Guy on Rocks: West African gold is looking hot again

Getty Images

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week.

Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market ructions

This week has really shone a light on just how well China is doing post-COVID-19.

“On the macro front it looks like a fairly strong recovery from China, probably a bit stronger than anticipated,” Guy Le Page told Stockhead.

“We’ve got a reported GDP growth in the second half of about 3.2 per cent year on year compared to minus 6.8 per cent in the first quarter. I think the consensus is about 2.4 per cent.

“This is really driven by construction and ramping back of production. Of the gross numbers a lot of that was driven by industrial production.

“The forecast for the second half is about 4.8 per cent versus about 4.4 per cent in May.”

Le Page says the performance of manufacturing index (PMI) figures are improving, inflation is picking up and the property market is strengthening.

The PMI measures changes in activity levels across China’s manufacturing sector from one month to the next. Anything above 50 signals that activity levels are improving while a reading below suggests they’re deteriorating.

“I think overall the Chinese story is looking pretty strong, which is obviously helping the iron ore price,” Le Page said.

“Steel consumption in June was up almost 11 per cent year on year. So there seems to be general upward movement there. Crude steel was up about 4.5 per cent in June. Overall that seems to be moving in the right direction.”

Gold also continues strongly as “ETFs have continued buying gold at a never-ending rate”, according to Le Page.

Spot gold is very quickly getting closer to the +$US1900 an ounce mark it broke through in 2011, now trading at around $US1888 ($2658) an ounce.

“As long as bond yields stay where they are and interest rates are low, I think there’s incentive to buy gold, and obviously we’ve seen the US dollar weakening quite considerably and the Australian dollar moving up,” Le Page explained.

“So I think the rising Australian dollar and rising iron ore and gold is just a trend that’s there for a while at this point.”

Global debt, however, is also reaching new heights – a trend Le Page also expects to continue.

“I think global debt is looking at about 250 per cent of GDP this year. It was about 222 per cent last year,” he said.

Hot stocks to watch

On the company front, as Le Page has mentioned a number of times previously, it is getting harder to find good value gold plays.

But with the excitement around West African gold again picking up and investor cash starting to flow into the region, Le Page has locked onto Chesser Resources (ASX:CHZ) as a stock to watch.

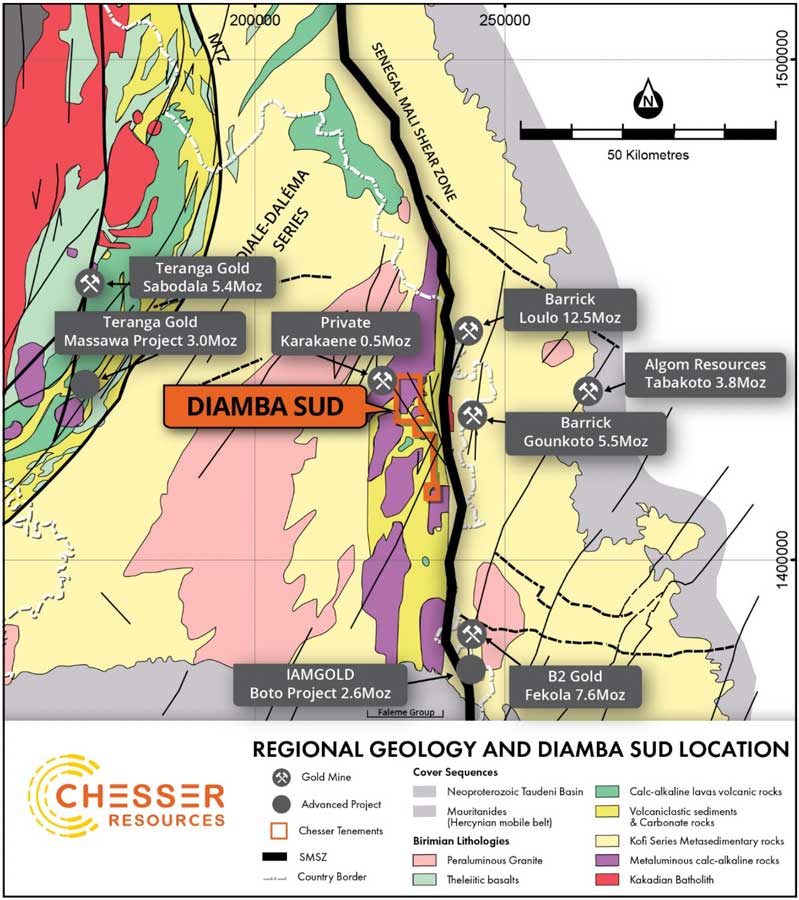

Chesser is pursuing a multi-million-ounce find at its flagship Diamba Sud gold project in Senegal.

The company is currently waiting on the remaining results of its 4,000m phase-four reverse circulation drilling program at the ‘Area A’ trend within Diamba Sud in the prolific Senegal-Mali Shear Zone.

Diamba Sud sits not far from Barrick Gold’s 5.5-million-ounce Gounkoto mine and just south of the 500,000oz privately owned Karakaene mine.

“There’s about 45 million ounces in Senegal,” Le Page said.

Drilling at Diamba Sud is starting to “deliver some pretty high-grade results”, Le Page said.

“You tend to get bigger gold anomalies, high-grade gold anomalies, in that part of the world. Not all of them come in, but in the last phase of RC [reverse circulation] drilling they’re getting results of 21m at 6 grams and 16m at 8 grams.”

Chesser just banked $6m from a strongly supported share placement to accelerate drilling in Senegal.

“The Birimian, which is the same sequence that Tribune is targeting at its Ghana project, is proving a prolific host of gold in West Africa,” Le Page noted.

“We’re going to see a lot more money poured into that, especially as the Australian dollar comes up and then the Canadian market seems to be following six months behind us.

“Once the Canadian money floods in there it’s really going to get moving. I think the chance of [Chesser] finding a million-ounce deposit looks pretty good.”

>>NOW LISTEN TO: Rock Yarns: Chesser is primed for West African gold rush success

Chesser Resources (ASX:CHZ) share price

Another stock on Le Page’s radar is Traka Resources (ASX:TKL), which this week secured the gold rights over Galaxy Resources’ (ASX:GXY) Mt Cattlin lithium and tantalum project.

Traka basically swapped its 20 per cent free-carried interest in the lithium rights for 100 per cent of the gold rights at the Mt Cattlin North tenements.

The ground had a long history of gold mining and exploration, with 18 separate small-scale mines that extracted a reported 23,006 tonnes of ore grading 24.56 grams per tonne gold.

Le Page says the Mt Cattlin North tenements, which are near aspiring producer ACH Minerals’ Ravensthorpe gold project, look like pretty good potential for 200,000 to 300,000 ounces of open pittable gold, which could supplement ACH’s underground operation.

“That is looking to produce about 350,000oz over 5.5 years, so about 60,000oz a year on average,” Le Page said.

“Total capex around $85m. The only criticism of that project was that it was a bit short on mine life. So I think Traka’s ground could add three to four years of mine life at least to that project and provide a blend of oxide open pittable blend to their underground operation.”

That news saw Traka advance over 400 per cent this week and hit a new 52-week high of 5.3c.

“I think that Mt Cattlin gold project is an absolute cracker looking at the grades they had,” Le Page said.

“They’ve got an EV of about $13-14m, so not necessarily cheap, but certainly strategically located next to that Ravensthorpe gold project.”

Le Page says there may be a bit of a selloff in Traka over the next few trading days, with day traders having rushed in there straight after the news, but “I think as you see the stock settle back that might be the time to re-enter”.

Traka Resources (ASX:TKL) share price

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada and the United States.

At Stockhead, we tell it like it is. While Chesser Resources is a Stockhead advertiser, it did not sponsor this article.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.