Guy on Rocks: Precious metals sold off… iron ore soldiers on!

Pic: Getty

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week.

Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions

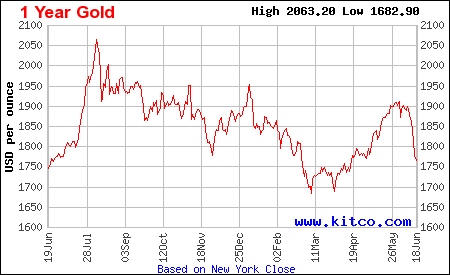

It was a volatile week following the FOMC meeting on Wednesday last week with gold a casualty of a surging US dollar (and a 6-basis point uptick in US 10-year treasuries) finishing the week at US$1,755 down US$150 over the last four weeks (figure 1).

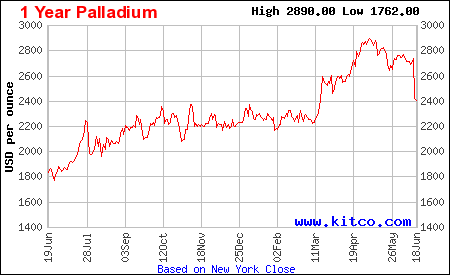

Other precious metals followed suit with silver down to US$25.86/oz off 7.5% for the week, platinum down 10% to US$1,032/oz Pt and the biggest mover palladium (figure 2) down 14% to US$2,400/oz over the last 30 days.

Not the first time we have seen seasonal weakness in precious metals (July and August) and I think this sell down has been a little overdone.

It is worth noting that even if FOMC anticipates interest rates in the range of 2% to 2.5% by 2021, which still equates to negative real interest rates, so I still think longer term this is bullish for gold.

Interestingly FOMC Chairman Jerome Powell predicted two rate cuts in 2023.

Appears their track record isn’t that crash hot after the committee in 2018 forecast three rate increases over CY 2019.

As the astute readers of Stockhead will remember, there were in fact two rate cuts over CY 2019! One thing I agree on is that the inflation genie is well and truly out of the bottle.

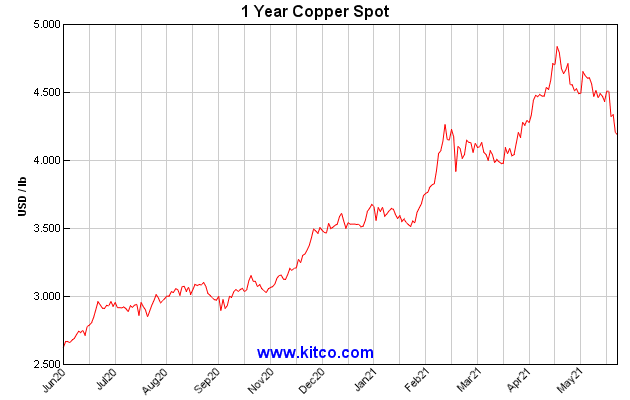

Not surprisingly copper, whose futures have been flat or in backwardation for much of this year, was off 7% for the week closing at US$4.19/lb (figure 3) after a stellar run this year.

It appears the Chinese selling of copper stockpiles has cooled the market with exports of copper ex China hitting a 14-month high.

The controversial mining windfall tax will be the subject of a month-long debate in Chile’s senate with companies and unions putting forward their case on the potential impact on mines that generate more than a quarter of global copper production.

Meanwhile rivals of Peruvian president elect Castillo has been comparing him to the late leftist President Hugo Chavez.

However, Castillo retorted by saying that his party were “workers, we are entrepreneurs and we will guarantee a stable economy, respecting private property, respecting private investment and above all respecting fundamental rights, such as the right to education and health.” All sounds very plausible.

Uranium was down marginally for the week off 18 cents breaking 7 week winning streak, possibly driven by rumours of a Chinese reactor leaking radiation. Thankfully this turned out to be false!

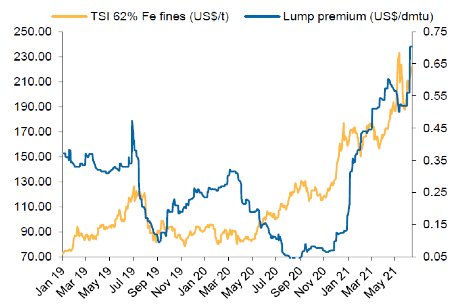

Our star performer for the week was iron ore with exporters ramping up to full capacity in Australia and Vale projected to be back to 350mtpa by late CY 2021.

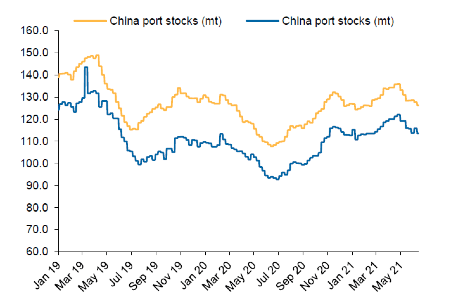

Iron ore lump premiums have blown out to US$56 cents/dmtu (figure 4) as Chinese port stocks are now reducing (figure 5).

Needless to say, the Australian iron ore producers (FMG, BHP and RIO) are suffering an embarrassment of riches while our junior iron ore producers/developers have continued to perform strongly.

Company News

As the Grinch (How the Grinch Stole Christmas, 2000) said, “one man’s toxic sludge is another man’s potpourri” so it hasn’t taken long for the bottom feeders to arrive on the streets of Yangoon looking for a bargain.

And ‘surprise surprise’: China’s Shenzen Stock Exchange listed Yintai Gold (market capitalisation US$4.3 billion) has made a non-binding conditional bid for the shares of Myanmar Metals (ASX:MYL) for A$65.5 million, or 3.5 cents per share compared to the last traded price of 7c in February of this year.

Civil unrest following the coup d’état in Myanmar saw the suspension in trading (3 February 2021) of MYL, which is looking to develop the historical Bawdwin lead mine in which it now holds a 51 per cent participating interest with local partners WMM and East Asia Power (Mining) Company (EAP) – which each hold a 24.5 per cent interest.

Bawdwin comprises JORC reserves of 18.4 million tonnes at 6.4 per cent lead, 5.4oz/t silver and 3.4 per cent zinc.

The definitive feasibility study outlines a $300m CAPEX and a 13-year mine life at 2 million tonnes per annum, with a four-year payback.

I can’t say it’s a bad move on behalf of Yintai Gold as negotiating a purchase while there are tanks on the street under the direction of military commander-in-chief Min Aung Hlaing shows some intestinal fortitude (and an eye for value).

Early days in the bid process given the conditions of the bid will include, inter alia, a site visit and legal and technical due diligence.

It appears MYL is looking to “assist” Yintai in the formulation of an offer so that may be a sign the white flag is up. It may well end up being Christmas in July for the MYL shareholders after all, Grinch style. “What is that stench? It’s fantastic”.

In other news the Alastair Cowden-chaired gold and lithium developer Firefinch (ASX:FFR) has secured US$130 million (over three stages) from cathode producer Jiangxi Ganfeng Lithium Co (Ganfeng) into their Mali Lithium BV (MLB) which will hold the interest in Firefinch’s Goulamina Lithium Project.

The parties intend to form a 50:50 incorporated JV to develop and operate Goulamina with the final tranche of US$91m due on Goulamina Final Investment Decision which will see Ganfeng’s equity interest in MLB reach 50%.

Ganfeng will either provide US$40m in debt or arrange US$64m in debt funding. In addition to receiving the life of mine offtake –50% on receipt of the full US$130m and 100% after debt financing is provided.

As part of the de-merger process FFR shareholders will receive a pro-rata allocation of LithiumCo shares.

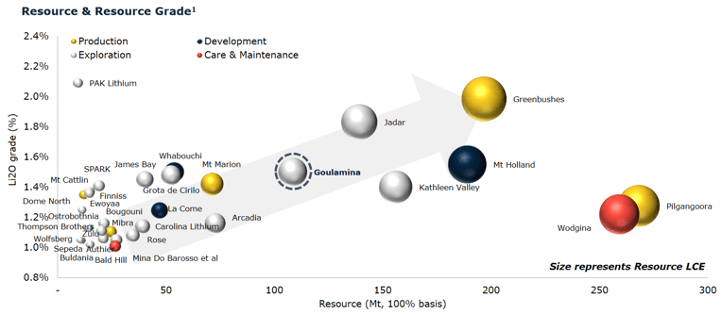

The project boasts an impressive set of metrics including a JORC Reserve of 52Mt @1.51% Li20 (figure 7) producing 436,000 tonnes of spodumene concentrate (6%+ Li20) over a 23-year mine life with low impurities. The feasibility study returned a pre-tax NPV of A$1.7 billion with an IRR of 55%.

As the second wave of lithium development unfolds, I would rank this as one of the better new developments out there notwithstanding the jurisdiction is a little spicy.

FFR are also developing the Morila Gold Mine with a view of transitioning the operation from a 40koz pa tailings retreatment operation to 150 –200koz pa gold producer with a life of mine production of 1.45 million tonnes @ 1.5 g/t gold.

Both MYL and FFR are just two examples of the ongoing role of China as a developer and/or financier of natural resources around the globe. Even the Government of Greenland is opening an Embassy in Beijing!

For those bureaucrats standing on their respective soap boxes complaining about China, they had better remember who is paying the bills around here. Take away China as a partner and we will all be going to work on a skateboard.

Anyway, I’ll have more to say about this in my politically correct end of financial year lunch speech in early July. I’m just waiting on some final edits from Kevin “Bloody” Wilson.

New Stocks

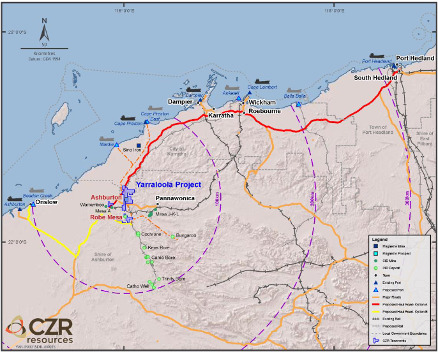

Continuing on with our iron ore theme CZR Minerals Ltd (ASX:CZR) (figure 8) is another Mark Creasy spinout led by mining engineer and former Atlas Iron Ltd Managing Director David Flannagan.

Their most advanced project is the Yarraloola iron-ore project (figure 9) covering 206 square kilometres situated approximately 100 km southwest of Karratha. The project contains channel iron-ore deposits (CID) with a JORC 2012 Indicated and Inferred Resource in excess of 90Mt @ 53% Fe (calcining to 60% Fe).

The December 2020 Pre-Feasibility Study based on a Probable Ore Reserve of 8.2Mt at 56 % Fe contemplated a 2 million tonne per annum DSO operation with a pre-production capex of $51 million, hauling by road to Port Hedland assuming US$145/dmtu (62% Fe Index Price) and an exchange rate of US70c.

The study demonstrated a life of mine net cash flow of $622 million over 5 years. The study used a relatively simple crush and screen for the production of DSO fines.

The company is also investigating trans-shipment opportunities at Beadon Creek near Onslow which has the potential to reduce haulage by approximately 160km compared to the route to Pt Hedland.

A Definitive Feasibility Study is currently underway including a study plan, timeline and budget to advance the project. If the 62% Fe Index price can hold over US$200/dmtu the DFS is likely to come up smelling of roses (again).

At a market capitalisation of $35 million this is definitely one to keep track of. With a resource sector still littered with overvalued junior explorers, the junior iron ore sector still represents good value if you look hard enough.

There has been an element of doubt among brokers about the viability of the junior iron ore sector here in the West, with many pointing to the infrastructure bottlenecks that have delayed/halted many developments over the 2006-2010 iron ore boom.

However, the likes of Fenix Resources Ltd (ASX:FEX), GWR Resources Ltd (ASX:GWR) and Strike Resources Ltd (ASX:SRK) have demonstrated that there are still opportunities providing you can solve the logistics issues.

The looming bottleneck will actually be the availability of skilled labour to bring new developments online.

In the interim, I will continue to wear my rose-coloured glasses, it seems to be working so far.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.