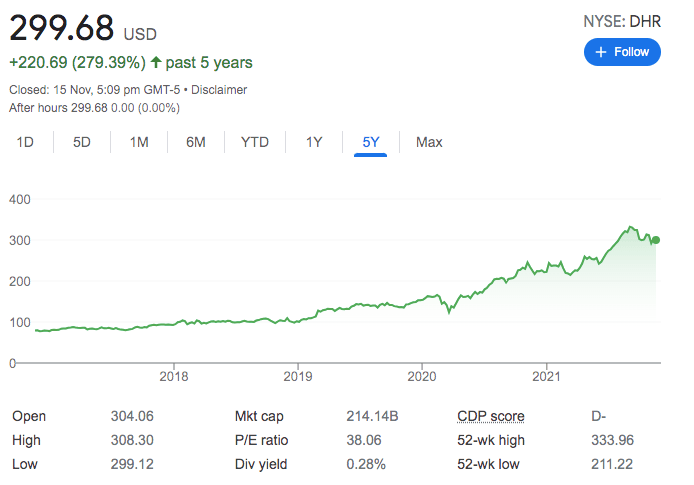

The next two were US listed Thermo Fisher Scientific (NYSE:TMO) and Danaher (NYSE:DHR).

“What we’re seeing in demographics is an ageing population in developed countries. Currently 11% of the population is 65 or older – that’s going to be 22% by 2050,” Fairbanks continued.

“As people age more and more, pharmaceuticals and research agencies have tried to address some of the age related diseases.

“These companies are lab equipment providers so are broadly exposed to increased spending in healthcare.

“In a gold rush you don’t want to own gold miners, you want to own the pick and shovel manufacturers – that’s what Thermo and Danaher are.

“They’re broadly exposed to that trend around ageing populations and increased spending on healthcare.”

Thermo Fisher Scientific (NYSE:TMO) share price chart

Danaher (NYSE:DHR) share price chart

Does the ESG shift mean tech is a no-go zone?

Big tech is an interesting area for ESG investors.

Mirova does invest in tech – with its top two holdings being Microsoft (NDQ:MSFT) and eBay (NDQ:EBAY) and it also owns MasterCard (NYSE:MA) and Adobe (NDQ:ADBE) as its 8th and 9th largest holdings – although unlike some other ESG investors it steers clear of the FAANG stocks.

“What we look at in technology from an ESG perspective is the protection of data predominantly,” Fairbanks says.

“We don’t own any of the FAANG stocks, we have ESG concerns around those stocks. But among the stocks we do hold, Microsoft is one of the largest cloud computing companies – we see valuable growth in cloud computing given the proliferation of data.

“We also see strong growth in ecommerce – hence our position in eBay which has been a strong stock for us – and increased digitisation of economy with people paying by credit and debit cards as opposed to paying with cash and cheque.

“And Mastercard is positively exposed to that and we think manages ESG risks well, even though they don’t necessarily create a positive impact.”

ESG shift protects investors in a declining market

Fairbanks says the first quarter of 2020 – when the markets crashed – was a solidly performing quarter for the fund and she credits it to the fund’s high quality bias.

“We typically have an 80% downside capture ratio which I think protects investors in a declining market.

“In March of 2020, we had a number of stocks on our watch list which we analysed and really liked from a fundamentals and thematics perspective but we weren’t quite comfortable with valuation.

“There were two stocks, Bright Horizons (NYSE:BFAM) and Intuitive Surgical (NDQ:ISRG) we added to the portfolio on April 1. Companies that were down 30-40% in the first quarter but the long term value was intact.

“For us as long term investors, we see that as an opportunity. There’s a lot of stocks that we don’t own and we’d love to, but don’t make sense on a valuation perspective.

“When we see that disconnect between short term outlook and longer term value it’s an opportunity to add stocks to the portfolio.”

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.