Hot Money Monday: Short squeeze could be a buying opportunity

Why a short squeeze could help investors profit from shorted stocks. Pic: Getty Images

- Pilbara Minerals tops ASX short-selling list

- Why buying shorted stocks could be a good idea

- Introducing Short Interest and the Short Squeeze

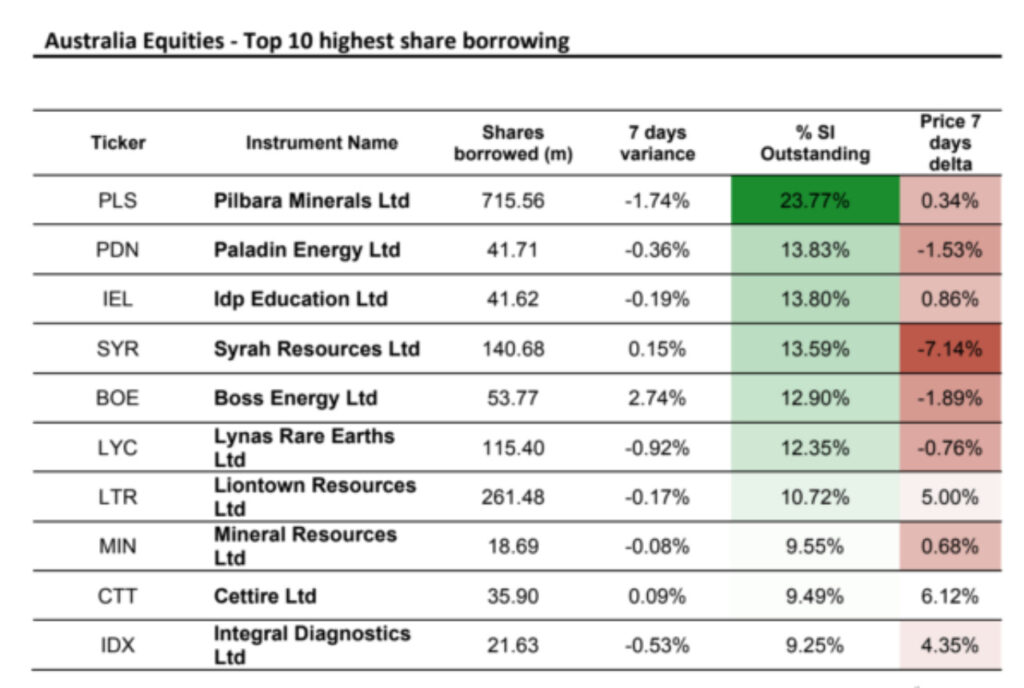

Last week, the S&P Global released its regular list of the Top 10 most shorted stocks in Australia, highlighting the stocks that investors are betting to fall.

S&P Global’s list of ASX’s most shorted stocks

Once again, Pilbara Minerals (ASX:PLS) has become the most shorted on the ASX.

Experts say the driving force behind PLS’ short interest is the pessimism around lithium prices, rather than any fundamental weakness within the company itself. Investors are essentially using Pilbara as a proxy for the lithium commodity.

Uranium miners like Paladin Energy (ASX:PDN) are also facing increasing short interest, as hedge funds target them following a drop in uranium prices.

The price of uranium dropped to US$76.56 per pound last week, falling from its 17-year peak of US$106 per pound in January.

Many experts, however, believe that uranium prices will rebound next year as global supply struggles to keep up with demand.

John Ciampaglia from Sprott Asset Management forecast it will rise to US$90-$100 by June 2025.

This, he said, will be driven by ongoing supply shortages, especially in the US, where uranium production is insufficient to meet the needs of big tech companies looking for reliable, clean energy sources.

What is short selling anyway?

Simplistically, shorting a stock is a way to make money if you think a stock’s price will fall.

Instead of buying the stock, you borrow shares from a broker and sell them. The idea is that you can buy the shares back later at a lower price, return them to the broker and pocket the difference.

It’s a common strategy for hedge funds but can be risky and complicated for individual investors.

You also have to pay a fee to borrow the shares, so experts are recommending against doing it at all cost.

But should investors buy heavily shorted stocks?

Typically, most believe that high short interest is seen as a bad sign, indicating that investors expect the stock to fall.

But there is a popular theory in the market called the Short Interest Theory.

The idea behind short interest theory is that when a stock is heavily shorted and its price begins to rise, short sellers may panic and rush to buy back shares to cover their positions, which can trigger a sharp, rapid increase in the stock’s price.

This buying activity can cause even more buying by other market participants, causing the stock price to go even higher, creating a momentum driven by what’s called a short squeeze.

In short, if enough people are buying a heavily shorted stock, it can drive the price up quickly and sharply, benefiting those who bought the stock early before the squeeze.

To identify these potential opportunities, smart investors often use what’s called the Short Interest Ratio (SIR), which compares the number of shares sold short to the stock’s average daily trading volume.

A high SIR means a stock is heavily shorted relative to its trading volume, suggesting that there could be more short covering (buying) if the price starts to rise, potentially leading to a big price jump.

Should you keep a shorted stock in your portfolio?

There have been many famous short squeezes in recent years.

For example, it happened to US stocks Tesla in 2020 and GameStop in 2021, where traders who had shorted the stock were forced to cover their positions, amplifying the price surge.

According to Simon Turner from Investment Markets, whenever a stock you own is as heavily shorted as Pilbara Minerals currently is, it’s worth asking yourself four simple questions.

The answers to these questions, Turner says, should tell you whether you should keep the stock or sell it:

- What was my investment horizon when I first invested in the stock?

- What was the rationale behind my investment when I bought the stock?

- Does the high short interest indicate a fundamental issue I’m not aware of, and does it impact my investment thesis?

- Do I still have confidence in the company’s management, assets, and strategy?

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decision.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.