MoneyTalks: MA Moelis Australia and 3 tech-free growth stocks cutting a path to Christmas

Ho-Ho-Ho: Now we have a machine axe. Via Getty

MoneyTalks is Stockhead’s regular recap of the ASX stocks, sectors and trends that fund managers and analysts are looking at right now.

Today we hear from MA Moelis Australia’s equity analysts Oliver Porter and Matthew Chen.

Growth = V/T

A simple animal is a growth stock.

It’s a company which investors reckon is on a bit of a growth spurt. How fast? Well, any company which looks set to grow at a faster rate than the broader market, which is typically ASX 200 (XJO) benchmark index.

Typically growth stocks come into play in moments of bullish high opportunity.

They can offer a seriously significant higher growth rate and return as opposed to the average (mean old) growth rate prevailing among the blue-chip names of the ASX.

It basically means that a growth stock grows at a faster rate than the average stock in the market and consequently, generates earnings more rapidly.

Growth stocks typically don’t pay out in this way. Balance sheets and dividends are secondary to expansion and growth, reinvesting capital which contrasts with – say, income stocks – which investors buy for consistent dividend payments, and value stocks, which investors buy in the hope that their prices will rebound from a recent setback.

On this front, last week we saw some timely softening data on US inflation figures out of the US on Wednesday morning which seemed to put the icing on the US Federal Reserve’s tightening cycle. Equity markets climbed both on Wall Street and here at home, but the clear beneficiaries were the Nasdaq’s growth names – encapsulated by the ‘Magnificent 7’ tech giants.

It all screams of Christmas Rally and if there is an ensuing shift to risk, then it could very well be game on for growth.

MA Moelis Australia analyst Oliver Porter told Stockhead that with growth stock selections, MA is very particular when considering a stock’s ‘potential for substantial appreciation in value over time.’

“Underpinned by robust operational outlooks and sector tailwinds and the little things which say these companies are well-positioned to achieve continued success and profitability.”

3 names to appreciate before Christmas

MMA Offshore (ASX:MRM): Bouyant mid-term outlook

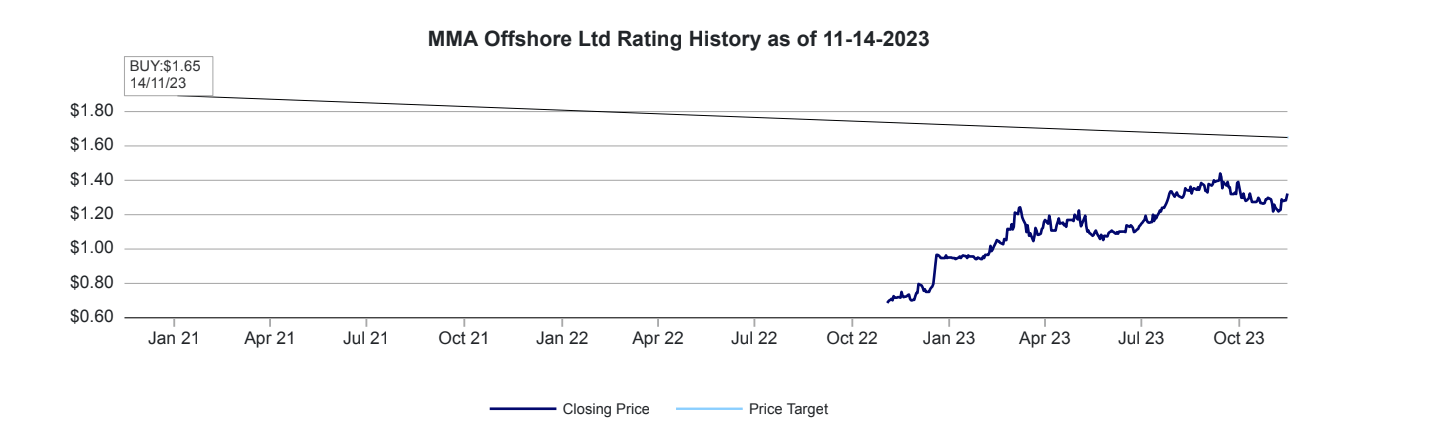

Oliver and Matt recently initiated coverage of MMA Offshore with a buy and a $1.90 Price Target.

Oliover says MMA Offshore provides marine-related services: Vessel, Subsea and Project Logistics Services; as well as the provision of specialised offshore support vessels

The most revenue derives from the Vessel Services segment in Australia.

MRM’s Subsea Services segment provides services to companies operating in subsea environments including inspection, maintenance and repair.

The Project Logistics segment includes project management of large marine spreads and complex marine logistics.

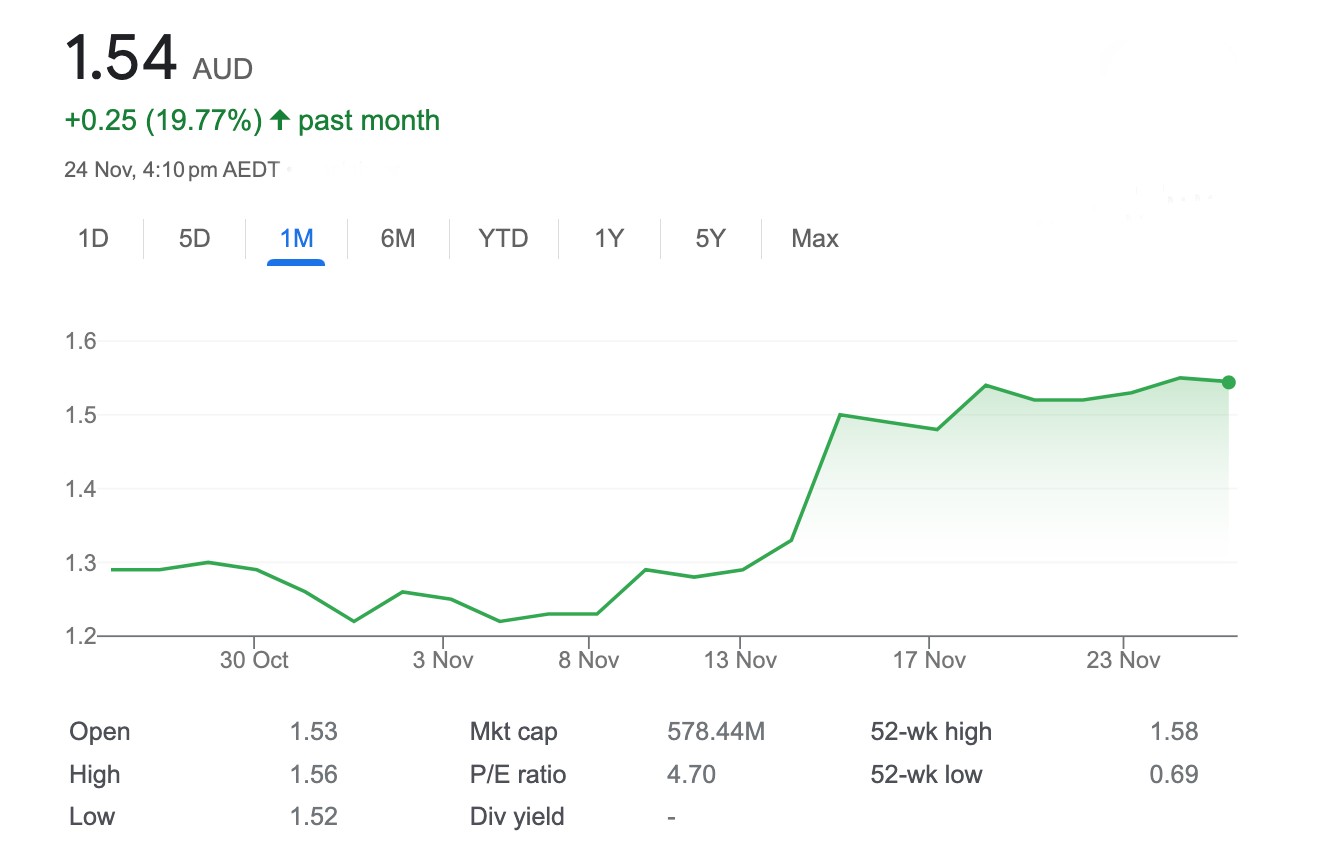

Dropping on the 16th of November, MMA Offshore’s first half EBITDA guidance range exceeeds our expectations: management has issued quantitative guidance for the first time, and expects 1H24 EBITDA in the range of $55-$60m, which implies +56% upgrade on prior MAe (at the midpoint), as well as +79% growth on the PCP and +54% sequential HoH growth;

“From an operational perspective, management noted strong contributions across all divisions (vessels, subsea, and project logistics) during the first four months of the year supported by strong activity across all key markets.

“Importantly. MRM also enjoys a ‘solid contracted revenue position’ for the remainder of 1H24; and management ‘expects positive market conditions to prevail’ as they firm up 2H24 contracted positions.”

Recent issuance of 1H24 guidance also affirmed Oli’s thesis that “the current vessel supply constraint against a backdrop of building demand would propel day rates and fleet utilisation, unlocking operating leverage.”

“Earnings are highly sensitive to day rates and utilisation,” and as such both analysts warn prospective traders that – “there is meaningful upside risk to earnings in the second half of 2024.”

So that’s MRM. The MA Moelis Australia Rating is a Buy and the Price Target, $1.90.

But get in quick, apparently:

IPD Group (ASX:IPG): Strong structural tailwinds

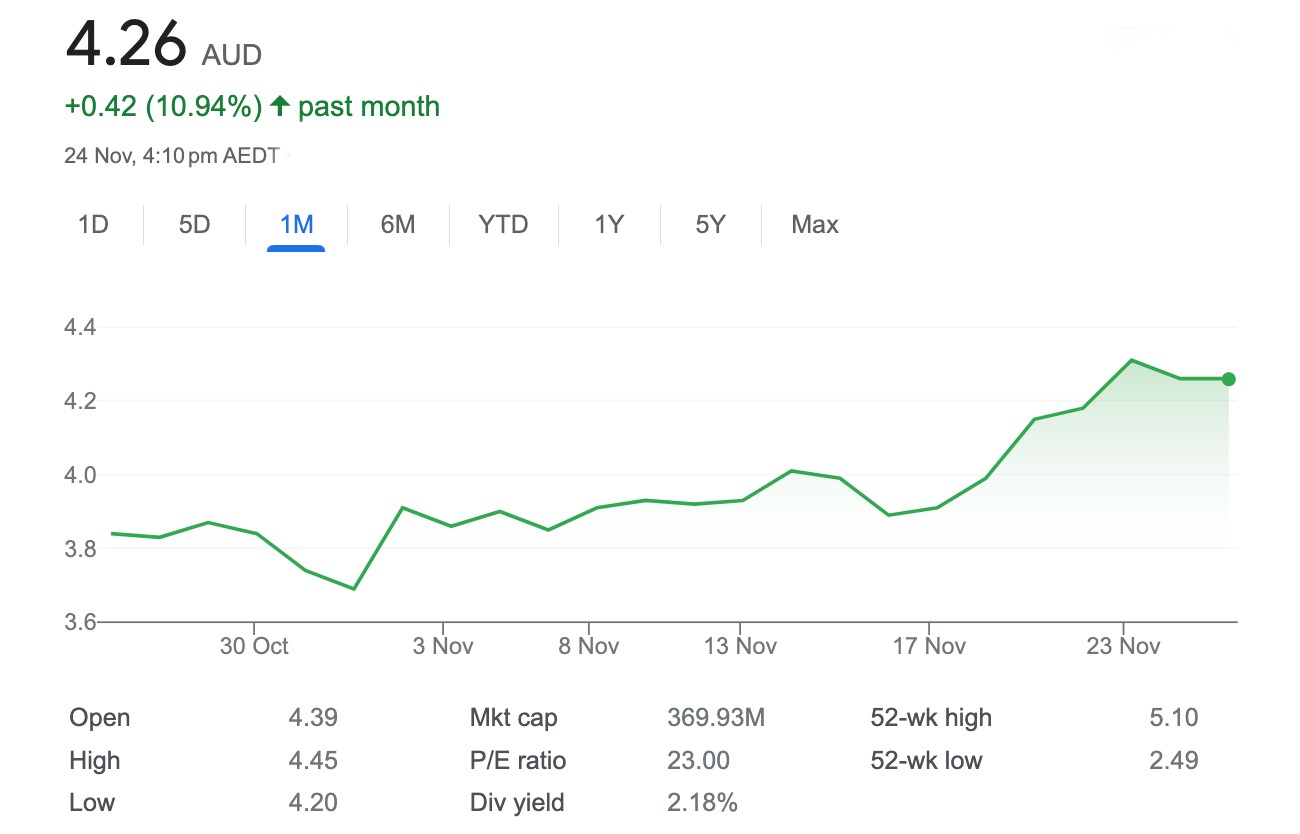

Matthew and Oliver have retained their Buy Rating on IPG, raising the Target Price (TP) from $5.12 to $5.27.

The company’s core focus is power distribution, power monitoring, industrial control, renewables, test and measurement, and services, across a range of verticals such as power generation, commercial, hospitality, infrastructure, and sports and leisure facilities.

Among its key segments – Products Division and Services Division – maximum revenue comes out of Products, which consists of five different categories namely, Power distribution, Industrial and motor control, Automation and industrial communication, Power monitoring, Electric vehicle solutions.

Matt and Oliver say the company’s delivered in spades this year.

“The full year was a strong result demonstrated continued growth and operating leverage, with positive update around FYTD conditions suggesting a bridge to buoyant medium term outlook, which in our view continues to be supported by strong structural tailwinds.”

Matthew says IPG’s asset base investment, the energy transition and decarbonisation, decentralisation and digitalisation which are all providing encouraging medium-term signals in the form of structural tailwinds.

“IPG recently outlined ‘double-digit organic growth’ as a strategic priority.”

Matt maintains the view that “operating conditions support this priority through the short-term, with risk to the upside.”

At the company’s recent FY result, (its second as an ASX-listed company) IPG delivered record financial results, with impressive year on year organic revenue growth of 28.3% dropping through to the bottom line.

CEO Michael Sainsbury told shareholders the acquisition of Perth-based Ex Engineering – a specialist in ‘the design, supply, modification, and repair of electrical hazardous area equipment’ – adds “another feather to our cap.”

“With revenue of approximately $12.4 million and EBITDA of $2.5 million, this strategic acquisition complements our portfolio and enhances our capabilities.”

Meanwhile, the stock has continued to climb:

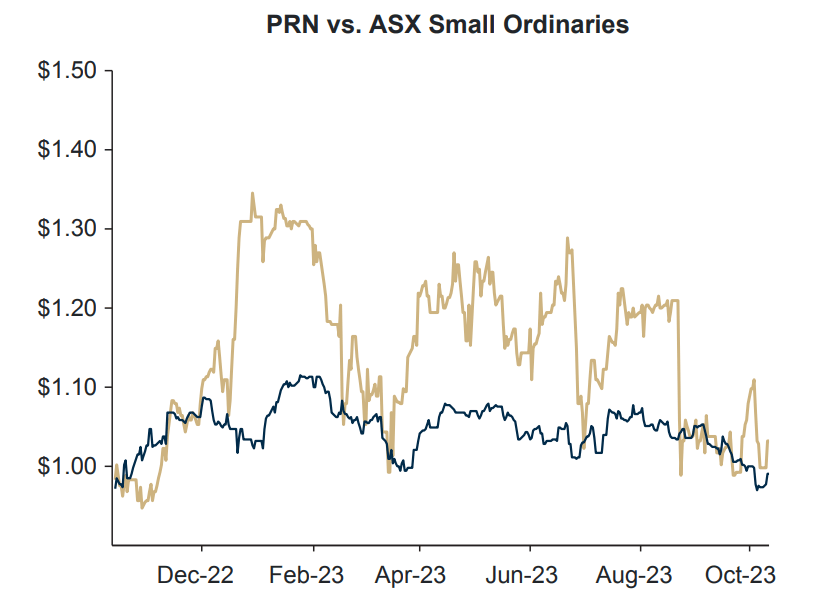

Perenti Global (ASX:PRN): Enjoying robust margins

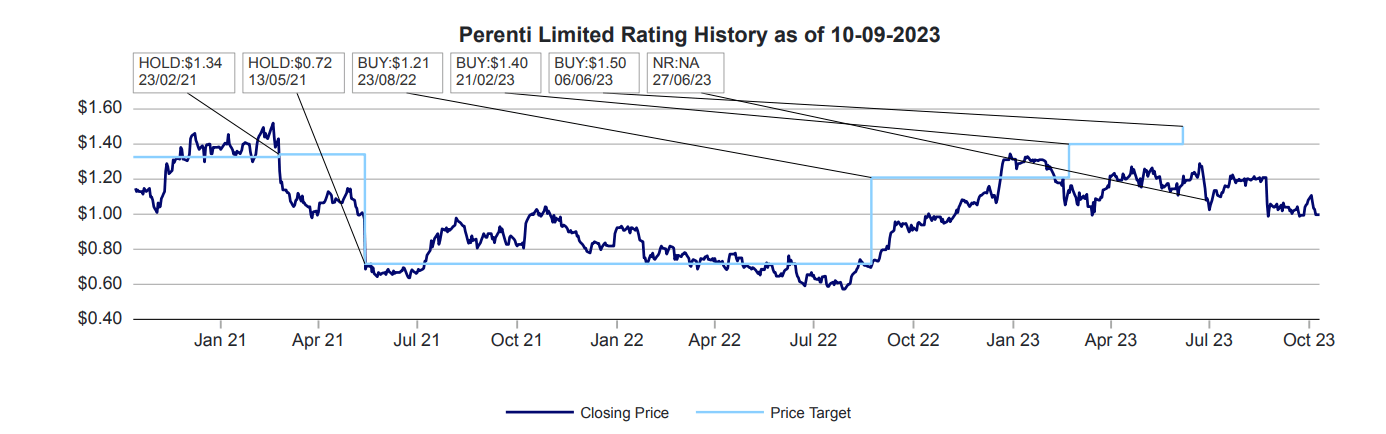

The analysts resumed coverage of PRN in September with a Buy rating and a Target Price of $1.35.

Perenti is an exploration and production drilling company that offers a range of mining services.

Perenti is an exploration and production drilling company that offers a range of mining services – from exploration and production drilling, blasting, trasnport and geotechnical services.

Dropped in October, MA says Perenti’s full year results delivered record underlying revenue of $2.98bn, EBITDA of $553mn, EBITA of $264mn and leverage of 0.9x.

The contractor’s projects are historic – including the KCGM Superpit, Huntly, Tropicana, Koolyanobbing, Mungari and Ensham among others.

The company’s operating segment consists of Contract Mining – Surface, Contract Mining – Underground, Mining Services and idoba. The greater majority of Perenti’s revenue comes from Contract Mining – particularly underground.

Matt says on 6 October, PRN completed the acquisition of DDH1 (ASX:DDH).

“We resumed coverage of PRN with a Buy Rating and TP of $1.35… In our view the additional cash generation from Perenti’s DDH acquisition, significantly improves gearing (0.7x FY24 MAe)… while FY24 FCF yield of +8.6% is in our view very attractively valued at 6.0x FY24 P/E, which is a 50% discount to Perenti’s peers.”

Matt says MA came off restrictions on PRN coverage following their script-based merger with DDH and rated the stock a Buy with margins looking so strong.

“DDH reported improving rig utilisation at a recent investor update and its core business – like a lot of underground contractors – is enjoying a robust margin outlook, illustrating that the combined businesses are both enjoying buoyant operation conditions,” Matt says.

“This, coupled with improved cash generation and historic lower multiples supports our investment thesis,” Oliver adds.

According to MA, PRN’s have won contract work packages totalling more than half a billion dollars, “which demonstrate encouraging momentum in converting pipeline opportunities ($14.4b FY23 end).”

“PRN’s progressive degearing and additional cash generation from the DDH acquisition paves the way for a dividend reinstatement while the recently relaunched on-market buyback program (of up to 60m shares) also provides an alternative outlet for capital management focus,” Matt says.

Perenti’s forward guidance for FY24 is for revenue of $2.8bn – $3bn; EBITDA of $260-$275m and net capital expenditure of $330m.

The co’s leverage should be between 0.8x to 0.9x, although an update which will include the DDH purchase is expected in coming months.

“We resume coverage of PRN with a Buy Rating and TP of $1.35.”

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.