Hot Money Monday: Expert says stick to 60:40 cushion and keep “dry powder” when the market tanks

Expert suggests 60:40 portfolio can weather market shocks. Pic: Getty Images

- Historical trends suggest stocks may thrive after Fed rate cuts

- But expert suggests 60:40 portfolio can weather market shocks

- Invest in bonds as markets soar, stick to the 60:40 strategy, says her advice

It’s often said the Fed Reserve takes the stairs up and the elevator down in an interest rate cycle – raising rates gradually while cutting them rapidly – but the current cycle has been the opposite.

From March 2022 to July 2023, rate hikes came quickly as policymakers responded to a sharp rise in inflation. But now, the process of unwinding them is expected to be much slower.

In fact, Friday night’s impressive September job numbers could even make it even slower.

US non-farm payrolls jumped by 254,000, far exceeding the 150,000 forecast. The unemployment rate fell to 4.1%, surprising many, and wages rose by 0.4% in September.

“On the face of this the Fed should be hiking rates with these sorts of figures, not cutting rates,” said a note from ING.

But cut they most likely will, and as the stock market surged to new all-time highs immediately post the Fed’s 50 basis point rates cut, the thrill of gains comes with an underlying question: how long can this rally last?

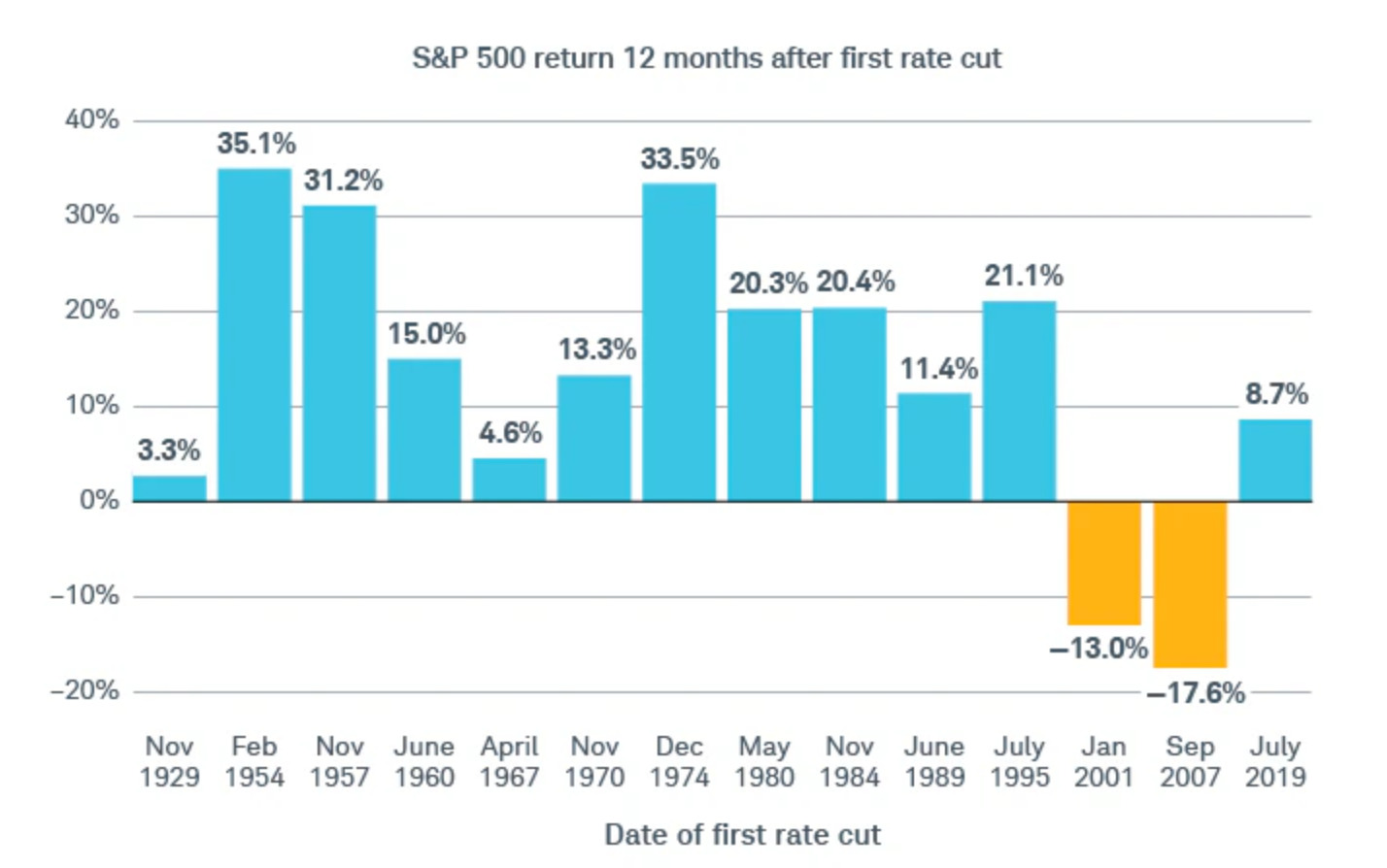

Historically speaking, the S&P 500 index sees gains for the next 12 months when the Fed cuts rates during a non-recessionary period.

Out of the 14 rate cycles since 1929, 12 resulted in positive S&P 500 returns within the 12 months after the first rate cut.

However, when the Fed cuts during a recession, the S&P 500 tends to drop by an average of 4% over the following 6 months.

“The linchpin to the whole thing is that the economy avoids recession,” said Michael Arone at State Street Global Advisors.

It’s worth noting, though, that recessions are typically called in hindsight by the National Bureau of Economic Research, and for now economists see little evidence that the US is currently experiencing one.

Greed takes wheel when markets rise

Gaby Rosenberg, co-founder at trading app Blossom, believes the cycle we’re in right now is historically good for investments.

However she said there are still some global uncertainties with the US election and geopolitical tensions, so investors still have reason to be a little bit cautious.

“It is also important to note that we are seeing stresses at the small and medium business level. With bankruptcies running at historically high levels, we could see this permeate into equity markets,” Rosenberg said.

She warns that fear and greed are the two forces that drive every market move.

When stocks are climbing, greed takes the wheel, tempting investors to chase the highs. But when the markets wobble, fear sets in, sending portfolios into a tailspin.

Markets may be flying high, but Rosenberg says that savvy investors know that markets are unpredictable, and bonds could offer a reliable cushion against sudden drops.

Stick to 60:40 portfolio

Rosenberg said the classic 60:40 portfolio—60% stocks, 40% bonds—has been a tried-and-true strategy for generations, offering a balance between growth and stability.

As markets surge and dips loom, this mix could help investors ride the highs while cushioning the lows.

Some experts believe the 60-40 investment strategy is no longer popular or even effective – with many now seeking greater growth potential and are willing to embrace volatility to achieve higher returns.

But Rosenberg believes the naysayers got that one wrong.

“No, it’s definitely not dead. The 60-40 strategy is designed to balance risk and returns appropriately,” she said.

“It ensures you’re never over-exposed to one side, and uses fixed income as a bit of a safety net for an investment portfolio.

“It can also be used as ‘dry-powder’ when the stock market may be suffering from a downturn.”

Bonds could outperform equities

As a recap, when rates decline, existing bonds with higher coupon rates become more appealing to investors, resulting in increased demand and subsequently elevating their market prices.

This dynamic highlights the basic inverse relationship between interest rates and bond prices.

In Australia, the RBA has kept interest rates on hold at 4.35% since November last year. Governor Michele Bullock has even stated that a “near-term” rate cut does not align with the board’s current perspective.

However, Rosenberg believes rate cuts globally are already predicted by many experts, and the market itself is anticipating around 5 rate cuts in Australia by this time next year.

“This will of course depend on the inflation rates and unemployment meeting the RBA’s targets in order to start cutting rates,” she said.

“The fixed income market, like that of property and equities, will potentially experience less volatility as the market becomes more certain on the RBA’s actions.

“During a market correction, we would typically expect to see investments in fixed income outperform equities.”

Now read: For the soundest sleep, Rosenberg reckons it’s gotta be bonds

The views, information, or opinions expressed in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.