MoneyTalks: India ‘is like the US 50 years ago’ but just how can you invest in it?

Just how can Australians invest in India? (Image via Getty)

MoneyTalks is Stockhead’s regular recap of the stocks, sectors and trends that fund managers and analysts are looking at right now and in this edition we’re looking at how to invest in India.

Today we hear from Mugunthan Siva, managing director at India Avenue Investment Management, one of a handful of firms allowing Australian investors the chance to invest in the Indian equities market.

While Siva estimates firms with an India-only strategy only have a modest ~$600 million in Funds Under Management (FUM) right now, this is more than double the ~$250 million in FUM five years ago.

He admits while it’s not the case people are scrambling to get in the door, there is increasing interest.

“I think it’s only natural because in the past couple of decades India’s growth rate – in GDP growth – has been rising, averaging between 6-7%, it is once of the fastest growing economies in the world,” he told Stockhead.

“Most Australians have high exposure to Australian equities as you’d expect and next [highest exposure] is the US.

“Both markets have done well over past couple of decades but there’s interest developing in emerging market areas. China and India are on the radar for different reasons and investors would be into thematics and ETF investing, they’re looking for options that can give them exposure to growth when income and yield has been low.

“Australian equities I suppose was darling for large part of last two decades driven by high yield and high income and we’re in an environment now where people do need to have growth in their capital and options like India are something to have exposure to.”

Is India ‘another China’?

Siva says people often put India and China in the same basket, but are typically doing so too fast.

“India and China are different economies growing fast but that’s where similarity ends,” he said.

“China is a different regime [while] India is the largest democracy. China’s population is ageing with an average age above 40, India is a young population so that’s where there’s a difference.

“We’ve participated in China through demand for our commodities and real estate but the Chinese equity market hasn’t been a great investment because when you have a regime like China does, a lot of index companies are SOEs (State Owned Enterprises) or government owned and they aren’t the best allocators of capital.

“So the equity indexes like the MSCI China [are] heavy weight [on] SOEs so you needed to dig deeper to get the best out of China as an investor.

“People look at India and say ‘I missed the [China] story or couldn’t find the right way’ and India is an option.

“Another thought is ‘India is like the US 50 years ago going through substantial change, going through an industrial, digital, financial revolution’.

“And for those who missed out on being Warren Buffett 50 years ago this is the opportunity again to buy simple basic companies. It might be a restaurant or retail outlet or might be something simple and basic but because of the size of [India’s] population it gives you chance to participate in the growth of things.”

Major sectors and investors

Siva says just like on the ASX, financials is the biggest sector in India accounting for 25%.

Nevertheless it is not just the banks in this space – with the financials category including insurance companies and consumer finance too – and the sector doesn’t have a monopoly.

“India is a market with diversity, it has a big IT sector, it has a big consumer sector, it has evolving manufacturing capabilities,” he said.

“A lot of industries are growing from an early stage but growing fast, so it’s quite diverse.”

Siva says the cohort of Indian investors has grown substantially in the last decade since interest rates have plunged from as high as 7-9% to near zero and other reforms implemented by the Modhi government.

“These have shifted the base from physical assets as a way of storing wealth to financial assets,” he said.

“A lot of investments have come into the equity market through mutual funds like monthly investments from your salary, retail investors have gone from 3% of them market to about 15%.

“So you’d find most of India’s High Net Worths are investing in equities in regular fashion but new millennials – India has a lot of millennials – they’re starting to allocate savings towards the equity market.”

Top stocks

While the ASX now offers two ETFs focused on India – ETF Securities India Nifty 50 (ASX:NDIA) and BetaShares India Quality ETF (ASX:IIND) – Siva says individual companies are a better opportunity.

“Our belief is you should always play India through an active investing philosophy. Not just try to replicate benchmark,” he said.

“Our successes have come from stocks where they are companies that are perhaps the larger player but in industry still evolving.

“One company we’ve had success with in our fund in 12-18 months is not in the index, not in MSCI India, it’s not even a top 50 stock.

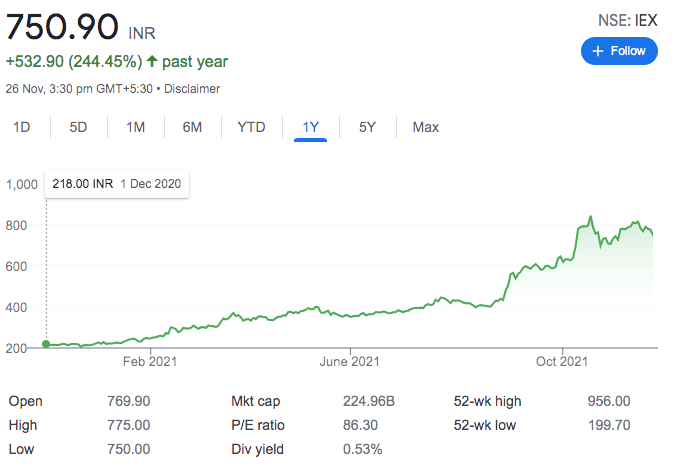

“It’s a company called Indian Energy Exchange (NSE:IEX). IEX creates a trading platform for electricity; if you have too much you can sell on the platform, too little you [go and] buy.

“It makes it far more efficient which is important for country like India and it means traded contracts have been increasing substantially. It has gone from [a share price of] 150 rupees to 750 rupees.

“So that’s the story of India, not just about buying large companies that’ve already grown, it’s finding the next exciting growth story.”

Indian Energy Exchange (NSE:IEX) share price chart

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.