MoneyTalks: Barclay Pearce Capital with 3 ASX stocks to safeguard against recession

Commentators around the world are now in chorus, singing songs about the very real threat of recession but these stocks provide opportunity. Pic: Getty Images

MoneyTalks is Stockhead’s regular drill down into what stocks investors are looking at right now. We’ll tap our extensive list of experts to hear what’s hot, their top picks, and what they’re looking out for.

Today we hear from Barclay Pearce Capital equities trader, Morgan McGuire.

What’s hot right now?

There are a significant number of macroeconomic and geopolitical movements that are creating an environment for investors to be understandably defensive or “risk off” (sic), McGuire says.

While economic indicators over the past two years signalled there were issues coming off the back of the pandemic, fuel has been added to the infernos of already embattled economies by way of supply chain constraints.

“The issues with supply have had a flow on to nearly every sector and industry globally, creating supply chain-led inflationary concerns taking the UK, USA an Australia into account as examples,” he says.

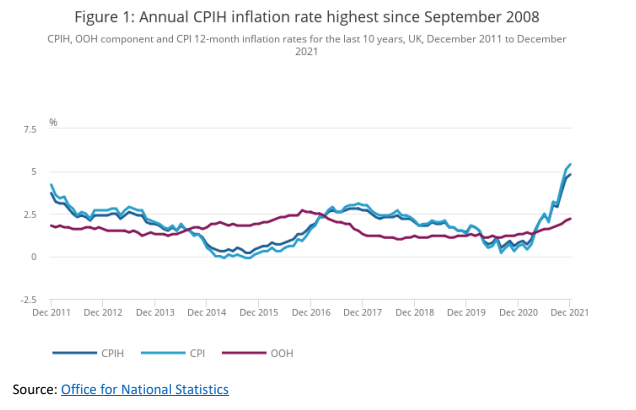

“In the UK we saw in December 2021 consumer prices, measured by the Consumer Prices Index (CPI), were 5.4% higher than a year previously in December 2020.

“This price increase (the annual rate of inflation) was up from 4.2% in the year to October 2021 and represented the highest rate since March 1992 (when it stood at 7.1%).

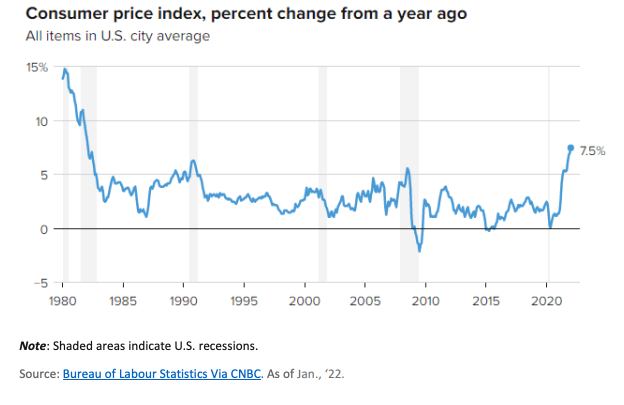

“US inflationary figures surpassed the median estimate of 7.3% in January 2022 and marked the strongest inflation since February 1982 while in Australia the Consumer Price Index (CPI) rose 2.1 per cent in the March 2022 quarter and 5.1 per cent annually.”

Market trends – Energy sovereignty

Economic commentators around the world are now in chorus, singing songs about the very real threat of recession – particularly in America, McGuire adds.

America is staring down the barrel of a not IF but WHEN scenario in relation to the potential for economic recession, he says, and not only that, but many nations are grappling with an energy crisis that is showing some frightening similarities to the top five energy crises of the past.

“Australia is set to brace itself for the change in governmental policy over climate change having direct effects on energy prices.

“Households and businesses should brace for higher power prices over the next few years after the Australian Energy Regulator approved price increases of up to 18 per cent in NSW and 12.5 per cent in Queensland from July 1.

“With soaring global commodity prices, Russia’s war on Ukraine and unplanned outages of coal-fired power stations, AER chairwoman Clare Savage warned pressures on the wholesale market would stay for some time.”

Market trends – Currency

McGuire points out the economic conglomerate consisting of Brazil, Russia, India, China and South Africa (BRICS) and the looming perspective of a currency underpinned by gold is leading to a potential threat to the US dollar no longer being the dominant global currency.

“Russia is ready to develop a new global reserve currency alongside China and other BRICS nations, in a potential challenge to the dominance of the US dollar as highlighted by a recent TASS article.

“Although this may become an issue for the US dollar, our trade ties with China will provide Australia with some level of insulation against a potential downturn in the value of the US dollar.”

Top picks

All these factors contribute to a significant level of confounding information for making clear investment choices.

“This is also compounded by the fact that we are coming off the longest bull market in history, which lasted from 2009 to 2020 and resulted in stock growth of more than 400%,” McGuire says.

“Now more than ever, making sound investment choices requires making calculated and informed decisions.

“Day trading in this climate (for the retail traders brave enough to be doing so) is akin to catching a falling knife and requires more than a sentiment driven or anecdotal approach.”

PILBARA MINERALS (ASX:PLS)

In the lithium space, McGuire says he seeks out players with stability and sustainable growth.

“Given the simple supply demand metric when it comes to lithium, I believe there is a long way to go for this commodity,” McGuire says.

“PLS shares surged from $1.455 at market open on 1 July 2021 to $2.29 at market close on June 30, 2022 which is a 57% gain.

“Pilbara Minerals reported a 394% increase in revenue to a record of $291.7 million and also benefited from positive broker coverage.

“Macquarie confirmed its outperform rating on the company’s shares in December with a $3.70 price target and forecasts record-level lithium prices in the next four years.

“Bank of America also lifted its guidance for the Pilbara share price by 13% in early January.”

NORTHERN STAR RESOURCES (ASX:NST)

There is constant appeal for gold, which is attractive to high-net-worth individuals (HNWI), as opposed to bonds or fixed income securities, he says.

“Many seek to shield their assets against any increases in volatility, however, Northern Star Resources is in a unique stock given that they mine and process gold deposits.

“The share price is exposed to volatility and thus must accept the spot and/or forward price of gold.

“Given the current global and economic landscape, I see many investors seeking gold as a potential hedge against market risks – plus NST’s projections for YOY growth to 2024 are very strong.”

WOODSIDE (ASX:WDS)

According to McGuire, Woodside has conventional, low-cost assets that are technically simple to operate.

“Around 95% of their production is in OECD jurisdictions and they produce 70% gas, which is increasing over time.

“The company has also recently merged with BHP Petroleum business to create a larger and more financially strong global energy company via an all-stock merger into Woodside Energy of BHP Petroleum.

“WDS has reported FY21 underlying NPAT of US$1.62B, which compares to market expectations of US$1.45B – however, the FY22 guidance is in line with current market expectations.”

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.