Money Talks: Global food supply is at risk and these fertiliser stocks are well-placed to capitalise

Pic: Rommel Gonzalez / EyeEm / EyeEm via Getty Images

MoneyTalks is Stockhead’s regular recap of the ASX stocks, sectors and trends that fund managers and analysts are looking at right now.

Today we hear from Paul Hart, executive director of Canary Capital.

The risk to global food supply

“We are living in increasingly volatile times and the war in Ukraine is going to have severe consequences for the world in terms of both food production and supply,” Hart said.

“Ukraine, which is the fifth largest wheat producer, is likely to see dramatically reduced output this season due to the effects of the war.”

Not to mention that fertilisers are a critical input in the supply of food to the world’s ever expanding population.

And Hart says that, so far, there has been limited media coverage of the recent turmoil in global fertiliser markets.

“Earlier this year China suspended the export of phosphate due to soaring prices amid reduced local supply, due to high energy costs and floods in China’s central Henan province,” he said.

“According to Reuters, China is the world’s top exporter of phosphate, and shipped 3.2 million tonnes of diammonium phosphate fertiliser in the first half of this year to major buyers such as India and Pakistan as well as 2.4 million tonnes of urea, according to customs data.”

“In 2021 there were record high fertiliser prices due to tariff disputes, supply disruptions and higher fertiliser manufacturing costs.

“There were also supply chain disruptions which increased the tightness in the market. According to DTNPF, Russia is the second-largest producer of ammonia, urea and potash and the fifth-largest producer of processed phosphates.

“It is estimated that the country accounts for 23% of the global ammonia export market, 14% of urea, 21% for potash and 10% of the processed phosphates.”

Then Russia suspended fertiliser exports

On the 10th of March 2022, Russian Minister of Industry and Trade Denis Manturov said Russia decided to suspend fertiliser exports.

This comes when global food prices are already at record highs, and European fertiliser makers are struggling to produce nutrients ahead of the spring growing season, increasing the risk to global food supplies and affordability.

“On top of this, a reduction in natural gas supplies from Russia, which is a critical ingredient in making nitrogen-based fertilisers, has forced some producers to reduce or completely halt production,” Hart said.

“For growers of staples like corn and wheat, it’s the first time they’ve been exposed to a fertiliser crisis fueled by an energy crunch, export curbs and trade sanctions.

“It now costs much more to buy fertiliser needed for spring crops.

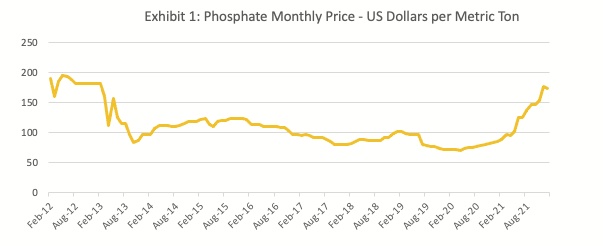

“Phosphate which was selling for $80 per tonne last year is currently around $175 per tonne, a rise of more than 100%.”

Hart says that, as a result of the current environment, companies which have the potential to develop large projects which can help to fill the supply deficit of fertilisers left by Russian and Chinese export restrictions are likely to perform very well in the near term.

“Countries which have relied upon China and Russia for their supply of critical fertilisers to grow their crops will now be looking for new markets to fill the void,” he said.

PHOSCO Limited (ASX:PHO)

Canary Capital’s top pick in the fertiliser sector is Phosco Limited which has a 50.99% controlling stake in the Chaketma Phosphate project located in Tunisia.

The Chaketma project is located 210km southwest of the capital Tunis, around 35km from the nearest rail head and also has access to ports. Gas and grid power are nearby.

Chaketma is a large, shallow, high grade well defined phosphate resource which features simple geology and significant potential for resource expansion.

“The company recently announced a resource upgrade which lifted the project to a total of 148.5Mt at 20.6% P2O5,” Hart said.

“The KEL resource grew by 50% to 55.5Mt at 21.2% P2O5, with an increase in confidence to measured and indicated status, whilst maintaining grade.

“This project alone would support a mine life of 30 years.

“A resource upgrade for the GK deposit (93 Mt @ 20.3% P2O5) is underway to incorporate an additional 21 drill holes.”

Phosco plans to develop the Chaketma project in two phases. Phase one would involve the establishment of an open pit mine with low strip ratios. Phase two would involve the construction of an integrated fertiliser project to produce phosphoric acid.

Hart says there are several other international companies active in Tunisia including BP, Shell, Anglo Oil & Gas and Glencore.

Plus, the government is pro-investment with incentives including a 35% tax rate reduced to zero for the first five years.

“With a current market capitalisation of $36.2m (based upon a price of 15 cents per share) and a tight share register (top 20 hold 66%), we see significant upside in Phosco as it moves towards the development of the large Chaketma rock phosphate project,” he said.

Fertoz Limited (ASX: FTZ)

Fertoz is focused on developing sustainable land management with organic farm inputs and native based carbon credit generation.

The company supplies rock phosphate and blends to the North American market. In Australia and selected Asia Pacific countries the company supplies fused magnesium phosphate.

“Fertoz offers quality organic fertilisation which is natural, high in available phosphorus and is free from contaminants,” Hart says.

“The company has undertaken substantial research which has shown that their rock phosphate works best in acidic and pH neutral soils, however, when combined with sulfur or humate, it is just as effective in alkaline soils.

“In the year to 31st December 2021 the company collected $3.3m in cash receipts with an operating cash deficit of $1.7m for the year.

“More than half of the cash receipts were received in the December quarter with $1.7m collected from customers.”

The company has also had a strong start to 2022 with record forward fertiliser orders.

And with 50% of the current inventory sold Fertoz plans to commence mining at Fernie and potentially Wapiti.

“Fernie has a current resource of 1.54Mt at 21.6% P2O5 .down to a depth of 30m with an exploration target of 2.9 to 3.3Mt at a similar grade,” Hart said.

“The company has a current market capitalisation of $64.0m and had cash on hand of $5.2m at the end of December, 2021.”

MinBos Resources Limited (ASX: MNB)

Hart’s final pick in the fertiliser space is Minbos Resources who have a phosphate deposit in western Angola.

The Cácata phosphate resource currently stands at 6.9Mt at 30% P2O5.

The company plans to mine Phosphate Rock from the Cácata Deposit and transport it to Porto de Caio where a granulation plant will be built and operated at the industrial site to produce Enhanced Phosphate Rock (EPR) granules.

On the 10th of March 2022, the company announce that DFS design had been completed on the Cabinda Phosphate Fertiliser Plant, which has been designed with an initial production capacity of 150,000tpa with the capability to expand up to 450,000tpa.

Based on current estimates, commissioning is expected in H1 2023.

“The new plant has access to stable and cheap grid and hydro power, water, gas & diesel and is close to the Ports of Caio and Cabinda for regional shipping,” Hart says.

“The company has received governmental support and can supply local African markets with ammonia based fertilisers.

“First sales are expected in 2023. Russia currently supplies 80% of the world’s ammonia, so a local manufacturer with a plant that can produce a variety of fertilisers suited to African conditions should be well received.

“With a market capitalisation of $86.7m and tight conditions in both the fertiliser combined with cheap power inputs, Minbos Resources is poised to enter the market at a good time.”

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.