Mills and Boom: Morningstar’s mining analyst Jon Mills and the 4 ASX names for a really good New Year

Via Getty

Morningstar Equity Analyst Jon Mills just released his Q4 overview of the mining industry.

He says commodity prices diverged in the quarter, with strong China steel production driving iron ore and metallurgical coal prices up, while base metals prices sagged on worries of a Western recession.

“Even so, prices are elevated versus history and cost-curve support.”

On the whole, balance sheets are strong with dividends and buybacks a priority.

“But high prices incentivise miners to chase growth. Merger and acquisition activity is up. Newmont bought Newcrest, while BHP and Teck sold coal mines to Whitehaven and Glencore,” Mills adds.

Now, because it is Christmas, I’m going to put Jon’s epic work on this into edible bullet points – as Shakespeare said: “Turning the accomplishment of many years into an hour-glass…”

Mills and the new mining boom

-

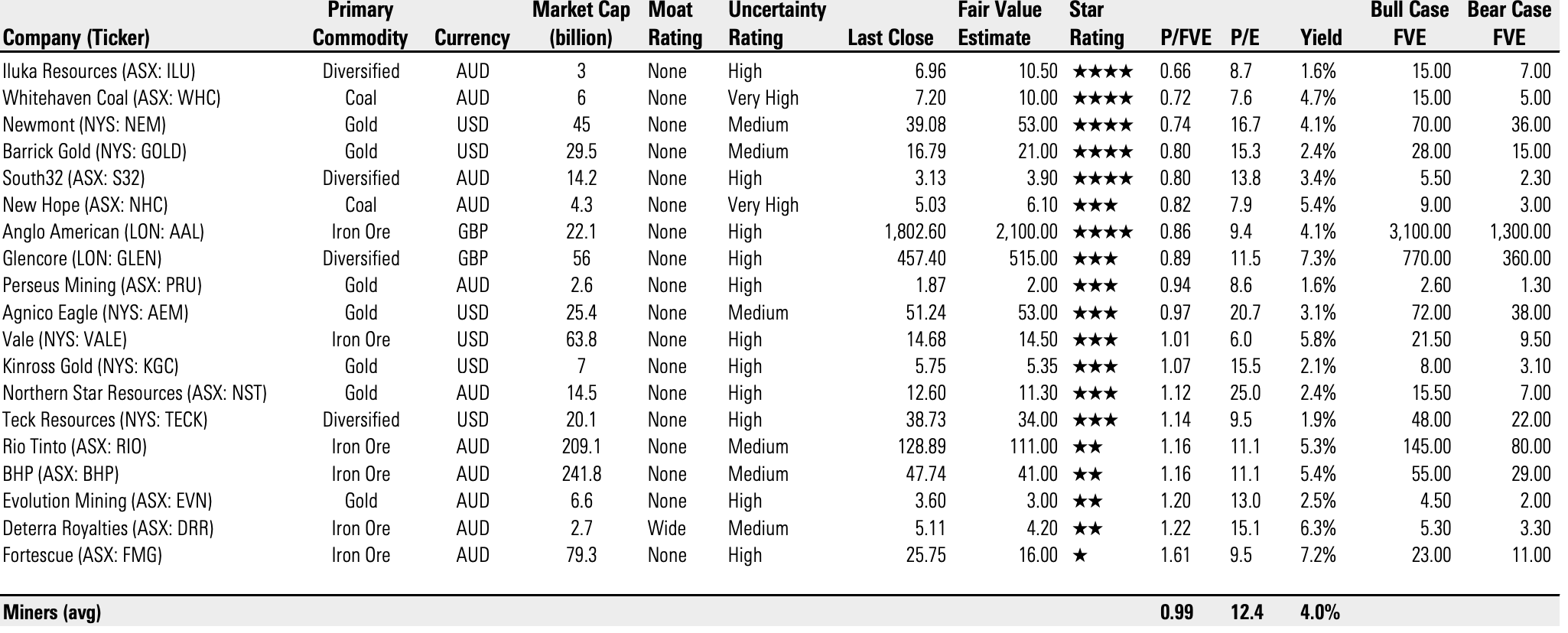

Most miners’ share prices increased during the quarter, and the average price/fair value estimate has risen to 0.99.

-

Thermal coal miner Whitehaven ‘remains materially undervalued, which we think reflects many investors shunning coal investment’

-

Gold prices are up on ‘optimism that global interest rates are close to a peak’

-

Lower rates reduce the opportunity cost for investors to own gold

-

This in turn ‘supports gold miners’ share prices, though many remain undervalued in our view’

Mills: Gold and thermal coal firms cheap on macro and ESG concerns

-

‘We think thermal coal miner Whitehaven Coal and gold companies Newmont and Barrick are among the cheapest of our coverage’

-

Newmont and Barrick’s sales volumes have disappointed, inflating unit costs. However, ‘we think volumes and margins will improve’

-

Whitehaven still benefits from above-average thermal coal prices and has agreed to buy two metallurgical coal mines from BHP

-

Strong cash flows will likely be used to repay debt for the acquisitions before excess cash is again returned to shareholders

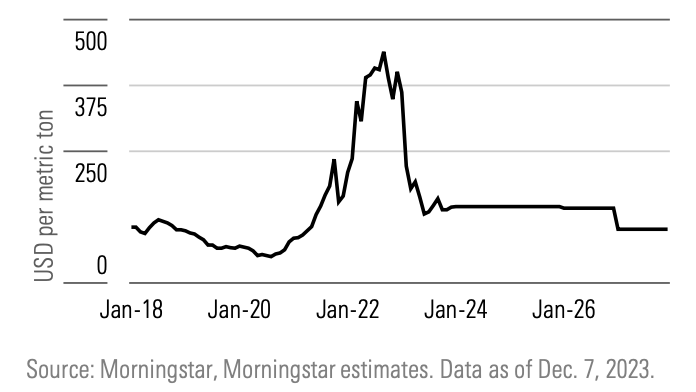

Mills: Thermal Coal Prices Likely to Remain Elevated

-

Prices continued to moderate over the quarter compared to record 2022 highs on reduced energy security fears, increased production in China, and slowing global growth.

-

Demand for high-quality coal, such as from Whitehaven and New Hope, is likely to remain robust in Southeast Asia.

-

It meets energy needs while reducing emissions versus lower-quality coals, such as those from Indonesia.

-

Western supply is likely to be constrained by ESG considerations and onerous regulatory hurdles.

Jon’s Top Mining Picks

Iluka Resources (ASX:ILU)

Jon says No-moat-rated Iluka’s shares are being affected by lower mineral sands prices on reduced demand driven by China’s property sector.

“Rising interest rates and slowing housing markets in the West are also a headwind. However, we think these concerns are more than reflected in its share price.

“Longer-term, maturing mines and a lack of large, high-grade, undeveloped resources are likely to support mineral sands prices. The company’s proposed rare earths refinery at Eneabba is an option on elevated rare earths prices, and we think Iluka has cut a good deal with the Australian government, which is funding much of the refinery’s construction cost.”

Whitehaven Coal (ASX:WHC)

No-moat-rated Whitehaven (ASX:WHC) is penalised by ESG concerns, according to Mills.

“We think its deal to buy two metallurgical coal mines from BHP is a good one, diversifying its production to roughly half thermal coal, half metallurgical coal, while the debt taken on to help finance the purchase is manageable.

“Both high-quality thermal coal and metallurgical coal are likely to be supply restrained due to ESG concerns and regulatory opposition, which could support prices longer-term.

“In our view demand for metallurgical coal for use in steelmaking is likely to remain persistent, while Whitehaven is well-placed to benefit from continued strong demand for high-quality thermal coal over at least the next decade.”

Newmont Corporation (ASX:NEM)

Jon says no-moat-rated Newmont’s acquisition of Newcrest extends Newmont’s lead over Barrick Gold as the world’s largest gold miner, with pro forma 2023 sales of roughly 7.3 million ounces of gold.

“The combined company also has material copper production of roughly 160,000 metric tons as well as numerous development projects that we think are valuable and perhaps overlooked.

“We think Newmont’s shares are undervalued given its weak sales volumes in the first nine months of 2023, which have led to elevated unit cash costs.

“However, we think sales volumes will recover, helping lower unit cash costs and driving some improvement in the enlarged Newmont’s current position around the middle of the cost curve.”

South32 (ASX:S32)

“No-moat-rated South32’s undemanding valuation metrics, diversified portfolio of future-facing commodities and strong balance sheet are attractive,” Jon reckons.

“Its strategy is to transition its portfolio to metals such as aluminum, alumina, copper, and zinc, commodities more likely to benefit from decarbonisation and electrification. As such, while elevated metallurgical coal prices saw the division comprise around one-third of fiscal 2023 EBITDA, we forecast metallurgical coal to be less than 10% of EBITDA at the end of our forecast period in fiscal 2028.

“A weak 2023 result and concerns over lower near-term commodity prices drive the valuation discount.”

Mills: Miners close to Fair Value on avg, but Valuations widely dispersed

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.