Guy on Rocks: There could be ‘7 to 8 times uplift on the current price’ for this mineral sands spinout

Experts

Experts

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Gold staged a modest rally on Friday to close at US$1,710/ounce down 1.6% for the week in spite of the US dollar index finishing the week at 109.59, up 0.7%, representing yet another high from the early 2000s. Silver also closed down marginally at US$17.99/ounce.

The 10-year bond index finished the week up 17 basis points to 3.2%.

Disappointing unemployment data in the US (3.7% v consensus of 3.5%) was offset by signs that wages inflation may be starting to ease with hourly wages increasing by 0.30% last month compared to expectations of 0.40%.

Wages in the US over CY 2022 have risen 5.2%. Major indices didn’t respond favourably with the DOW closing down 3% at 31,318 and the NASDAQ finishing the week at 11,632 for a 4.2% loss.

Other precious metals were also softer at the end of the week with palladium down 4.5% to close at US$1,945/ounce and platinum at US$835/ounce down 3.0% for the week.

Copper also declined over 8% for the week to close at US$3.40/lb on the back of rising interest rates, a weakening European economic outlook, and another round of lockdowns in China.

The elephant in the room now looks like Europe which appears destined for not only a recession but a very long cold winter.

The closure of the Nord Stream pipeline “for repairs” is likely to see a run on warm clothing (and firewood) as the European winter looms large.

The Nord Stream 1 pipeline, owned and operated by Gazprom, stretches 1,200km under the Baltic Sea from the Russian coast near St Petersburg to northeastern Germany.

It opened in 2011, with a maximum capacity of 170 million cubic metres of gas per day from Russia to Germany.

Last Tuesday French Energy Transition Minister Agnes Pannier-Runacher accused Russia of “using gas as a weapon of war” after Gazprom had indicated it would suspend gas deliveries to the French energy company Engie.

Putin denied these accusations and said the “technological problems” were attributable to sanctions.

According to the BBC, Russia has been burning off an estimated $10m (£8.4m) worth of gas every day at a plant near the Finnish border.

The EU has responded by putting a cap on the price of Russian oil as large numbers of people are refusing to pay energy bills that have risen 10-fold compared to decade long averages.

Things aren’t faring any better in the US with the new methane rules aimed at reducing 41 million tons of methane emissions (equivalent to 920 metric tonnes of carbon dioxide) from 2023 to 2035.

This is likely to have a dramatic effect on oil and gas production with the EPA in the US reporting that this amounts to more than the amount carbon dioxide emitted by all US passenger cars and commercial aircraft in 2019.

Uranium (up 40% over the last 12 months – figure 3) was one of the few bright spots during the week, closing north of US$53/lb with a number of countries likely to revisit their plans to phase out nuclear power plants.

Japan, which currently has 33 reactors in operation, is likely to bring another seven back online within the next 12 months.

The Japanese Nuclear Regulation Authority has also approved 17 existing reactors to be reactivated, while six reactors have already restarted operations.

The California Governor Newsom has also proposed extending a $1.4 billion loan to extend the life of the Diablo Canyon power plant until 2025. Swiss politicians have launched a petition to revise the country’s nuclear energy policy and avoid power plant shutdowns.

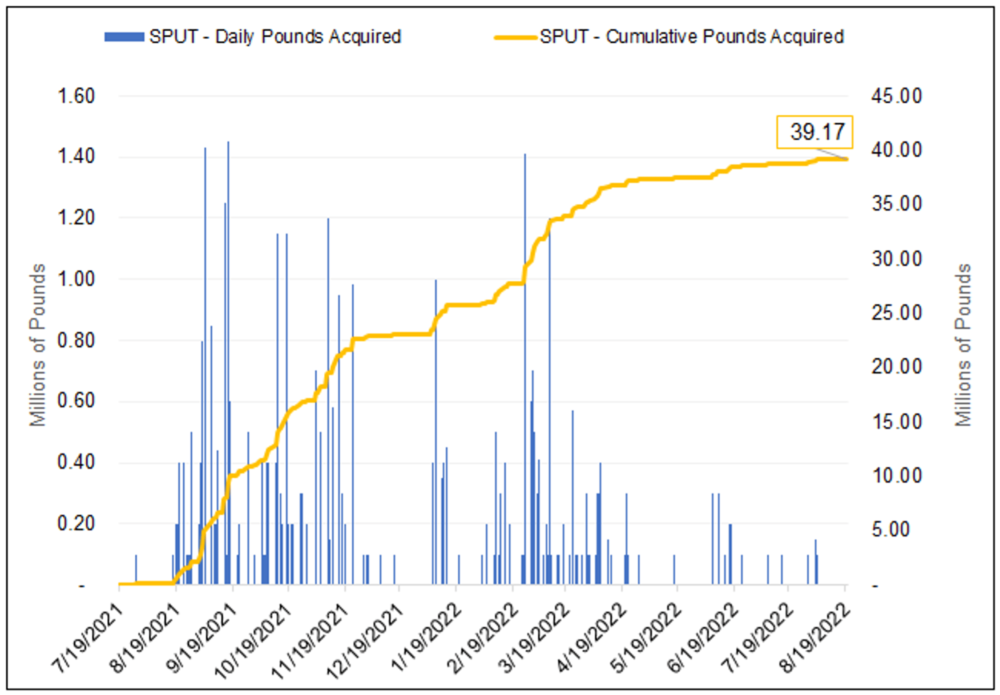

It looks like the luminaries at the Sprott Physical Uranium Trust are believers in the uranium thematic. Spot purchasers however have recently slowed down after a fairly aggressive accumulation since inception in July 2021 (figure 4).

I have never had a lot of luck with mineral sands plays however the recent spinout (July 2022) of Iluka Resources (ASX:ILU) mineral sands operation in Sierra Leone, Sierra Rutile Holdings, (ASX:SRX) is worthy of bringing to the attention of the Stockhead faithful.

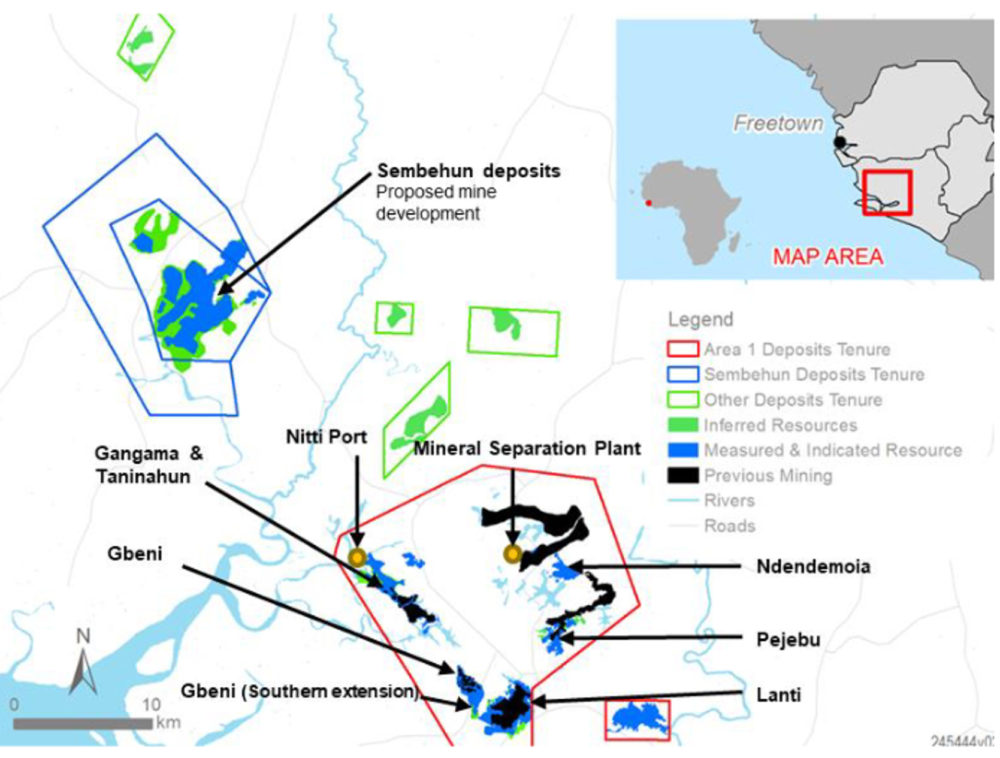

The company produces standard and industrial grade rutile, high-grade ilmenite, and zircon in concentrate from its multi-mine mineral sands operation straddling the Bonthe and Moyamba districts of southern Sierra Leone (figure 6).

Current mining and mineral processing operations are taking place at Area 1 (figure 7) and include wet concentrator plants (500-600tph) a mineral separation plant (MSP) and associated infrastructure.

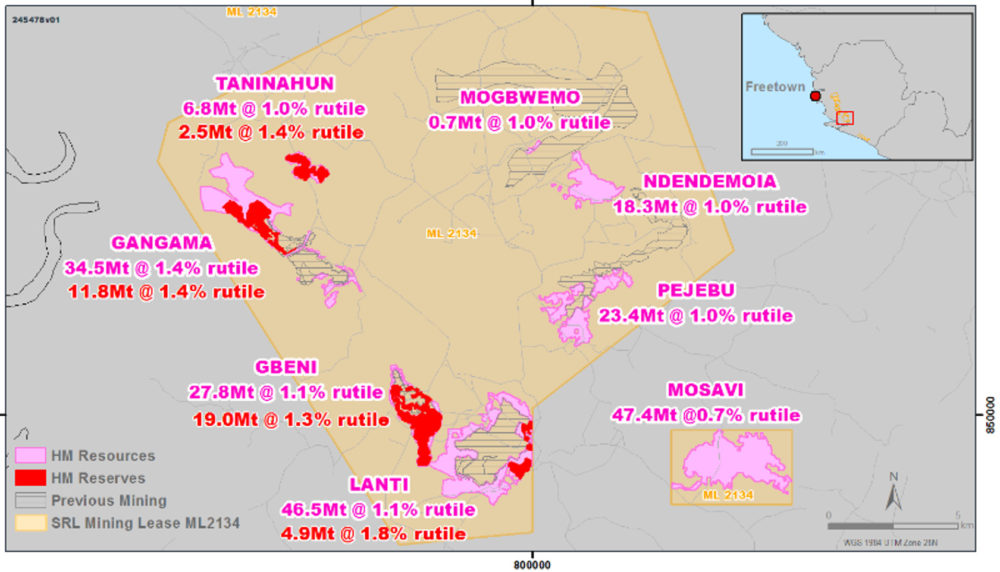

Growth is likely to come from expansion of Area 1 in addition to the Sembehun Project situated approximately 30km from Area 1. The project is, according to SRX, one of the largest and highest quality known rutile deposits in the world.

SRX is also planning to aggressively explore the Pejebu and Ndendemoia deposits situated less than 5km from Area 1 and complete mining studies with a view to extending the mine life.

Rutile resources total 2.1Mt with a reserve of 541Kt.

FY 2022 guidance of approximately 140Kt of rutile at an operating cost of US$892/tonne (based on the last Quarter guidance) of rutile should generate (assuming steady state production) an EBITDA in the order of +$75 million.

At an enterprise value in the order of $60 million I am wondering if this presents a medium term opportunity?

Management makes no secret the last few years have been difficult between the coronavirus and on site management and staffing issues, however I am taking a glass half full approach on this based on a US$335 million ($480 million) Net Present Value for Sembehun alone together with strong free cash flow from existing operations.

I can envisage 7 to 8 times uplift in the current price of 30 cents (+$2.10/share) on its successful commissioning over the next 2-3 years.

This doesn’t include a re-rating based on the existing mining operations. I think this is a good opportunity to accumulate a quality mineral sands producer as the share register adjusts to life as a standalone company.

I will follow this up in 12 months’ time and see if I have been smoking something a little strong at Cigar Social….

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.