Josh Gilbert: Sticky ASX lithium proving more than just a honey trap

Ah. Mr Gilbert. I put what's left of your soul in this bottle. Via Getty.

- eToro releases Q1 Top Stocks, AI, Big Tech, lithium in focus

- Nivida, Taiwan Semiconductor, AMD top 3 risers in Australia

- AI buzz grows for Nvidia, Microsoft and Alphabet

By the end of last quarter Aussie retail investors were still salivating for a stake in Big Tech and AI stocks.

And while China’s latest video game regulations continue to slap tech investor giant Prosus NV, the Aussie lithium miners are defying the broader selldown with punters still keen to back local lithium despite the malaise

These are a few of the conclusions according to the latest quarterly stocks data out of eToro.

Each quarter eToro diggers analyse which companies saw the biggest proportionate changes, quarter-on-quarter while also looking at movements in the most held stocks on the platform here in Aussie.

Elon vs Nvidia

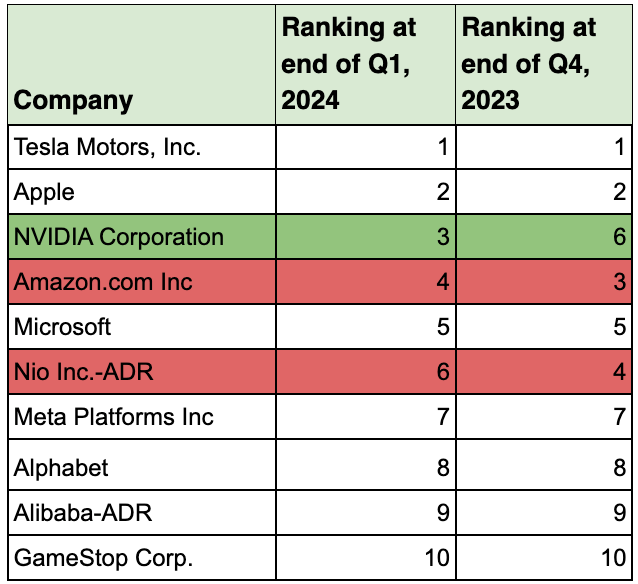

While the list of most held stocks was unchanged at the top, with Tesla and Apple leading the pack, further down the rankings there was significant disruption thanks to Nvidia.

The AI market leader climbed from 6th to 3rd in Q1, as the firm’s share price continued its extraordinary ascent, now more than 230% up in the last year.

The data also shows manic Aussie eToro users showing no sign of letting up on Big Tech mania and AI mania.

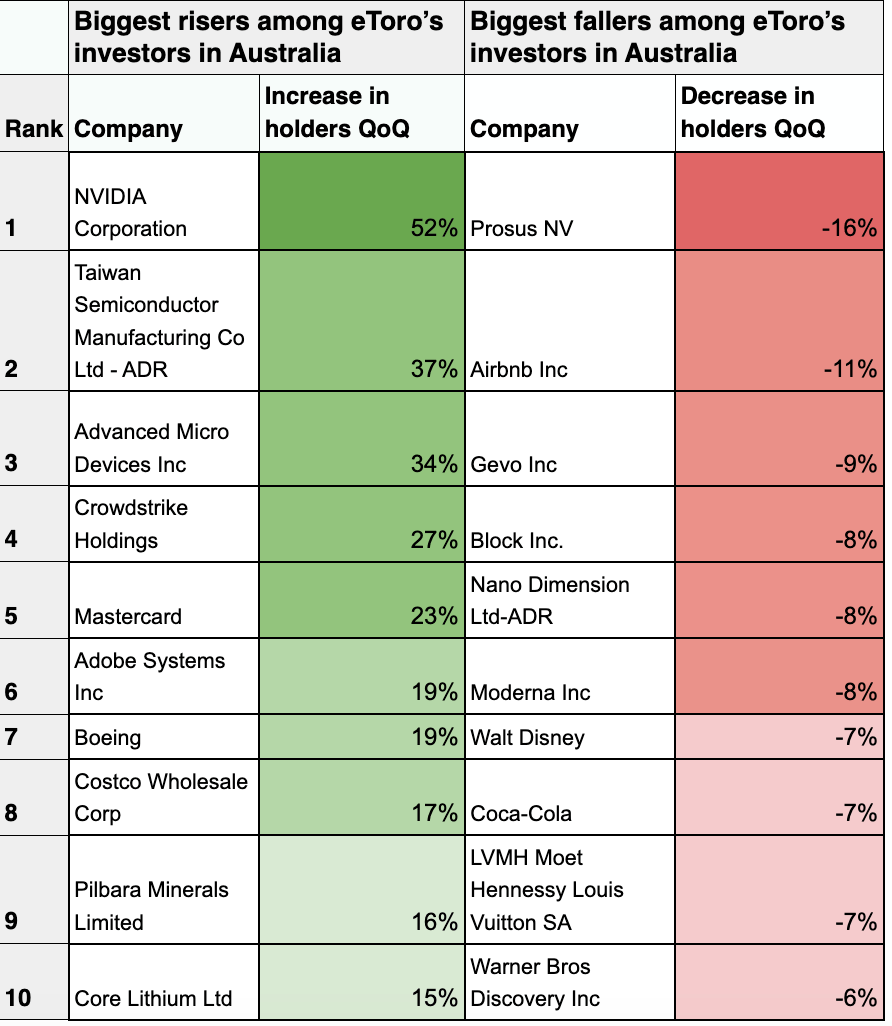

Nvidia, Taiwan Semiconductor Manufacturing Co and Advanced Micro Devices all made the biggest risers list for Q1, with the number of investors holding the stocks climbing 52%, 37% and 34%, respectively.

Also on the list were tech stock stalwarts Microsoft, Intel and Apple.

Pasty Cornish

Lately out of Cornwall, the Sydney-based eToro market analyst Josh Gilbert says the attention Nvidia’s been attracting is a no-brainer.

“It won’t be a surprise to anyone to see Nvidia climbing up the charts after its stellar performance over the last 18 months as it continues to reap the rewards from AI. Tech stocks are still the main attraction for seasoned and new investors, as we continue to see these businesses move from initial hype to revenues and profits reality.”

At the other end of the spectrum, Australian eToro users appeared to lose patience with China’s Prosus (-16%), a major shareholder in Beijing’s tech giant Tencent.

“This investor exodus continues from Q4, when Prosus also saw a 16 per cent drop in Aussie holders following news of new Chinese regulations announced in December that intend to curb spending on video games.

“Another company that saw a significant QoQ fall was Airbnb (-11%), as its legal battles, negative feedback on policies and broader controversy surrounding short-term rentals amid a cost of living crisis continue to affect investor sentiment.”

eToro stocks most widely held/position last quarter

What interests Josh most, however is just how sticky lithium stocks are – investors just aren’t willing to give up on them.

“Lithium shares have seen significant drawdowns in the last 12 months. We’re in the midst of a lithium winter, with EV demand slowing, and lithium miners are at the whim of falling lithium prices that continue to fall, whilst inflation and high interest rates elevate the cost of initiating new projects,” Josh says.

“However, short-term fluctuations aren’t deterring long-term investors from what seems to be the inevitable transition to electric vehicles.”

Instead, according to eToro data, they’re seeing the drawdown in businesses like Pilbara Minerals (ASX:PLS) as an opportunity to own a quality business at a lower price for the long term.

Elsewhere, retail investors are increasingly looking for opportunities in European stocks while holding firm on AI and weight loss drug leaders, Josh reckons.

He says this insight comes ahead of a widely predicted market rotation away from US and tech and towards Europe and emerging markets.

“European firms on the list include weight loss drugmaker Novo-Nordisk, Spanish energy firm Repsol, and German defense stock Rheinmetall, with the latter seeing a massive 80% share price jump so far in 2024 as military spending grows due to the ongoing Ukraine-Russia conflict.”

Biggest movers on eToro QoQ

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.