MoneyTalks: Here’s what you need to know about investing in Japanese shares

What's different about investing in Japanese shares compared to the ASX? (Image via Getty)

MoneyTalks is Stockhead’s regular recap of the stocks, sectors and trends that fund managers and analysts are looking at right now and in this edition we’re looking at investing in Japanese shares.

Today we hear from Robert Swift of Delft Partners, a fund manager which is focused on investing in Asian equities and infrastructure, particularly Japanese shares.

ASX stocks that have anything to do with Japan are few and far between but if you want direct exposure to the market there are many opportunities for investors.

Yet, there are some differences for investors and Swift says one distinguishing feature is in the management of companies.

“I think it is fair to say that there’s this apparent difference that the next quarter or six months matter more in the Anglo-Saxon model – they tend to underinvest in capital projects,” Swift says.

“In Asia, particularly in Japan, the image of management is that they’re very, very long term, they have lower hurdle rates of return before making an investment.

“That has resulted in good and bad developments in Asia. Japanese companies have been quite prone to diversifying, they often have got into projects that haven’t really been essential or in their core competency.

“There are some bad investments as a result of redeploying capital into business as opposed to giving it out to shareholders.

“That doesn’t mean anyone’s got it wrong or right, companies can overinvest in Asia and one of the problems we see is cash balances are very, very high and only a few seem to be showing signs of distributing that cash back to shareholders as they should.”

But Swift says the pendulum is beginning to shift in favour of investors – albeit gradually.

“There are some signs of change and this pendulum is swinging in favour of shareholders away from management, employees and [other] stakeholders,” he said.

“The pendulum has swung not as much as it has in the US to equity holders, but swinging nonetheless – it is going to lead to higher returns and better profit sharing for shareholders and that should drive the stock market higher.”

Another way in which the Japanese market is different to Australia is the weight many individual sectors have in the main equity benchmark.

“The ASX 200 has about 30% in financials, Japan has 8%; ASX 200 has 8% industrials, Japan has 25%; Australia 8.5% in consumers, Japan is 28%,” Swift says.

Many local investors are different too, in respect of their priorities.

“Investors tend to be less concerned about multiples and more concerned about the story, momentum and thematics,” he said.

Top Japanese shares

Despite the Japanese share market being skewed towards consumer and industrials-chemical stocks it is possible to gain exposure to the technology boom at valuations more fitting of traditional industrials.

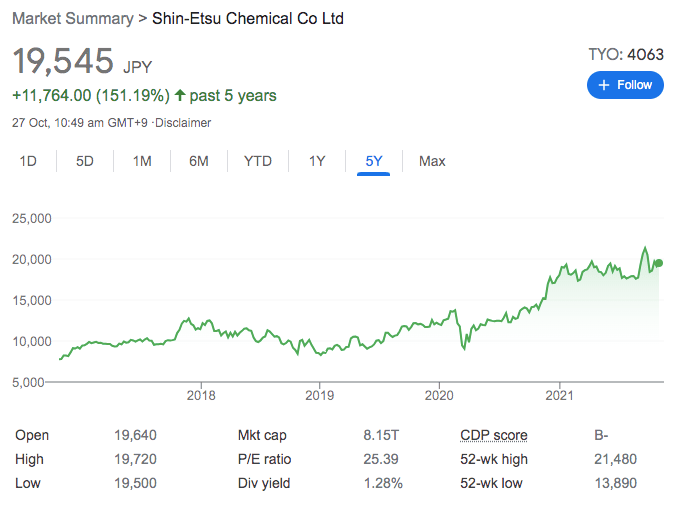

One is Shin-Etsu Chemical (TYO:4063) which is a chemical company but has a significant portion of clients in the semiconductor space.

“It makes chemicals for the development of silicon wafers – you have to coat them for circuit boards to be printed,” Swift says.

“It’s highly engaged with major equipment makers in the world but priced as a chemical company. We’ve done well owning it in the last 3-4 years.”

Two similar Japanese shares Delft has been investing in are Advantest Corporation (TYO:6847) and Tokyo Electron (TYO:8035).

“[These are] companies that are lower in PE than the likes of Amazon, Facebook and everyone else of the technology favourites but are integral and essential to the manufacturing of electronic bits and pieces and so we’ve done well out of those companies in the global equity strategy,” Swift says.

Another category of names Delft likes are traditional electronics sellers including Sony (TYO:6758) and Fujitsu (TYO:6702).

Elsewhere in Asia, Kerry Logistics (HKG:0636) was one holding that has done well.

“It’s a warehouse logistics business, listed in Hong Kong, was [51.8%] bought by mainland Chinese company [SF Holding] primarily for intellectual capital in it,” Swift says.

“It’s another area lowly rated by the stock market but when you think of how difficult it is to procure stuff globally, there’s quite a big moat in these kind of companies.”

But what about the economy?

A common turnoff for investors is the perception of the Japanese economy as having been stagnant, debt-ridden and aging from a population perspective for decades, and that these will all impact the market and returns.

Swift says these perceptions are a mistake.

“I think Japan’s nominal growth has been hampered by the demographic but if you were to adjust GDP for demographic – look at GDP per capita of working age – then Japan has actually grown well,” he said.

“Japan’s had growth that’s been more consistent and persistent than many other countries. Japan’s issue is not productivity of its workforce or efficiency of capital stock, issue is population growth.

“If you were able to make adjustment for Australia, whose growth is only by population and immigration growth, Japan’s GDP per capita has outstripped Australia.”

While Swift also noted Japan has nonetheless began to allow immigration for blue collar jobs to grow the economy, GDP has little relevance to the stock market.

“It’s a mistake for equity investors because GDP has no relationship to equity returns – people keep looking at it and there isn’t one,” he said.

As for the nation’s debt burden, Swift said again that Japan is in a better position than Australia.

“Japan is net creditor nation – where its net foreign assts are 60% size of GDP and has over 60% net foreign asset position. If you did same for Australia, we’d have deficit of 60% of GDP,” he said.

“And so Japan does have a lot of debt but the benefit of a net foreign asset position is that Japan’s debt is owed to itself whereas Australians owe it to other countries.”

Swift admits Japan’s demography isn’t good but says it provides some opportunities for local companies beyond their own borders.

“You can substitute capital for labour so Japan has countries where some companies make stuff, industrial robots that can replace expensive labour. Japan has been innovative and world leading in companies in this space,” he said.

“And we would expect in next few years as Chinese labour becomes more expensive, Japanese companies (such as SMC (TYO:6273)) will start to do a lot business in China and export a lot of their product to China.

“The demographic isn’t great by Western standards but is also an investment opportunity for investors to look at replacement of human beings by machines.”

What about COVID?

In the short term meanwhile, Japan has battled several waves of COVID-19 but Swift continues to be bullish about the economy.

“We think the worst of COVID shutdown is behind us and countries are realising you can’t keep economies closed forever. Year on year comparisons in 2022 will look good for Asia versus North America because North America opened up first,” he says.

But COVID-19 is just one of many issues facing Japan – the most pertinent of these is supply chains. This could be positive for investing in certain Japanese shares.

“I think because of what we see with respect to trade friction, you’re going to see duplicate supply chains built out,” Swift said.

“That’s what’s happening at the moment and that’s going to benefit capital expenditure beneficiaries in Japan as they build out warehouses and ports.

“Infrastructure is increasingly being seen as having to be renewed and Asia will be at the forefront of that.

“That’s another massive opportunity for companies in Japan, China and Vietnam and that’s going to last longer than COVID as a long-term tailwind to companies and the changing composition of the stock markets.

“One doesn’t have to buy Amazon, Facebook and Netflix; there’s a lot of stuff in Asia you should be buying where there’s lower P/E multiple afforded to what we think are persistent profits.”

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.