Hot Money Monday: As sports-betting market consolidates, BlueBet and PointsBet could be ones to watch

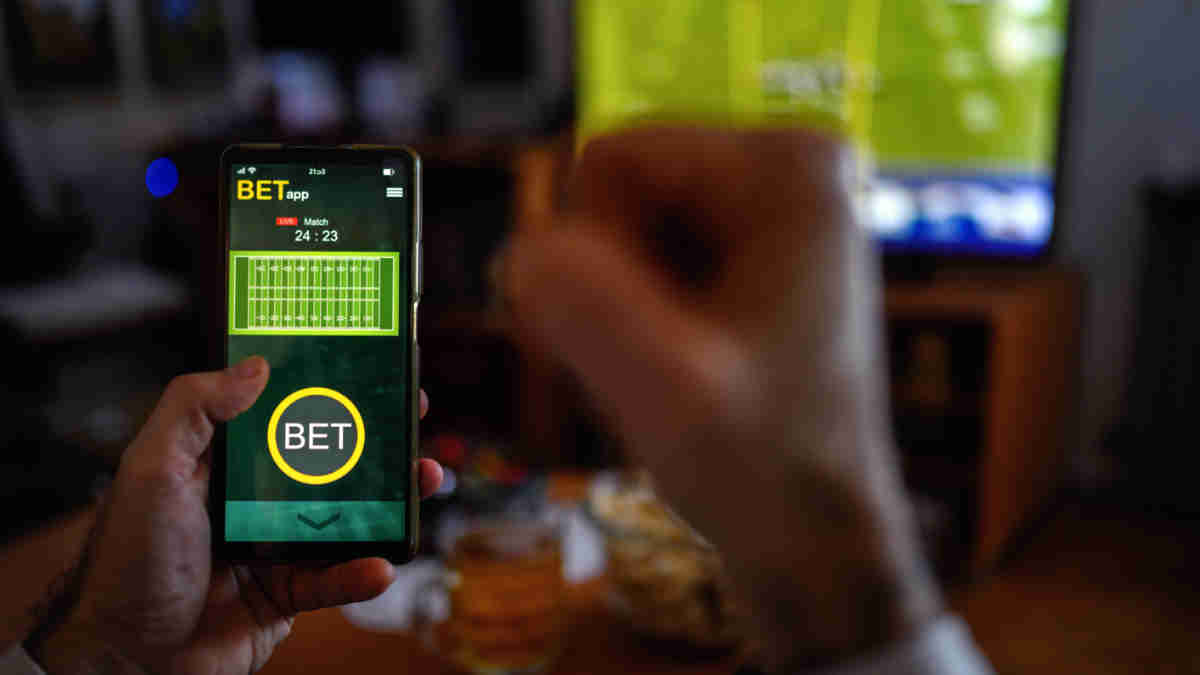

Asset manager Tamim tips Bluebet and Pointsbet to perform well. Picture via Getty Images

- Australia’s betting boom fuels market growth

- Tabcorp, Sportsbet dominate but consolidation looms

- Asset manager Tamim tips Bluebet and Pointsbet to perform well

The Melbourne Cup earlier this month showcased Australia’s love for betting, with more than $221 million wagered on the event.

The Australian gambling market is part of a $1.2 trillion global industry, with Aussies spending $25 billion annually.

“Australia has some of the highest per capita gambling losses globally,” said a note out of Tamim Asset Management, highlighting the sector’s continued growth despite strict regulations.

Sports betting, in particular, has grown significantly, with around $1 billion spent annually, even within the tightly regulated market.

Digital platforms, mobile apps and technology like data analytics and AI are shaping the future of gambling, according to Tamim, with in-play and mobile betting especially popular among younger Australians.

The sector is also seeing growth in esports, fantasy sports, and blockchain-based betting.

However, the industry faces challenges such as margin compression, rising regulatory costs and increased competition.

“Operators are adopting more efficient technology and focusing on customer retention,” Tamim explained.

Larger companies, like Tabcorp and Sportsbet, dominate the market, but consolidation could create opportunities for investors.

“Consolidation often leads to a more stable industry, where larger players have the scale to navigate regulatory challenges,” Tamim added.

Tamin’s two stock picks

Tamim has been closely analysing the Australian betting sector and has identified two smaller-capped stocks that show strong potential for growth in the evolving market.

Specifically, the asset manager has recommended Bluebet and PointsBet, noting they are well-positioned to benefit the most from the growth of sports betting and online platforms in Australia.

Bluebet (ASX:BBT)

BlueBet Holdings, a technology-driven online wagering operator, has seen significant growth following its merger with Betr.

“The merger with Betr has been a key move for BlueBet,” said Tamim, highlighting the efficient integration that strengthened its market position.

One of the major achievements was migrating Betr’s customer base onto BlueBet’s platform within just 59 days, which Tamim said was a “remarkable feat.

Following the merger, BlueBet has seen positive financial results, with a 100% increase in net win in September compared to last year.

“This momentum continued in October, with turnover and net win up by 120% and 140%, respectively,” Tamim noted.

A key part of BlueBet’s strategy is reactivating Betr’s customers with targeted marketing around major sporting events,

which has helped the company outperform expectations.

BlueBet has also increased its cost synergy target to $16.9 million, positioning the company for future profitability.

“With a solid cash position, the company is now focused on delivering profitability in the near term,” Tamim said, with full-year EBITDA positivity expected in FY25.

Looking ahead, BlueBet aims to capture a 10% market share in Australia, with expectations of $15-20 million in EBITDA for FY26.

“The integration of Betr and the resulting cost savings are paving the way for future profitability and organic growth,” Tamim concluded.

Pointsbet (ASX:PBH)

PointsBet, a wagering and iGaming company, has seen significant growth, especially in Australia and Canada.

In FY24, Australian revenue grew by 10%, with EBITDA rising to $26.8 million, up from just $0.1 million the previous year.

“The company’s Australian operations have been solid, with revenue increases driven by both racing and sports betting,” said Tamim, noting this marks the fifth consecutive year of positive EBITDA for its Australian business.

In Canada, PointsBet’s revenue increased by a massive 87%, with Ontario seeing particularly strong growth after the regulation of online sports betting.

“PointsBet’s success in Ontario is setting the stage for further growth as other provinces like Alberta and British Columbia are expected to regulate their markets,” Tamim added.

Technology, including PointsBet’s “Odds Factory” platform, has been a key factor in this expansion, alongside investments in data science and customer relationship management.

Looking ahead, PointsBet expects FY25 revenue to be between $280-$290 million, reflecting growth of 14-18%.

PointsBet is also on track to achieve EBITDA profitability and cash flow breakeven in FY25.

“The company is on track to generate $60 million in EBITDA in the coming years,” Tamim stated.

Additionally, media reports suggest PointsBet could be a potential acquisition target, with a merger with BlueBet potentially creating significant synergies and up to $30 million in cost savings.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.