Guy on Rocks: Pastor, turn this water into brine!

Picture: Getty Images

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

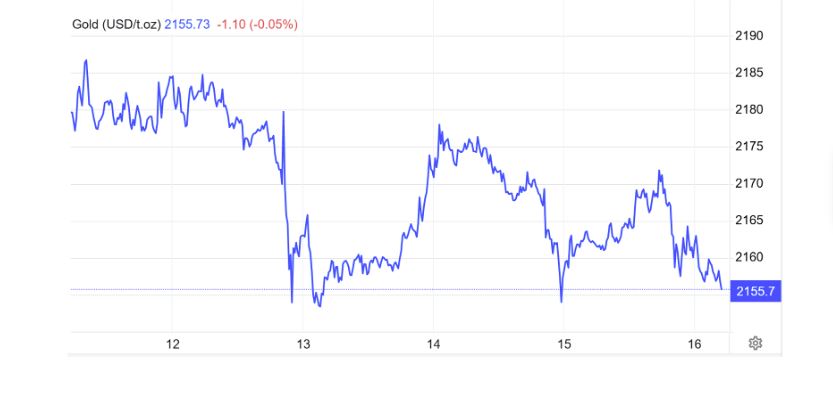

Market Ructions: Inflation pares gold’s gains

Last week saw gold reach a series of successive highs while trading between US$2,153 and US$2,184/ounce, however a higher than anticipated CPI report last Tuesday put the brakes on any further rises with gold futures finishing the week at US$2,159/ounce. The Producer Price Index also saw producers raise prices by 0.60% over February.

I anticipate gold will trade sideways ahead of the March FOMC meeting with the CME FedWatch tool predicting no change to interest rates this month.

Platinum had a volatile week trading in a US$50 range and closed at US$938/ounce, more or less flat for the week. Palladium had one of its best weeks in a while, closing up around US$40/ounce to finish the week at US$1,079/ounce.

Chris Joy (Coolabah Capital) acknowledges that while an attenuation in inflation pressures sparked a risk rally earlier this year, he believes that once the supply chain normalisation process is exhausted and foods deflation tapers off, core inflation could increase sharply due to higher services inflation driven by tight labour markets and strong wages growth.

China’s CPI inflation appeared to return to the positive in February, breaking a six-month run of deflationary figures.

Whether this deflationary cycle has reversed itself remains to be seen with some of the price volatility possibly associated with seasonal events such as Chinese New Year.

The figures showed that durable goods prices are still declining as overcapacity looms large.

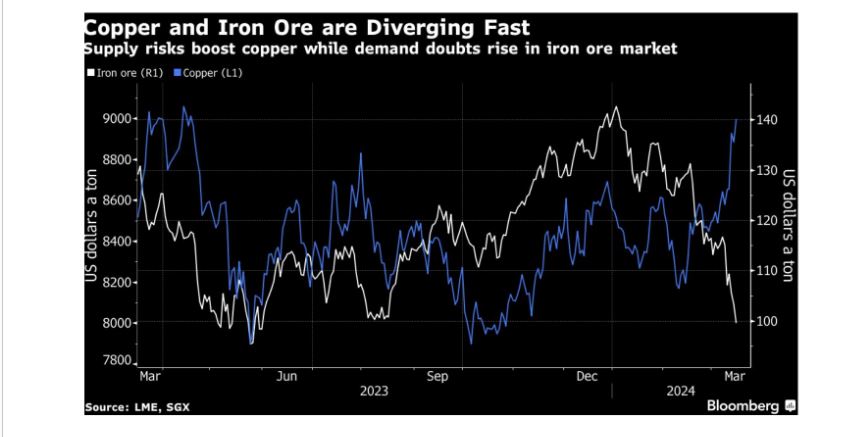

The big mover during the week was copper which surged 5% and closed at US$4.11/lb. In a recent interview with Kitco, Cupel Advisory director Nicole Adshead-Bell believes we are at the start of a long bull run.

Copper (figure 2) hit seven-month highs last week in response that China plans to mothball loss-making smelters which is likely to severely reduced supply.

“The price is moving now [because] market participants are finally starting to realize that there is a very material, looming structural-shortage in primary copper supply,” according to Adshead-Bell in a recent Kitco interview.

Adshead-Bell also highlighted that energy transition and artificial intelligence is going to require more copper than analysts previously estimated, with the years of sub-US$4/lb likely to not represent a high enough incentive price to start new developments.

Adshead-Bell is projecting a “parabolic rise in the copper price.” Somone give that lady a cigar!

According to Andy Holme in a recent Reuters article, he commented that smelter treatment charges say a lot about what’s happening in the upstream segment of copper’s supply chain.

Notable was spot charges in China tumbled to $11.20/tonne (or just under 80%) last week, in just two months representing the lowest level since 2013.

This together with the recent closure of First Quantum’s (FM.TO) Cobre Panama mine has resulted in a 350,000-tonne shortfall in China’s copper supply chain. A number of Chinese producers, according to Home, are insulated by annual supply deals, many of which were priced at a benchmark treatment charge of US$80/tonne for this year’s shipments.

Iron ore (figure 3) appears to be diverging from copper and is trading at around US$99/tonne (62% fines) as sentiment wanes towards Chinese infrastructure and construction sectors where the recent National People’s Congress in Beijing set an ambitious growth rate target of 5% for CY 2024.

As highlighted last week, copper stockpiles in China as tracked by the Shanghai Futures Exchange reached their highest level since the early days of the pandemic in 2020.

The hope is that headwinds in traditional industrial areas will be offset by an ongoing surge in usage in electric vehicles and renewables.

As premiums for the prolific Athabascan Basin (Saskatchewan, Canada) uranium plays continued to soar, punters at the PDAC in Toronto also talked up the possibility of opening up other uranium exploration frontiers in Canada, Africa and elsewhere ahead of another anticipated rise in the spot price which is now hovering around US$95/lb after breaching US$106/lb earlier this year.

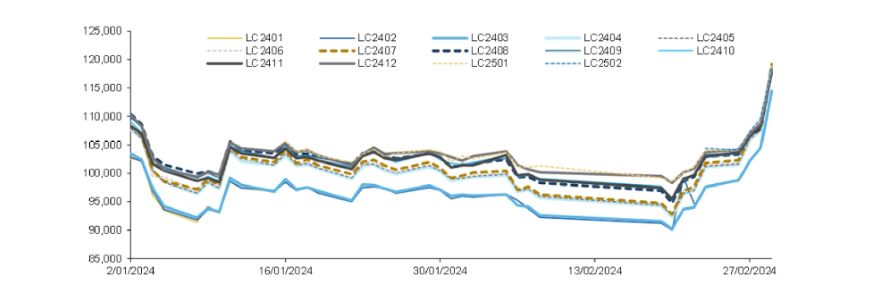

Finally, lithium prices (figure 4) seem to be firming and this has filtered down to equities with a broad rally among explorers and developers.

July contract prices were up 28% in the last week of February and later pulled only <5%, with volatility in equity pricing outshining the underlying commodity. Macquarie Research also pointed out that with a view that lithium prices had bottomed, producers such as IGO have changed their pricing mechanism from M-1 to M+1. The price rally according to Macquarie Research seems to be due to the recent lithium stock rally where futures prices outperformed spot lithium prices by >15% in the last week of February.

As is my custom, we followed on our hard work at PDAC with some personal development time on the slopes of Park City, Utah. Nothing like powder and bright sunshine to bond the party faithful.

This was followed by a visit to the Tabernacle in Salt Lake City to seek salvation from the sins of the last 12 months.

Mind you the soft market for juniors last year wasn’t particularly conducive for bad behaviour.

Unfortunately, after I asked my host which of the 24 doors leading into the Tabernacle was reserved for entry by alcoholics, my spiritual journey came to an abrupt end.

New Ideas: Emerging producer

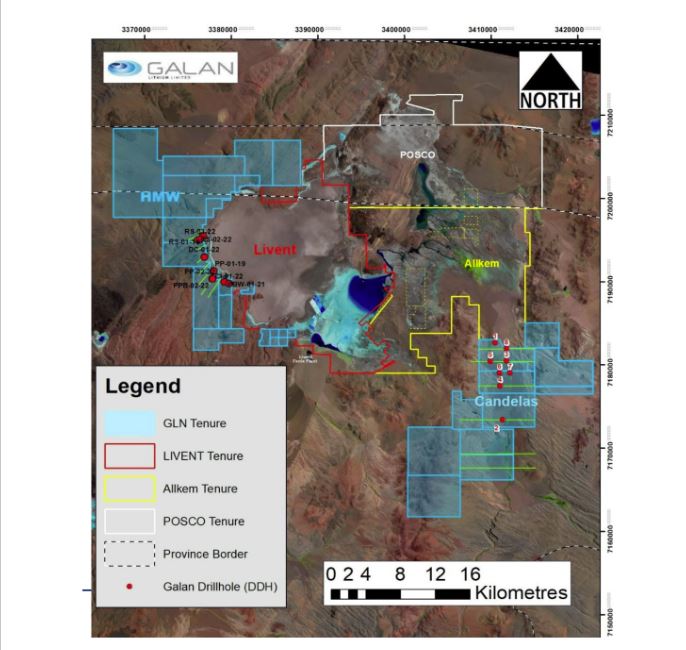

Galan Lithium (ASX:GLN) is developing two lithium brine projects in Argentina namely Hombre Muerto West (HMW) and Candelas, both situated in the Hombre Muerto salar in Argentina, within the ‘lithium triangle’.

The area (figure 6) is home to a number of operations including El Fenix lithium (Livent Corporation) and Sal de Vida (Allkem) and Sal de Oro (POSCO).

The company is planning a two-staged development up to 60ktpa (Phase 1: 5.4ktpa) from a 7.2Mt JORC Resource @ 852 mg/l with significant potential to expand.

While each brine project has its own unique set of operating parameters, the lithium triangle is host to some of the highest grade and lowest purity brines.

In late February GLN (figure 7) announced that pond 1 earthworks and liner installation (2.4kms in length) were complete with filling of the remainder of pond 1 underway.

The evaporation process also commenced with the construction of Pond 2 underway. Nine production wells have also been constructed.

All in sustaining costs are in the 1st quartile of lithium industry’s cost curve with lithium carbonate hovering around US$15,000/tonne, operating costs of $US3,510/t gives us an NPV8 in the region of US$250m ($384m), which equates to some upside based on the current market capitalisation of $155m.

More specifically, if Phase 1 rolls out as scheduled and based on current lithium carbonate prices, I would expect to the stock to drift back to 80 cents and over the next 12 months or so.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.