MoneyTalks: Desert Island Risks – three random Emerging ASX Company hits in order of preference

It's all on tape. Via Getty

MoneyTalks is Stockhead’s regular drill down into what stocks investors are looking at right now. We’ll tap our extensive list of experts to hear what’s hot, their top picks, and what they’re looking out for.

Today we hear from the team behind Shaw and Partners’ James Gerrish at the very different online advice platform Market Matters.

Alongside co-founder former Macquarie and Goldman Sachs macro-analyst Shawn Hickman, Gerrish is the lead author of MM’s daily investment reports – sent to MM members morning and evening, with live alerts across the trading day, whenever they amend portfolios.

The aim? To provide concise, actionable, and consistently melodical market insights in 4/4-time.

This weekend the MM team was asked from a very left field which of the following emerging ASX stocks they’d back in order of preference bearing in mind MM hold all three in their Emerging Companies Portfolio:

A little background:

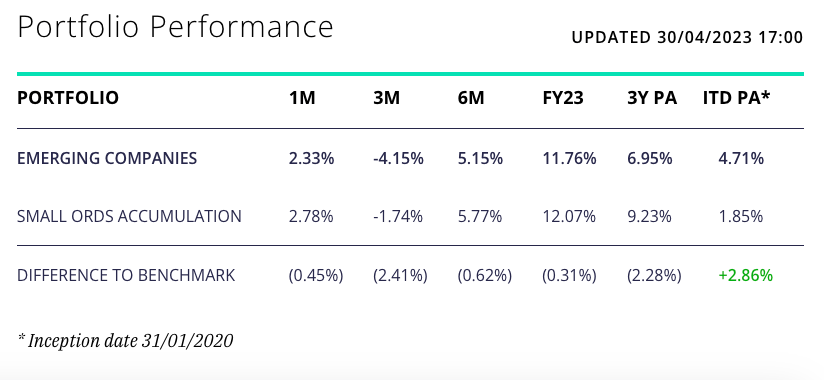

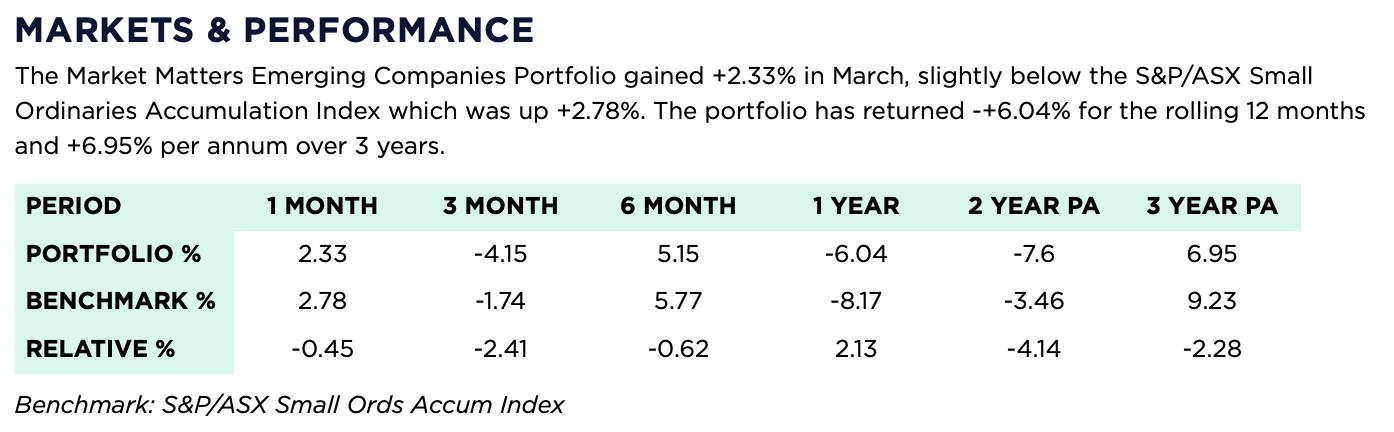

The newest Market Matters Portfolio that searches for small & mid capitalisation emerging stocks (ex-100) that show strong underlying growth characteristics. This is a higher risk portfolio and investors should expect greater volatility in returns.

James says the objective of the Market Matters Emerging Companies Portfolio is to provide an active exposure to Australian emerging companies defined as all listed stocks outside the S&P/ASX 100.

“Returns will primarily be achieved through capital appreciation rather than income with an overall objective of outperformance of the S&P/ASX Small Ordinaries Index over five years.”

1. ReadyTech (RDY) $2.89

“RDY is a software based educator. RDY has now fallen over 30% from its spike high in November following a $514mn takeover bid by Pacific Partners at $4.50.

“The stock has been under pressure following its 1H23 result but we believe it can deliver on its longer-term targets making the current weakness a great value opportunity.”

2. SRG Global (SRG) 73c

SRG is a local construction services company.

“SRG’s FY22 results and FY23 outlook provide strong evidence that SRG is delivering on its strategy and is a lower risk investment when compared to many construction and mining service peers given the recurring nature of a large portion of its revenue.”

“We believe the stock’s cheap, trading on an Est 10.9x valuation for FY23 while the stock pays an attractive steady 5.5% yield,” James said.

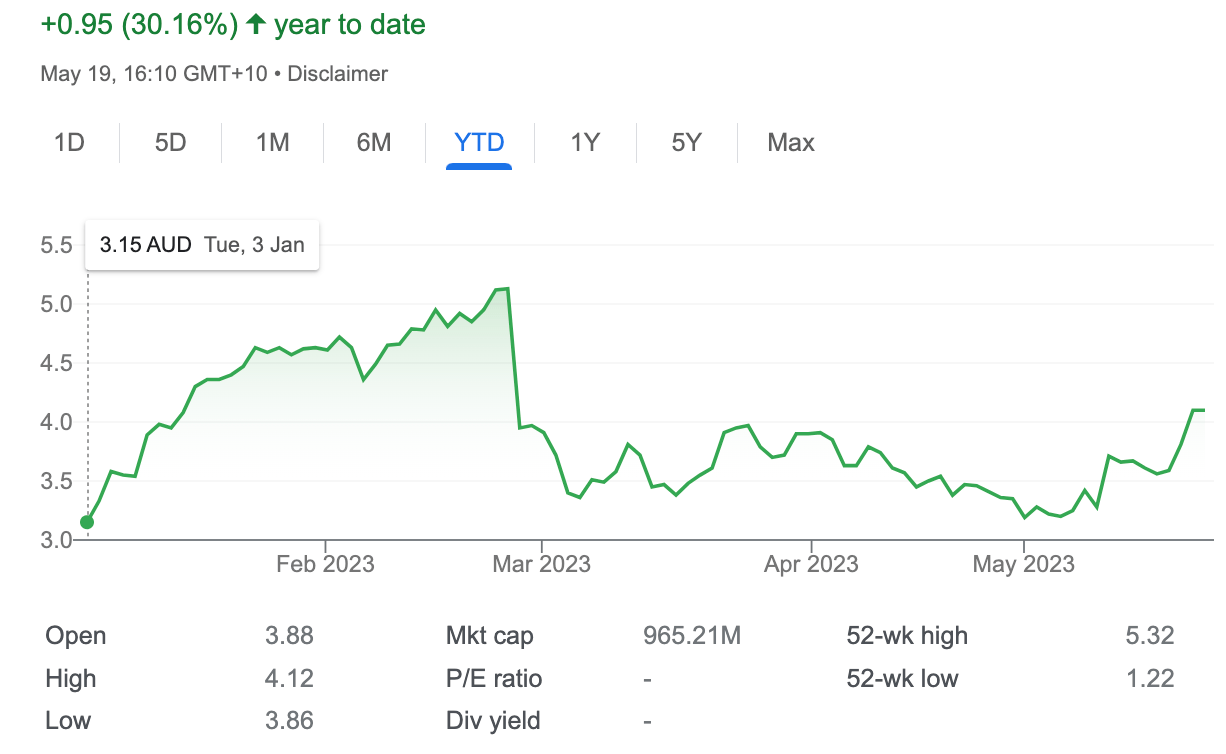

3. Silex Systems (SLX) $3.81

“A slightly different take on the uranium story.”

“Silex is developing a laser-enriched uranium technology in conjunction with sector giant Cameco. The demonstration plant in Kentucky is expected to be up and running in around 12 months’ time.

“The company is well funded following a capital raise earlier in the year while the US Government is also likely to support any capital requirements as part of the Inflation Reduction Act – note the supply of High Assay Low Enriched Uranium (HALEU), which the next generation of nuclear reactors require, is heavily reliant on Russia which throws a curve ball into the equation at least short-term.”

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewee and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.