MoneyTalks: 4 US stock picks from NY fund manager Jennison, including a peculiar way to play the EV space

Jennison says its US stock picks are leaders in its sectors and which therefore have pricing power (Image via Getty)

MoneyTalks is Stockhead’s regular recap of the stocks, sectors and trends that fund managers and analysts are looking at right now and in this special edition we’re looking at US stocks.

Today we hear from Benjamin Bryan, a portfolio manager at New York based fund manager Jennison Associates.

Jennison was founded in 1969 by Spiros Segalas at a time when value investing was in vogue and growth investing was, in Bryan’s words, “something a little bit new”.

“We’re mostly a growth driven shop, we look for secular changes in businesses and investments that can really drive the duration of growth and change how we think about the world – how we live, how we work and how we play,” he told Stockhead.

“We tend to be longer term oriented in terms of our investment process and focused on growth and as a result of that it gives us perspective to think a longer term view of how the world is changing and to try and find those secular changes.”

US stocks with a unique model or niche product

Bryan says Jennison is trying to find companies that are leaders in their sectors and therefore have pricing power.

“Even if we’re in an inflationary environment, we feel confident the companies we’re invested in have that pricing power because they are leaders in their space,” he said.

“That’s one of the core tenants in terms of companies we look to, making sure they have a unique business model or niche product that provides them that latitude.

“Valuations will come and go but at the end of the day these are companies that have duration of growth and visibility to growth that goes out more than a year or two given the businesses they’re involved in.”

Approximately a third of Jennison’s holdings are technology and many have benefited from structural shifts sparked by COVID-19.

“If you told anyone [pre-COVID] you’d be working from home five days a week for more than 18 months, they’d think we wouldn’t operate properly,” Bryan said.

“But technology has evolved such that – at least for us – it means the process is relatively seamless and a lot of companies have said productivity has increased as a result of what’s occurred during the pandemic.

“A lot of these companies have talked about their digital migration to be more digital enterprises has been accelerated by at least two years and so a lot of the companies in the digital space we’re invested in are weighted to that trend and are seeing a significant benefit as a result.”

US stock picks

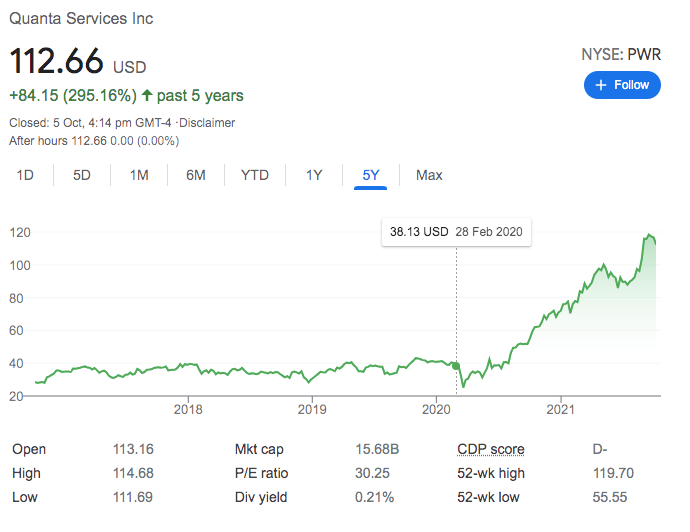

Quanta Services (NYSE:PWR)

One of Jennison’s top US stock holdings was this US$15.6 billion company involved in electric utilities space.

It has been a difficult period for electricity providers in the USA with the various extreme weather events in 2021 and many companies set to lose a large portion of their long serving workforce to retirement in the next few years.

But Quanta Services might benefit going forward as grids are upgraded, energy goes renewable and it might even be a niche way to play the EV space.

“Even before we talk about EVs and renewable energy, the grid was in a position it needed to be hardened and upgraded,” Bryan said.

“And if you think about the fact that EVs in the United States are 2% of car sales today but expected to grow quite quickly, it raises the question of how we can service all these cars, how are we going to charge them to get to carbon neutral environment?

“We need more generation and it has to be wind and solar but a lot of those wind and solar generation facilities are not close to the existing grid.

“They tend to be in rural areas – wind is offshore – so you need to run electric lines from those more remote areas back to the grid.

“Quanta comes in as a trusted partner and can help these utilities migrate to a carbon neutral world. Quanta has been a holding for over five years, done well for us and based on secular change in how we think about the world, should continue to do quite well.”

Quanta Services (NYSE:PWR) share price chart

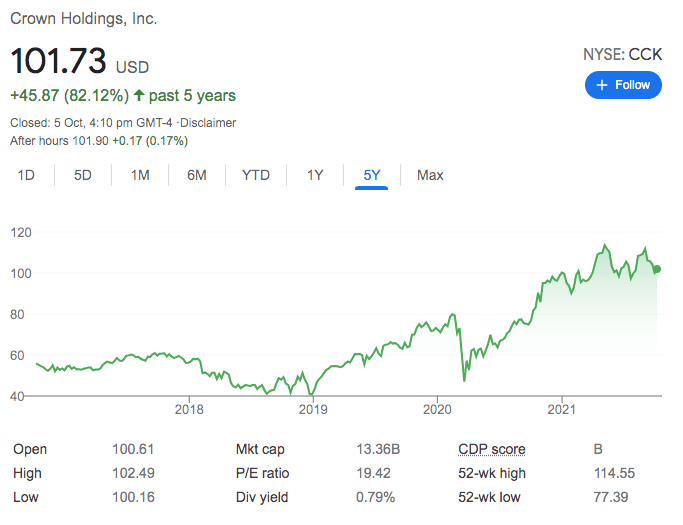

Crown (NYSE:CCK)

Crown Cork makes and produces aluminium cans and it is benefiting from a number of structural trends.

“There’s a big push from plastic to aluminum given it [plastic] doesn’t break down, but aluminium is easier to recycle,” Bryan said.

“We’re in a shortage position right now in terms of aluminium cans, we have been since the pandemic started. We imported cans mostly from Latin America because there’s a shortage.

“In addition to the push towards displacing plastic, you’ve got people working from home, not going to bars or restaurant and therefore they’ve been buying beer or other drinks to consume at home.

“They’ve very popular and growing quickly and it’s created a shortage as well.

“That’s another name that fits the mould of being more environmentally friendly but seeing a shift in terms of how people consume products and therefore a supply/demand imbalance that’s creating a good environment for Crown.”

Crown (NYSE:CCK) share price chart

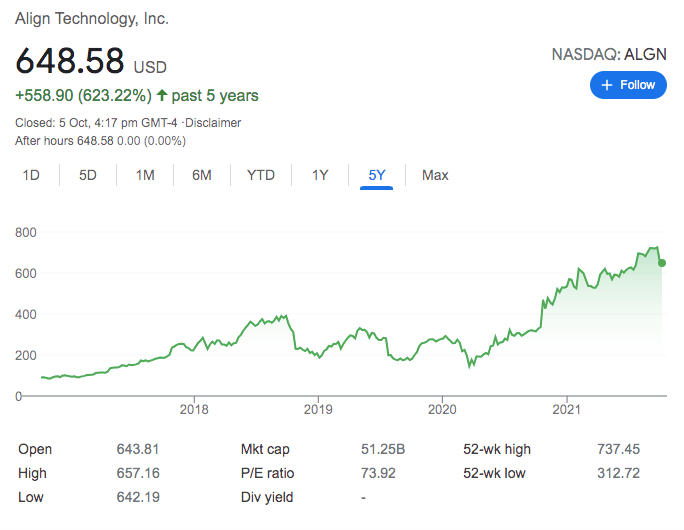

Align Technology (NDQ:ALGN)

While the ASX is only home to one dental equipment maker – $121m company SDI (ASX:SDI) – the NASDAQ is home to US stock Align Technology which manufacturers aligners used in orthodontics.

And its Invisalign devices differ from competitors in being more asthetically pleasing – being clear – and according to Align, more predictable. They began targeting adults but are expanding into kids and teens as well as into Europe and Asia, including China.

Bryan explains while there were short-term effects with patients fearful of COVID not going to the dentist, business has ultimately boomed because it is more efficient for dentists.

This is because it is a quicker procedure and as a plus the initial scan and some subsequent check ups can be done remotely.

“Align because of their model allows orthodontists to be much more efficient – they like to call it time in the chair,” he says.

“As a result of the pandemic Align has been able to push orthodontists who were reluctant to jump into the aligner space much more quicker.

“Because if you think about COVID, you couldn’t have as many people there but with Clear Aligners you could be more efficient at the orthodontist and taken a tremendous amount of share.

“They got high marks from orthodontists.”

Align Technology (NDQ:ALGN) share price chart

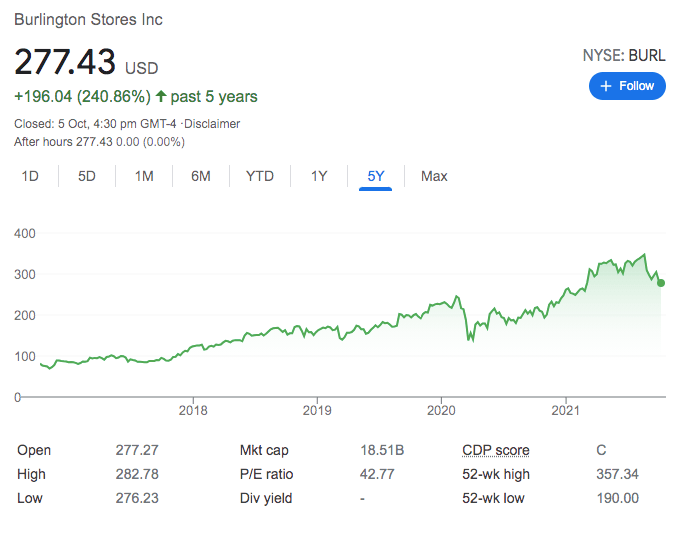

Burlington Stores (NYSE:BURL)

Rounding out Jennison’s US stock picks is Burlington, a retailer with an “off price” business model whereby inventory is bought from other retailers or manufacturers with inventory issues and sold to consumers at a discount.

“For a consumer looking for name brand product but doesn’t want to spend full price they can visit Burlington store and consider it a treasure as the inventory changes periodically – you never know what you’re going to get,” Bryan says.

“When you think about competing with large ecommerce retailers who price everything very attractively, that’s always a risk for traditional retailers – I’ve got to worry about that guy in Seattle.

“But with Burlington because the products change every so often, it keeps consumers coming back again and again because of that treasure hunting experience.”

Bryan is also a fan of the management team that has taken over the business in the past couple of years and the long term focus they have.

“There are a number of things they’re doing, there’s still a lot of running room in how store footprint can grow but also the push towards shrinking it [individual stores] making it more efficient.

“It’s not the most exciting, they’re not changing the world obviously, but it’s a classic growth story in terms of how they’re taking proving strategies that reshape the business and generate more profits in the long term.”

Burlington Stores (NYSE:BURL) share price chart

What now for US stocks?

Despite the difficult past couple of months for investors in US stocks, Bryan is still optimistic but admits there’s some economic transformation to happen.

“Our perspective that is the economy was very concentrated in WFH technology companies and our view coming into this year is that given the vaccine and people want to get out and about, the economy was going to broaden out,” he said.

“I think at this point most people are gaining some level of comfort that perhaps COVID will be more endemic as opposed to a pandemic and therefore we have to figure out how to live it.”

Bryan said while there have been supply chain challenges, the very reason they are a challenge is because the consumer demand is still there and not all of the stimulus has been put to use just yet.

“I think at that point things will broaden out and settle down. Whenever there’s a change in interest rates or the rate curve starts to move higher people tend to get overly concerned too quickly in my opinion,” he said.

“Most economic cycles go 5-10 years and we’re still in the first inning of this cycle so I think we’ve got a long way to go.”

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.