How to invest in Netflix, Apple, Alphabet, Meta and Microsoft with a single click. (Maybe two clicks.)

Pic: Getty Images

- NASDAQ more than technology it is about modern-day global infrastructure stocks

- Global X launches new ETF tracking performance of largest 100 companies on NASDAQ

- FAANG companies diversified against multiple industries with high cash reserves to continually innovate

Short for the National Association of Securities Dealers Automated Quotations, the NASDAQ is one of the world’s largest and most well-known stock exchanges.

It was founded in 1971 by the National Association of Securities Dealers (NASD), now known as the Financial Industry Regulatory Authority (FINRA).

The NASDAQ has always been known for innovation and was originally established as the world’s first electronically-operated stock exchange globally. In 1998 it became the first in the US to trade online, with the slogan “the stock market for the next hundred years”.

It became a for-profit company in 2000 after the NASD membership voted to restructure and spin it off into a shareholder-owned, for-profit company.

It then went on to operate as a national security exchange and combined with the Scandinavian exchanges group OMX to become the NASDAQ OMX Group changing its name to NASDAQ Inc in 2015.

Global X ETF tracks largest 100 NASDAQ companies

The new Global X US 100 ETF (ASX:N100) tracks the performance of the largest 100 companies listed on the NASDAQ exchange, excluding financials and REITs, for a 0.24% management fee, the lowest cost for an ETF of its kind.

Stocks include those driving the strongest gains on the NASDAQ, such as FAANG stocks Netflix, Apple, Alphabet, Meta, Microsoft, and Nvidia.

Global X ETF’s head of distribution Kanish Chugh says the NASDAQ is one of the most well recognised exchanges in the world but worth noting is while it is considered tech-based, this is not exactly the case.

“When you look at the companies and what sector they sit in, technology is just under 50%,” he says.

Chugh says companies like Meta (formerly Facebook) may have historically sat in the tech sector; now they’re a media and communication company.

“The way I see it the FAANG stocks are modern day infrastructure stocks,” he says.

“They’re really creating how we will live in the modern world and are not traditional technology as the sector classification would go.”

He says Amazon is a consumer company, while Facebook and Alphabet are media and communications sector companies generating most of their revenue from SEO or advertising.

“When I think of Amazon now the majority of its revenue is still coming from consumer shopping platform but about 35% of its revenue is coming from its cloud software AWS,” Chugh says.

“If that gets to a point where the majority of its revenue is coming from cloud software then theoretically at some point it could be re-classified as a tech company as we assume it to be but it is currently not,” he says.

Big FAANG companies constantly innovating

Chugh says cashed-up FAANG companies are diversified against not just one industry but multiple and have very high cash reserves to continually innovate.

“They’re constantly trying to innovate, disrupt and stay relevant and have the ability to do so because they’re sitting on very high cash reserves,” he says.

“So, when you think about the NASDAQ it’s more around innovation than technology and we often link those two closely together.

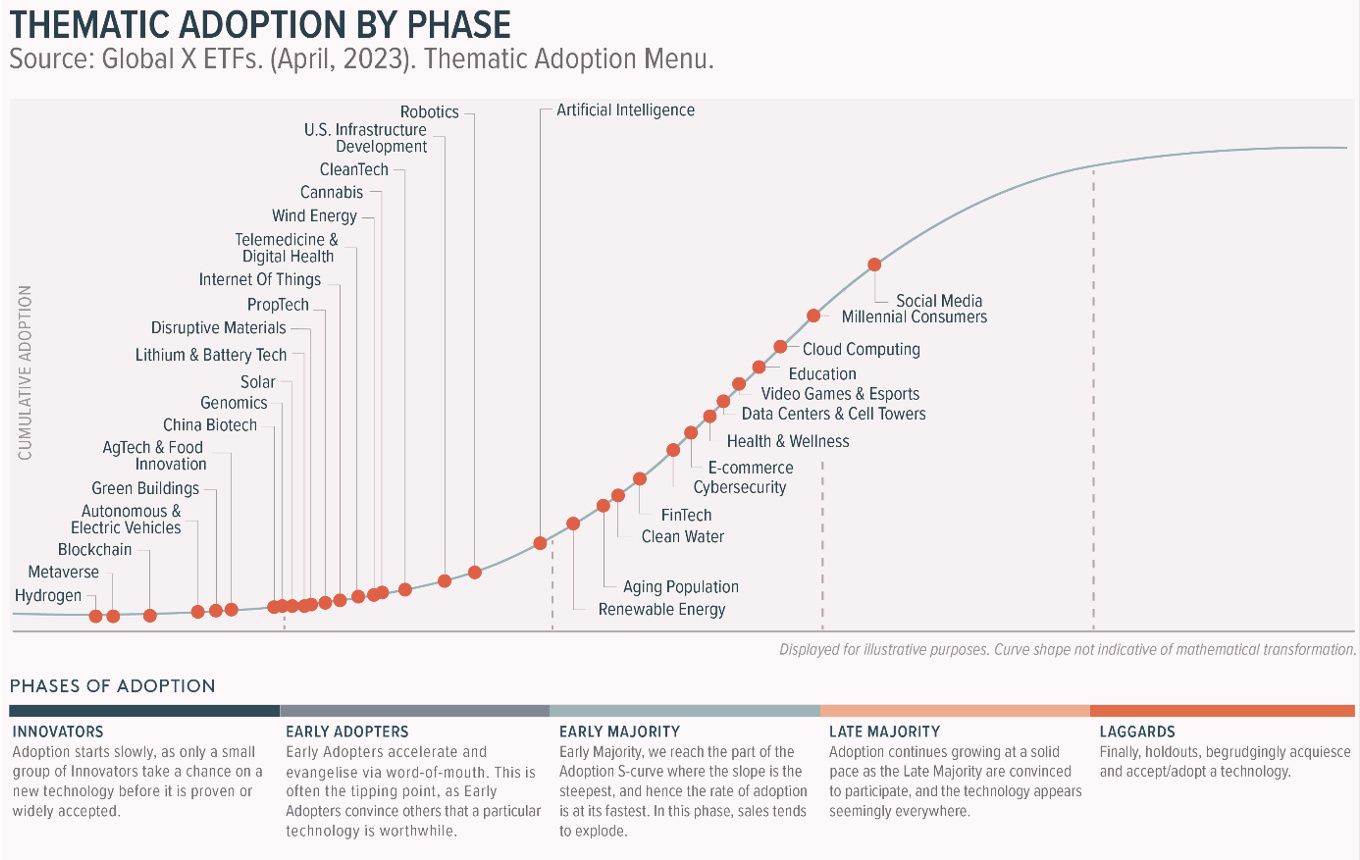

He says a good example is Meta which was part of the social media megatrend which is now at the late majority stage. Now it is concentrating on the metaverse, which is at the innovator stage.

“In an environment where interest rates are rising, growth companies would traditionally be impacted,” he says.

“But rates aren’t the only determinant for the performance of high quality companies like Amazon and Apple.”

Should Aussies have exposure to the NASDAQ?

Chugh says when you think about investing in the NASDAQ it is a positive for Australians because it offers diversity.

“Whilst listed in the US these are global companies and are not just reliant for the US for growth,” he says.

He says beyond the FAANGs, companies like Adobe, Netflix, Costco or other semiconductor chips companies such as AMD are generating revenue outside of the US including Asia, Europe, and emerging markets like India.

“These types of companies offer diversification beyond just the US which is what you’re looking for within portfolios,” he says.

Weighted average R&D as a percentage of sales

Chugh says the N100 is designed as a core building block within a portfolio. He says the Global X FANG+ ETF (ASX: FANG) can complement this building block by further tilting a portfolio towards the mega cap stocks of the US market.

“N100 is considered a more diversified investment given it holds a portfolio of 100 US-listed companies excluding financials and REITS whereas the FANG is a highly concentrated and equally weighted portfolio of 10 US-listed mega cap stocks,” he says.

Chugh says the Global X US 100 Index, which N100 tracks, returned 25.8% over one year and 44% YTD as of July 31, 2023.

He says the Global X FANG+ ETF returned 52% over 1 year and 81.6% YTD as of July 31, 2023.

Be wary of the bandwagon

Chugh says artificial intelligence (AI) has been the buzzword for 2023, with mentions of it up 77% in the latest US quarterly earnings season.

“But investors should be wary as some companies are jumping on the AI bandwagon,” he says.

“When wanting to invest in the AI megatrend, investors can take broad diversified approach by adopting ETFs like N100 or FANG or they can consider these thematic ETFs which offer angles which are not yet discussed as much in popular coverages.

“An example of one thematic ETF is semiconductor ETFs because chip and sensor companies offer a compelling hardware play on AI adoption as firms act as the connective tissue between the physical and digital worlds.”

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.