Guy on Rocks: Scramble for nickel continues, experts predict EV sales to rise 64pc in 2022

Unmarried Vietnamese men jostle for a 20 kg wood ball representing the sun at an annual festival to honor male strength, local gods who defeated lagoon monsters in the 6th century, and to pray for bumper crops. (Pic: Tran Tuan Viet, Moment Unreleased/ Getty Images)

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: Russia Central Bank sells gold

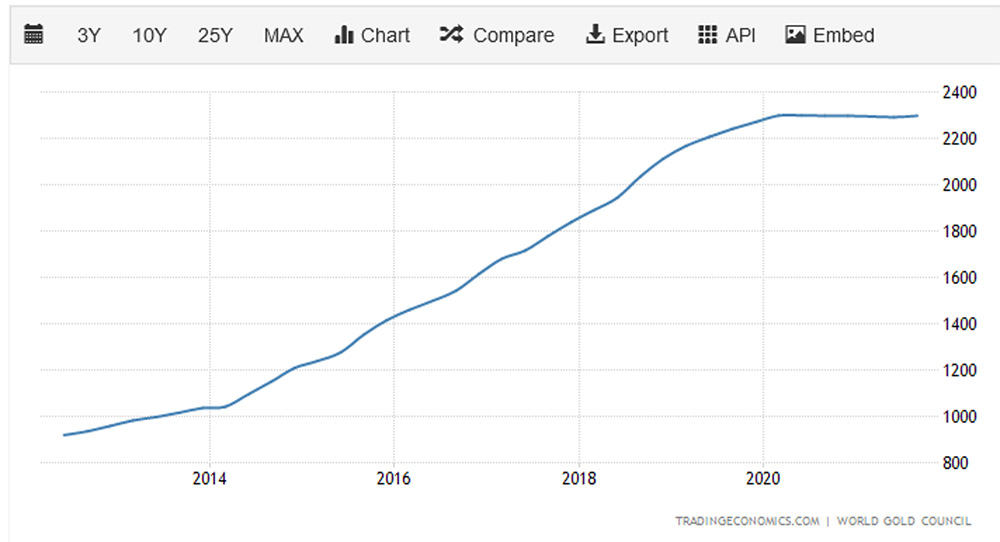

Russia has been steadily accumulating gold over the last 10 years (figure 1) which now provides a US$133 billion lifeline and some short-term relief given it has around US$300 billion of foreign reserves that remain frozen as of mid-March 2022.

More recently, the Russian Central Bank sold 1 tonne of the yellow metal while at the same time offering to purchase gold at 5,000 Roubles (approximately US$58/gram) or 10% below the LME spot price.

While the LME has banned the trading of Russian gold there are plenty of other avenues to trade the metal.

Sky News recently reported that the Russian troops had introduced the Rouble into parts of south-eastern Ukraine.

That was timely given the local populace was also running short on toilet paper.

A range of Russian forex controls and inflows from US$ denominated energy sales has seen a recent rebound in the Rouble (figure 2).

Gold has put on around 6% in CY 2022 driven by fears of inflation and the Ukraine war after a dismal 2021, gold’s worst year since 2015.

Other precious metals such as platinum (off 1.6% to US$985/ounce) and palladium (down 1.7% to US$2,208/ounce) followed gold down last week.

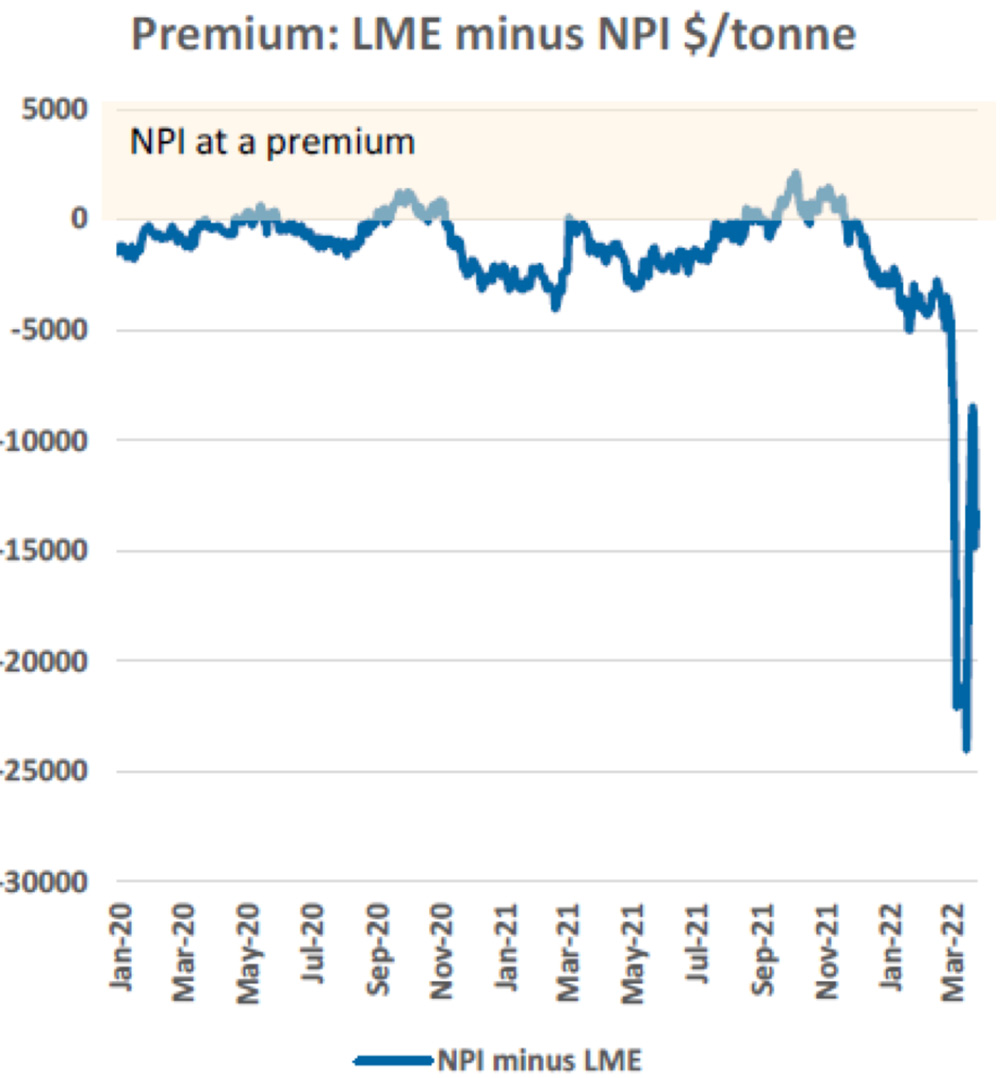

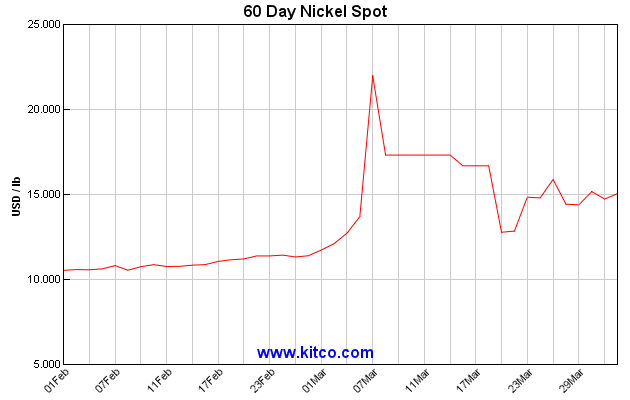

While we have been witnessing extreme volatility in LME nickel prices, particularly after Tsingshan’s short positioned (150,000 tonnes) emerged a few weeks ago, this has not been reflected in other nickel prices such as and nickel sulphate-figure 3 (batteries) and nickel pig iron (figure 4) mostly destined for stainless steel, with sizeable discounts the order of the day.

Given much of nickel in sulphate is derived from nickel briquettes (with additional conversion costs up to US$1,500/tonne), these price disparities are unlikely to last.

In the case of NPI this is the largest discount, according to Macquarie, which has ever been observed.

In response to this volatility, and concerns over longer term supply security, end users such as Tesla who are heavily dependent on nickel in their EVs (average of 45kg/EV vehicle) have moved to secure long term supply deals with producers such as Vale.

Rho Motion (EV Seminar in London on 29/3/2022) are projecting that EV sales will rise by 64% YoY to 10.6m up from 6.6m in CY 2021 and 3.3m vehicles in 2020.

Trading at the LME, which imposed a maximum trading limit of 8% then 15% per day, is yet to “normalise” following the resumption of trading on March 16 (figure 5).

Difficulties in determining the closing settlement price (CSP) at the end of the day’s trade is making it challenging for nickel suppliers and nickel sulphate producers that rely on the CSP for physical settlement.

The same goes for scrap which relies on CSP for price determination.

The disparity between LME and downstream prices is set to continue for the short term at least. A significant risk could be a trend towards lithium-ion or LFP batteries if the nickel market remains in disarray.

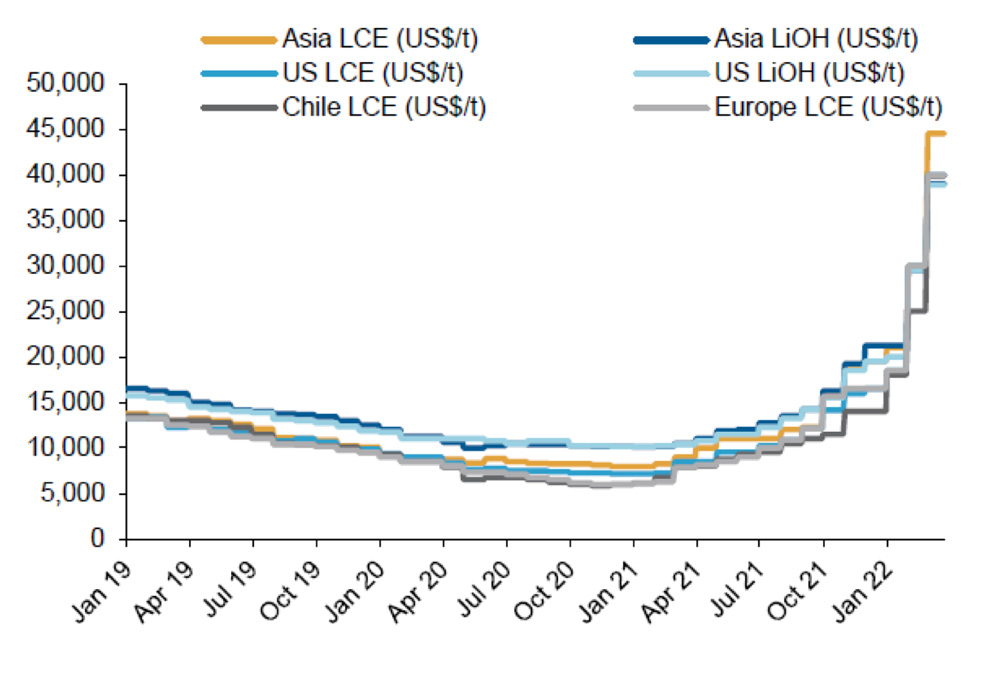

Elsewhere, spodumene prices moved 1% higher last week (figure 6) to US$2,810/t, with technical and battery grade lithium carbonate prices remaining unchanged around $74,000/t) and US$78,000/t respectively.

Copper, which has put on 20% this calendar year, closed at US$4.62/lb and remains in strong contango (5 cents) for three-month delivery.

Zinc has put on 50% to US$1.83/lb (due to smelter difficulties) while aluminium and nickel up 100% YoY.

The wild card remains oil that closed the week at US$99.55/bbl (off 1.5%) after Uncle Joe announced a 1M BOPD release (a total of 186 MBBLS) which should see the US down to 19 days (down from 32 days) of oil supply after six months.

So, in the absence of OPEC increasing production, oil prices are likely to remain elevated (and volatile) for the foreseeable future.

Uranium (figure 7) remained flat after hitting US$60/lb last month.

The US imports 16% of its uranium and 20% of its enriched uranium from Russia. With no existing enrichment facilities in the US this is an interdependency that the US could currently do without.

New Ideas

There has been a lot happening over the last two weeks while I have been holed up in Adelaide with the coronavirus.

Fortunately, I have used the time wisely and watched some quality movies including Snowtown and Bad Boy Bubby to reacquaint myself with the culture here.

Our new man in the White House, Andrew Forrest (first man in WA to walk on water), appears to have sold Uncle Joe on his hydrogen vision securing a meeting ahead of Scott Morrison, who despite notching up over 1,000 hours of reaching for the heavens at his church, has been forced to wait in line.

The manoeuvring in the uranium space has started in earnest with uranium explorer Deep Yellow (ASX:DYL) agreeing to merge (subject to inter alia shareholder approval in July 2022) with Vimy Resources (ASX:VMY) (figure 8) receiving 0.294 DYL shares for every VIM share they hold.

The merger will see a $680m million company with a combined JORC resource inventory of 389 million pounds U3O8 (14,963 t U).

Two advanced projects including the proposed 3.5m pounds per annum Mulga Rock Project (290km north-east of Kalgoorlie in WA) and the Tumas Project (Namibia) where a DFS is due for completion late 2022, will form the backbone of the merged group.

Permitting and developing uranium projects has significant challenges so no doubt the John Borshoff-led company will be turning its attention to getting the approval process at Mulga Rock back on track with the previous Government approval running out in late 2021.

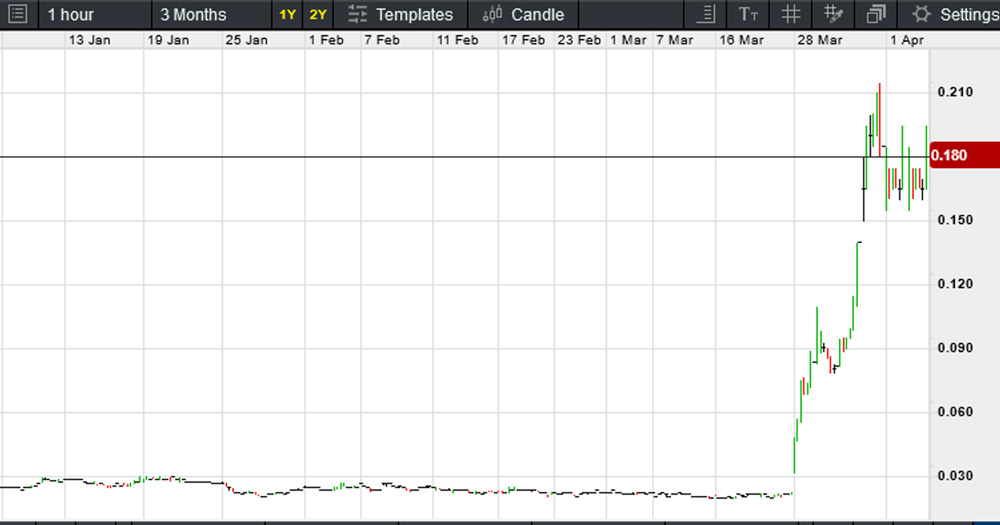

The Stockhead faithful would have been delighted to see our mid-July 2020 pick Tempest Resources (ASX:TEM) (figure 9) which has been relatively quiet ever since.

The only news reports I had received about the Company since that article was that MD Don Smith had been spotted walking his dog around West Perth in the middle of the day.

Not ideal for a struggling junior but probably not the worst thing going on at lunch time in West Perth…

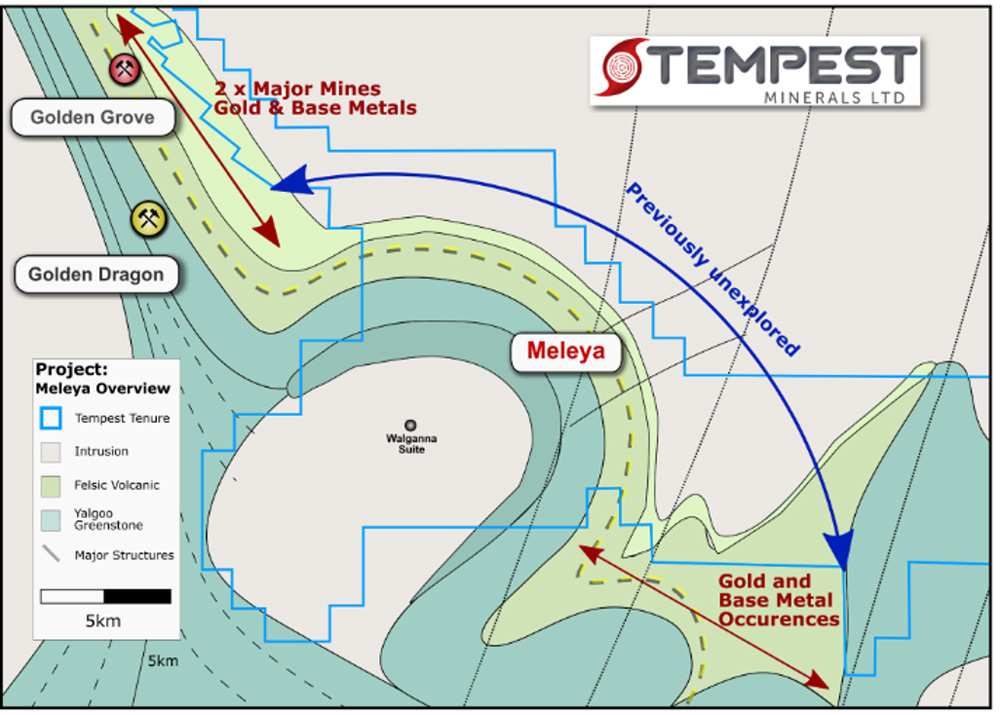

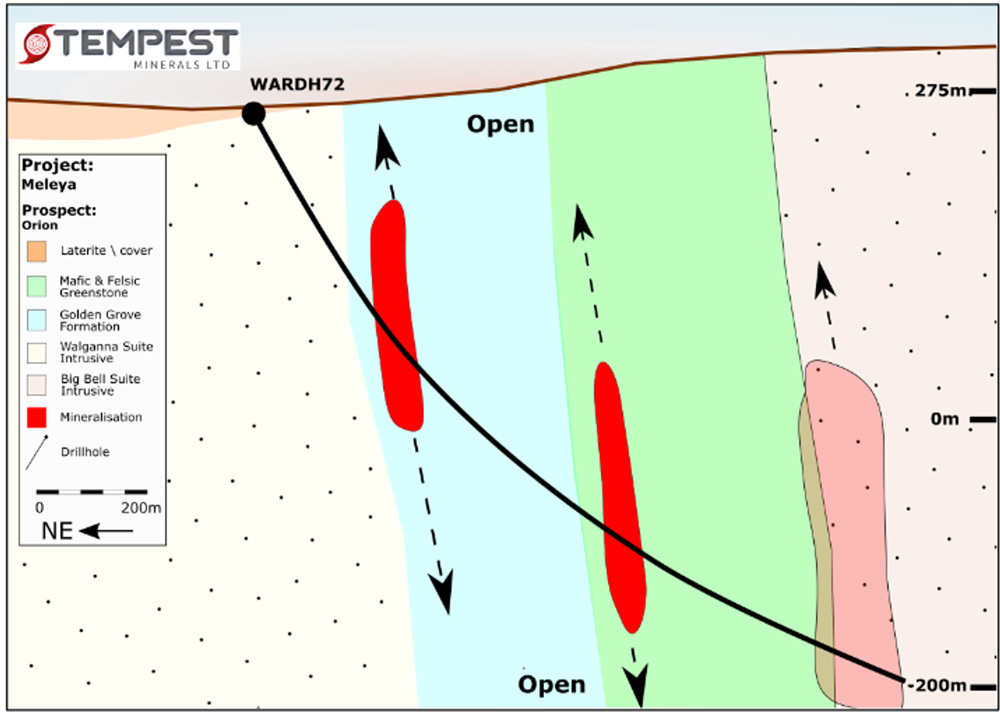

The stock soared however with the announcement that WARDH72 at the 100% owned Meleya Project (Figure 9, Yalgoo region WA) has intersected copper sulphide intermittently mineralisation (figure 11) throughout the entire 709.1 metres including:

- 8 metres of interbedded semi-massive base metal/magnetite from

18 metres downhole; - 10 metres of copper bearing semi-massive sulphides within a 20 metre of disseminated sulphides from 422 metres downhole; and

- 18 metres of copper bearing disseminated and stringer veins within a broader ~100 metre

disseminated sulphide and strongly potassic altered intrusives zone from 610 metres to end of hole.

The market seemed to like the announcement with the stock rising from around 2.4 cents hitting 21 cents late last week on some serious volume.

A report on a second drill hole is imminent.

The geology comprises a mixture of the Yalgoo Greenstone Belt and the Golden Grove Formation (hosting the Golden Grove Deposit).

A little hard to say from the pictures of the core (figure 12) however we are all hopeful this may represent another Golden Grove (29 Metals Limited, ASX: 29M)) which comprises Proven and Probable Reserves of 12.37Mt @ 1.9% Cu, 4.4% Zn, 30g/t Ag, 0.30% Pb and 0.80g/t Au (ASX Announcement 31 March 2022) and delivered an EBITDA of $254m for CY 2021.

TEM currently has a market capitalisation of around $72 million based on the last traded price of 18 cents per share.

Results are due out in the June 2022 Quarter however I anticipate any decent drill holes will warrant another release.

No doubt from here there will be some good trading opportunities with the inevitable lag time between assays with the laboratories at full stretch.

Whether this and the follow up hole carries any grade remains to be seen, however it all bodes well longer term for the Meleya project.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.