MoneyTalks: Hyperion’s top ASX stocks look big already, but here’s why they’ve got more room to grow

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

MoneyTalks is Stockhead’s regular recap of the big ASX stocks, sectors and trends that fund managers and analysts are looking at right now.

Today we hear from Mark Arnold and Jason Orthman, Chief and Deputy Chief Investment Officers (CIOs) from Hyperion Asset Management.

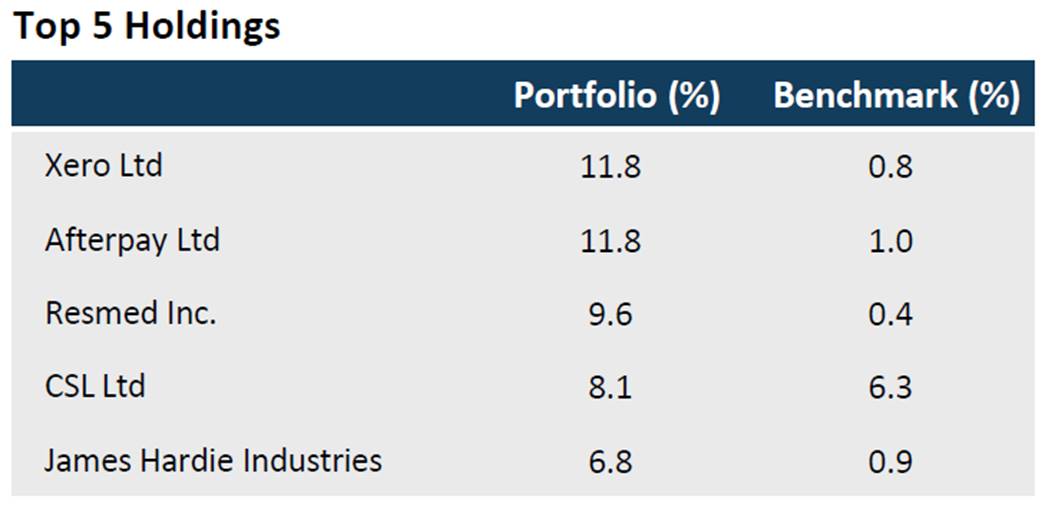

Here are the top holdings in the Australian Growth Fund:

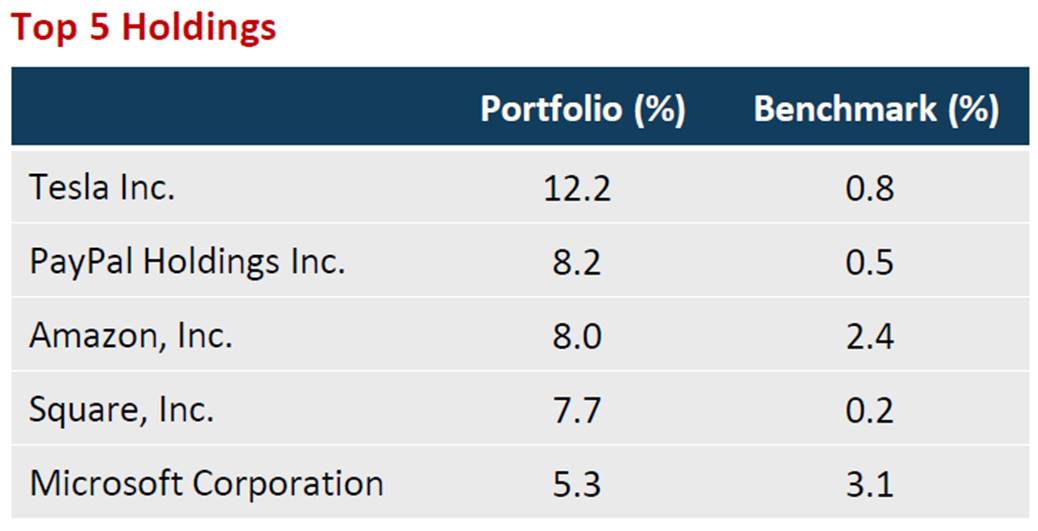

And here are Hyperion’s top holdings in the Australian Growth Fund:

As owners of both Afterpay (ASX:APT) and Square, Arnold and Orthman were happy with the deal noting not only would it take Afterpay from being a one product company to multifaceted but would in effect result in Square listing on the ASX.

“If you’re an Afterpay investor you shouldn’t be nervous, you are going from a single product company to a larger multi-product, multi-faceted business,” Orthman said.

“Square listing on the ASX should be exciting for the broader market bringing a level of quality and growth that’s unusual to the Australian market, so it’s a big thing to bring a business like that to the ASX.”

More big ASX tech stocks deals to come?

We asked the pair about if we might see more takeover deals from the other big ASX stocks they own, particularly the other four members of the so-called WAAAX stocks.

The WAAAX list includes Xero (ASX:XRO) a tech heavyweight that Hyperion has as stake in, worth just over half of Afterpay’s market capitalisation.

Orthman said you could never say never but it was not the base case scenario for Hyperion.

“We believe that a lot of these businesses – Afterpay and Xero – are very valuable and a lot of earnings and cashflow are ahead of them and there’ll be strong returns,” Orthman noted.

“Even if Square didn’t come in, we were excited about what they could do over the next 10 years.

“But the prism through which we look at businesses is different – it’s not our base case that some of these businesses we own will be acquired – but we owned Altium (ASX:ALU) and that was in play.

“For those businesses that execute day to day and [are] flying through COVID-19 it would be unusual for someone to take a plus bet [but] not impossible because that’s what Square has done and they’re excited about what they’re bringing into the business.

“Jack Dorsey is a special CEO and he saw something your average board and advisors couldn’t see.”

Can Xero grow further?

Xero is in a similar position to Afterpay having gone up several times since its listing, specifically from $4.65 when it first listed on the ASX in 2012 and is at nearly $150.

But while it may seem mature on both sides of the Tasman, Mark Arnold noted it was different elsewhere.

“We think in terms of Xero, we think there’s substantial long term growth potential for that business because their market’s so large and it’s still early days,” Arnold said.

“They’re more mature in places like NZ and Australia but that product and platform they have is applicable to the whole world, the global addressable market.

“We think they have decades of growth to go and our view is that Xero will dominate that space – the small and medium business-sized accounting space – longer term.”

“Clients love Xero so we think that’s powerful if you’ve got a large group of client that really like the product, it allows the product to expand without marketing and that’s similar to Tesla. They don’t advertise at all and their sales really come from word of mouth – it’s existing customers promoting Tesla to other potential users and encouraging them to have a test drive, so similar position with Xero.”

One exemption was North America where Arnold noted Intuit (NDQ:INTU), which Hyperion also had a stake in, was dominant and would continue to be.

Xero (ASX:XRO) share price chart

Can CSL and ResMed grow further?

Orthman said it was similarly true with fellow big ASX stocks CSL (ASX:CSL) and ResMed (ASX:RMD).

This was even though they are slightly ahead of Xero in market penetration in the major markets and had some short-impact impacts due to COVID-19.

“Long term there are these structural drivers like aging of population – we’re all getting older and it’s in all markets,” he said.

“Not only are we aging but [there is] greater incidence of some of these diseases and awareness as the world becomes more sophisticated – greater awareness to have these treatments.

“You can get short term issues and clearly for things like ResMed and CSL their centres can get locked down or it’s harder to get to those centres but we’re looking longer term and thinking where will these businesses be in 10 years’ time.”

CSL (ASX:CSL) and ResMed (ASX:RMD) share price chart

Big stocks in America

Orthman also mentioned another foreign stock in Intuitive Surgical (NDQ:ISRG) which makes robotic products for surgery.

“Most hospitals still require specialists to use their hands rather than robotics but the value proposition is superior if you use robotics – again it’s really earlier on, some treatments rely on it [robotics] but most don’t,” he said.

“And that stock was sold down through COVID-19 and hospitals would get shut down – half were discretionary, and they get deferred. But these are the opportunities, taking a long-term view.”

The principle was even true in relation to some of the bigger tech giants in cloud computing including Amazon (NDQ:AMZN) and Alphabet (NDQ:GOOGL) which despite having dominant market positions, were in a market at its relatively early stages.

“Despite having market leadership and strong market positions there’s not a long term demand issue, they can still grow into demand and customer bases over a long period of time,” he said.

“So just because some of these businesses are large and dominant in what they do, they have a large run rate but some of these next tier businesses they’re exciting because in effectively they’re Day One, all these businesses will grow for activities.”

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.