GUY ROCKS ON: A base metal play that even the King himself finds compelling

Thank you. Thank you very much. Picture: Getty Images

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: Gold sets record highs

A positive finish as the PDAC mining conference in Toronto drew to a close with gold now up USD$141/ounce to a new high of USD$2,176/ounce (figure 1) as Fed officials and chairman Powell believe that inflation levels support a June rate cut.

Last week’s disappointing US jobs report showed nonfarm payroll employment rose by 275,000 in February this year with the unemployment rate increasing to 3.9%.

US January employment numbers were also revised down. Powell however stated that he needed to see more supportive data that points towards achieving the target rate of 2% before it commences interest rate cuts.

Central bank buying also helped underpin gold last week with the positive momentum also filtering down to platinum and palladium. Platinum finished the week up 2.5% to close at US$908/ounce and palladium was up 7% to US$1,006/ounce, representing a high since early January this year.

The CME’s FedWatch tool suggests that the probability that the Federal Reserve will maintain its current interest rate in March is 97%, and 70.5% in May. The probability of the first rate cut in June is exceedingly high at 71.5%.

US Treasury yields moved lower, taking the yield on the benchmark 10-year note to 4.07%. The USD was trading around 103.20.

The market will be watching next week’s inflation data relative to the CPI which comes out on 12 March. Morningstar believe that this is likely to show inflation heating up and are projecting 0.40% growth compared to January’s figure of 0.30%.

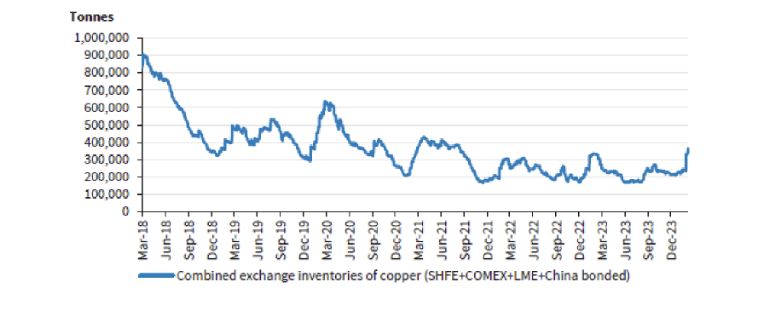

Copper futures (figure 2) have breached five-week highs of US$3.88/lb driven by increased demand from China and indications of interest rate cuts in the US. In China unwrought copper imports increased by 2.6% in the first two months of 2024 as well as a 0.6% increase in copper concentrate imports.

While the property sector remains weak, copper producers are looking to ramp up production in response to EV and renewable demand.

The National People’s Congress recently set a GDP target of 5% for this year which appears high relative to last year’s figures however Bloomberg noted that spending on activities likely to boost raw materials prices will be fairly modest.

Barclays (March 2024) noted that close to record high copper cash-2M spreads on the LME earlier this month were resulting in increased volumes into both Shanghai, Comex and LME and China bonded warehouses (over 60% year to date) resulting in a depressed front end of the curve despite more bullish long-term sentiment.

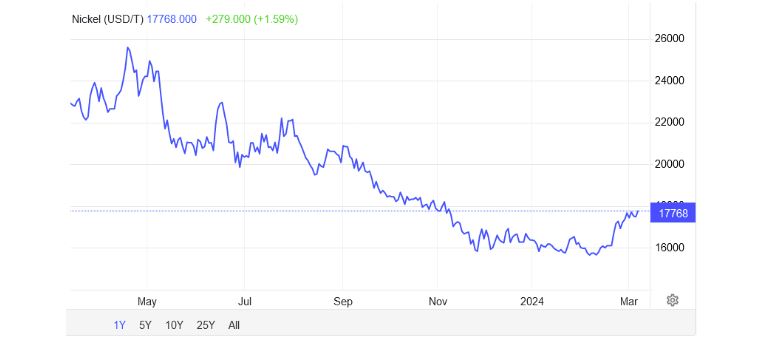

LME has hosed down speculation that the market for “Green Nickel Futures” would be large enough to create a viable market with no plans to change the brand specifications for the LME nickel contract or list a parallel LME contract.

On the spot market, nickel (figure 4) breached four-month highs last week and is now trading just over US$17,700/tonne in response to concerns about tightness in the supply of nickel ore since the recent Indonesian presidential election.

According to Fastmarkets, market participants continue to report low rates of approval for 2024 nickel ore mining quotas with only 10% of more than 350 quotas approved in 2024.

Difficulties in buying nickel ores have been reported by various market participants, with Indonesian NPI producers claiming that they only have sufficient stocks to maintain production until the end of March, with no meaningful inflows for now. This has created fears of NPI supply disruptions in Indonesia, pushing up the prices.

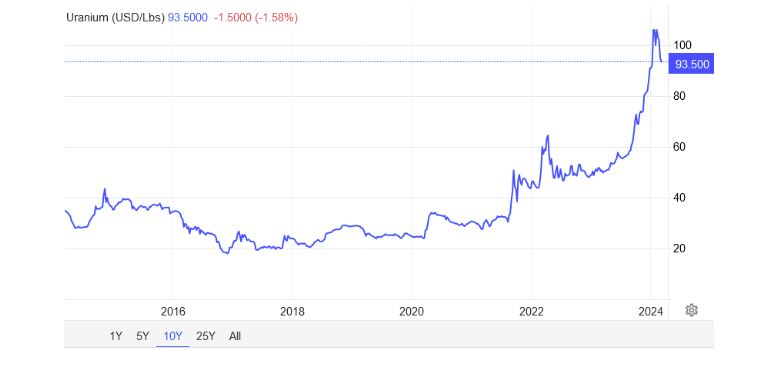

Uranium prices are trading just above US$93.5/lb after the US government stopped short of banning Russian imports of nuclear fuel in the most recent sanctions package.

According to Trading Economics (March 2024) there is a hearing on banning Russian imports expected in the coming weeks.

Kazatomprom, in its latest forward-looking statements, has projected a 13% decline in output while Cameco also downgraded production forecasts.

The US and 20 other countries announced that their nuclear power will be tripled by 2050. This includes China which is building 22 of 58 global reactors.

If this doesn’t give uranium a shot in the arm nothing will.

New Ideas – If I can Dream

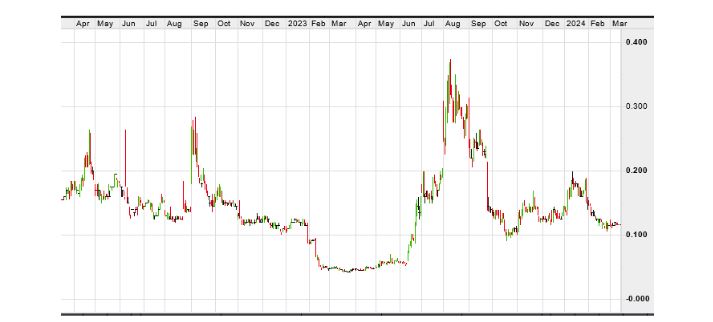

American West Metals (ASX:AW1) (figure 6) has featured a couple of times in this column as an emerging copper explorer with district scale potential at their 80% owned Storm Project in Nunavut, northern Canada (figure 7).

The Stockhead faithful have done well out of this spiking from just under 5 cents prior to the 2023 field season last year to 37 cents in August 2023.

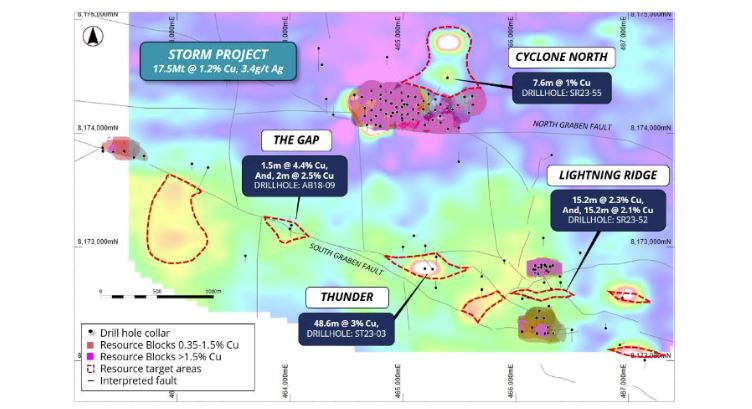

The company didn’t disappoint with an impressive maiden MRE of 17.5Mt @ 1.2% Cu (figure 8) that was reported earlier this year. The 2024 field season has been supersized from 10,000 metres of RC/Diamond to around 20,000 metres+ so I am optimistic of a significant resource upgrade and regional exploration success.

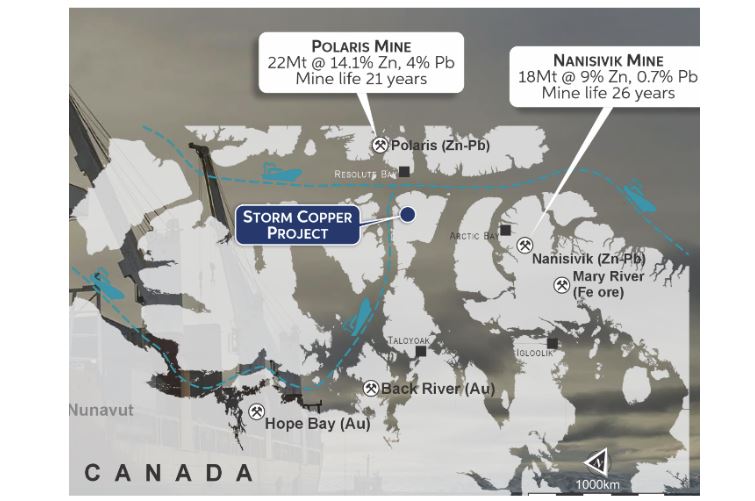

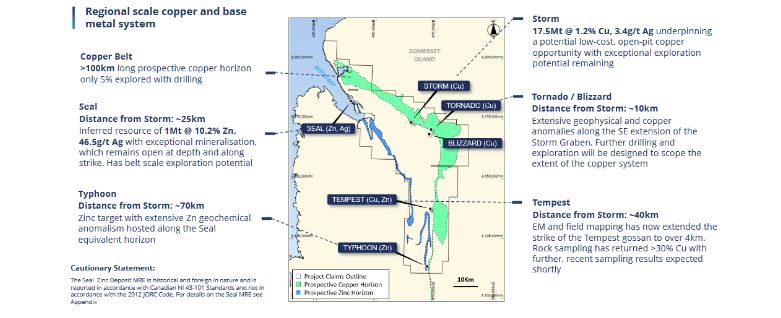

Prospective base metal horizons strike for over 100km at Storm (figure 8). What will transform this project to a district scale play will be, among other things, exploration success at Blizzard/Tornado (10km southeast of Storm) and Tempest (around 40km southeast of Storm). This region also has good provenance for delivering high grade base metal mines (figure 9) such as Polaris and Nanisivik.

Mineralisation remains open at Storm with a number of the 2023 copper discoveries at Thunder, Lightning Ridge and Cyclone North yet been included in the MRE.

Furthermore only 5% of the 100km of prospective strike (figure 10) has so far been explored so there is definitely potential to find resources that rival giant deposits found in the Zambian Copper belt in terms of both scale and grade if exploration pans out the way I think it will.

Also worth noting is the excellent logistics and access as well as the 100% success rate from the 2023 field season from the follow up of EM anomalies which all returned copper sulphides.

Cashed up after a recent $10.0m capital raising earlier this year (managed by the gang of three, namely RM Capital, Ord Minnet and Bell Potter), and at an undiluted market capitalisation of just under $58 million (based on an 11.5 cent share price), AW1 represents one of the most compelling base metal plays listed on ASX and TSX-V for that matter.

After all, a reliable source informed me that Elvis took time out of his busy schedule last year for an impromptu site visit where he did a brilliant acoustic version of If I Can Dream.

Now that’s good karma.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.