Guy on Rocks: This high grade copper play won’t disappoint

pic: Bloomberg Creative, Via Getty Images

- Sell down in local gold stocks such as Northern Star Resources, Evolution Mining and a number of quality junior plays a little overdone

- Copper closed down 375 points at US$3.30/lb, representing a nine-week low

- American West Metals a compelling copper play; “near certainty of delivering more eye-watering drilling results”

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: Global economy is sick, says Dr Copper

It was more of the same this week with gold not far off 2.5-year lows and silver at two-week lows with rising government bond yields and a very strong US dollar index (which hit 114.1 on Monday) forcing precious metals lower.

Gold staged something of a comeback after testing US$1,600/oz and closed at US$1,639/oz in Australian trading on Tuesday, up US$14/oz for the day.

The gold index peaked at around 9,900 in July last year and has since retreated over 56% and is nearing a five-year low (figure 1).

At A$2,518 the gold price has held up well in the local currency, so I think the sell down in stocks such as Northern Star Resources (ASX:NST) and Evolution Mining (ASX:EVN) and a number of quality junior plays has been a little overdone (figures 2 and 3).

Not surprisingly gold ETF outflows have been gathering pace with holdings approaching two-year lows.

ETF outflows totalled 51 tonnes (US$2.9bn, 1.4%) in August, representing the fourth consecutive month of outflows. Year to date global inflows are 102 tonnes (US$7.5bn), with total holdings at 3,651 tonnes (US$202bn), up 3.6% this calendar year.

The LME has some difficult decisions to make as it contemplates the delisting of Russian metals or alternatively risks becoming the market for and price maker of Russian metal. There is a real chance that the LME could end up with large stockpiles of Russian metal as surpluses grow.

Meanwhile there is turmoil in global bond markets as the UK is planning to sell more government bonds in to shore up government coffers with the British pound now under some serious pressure, passing through a record low in 1984 at US$1.04 to the USD. Meanwhile 10-year Treasury notes have spiked to 3.771% and the 2-year Treasury note to 4.74%.

Oil hasn’t escaped either and hit a seven-month low earlier this week at US$78.00/BBL.

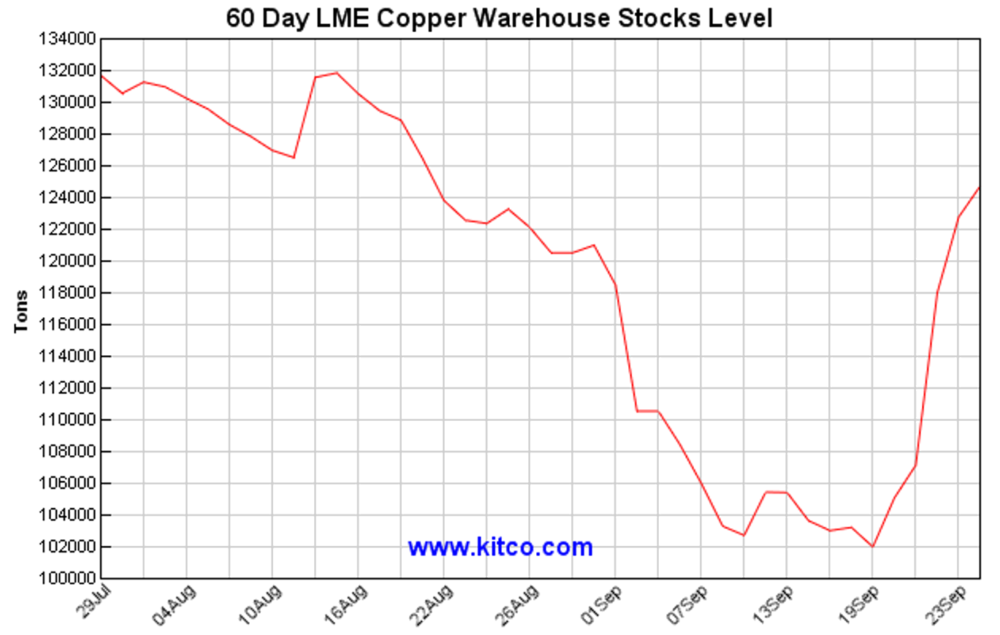

Copper closed down 375 points at US$3.30/lb (Figure 3) representing a nine-week low as fears of a global slowdown, weaker demand, a higher dollar and climbing stocks (figure 4) on London Metals Exchange (LME) registered warehouses sparked a sell-off.

Comments from the likes of John Hathaway at Sprott Asset Management, who believes we are heading towards a “recession that we don’t recover from for a couple of years,” hasn’t helped sentiment.

LME copper stocks reached 129,000 tonnes, up more than 25% since mid-September, while cancelled warrants – metal earmarked for delivery – are around 7% compared with 50% in late August.

New ideas: This high grade copper play won’t disappoint

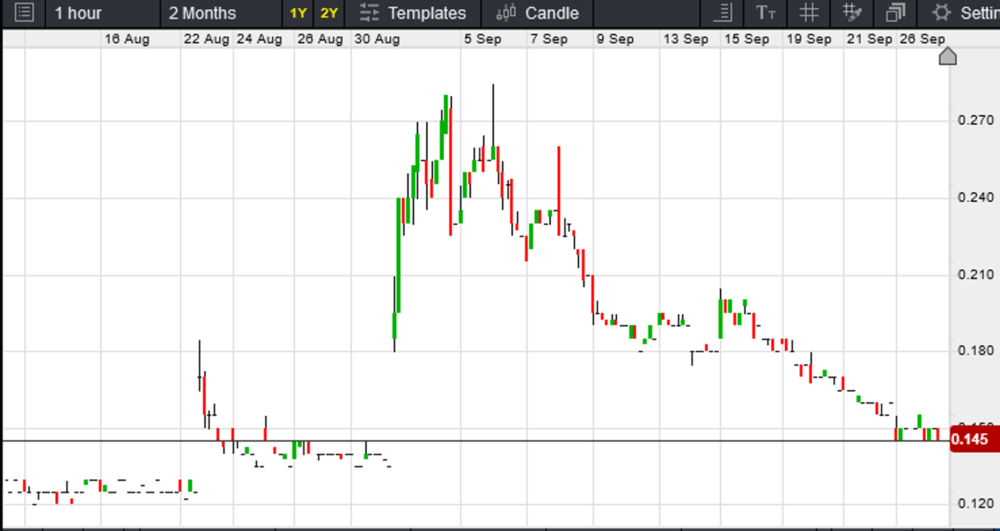

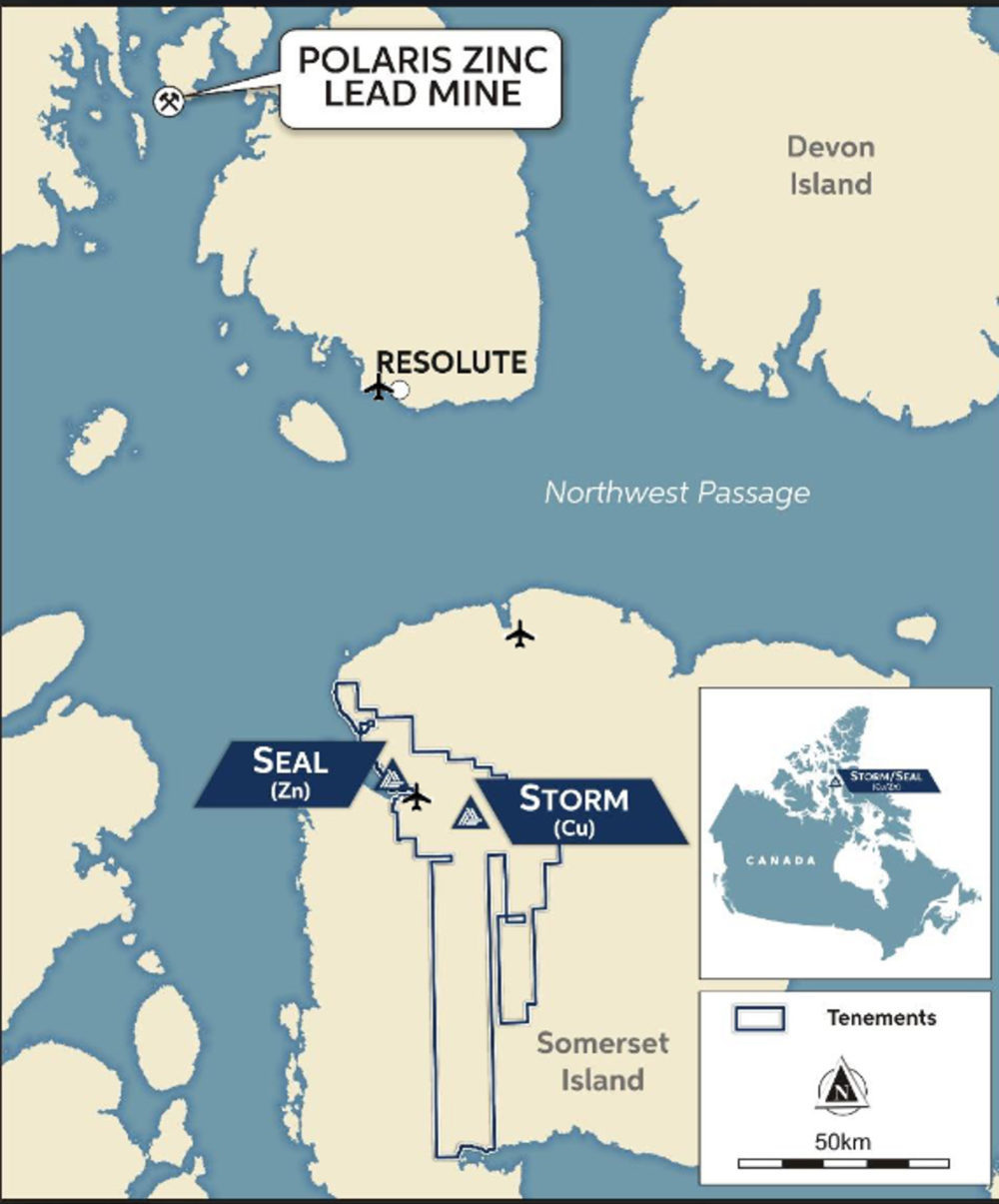

American West Metals (ASX:AW1) has had a rollercoaster ride in its brief trading history on ASX (figure 5) and looking at the high-grade copper results from its Storm/Seal Project in Northern Canada, this is surely set to continue.

The company is led by geologist and managing director Dave O’Neil and listed in December 2021.

The company has two key projects. The Western Desert project is situated in Utah and hosts a JORC Resource of 16.53Mt @ 6.3% zinc and 0.30% copper and 33g/t indium. The Storm/Seal project in Northern Canada is its second key project.

More recently the market has taken a great deal of interest in high-grade near surface copper results from recent drilling campaigns at Storm (figure 6). Better intersections from recent drilling included ST22-05 with 41 metres @ 4.2% copper from 38 metres downhole and 52 metres @ 2.5% copper from 8 metres downhole in ST22-02 (figure 7).

More recently the company believes ST22-10 (figure 8) has intersected over 100 metres of previously unidentified sedimentary and sulphide mineralisation associated with a 800m x 300m EM plate. Six similar plates remain to be tested.

AW1’s presentation released September 27, 2022 makes for some compelling reading and at an enterprise value of around $24 million, I don’t think you could go too far wrong picking up the stock under 15-16 cents given the near certainty of delivering more eye-watering drilling results. This one won’t disappoint…

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.