Guy on Rocks: Uranium boom in ’24? We’ll smoke to that…

Picture: Getty Images

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions

10-year treasuries took a dive along with the US dollar with the DXY closing last week at 102.6, down 1.3% on the week falling further to 101.8 by early afternoon trading on Friday.

US 10-year treasuries were soft dropping 39 basis points to 3.92% and falling further to 3.85% mid-week with volatility remining very low with the VIX at 12.3.

Precious metals responded with gold climbing just under 3% to US$2,049/ounce by late this week with silver putting on 3.5% to close at US$23.81 3.5%. Platinum was up 2.4% to US$940/ounce and palladium, after Russia threatened to withdraw supply, put on a whopping US$233 to close at US$1,162/ounce up 25% last week (figure 1), moving higher later in Friday trading to US$1,220/ounce.

On the back of the bullish Federal Reserve comments last week, copper was up 4 cents to US$3.89/lb with a very large 5 cent contango for three month futures.

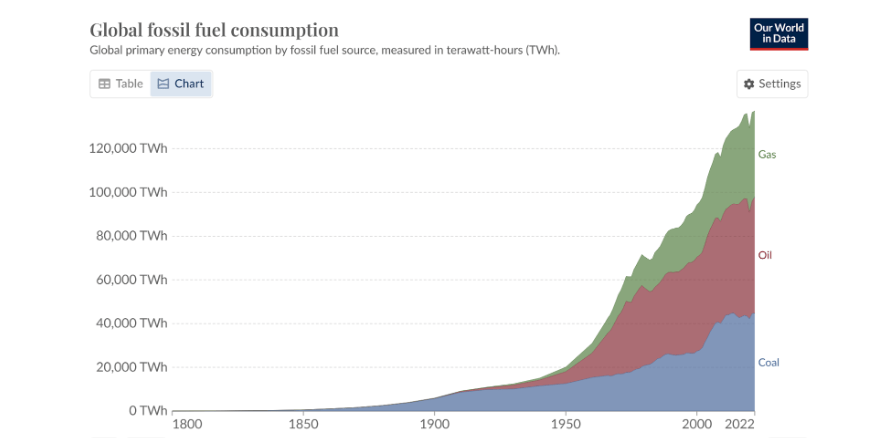

COP28 wrapped up last week which saw the luminaries commit to a tripling of renewable energy capacity and doubling the rate of energy efficiency. The agreement contemplates transitioning away from fossil fuels.

I am not sure what the punters were smoking at COP28 but clearly they haven’t seen the charts on fossil fuels (figure 3) which show a rapidly increasing consumption of fossil fuels, accelerating as we transition to renewable energy.

Given China is putting on more coal-fired power stations (to make batteries of course) and the majority of inputs to EVs use fossil fuels as the primary energy source (because renewable energy is too expensive), then I see no reason for the trend of increasing fossil fuel consumption to change.

Other notable (aspirational) statements from COP28 included a plan to adopt more zero-emission commercial vehicles, reduce cooling emissions and the implementation of new green shipping corridors.

I have no doubt that OPEC has it right, projecting 2024 will be a bullish year for oil with a 2% year-on-year increase in consumption.

The only sensible (and sustainable) outcome from COP28 was the commitment to increase nuclear power capacity which the IAEA believes will grow from 9% to 25% from 2022 to 2030.

If this takes place, then there should be some sort of reduction in fossil fuel consumption, but I have my doubts. Coal would also likely be a casualty however this assumes nuclear power targets could be met.

WTI was up 0.6% last week to close at US$71.62/BBL before edging up to US$74/BBL later in the week. US Inventories were down over 4MBBLS, imports steady at 6.5MBOPD, domestic production at a record 13.3m BOPD and refineries remained flat at 16MBOPD.

Angola’s departure from OPEC last week leaves only 12 nations left as it rejected calls to reduce output.

According to Morgan Stanley (22/12/2023) EV sales in China grew by 14% YoY to ~702,000 units and rose ~6% MoM following month-end sales by automakers. Morgan Stanley believes the medium-term outlook looks subdued with MSe China Autos projecting 2023 BEV sales of 5.65mn units.

That, combined with elevated battery inventory levels and increasing African lithium supply, should see lithium carbonate prices remaining depressed at 1Q2024: US$13.5/t, 2Q2024: US $12.5k/t (spot: ~US$12k/t).

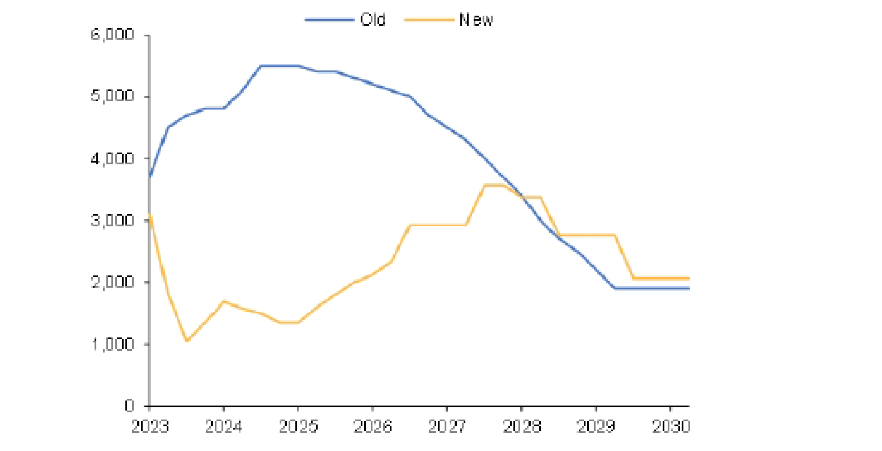

Macquarie (21/12/2023) have also lowered their spodumene prices by 61-74% in CY2024-2026, by 2-37% in CY2027-2028, and increasing by 9-19% in CY2029-2030 (figure 4).

The current depressed prices are clearly taking a toll on domestic producers with Core Lithium (ASX:CXO) suspending operations at its Finnis Lithium Project in the Northern Territory blaming soft spodumene prices. The shares were down over 20% late last week.

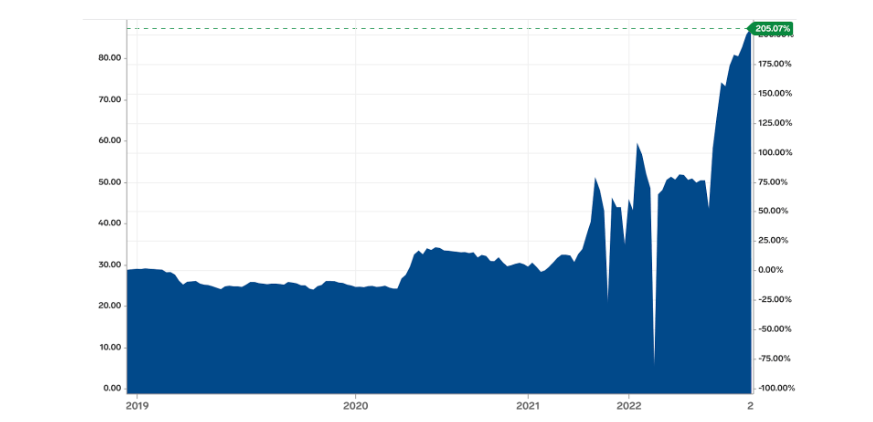

Uranium (figure 5) took a big jump last week on the back of COP 28 closing at US$86/lb for a 5% gain. Uranium is up 8 of the last 9 weeks and over 70% year to date. The US remains heavily dependent on Russian Uranium (controlling 40% of enriched uranium) and no doubt US domestic policy is likely to remain favourable for uranium explorers and developers.

I have no doubt, and the Cigar Social Climate Change Sceptic Committee (CSCCSC) is right behind me on this one, that we are in for a uranium boom like no other. I just thought I should share a photo of the CSCCCS smoking some zero emission Cuban cigars just after our COP29 meeting where we resolved to raise funds for water-laden rockets to the sun as part of the war on climate change (figure 6).

The basis for this resolution was that dumping water on the sun would have more impact on global warming than the developed world’s current energy policies.

Chairman Jeff Balfe can be seen on the far left being overseen by Wendy Rhoades (Maggie Siff) from Billions.

New Ideas

I will wait for the cigar smoke to clear and the scotch to run out before rolling out the next chestnut to the Stockhead Faithful.

I thought however I would recap on the performance of ASX listed uranium explorers and developers this calendar year which showed a 63% weighted increase without much fanfare (table 1).

I anticipate this list will expand significantly next year as Australian resource companies branch out into jurisdictions such as Canada, the US and Namibia. As U threatens to break US$100/lb, this could make for a wild ride in 2024. Enjoy the break and I will see you around like a rissole next year…

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.