MoneyTalks: Has the ASX stock hunter James Gerrish been too bearish?

A formidable mexican wrestler disguised as ASX stockman J Gerrish. Via Getty

MoneyTalks is Stockhead’s regular recap of the ASX stocks, sectors and trends that fund managers and analysts are looking at right now.

Today we hear from James Gerrish, lead author at Market Matters and portfolio manager at Shaw and Partners, with circa $20 billion of assets currently under management.

Gerrish: Maybe I have been too bearish

We’ve been sitting on the bearish side of the bond yield fence for a few months, a more reflective James Gerrish tells Stockhead.

“In hindsight, we were too early with our call, underestimating the push/blow-off higher through October; however, the reversal lower over the last few weeks is looking very encouraging, especially after the recent RBA hike from 4.15% to 4.35%.

“The 3.75-4% area should provide stubborn support into Christmas, but if the market embraces our view that the next move (s) by the RBA will be to down, yields are likely to drop further below the official rate.

“We believe it’s highly unlikely that Michele Bullock will announce another hike in the December meeting, making the first week of February the next meaningful get-together by the RBA.

“It’s our opinion that cracks were already appearing in the economy before borrowers had to deal with Tuesday’s hike, a few weak economic prints into/out of Christmas, and bond yields will start to point that way – the 3s are already trading -0.2% below the current RBA rate only 48-hours post the hike!”

“No change, we are looking for the Australian 3s to test 3% through 2024/5, with current weakness under 4.25% supporting this outlook. If we are correct on yields, it should benefit the interest rate-sensitive sectors such as real estate, tech and health care,” James says.

On the state of play for the local benchmark, James says there is strength in the numbers.

“The ASX200 has now spent three days consolidating around the 7000 level, a good performance considering the rapid rise from late October’s 6750 low.

“Over 65% of the main board advanced on Wednesday, but a poor session by the major miners restricted the index’s gain to +0.26%, i.e. South32 (S32) -4.3%, IGO Ltd (IGO) -2.4%, RIO Tinto (RIO) -2% and BHP Group (BHP) -1.9%. The banks bounced back from Tuesday’s weakness, perhaps investors are starting to contemplate the attractive dividends due this month from ‘3 of the Big 4’ – Westpac (WBC) traded an ex-dividend 72c fully franked on Thursday.”

Perhaps most excitingly for the punters, Market Matters maintains its official line on what the rest of 2023 holds for us:

“We continue to believe the ‘Christmas Rally’ is off and running, with another test of 7500 a distinct possibility over the coming weeks.”

We favour growth/rate-sensitive names into 2024

“For more than 18 months the RBA have been hiking interest rates at an unprecedented rate to rein in inflation, after it surged higher following the huge amounts of economic stimulus which washed through global economies through COVID.

“However, at MM, we believe this journey has reached its conclusion and economic contraction in 2024 will eventually necessitate rate cuts, it feels like ages since those were considered. Hence, stocks/sectors that underperformed over recent years should be well-positioned to address this relative performance gap into 2024.”

The standout sectors through 2023 are as follows:

Winners: Tech +22.7%, Consumer Discretionary +11.8%, and Commercial Services +6.8%.

Losers: Healthcare -10.1%, Consumer Staples -2.4%, and Real Estate -1.7%.

James says this illustrates a couple of points.

“Investing is never a perfect science with the rate-sensitive tech and consumer discretionary names already strong over the last 12 months, demonstrating how markets look at least six months ahead. This time last year, tech was struggling badly as rising interest rates weighed down growth stocks, but as a pivot point for yields started to be discussed, the sector turned, even as further rate rises were on the table.

“Of the above six sectors, we have varying opinions that are determining how we structure our Active Growth Portfolio into 2024.”

Tech – Bullish looking for ongoing strength into 2024, but the move is maturing.

Consumer Discretionary – Neutral as the economic backdrop clouds into 2024.

Commercial Services – Neutral.

Healthcare – Good risk/reward at current levels, at least for a bounce into 2024.

Consumer Staples – Neutral, we believe most stocks are too expensive in today’s risk-averse market.

Real Estate – Bullish, looking for at least +15% upside after a tough two years.

James says firstly, consider the size of the sectors he wants to be overweight into 2024…

Tech ~3.6% of the ASX200: we currently hold 5% in Altium (ASX:ALU) and 5% inXero (ASX:XRO) = overweight.

Healthcare ~9% of the ASX200: we currently hold 5% in Ramsay Health Care (ASX:RHC) and 5% in ResMed (ASX:RMD) = market-weight

Real Estate ~5.7% of the ASX200: we currently hold 4% in Goodman Group (ASX:GMG) and 5% in National Storage REIT (ASX:NSR) = overweight

“So, at this stage, our portfolio is largely positioned as we want into 2024, with a structural switch from tech into the resources – a move in 1H of 2024.

“However, if we decide to increase our exposure to rate-sensitive names into 2024, it’s likely to be through the battered Real Estate and/or infrastructure Sectors where we see some deep value.”

Today, James has picked out MM’s favourite four plays at current levels. With a bonus scrutiny of x3 ASX stocks the MM team have been watching lately.

Four to the floor

Goodman Group (ASX:GMG) $22.33

Goodman Group is an integrated industrial property group with operations in Australia, New Zealand, UK, Asia and Europe. Goodman’s into property investment, funds management, property development and property services. The Group’s property portfolio includes business parks, industrial estates, office parks and warehouse/distribution centres.

James says this is a quality business.

“We have recently bought back into GMG, so there’s nothing really new to add to recent comments, it’s a top-quality stock pivoting into an attractive new area with low gearing and a huge war chest to buy assets if/when they become attractive over coming years.”

MM bought GMG heading out of October to “increase our real estate exposure in anticipation of an eventual decline in bond yields.”

And voila, almost on cue, US Fed Chair Jerome Powell ignited the sector, sending MM’s new purchase surging.

“We are big fans of GMG, our only regret potentially being we recently only bought 4%, not 5% – we hold GMG in our Active Growth Portfolio.”

GMG – MM is long and bullish toward GM

Centuria Capital (ASX:CNI) $1.24

“CNI is the classic high-leverage, high risk play on interest rates,” James says. “And it clearly suffered as they’ve risen over the last two years.”

“We like CNI as an aggressive play on bond yields, especially as it is forecast to yield ~9% over the coming year – we hold CNI in our Active Income and Emerging Companies Portfolios.”

CNI MM is long and bullish CNI ~$1.20

Dexus Group (ASX:DXS) $6.92

“DXS is offering deep value as it arguably occupies the most unloved seat in the sector, its strong bounce over the last fortnight illustrates what it’s capable of if we see some love return to the sector.

“We like DXS as a recovery play on real estate, especially as it is forecast to yield ~7.8% over the coming year – we hold DXS in our Active Income Portfolio.”

DXS MM is long and bullish on DXS

APA Group (ASX:APA) $8.38

While not in the real-estate sector, this infrastructure company has been weighed down by some stock-specific factors, but rising bond yields have also been a major impediment. We have discussed APA a number of times over recent months as it screens well around $8 – recent MM APA comments.

We like APA Group (APA) as a defensive bond-like play into 2024, it’s forecast to yield ~6.8% over the coming year – we hold APA in our Active Income Portfolio.

APA – MM is long and bullish on APA

Bonus Gerrish on: JHX, S32 and STO

James says these three stocks briefly caught MM’s attention midweek.

“Two we’ve considered recently and one that remains largely unloved due to macroeconomic factors.”

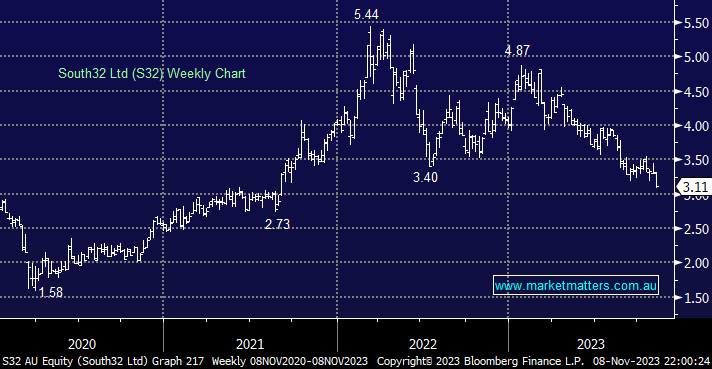

South32 (ASX:S32) $3.11

S32 fell another -4.3% on Wednesday, posting fresh two-year lows in the process. The diversified miner’s 1Q production numbers disappointed last month, and the stock’s subsequently drifted lower ever since.

“The company’s portfolio mix has kept us on the sidelines over recent months with large exposure to the out-of-favour aluminium, alumina and coal weighing on the stock. It will eventually be a great turnaround story, but it still feels too early, and it’s not particularly cheap compared to its peers trading on an Est P/E of 11.2x for 2024 when BHP on a slightly lower multiple,” James satys.

“We continue to watch S32 after its ~43% decline; a further foray under $3 wouldn’t surprise us. And avoiding catching this falling knife has added alpha to the MM portfolios.”

S32 – MM is neutral towards S32 around the $3.10 area

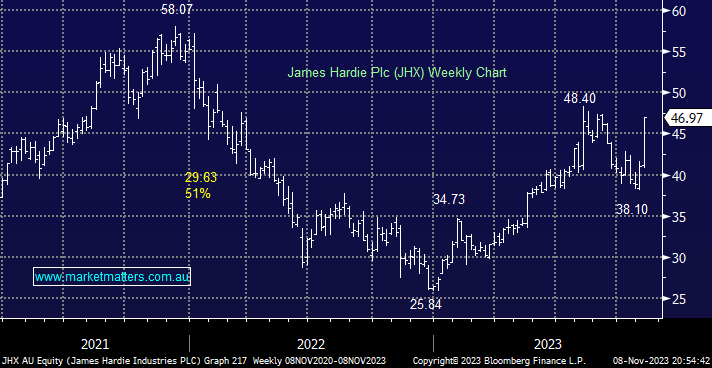

James Hardie (ASX:JHX) $46.97

JHX absolutely soared +13.8% on Wednesday this week following some strong guidance amid improving margins.

“The company said 3Q earnings were expected to come in at $US165-185m, a huge $US40m beat to consensus, and if this run rate can continue through the rest of the year, JHX could produce FY24 NPAT ~10% ahead of consensus expectations. Shareholders also enjoyed the new $US250m buyback.”

James tells Stockhead that his team revisited JHX to ‘point out an important aspect of successful investing, which is often overlooked.’

Ie: the Psychology of investing.

“It would have been easy on Wednesday to say phew, we avoided S32 or expletive, we missed JHX, but overall, it is adding value/alpha that matters on a quarter-by-quarter basis. Nobody will get all the winners or avoid the losers, but an honest and balanced approach will add value in the long run.

“We are still targeting a test of ~$50 for JHX, although after yesterday’s move, that is only 6% away.”

JHX – MM is bullish on JHX into Christmas

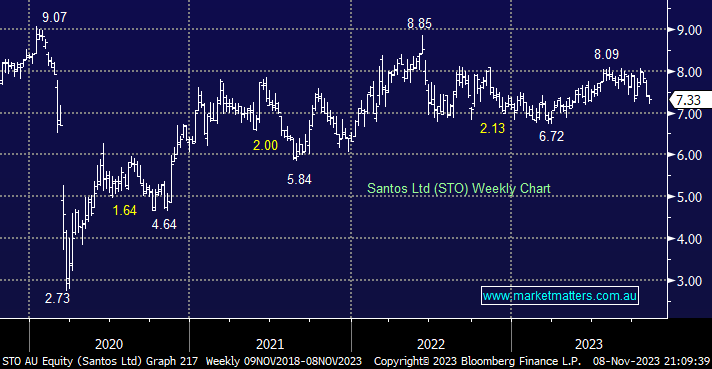

Santos (ASX:STO) $7.33

STO closed unchanged on Wednesday, close to its June swing low as tumbling crude oil prices weighed on the energy sector, although the stocks didn’t fare too badly under the circumstances, Gerrish says.

“We believe the aggressive decline by oil over the last few weeks, even as war continues between Israel and Hamas, is a testament that investors and traders are voting for a global economic slowdown into 2024.”

He says this is one of the main reasons MM believes it’s time to have portfolios skewed to stocks/sectors that benefit from falling bond yields.

“Supply of oil is rising, with Russian shipments at four-month highs as political hypocrisy abounds, but it’s demand worries, which have caused the economic bellwether to fall towards four-month lows, telling us it’s too early to go heavily overweight the resources.

“Crude oil fell another -2% on Thursday morning to three-month lows as demand concerns increased. We can see STO testing/breaking its 2023 low if oil and inflation fall through 2024/5.”

STO – MM is neutral towards STO, around $7.30

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.