Guy on Rocks: With momentum behind Euro gas plays, this ASX small cap could be caught up in the rush

Pic: Via Getty

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: Gold sentiment improves

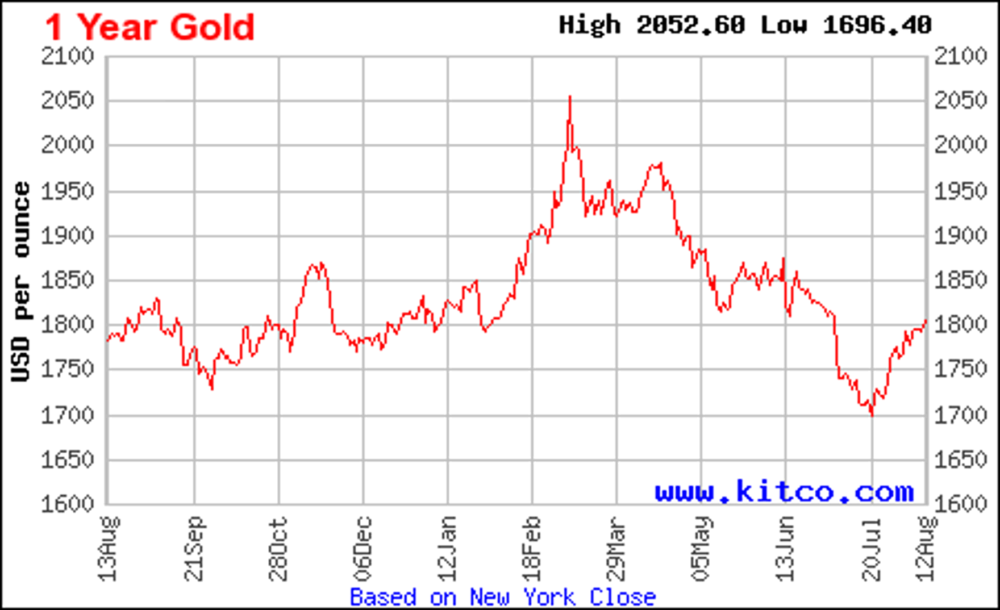

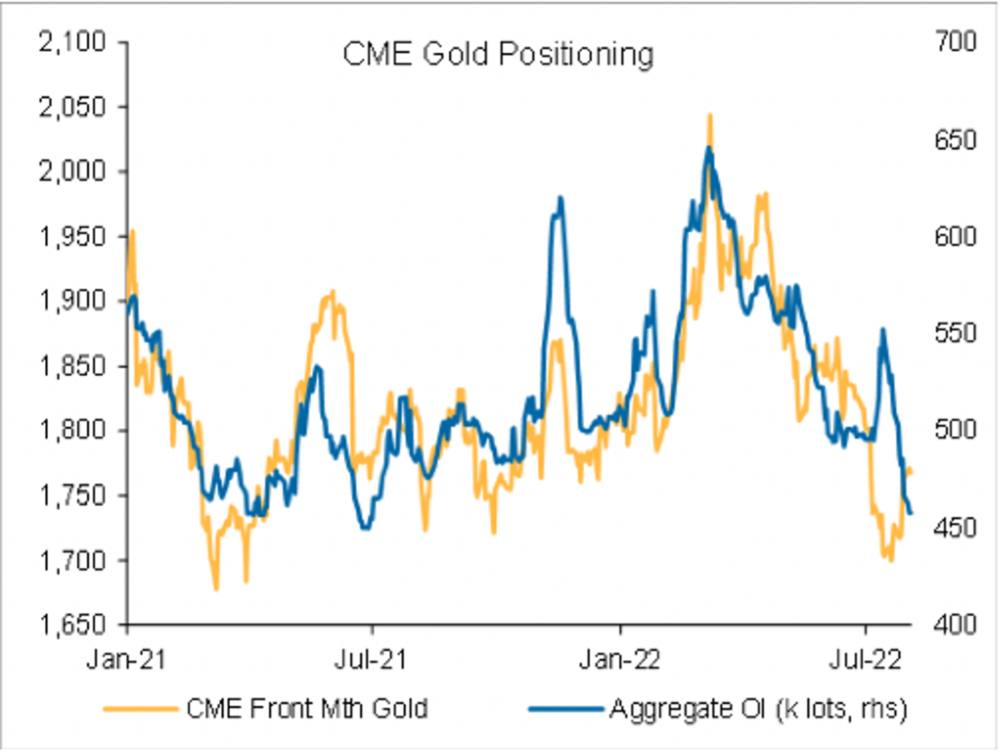

Gold appears to have staged something of a comeback and is holding above US$1,800/oz (figure 1) with investor positioning (figure 2) looking weak at the end of July resulting in a short-covering rally.

Geopolitical tensions (Taiwan-China) also spurred on gold prices.

The US dollar dropped over 90 basis points last week with commodities improving across the board, a trend we have seen all year. July represented the heaviest wave of physical ETF net redemptions since March 2021. This is likely to slow or reverse this month.

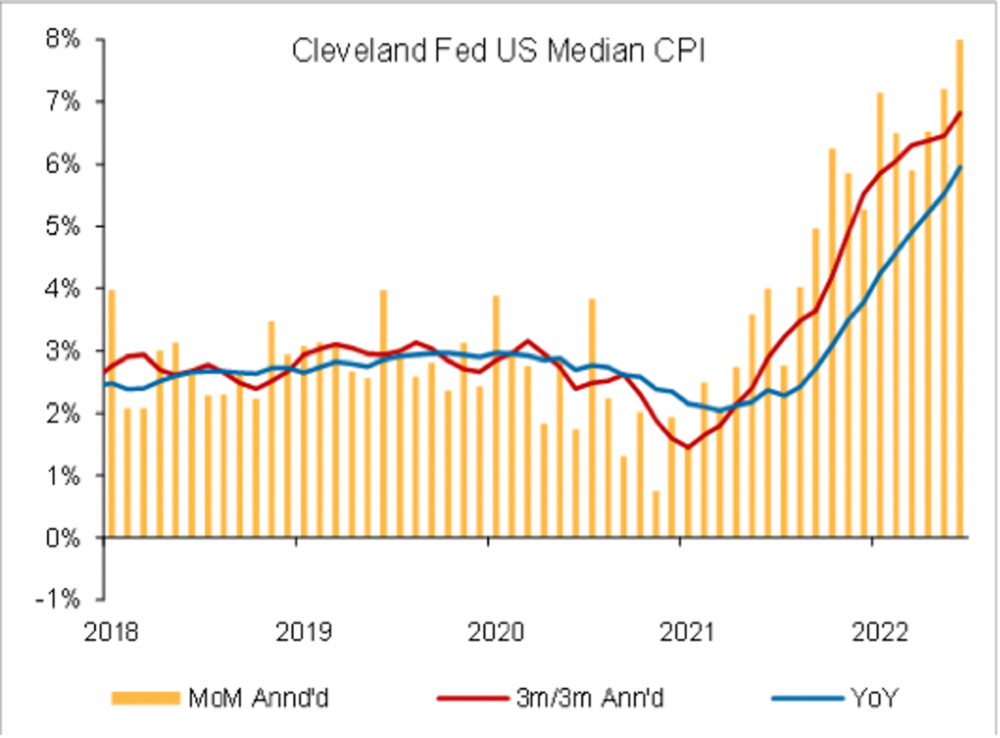

Inflation remains at 40-year highs (figure 3) despite a consensus among many analysts that inflation has peaked.

According to Mercenary Geologist Mickey Fulp, inflation remains at over 17% if you apply 1980s calculation methodologies. The Argentinian punters must be having a laugh given the central bank recently raised its forecast to over 90% in CY 2022.

No doubt the Stockhead faithful are on top of things and well realise that they will need to be targeting returns in excess of 15-20% if you really want to stay ahead of inflation.

That should be a walk in the park if you read this column and are quick on your feet. With record government stimulus and rampant inflation, I can’t help thinking that the broader market is setting up for another fall.

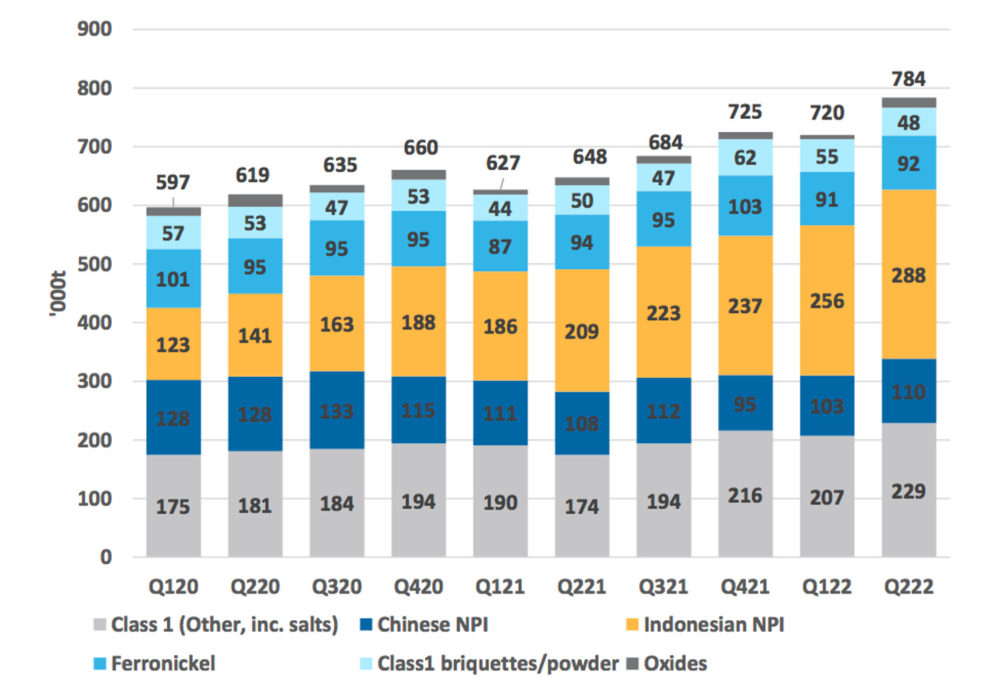

While supplies of copper and zinc look tight, nickel production appears to be growing around 21% YoY to 784kt Ni per annum according to Macquarie Research (August 2022), bringing first half production to 1.504mt, up 18% YoY.

The increase is primarily due to an increase in Indonesian nickel (laterite) production with nickel pig iron production rising 38% YoY and all processed nickel units (including intermediates) increasing by 50% YoY in 1H22 to just under 660t.

Production increases in Indonesia are likely to offset production shortfalls by BHP and Vale.

63% of global nickel production consisted of ferronickel and nickel pig iron, non-LME deliverable products and products used almost exclusively to make stainless steel.

The majority of Indonesian nickel production will be processed into nickel sulphate in China in the process displacing class 1 nickel briquettes and powder.

New idea: North sea offshore gas development opportunity

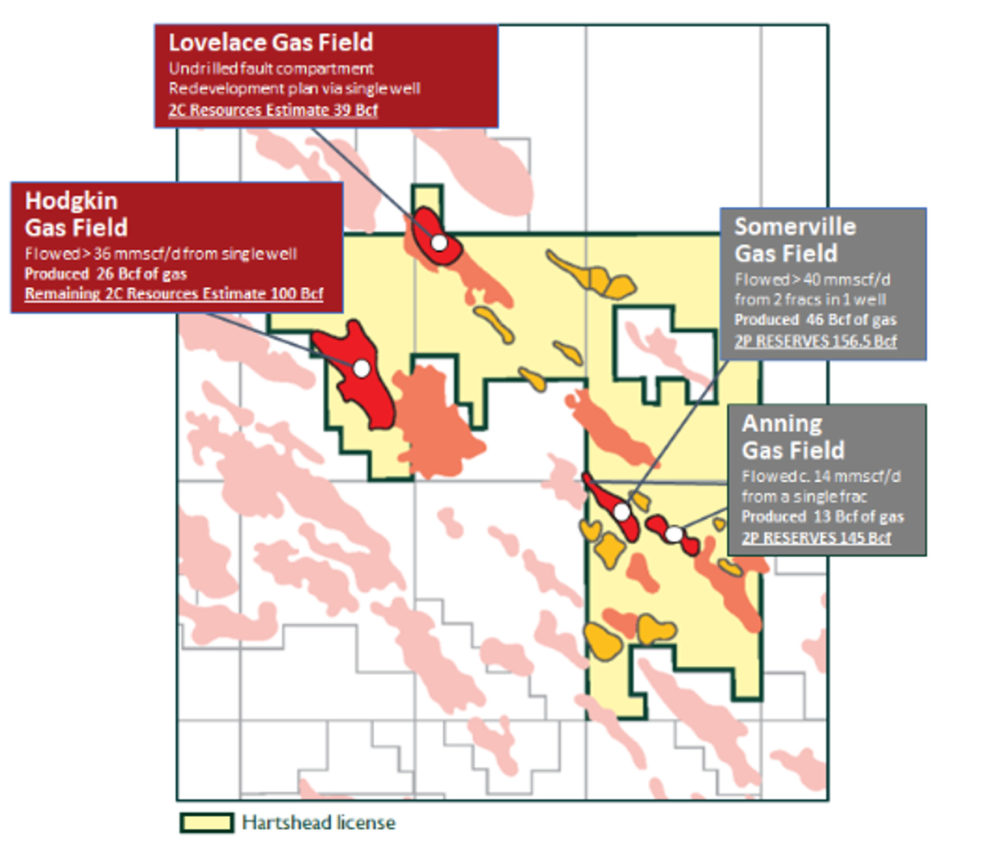

Hartshead Resources (ASX:HHR) is starting to receive some market attention (figure 5) as it moves into the development phase of its 100% owned P2607 licence that comprises five blocks in Quads 48 and 49 on the United Kingdom Continental Shelf, in the Southern Gas Basin (figure 6).

The licence contains multiple gas fields with a combined 2 P Reserve of around 52 MBOE (table 1).

Work on the Phase I (of three phases) development has commenced with the submission of a Concept Select Report (CSR) to the North Sea Transition Authority (NSTA) in May 2022.

The company will look to complete the Front-End Engineering & Design (FEED) stage and define the gas export route over 2022/2023 ahead of a Final Investment Decision (FID) in 2023 with first gas sale in late 2024.

The company is in discussions with a number of potential development partners and infrastructure owners regarding gas transportation and export routes.

Auctus Advisers believes production will peak at around 140mmcf/d. The Auctus research report (on the company website) also considers that the likely valuation of the farm-out transaction between IOG and CalEnergy in 2019 suggests that the market could pay A$0.20-$0.30/sh for the HHR portfolio.

The Auctus valuation assumes a US$100 mm farm-out and 75% chance of field development giving a $0.14 valuation rising to $0.20 assuming the phase II development proceeds.

The company is likely to require further funding in the next 6-9 months, however there is significant momentum behind European gas plays with plenty of government incentives to reduce dependency on Russian gas.

Pre-production I think 5-10 cents is likely next calendar year so picking around 3 cents looks like reasonable value.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.