MoneyTalks: Bellevue Gold has been oversold. Is it time to back up the truck?

Pic: Stockhead/ Getty

Stockhead taps an extensive list of experts in Money Talks, our regular drill down into the stocks investors are looking at right now.

Today, we hear from Simon Popple of UK-based Brookville Capital.

A few weeks ago, popular near term WA gold producer Bellevue Gold (ASX:BGL) released a project Feasibility Study (FS) – a detailed look at whether a project is economic to build — which the market did not like.

The stock plummeted ~28 per cent before paring some of those losses.

We need to look at why the market did not like it — and whether investors should “back up the truck” or “run for the hills”, Simon Popple says.

A quick background

Since January 2017 Bellevue’s share price has rocketed from 2.5c to +81c per share, driven by some unbelievable drilling success at its historic WA project.

Bellevue has now defined 2.3 million ounces (moz) grading 10 grams per tonne (g/t) gold — making it one of the fastest and highest-grade gold (re)discoveries in the world.

The resource includes the ‘Viago’ and ‘Deacon’ lodes which host an indicated resource inventory of 480,000 ounces of contained gold at an impressive 15.5 g/t.

Bellevue’s Stage 1 mine would produce ~151,000oz per annum over an intial 7.5 years, according to the recently released FS.

It would be one of the lowest cost gold mines in Australia, with an all in sustaining cost of $1,079/oz – which means massive profits at a current gold price of ~$2,249/oz.

So why didn’t the market like it?

With all this good news, you’re probably wondering why the shares tanked, Popple says.

“I think the main reason was a life of mine (“LOM”) projection of just 7.4 years,” he says.

“This sits well below the average length of operation of their peer group of 26 years. The question that many investors may have is – can they extend this?”

Popple believes they can.

“I contacted an equity analyst about this and we both agree that this is very conservative,” he says.

“Assuming they can keep adding to their resource (they are exploring in a particularly high-grade area), then a mine life of over 10 years could be achievable.

“I’m hoping that around 10 – 15 years may be achievable if the gold price improves and they find more gold (but this is a major risk and you must discuss it with your financial advisor).”

Although the study forecasts annual production of 160,000 ounces a year, their second study in June this year will include some other deposits so Bellevue may be able to produce more, Popple says.

“Since the resource estimate the Feasibility Study is based upon was completed there has been +40,000m of diamond drilling completed with a significant number of assays pending,” he says.

There is also a significant drill program underway which is looking to further resource conversion (improving the quality of the resource) as well as grow the project with new discoveries.

“The analyst thought production could be as high as 200,000 ounces a year,” Popple says. This would be a whopping 25% more production than currently forecast.

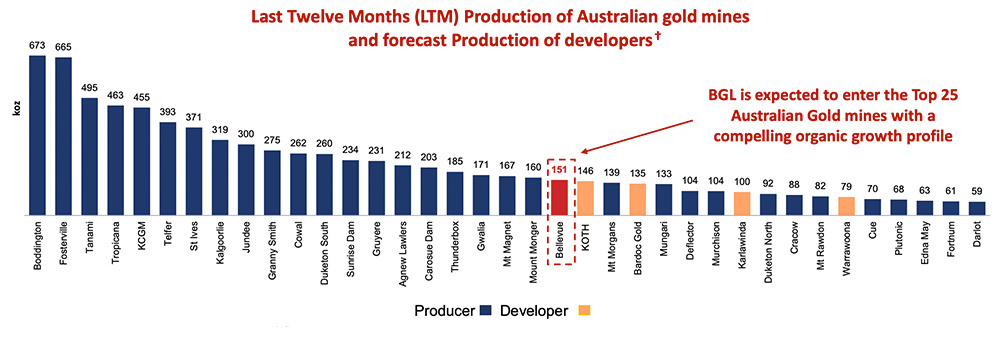

As things stand Bellevue are forecast to become a top 25 Australian gold producer, coming in at 21 (take a look at the table below).

But if their stage 2 feasibility study suggests they can produce 200,000 ounces a year this would bump them up four places, which Popple believes would be well received by the market.

Whilst production is important, it’s only one piece in the jigsaw. There are several others, Popple says.

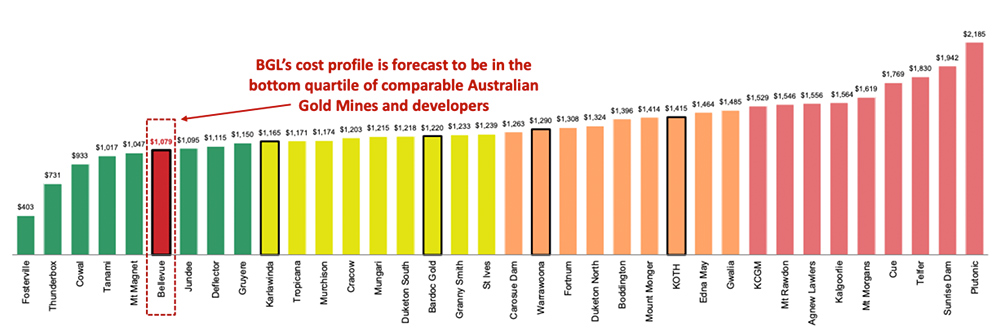

First of all there are costs.

“It’s important that these are competitive: the higher your costs the lower your profit margin,” Popple says.

“Fortunately, Bellevue are forecast to be in the bottom quarter (which is good) from a cost perspective.”

Take a look at the chart below:

“This is good from a number of different perspectives but let me focus on one: the lower the costs, the lower gold price they can operate profitably at,” Popple says.

“Given the gold price is currently US$1,723 per ounce, not only does this mean the price would have to come down a lot before they were making a loss.”

Popple says he likes to “kick the tyres” when he sees a low AISC. It’s important to understand WHY it’s so low.

“In the case of Bellevue it’s largely explained by their particularly high grade,” he says.

“Their maiden probable ore reserve sits as the second highest reserve grade of all the current Australian gold mines.”

The combination of these low costs and good grades goes a long way towards explaining their forecast of a particularly high EBITDA margin.

Summary

While there are clearly some risks attached to this – such as the gold price, funding risk (the need to raise the capital to build the mine) and operational risk – Popple is inclined to sit tight, given it’s such a high grade deposit.

“In fact, if the shares go much lower, I might buy more,” he says.

“If the stage 2 FS delivers (particularly extending the life of the mine), then I’d hope the shares recover. But clearly there are no guarantees on this.

“What I also like is their strong ESG focus – I hope this will make it easier for them to raise the capital on reasonable terms and move the project forward.

“So I’m not backing up the truck. But I’m getting in it. Thinking more about backing it up then charging away!”

After completing his MBA at Birmingham University in 1993, Simon joined the corporate finance team at Singer & Friedlander working on small and mid-cap mergers and acquisitions. In 1997, he joined the senior banker team at ABN AMRO before moving into their corporate finance department in 1999, where he specialised in private equity. He then became head of investment management at Strutt & Parker’s Real Estate Financial Services before becoming a director of Topland, one of Europe’s largest private investment companies.

In 2008, he set up Brookville Capital, a capital-raising business which subsequently won mandates with, amongst others, Bunge, the Bank of China (Suisse) and Fleming Family & Partners. He now writes the Brookville Capital Intelligence Report which covers gold and silver mining stocks.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.