Guy on Rocks: There’s high voltage lithium action to come for this Yinnetharra nearologist

1979: Australian rock band AC/DC pose for an Atlantic Records publicity Photo for the cover session for the album Highway to Hell in 1979. (Photo by Atlantic Records/Michael Ochs Archives/Getty Images)

Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: Bring back the gold standard?

Gold was down US$6 to finish the week at US$2,010/oz with silver volatility continuing down 6.7% for the week to close at US$23.94/oz. Mid-week saw a slump in both gold and silver prices to US$1,988/oz and US$23.72/oz respectively as the USD firmed and 10-year treasury yields climbed.

Platinum lost US$7 to finish the week at US$1,052/oz and Palladium had a big jump up $59 or 4.2% to US$2,017/oz on Friday.

Gold is now up over 10% year to date with Kitco reporting late last week of a recent Gallup survey that reported over 25% of American’s believe that gold is the most preferred long-term investment (doubled from last year’s results) behind real estate.

BCA Research also consider that the gold should be trading at around US$2,200 based on their belief that the USD is overvalued by 20% and are forecasting gold could hit US$2600 in next 5-10 years. This sounds a bit like my theory on the Adelaide Crows making the top 8 in the next 5-10 years.

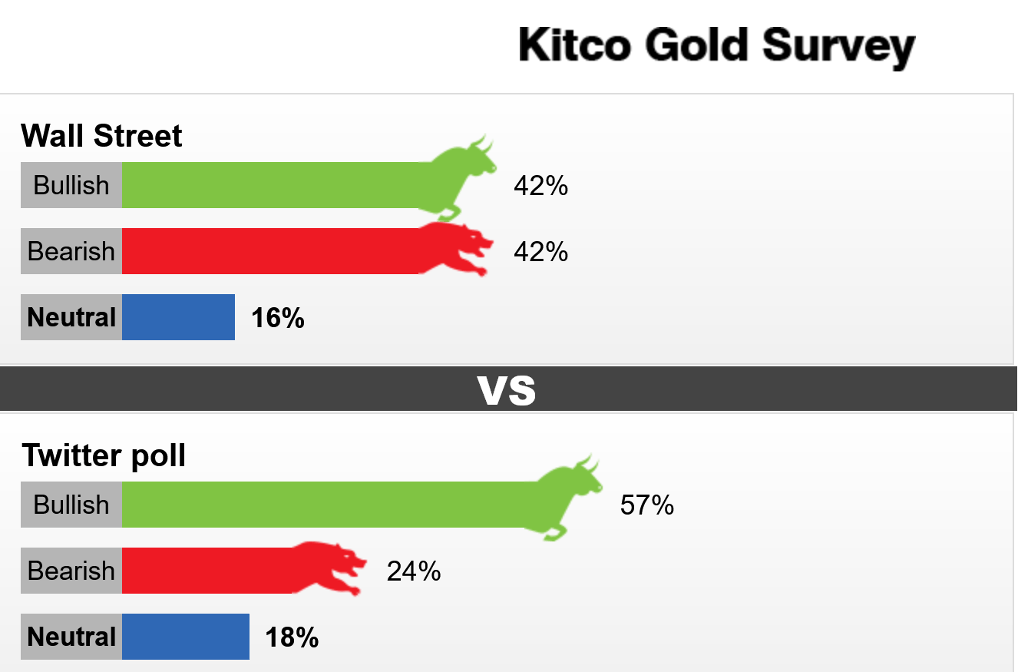

Looks like the Wall Street gurus are evenly split on where gold is going short term with the Twitter poll very bullish (figure 1). The futures market remains in contango with the June futures trading at US$1,994/oz.

Steve Forbes is an advocate of the gold standard from the 1790’s through to the 1970s which he believes would have prevented many financial disasters.

There is no inflation with the gold standard. If the gold standard was pegged at US$1,900/oz for example, if it went above this figure it would reduce the money supply, if it went below US$1,900/oz it would increase the money supply. Post world war II, economic growth rates averaged 4.2% (during the gold standard) compared to 2.7% by the late 70’s.

Mercenary Geologist Mickey Fulp also points out that gold has outperformed inflation by a factor of around 10 to 1 since 1970, contrary to a recent Forbes Magazine article.

On the other hand, Ben Bernanke (Parker Willis Lecture in Economic Policy, March 2004) pointed out that countries that left the gold standard earlier than other countries recovered from the Great Depression sooner. Great Britain and some Scandinavian countries, which departed the gold standard in 1931, recovered earlier than France and Belgium, which remained on the gold standard much longer. Countries such as China, which had a silver standard, almost entirely avoided the depression (probably due to the fact it wasn’t integrated into the global economy). The connection between leaving the gold standard and the severity and duration of the depression was consistent for both developing and developed economies.

Last week the USD had one of its strongest weeks of 2023 up 1.4% for the week with the USD Index closing at 102.68 on the back of soft economic news out of the US including consumer sentiment at a 6-month low. The University of Michigan’s May Consumer Sentiment survey was disappointing and reported 5–10-year inflation expectations to rise to 3.2% (consensus 3%) from 2.9%. This compared to 3.4% for the mid-2008 GFC and 3.2% in March 2011. This caused a slump in Consumer Sentiment from 63.5 to 57.7.

While core SPI inflation was down from its peak it is still running around 5% on a monthly annualised basis with Bell Potter (12 May 2023) believing that the Fed will hike rates a further 25bp at the June FOMC and again in July. Not surprisingly late last week the Bank of England also raised rates by 25bps. Volatility remains subdued at 17.

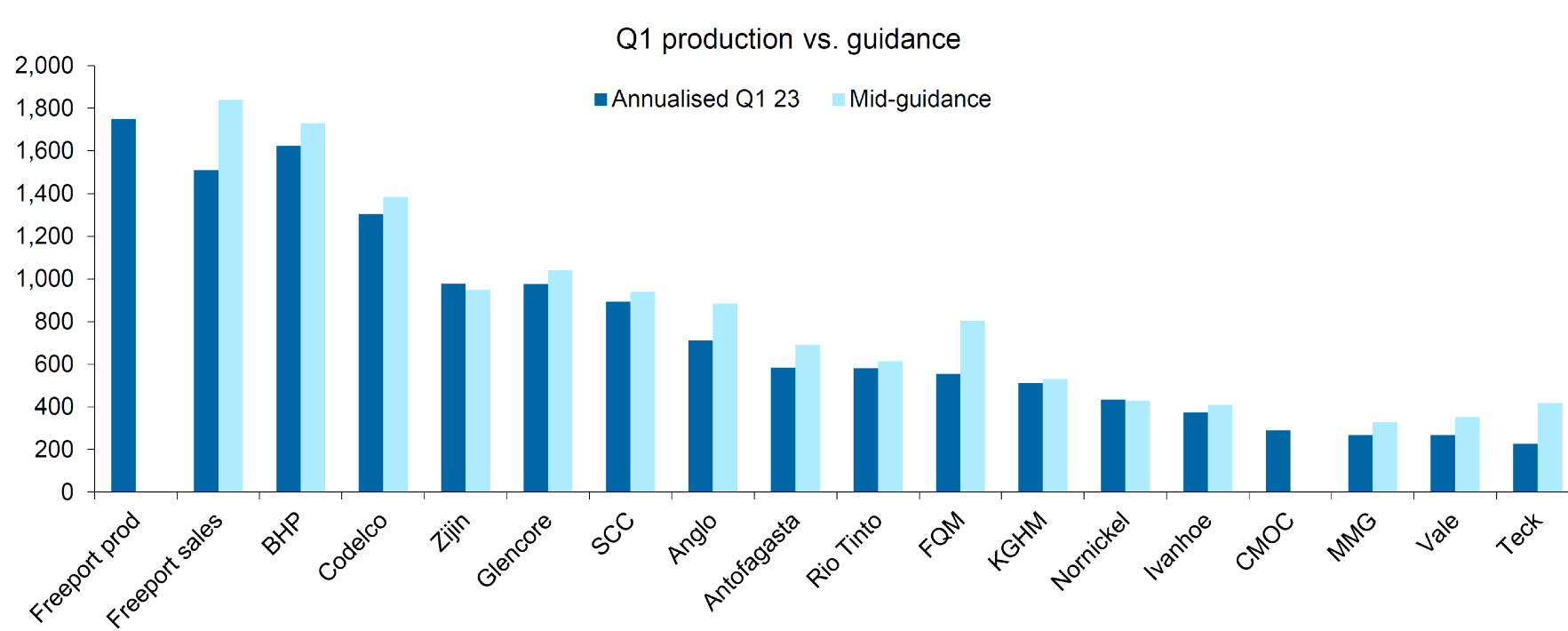

On the metals front, the knock-on effect was softer copper prices despite medium to longer term projected supply deficits. Copper closed down 13 cents for the week to US$3.74/lb with the three-month futures contract remaining in a 1.5 cent backwardation, before further sliding to US$3.69 mid-week. While the demand side looks weak, global copper production based on first quarter reports also looks weak (figure 2).

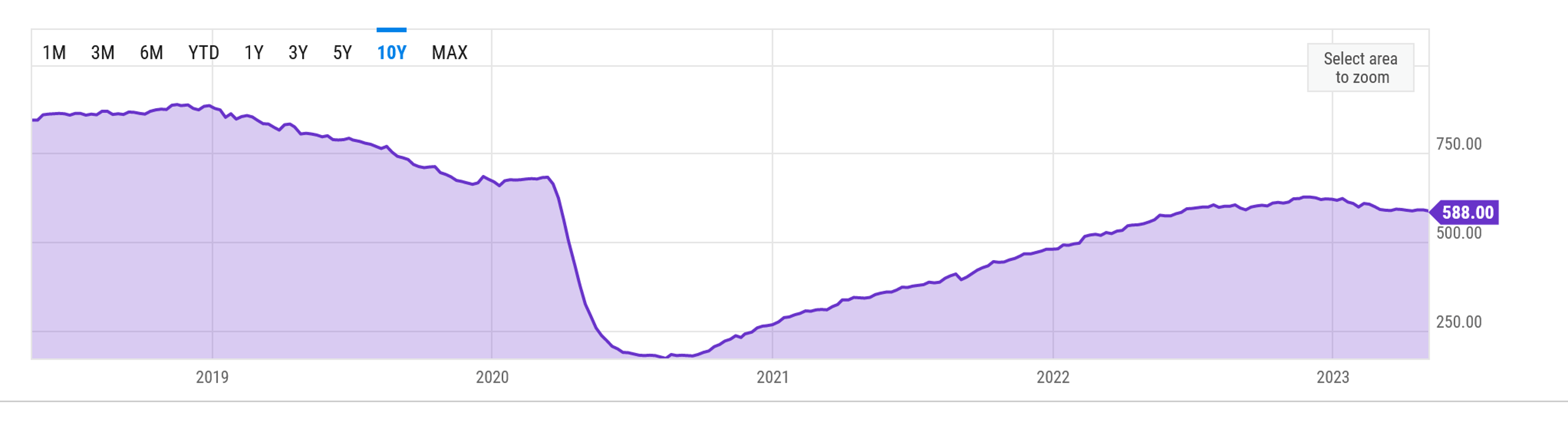

Crude oil also responded to the poor economic news and continued its losses down US$1.21 to US$70.15/bbl for the week. Drilling rigs (figure 3) were also down 17 for the week with the downturn likely reflecting Biden’s “war on fossil fuels”.

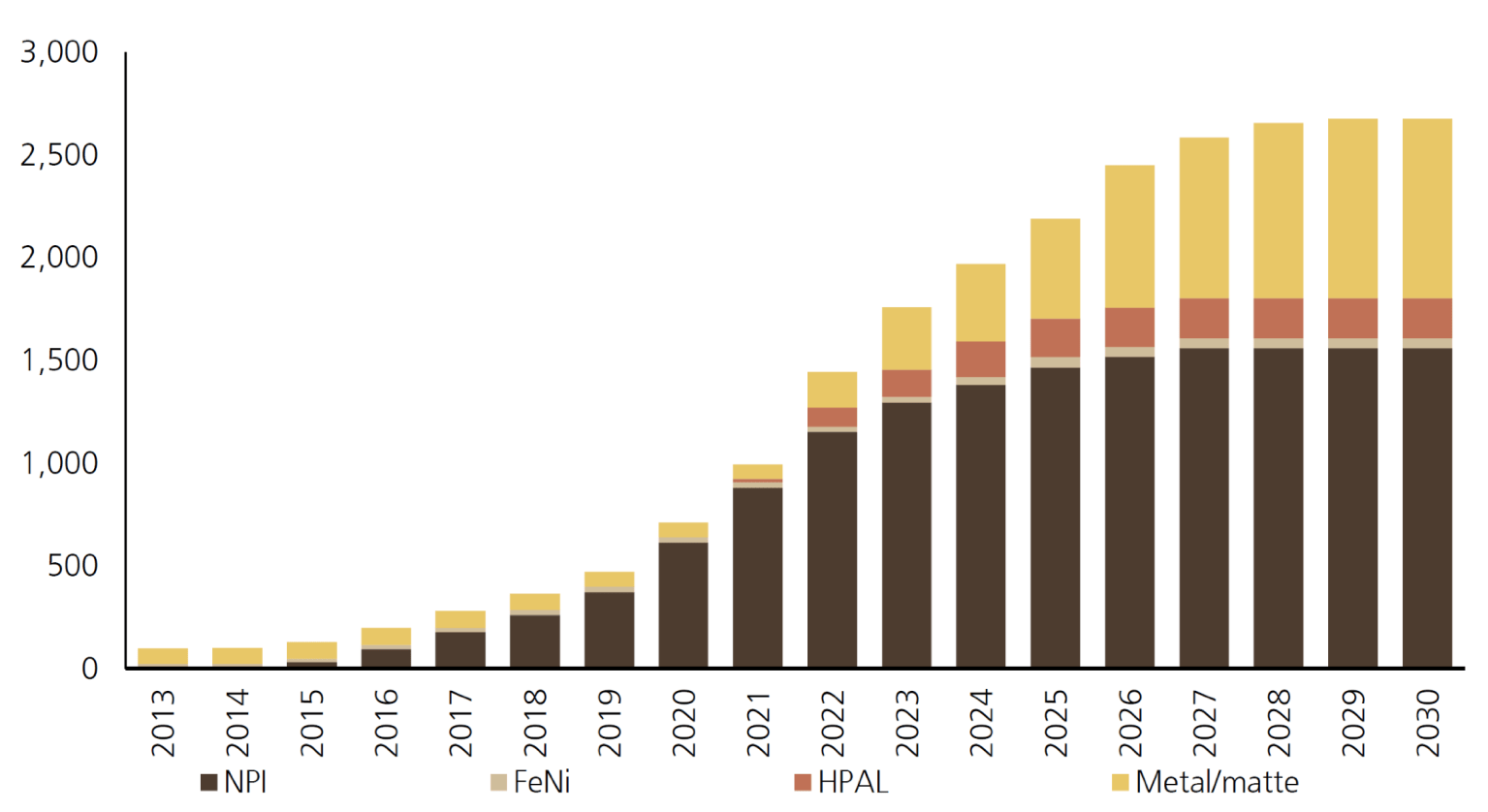

UBS remains bearish on nickel pointing to oversupply in NPI and NiSO4 which have resulted in record discounts vs benchmark metal prices. While world demand remains strong, the success of Class 1 projects in Indonesia (HPAL/matte) with more in the hopper increases the risk of short to medium term nickel surpluses.

Nickel supply growth from Indonesia, in particular NPI/Class 2 nickel to Class 1 nickel from NPI -> matte conversion and HPAL projects (figures 4 and 5) has exceeded expectations with more flexibility to switch between NPI -> stainless vs matte -> battery material makers depending on economics/margins (NPI vs NiSO4 price). The contraction in stainless demand over CY 2023, particularly in China, has also been offset to some extent by growth in battery demand.

Overall, the demand outlook is mixed with the recovery in Chinese stainless demand seen in early 2023 falling away and UBS highlighting increasing risks to Europe/US stainless demand. Furthermore, the demand for nickel – cobalt – manganese (NCM) chemistry will face increasing pressure from lithium-ferro-phosphate (LFP) batteries which are increasingly being used in EV’s.

In China economic news has generally been a little softer with some lift in iron ore prices on the back of government stimuli. Overall exports are weaker, and imports of key commodities have fallen (figure 6).

Plenty of economic news out this week including industrial production (Tuesday) and housing starts on Wednesday.

Stock pick of the Week: High voltage rock and roll

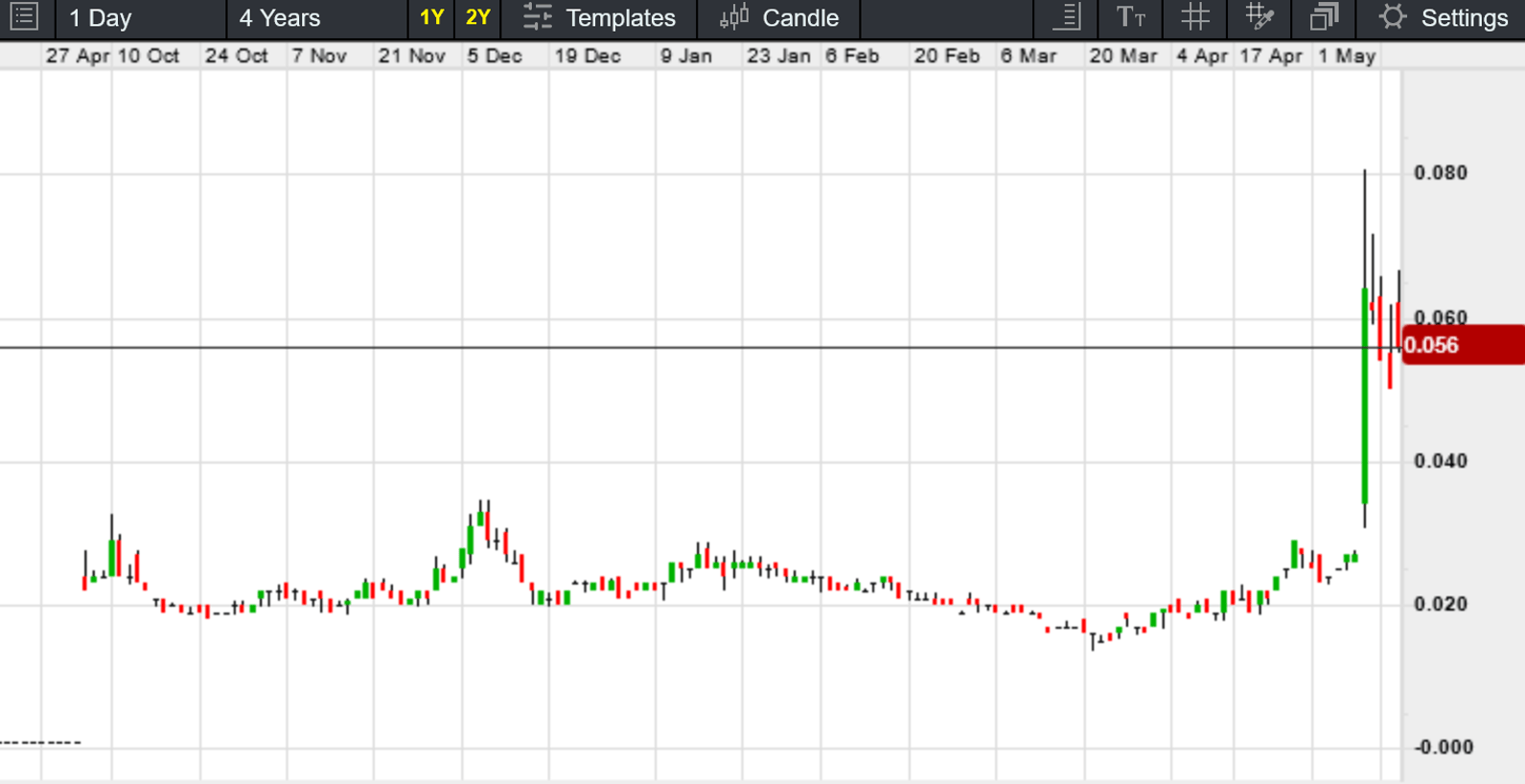

Voltaic Strategic Resources Ltd (ASX: VSR) (figure 7) has been on a tear recently after announcing multiple thick pegmatite intersections from its 15-hole, Phase 1 drilling program at its Andrada prospect, part of the Ti Tree project in Western Australia.

Widths up to 58m of continuous pegmatite were returned from surface with better intercepts including;

o ANDRC015: 58m pegmatite intercepted from surface to EOH* at 58m (0‒58m; >29m TW**)

o ANDRC012: 50m pegmatite intercepted from surface to EOH at 50m (0‒50m; >25m TW)

o ANDRC011: 34m pegmatite intercepted from surface (0‒34m; >17m TW)

o ANDRC006: 13m pegmatite intercepted from surface (0‒13m; >5m TW)

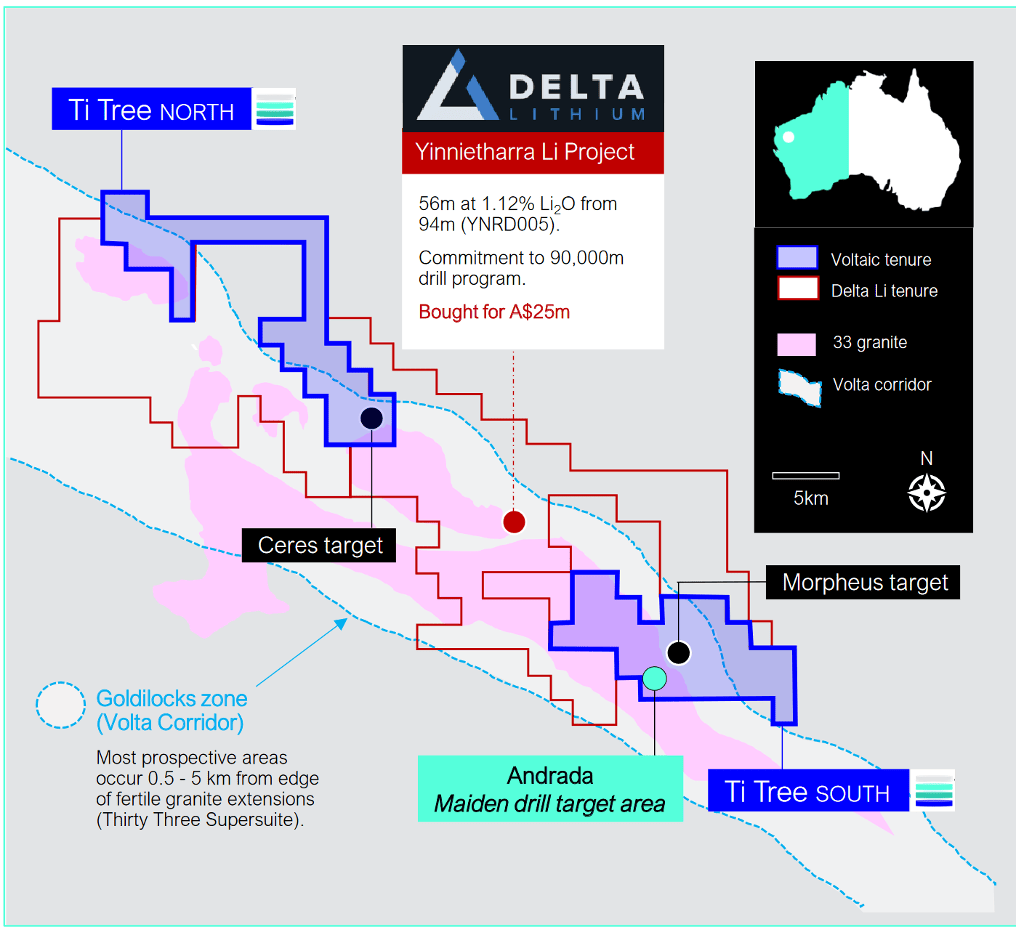

The company is anticipating assays in around 6 weeks. The region has good provenance and sits along strike from the David Flanagan led Delta Lithium Limited (ASX: DLI) which has returned multiple intersections from its nearby Yinnetharra Project with impressive grades and widths including YNRD028: 21m @ 1.13% Li2O from 71 metres downhole.

Voltaic, led by engineer and CEO Michael Walshe, believes drilling has confirmed “key structural trends associated with favourable lithium, caesium, tantalum (LCT) pegmatoids in close proximity to granitic contacts”.

The Company has an enterprise value of around $20 million with just over $9.0 million in cash following the unlimited generosity of RM Corporate Finance (I am a shareholder and director of RM Corporate Finance) that was lead manager to a two tranche $7.0 million share placement at 5 cents (with 1 for 2 free attaching options exercisable at 8 cents each on or before 30 June 2026).

Note there are just under 200 million “in the money” options exercisable at 3 cents (expiring in October 2025) however only five million are tradeable.

Planning for a Phase II drill program is underway and there are apparently over 300 mapped pegmatites with only 10% of the tenement so far explored. Delta is turning the entire state of Western Australia into Swiss cheese by the look of it starting off with a 90,000-metre program at Yinnetharra with an exploration target of >80Mt. This should maintain some positive momentum in the district.

Keep your eye on this one and be prepared for some high voltage action. What could possibly go wrong…

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.