Guy on Rocks: Palladium to notch up a decade of supply deficits

Pic: DKosig / iStock / Getty Images Plus via Getty Images

Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week.

Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market ructions

Gold had its fourth straight positive week, touching $US1,910/oz ($2,479/oz) on Wednesday before finishing at $US1,903/oz – up $US5 year to date. Silver also finished up, gaining 42c and closing at $US27.92.

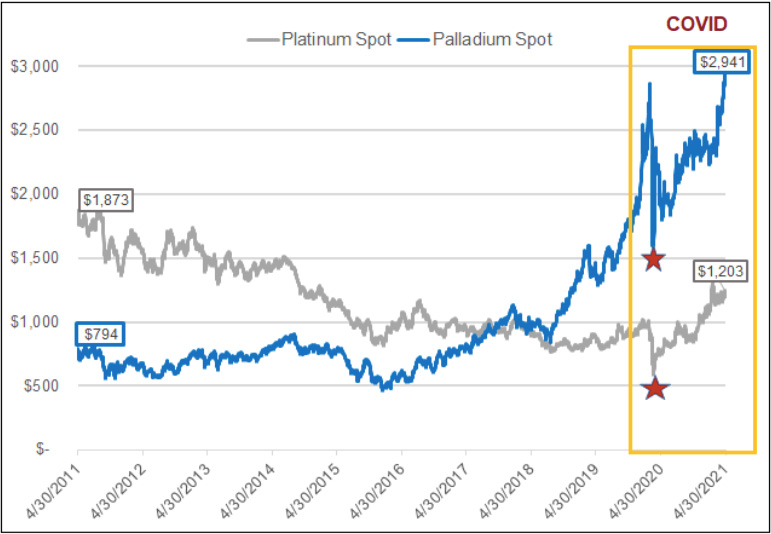

Platinum was up $US14 to $US1,176, while this year’s star performer, palladium, climbed another 5 per cent to $US2,720 (figure 1).

Eighty-five per cent of palladium demand is attributable to auto production (mostly auto catalysts used for catalytic converters), while platinum is used in a range of industrial applications as well as investment demand and jewellery production.

Also driving demand for palladium is the structural deficit whereby demand is exceeding combined primary and secondary supplies, despite record recoveries of palladium from auto scrap and higher output from South Africa. According to Sprott Insights, it is likely to be the 10th consecutive year that palladium supply is in a deficit.

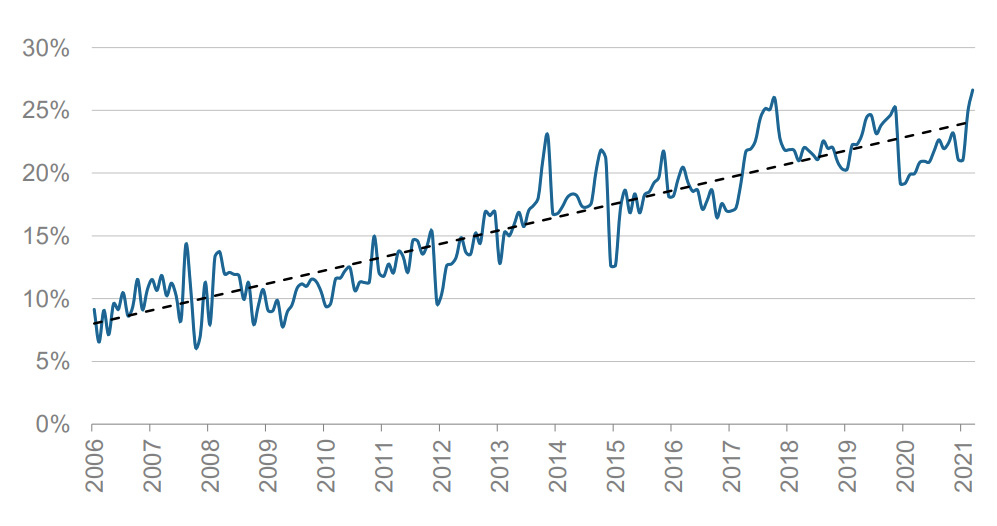

Copper was up 10c to close the week at $US4.60/lb, with Citi’s China copper end-user tracker (CCET) up 11 per cent in April in contrast to the 10 per cent year-on-year decline in refined copper demand, suggesting material destocking of refined copper in downstream sectors.

Further supply side pressures for copper are looming, with workers at BHP’s (ASX:BHP) remote operations centre in Chile rejecting the company’s latest wage offer and walking off the job last week.

Higher costs resulting from Chile’s constitutional reform, a higher tax burden from a more moderate version of the current royalty bill, is also likely to put further pressure on copper supply. It appears the overall regulatory and fiscal landscape in Chile is becoming more challenging, particularly around labour, water, land and environmental rights currently being debated in parliament.

China’s steel consumption rose 10 per cent year on year in April (+18.5 per cent in March), with net steel exports up 28 per cent year on year. Iron ore imports in April rose 3 per cent year on year. Given China’s tightened control on steel capacity swap and stringent requirements on emission reductions, we expect the lower steel production to reduce export volumes.

Scrap (figure 3) has played an important role in Chinese steel production, accounting for 98 million tonnes in April, in spite of the country’s focus on curbing its steel emissions.

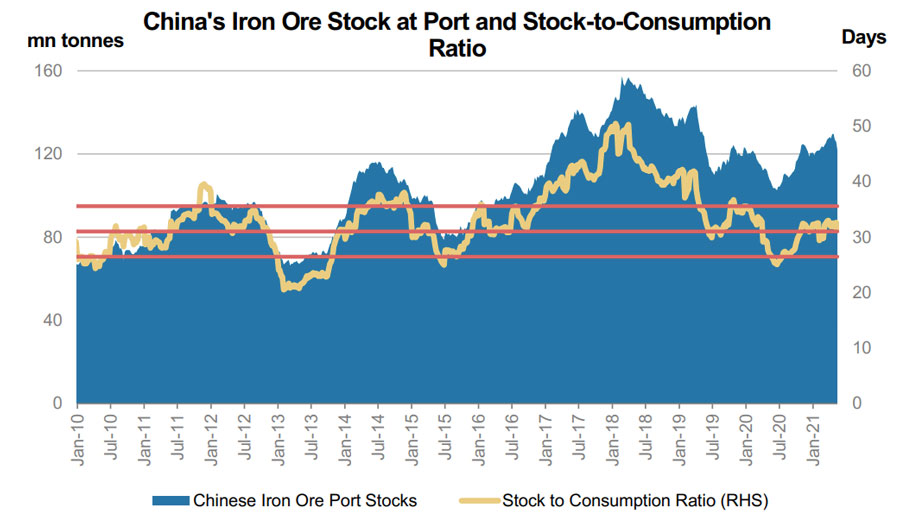

Tangshan’s curbs in steel production and high steel margins have continued to contribute to China’s scrap consumption. The increasing use of scrap should help to keep a lid on runaway iron ore prices, with iron ore imports falling 16 million tonnes short of China’s annual iron ore consumption this calendar year.

Looking at the scrap to iron price ratio, this currently stands at 3.1x, compared to a long-run average of 3.8x (figure 4).

Morgan Stanley (Commodity Matters, 26 May 2021) notes that while the wider ferrous complex in China is currently retreating from its recent highs, it considers iron ore remains overvalued versus scrap.

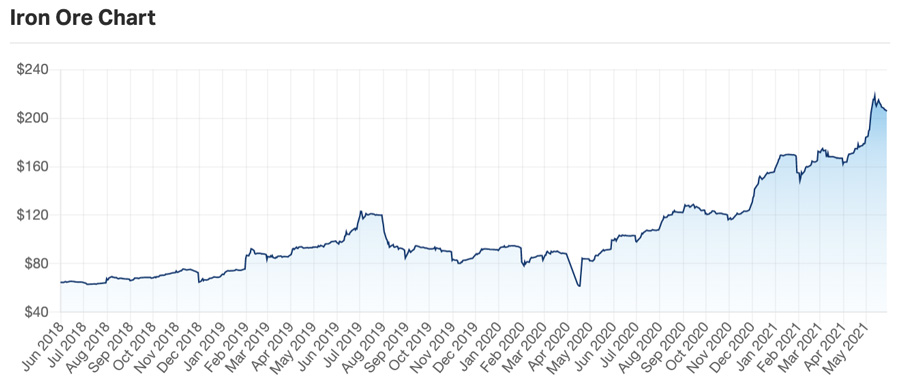

Based on a China steel scrap price of $US583/tonne and the long-run multiple of 3.8x, Morgan Stanley considers fair value for 62 per cent fines would be in the order of $US154/tonne compared to the current spot price of over $US200/tonne, up over 100 per cent year to date (figure 5).

Movers and shakers

First Quantum Minerals (TSE:FM) recently announced the sale of a 30 per cent equity interest in the Ravensthorpe nickel operation (Western Australia) to one of the worlds’ largest steel makers, Korea-based POSCO, for $240m.

First Quantum will retain a 70 per cent interest and continue as operator. The parties also agreed to jointly evaluate the potential for battery precursor materials from the mine.

Since resources were first outlined by Comet Resources (ASX:CRL) in the late 1990s and sold to BHP in 1996, the project has since consumed in excess of $5bn in capital and struggled to live up to nameplate production. Significant problems with grade reconciliation, a poorly configured crushing circuit together with the collapse of an atmospheric leach tank in 2014 were just some of the problems encountered.

Meanwhile, we picked up Eastern Iron (ASX:EFE) (figure 6) late last year as a potential iron ore producer that is currently well down the track to having its 2014 feasibility study (CAPEX $36m, $26/tonne finished product) updated by Perth-based consultants Engenium Pty Ltd.

The plan is to beneficiate ore from Eastern Iron’s 9.05 million tonne at 50.8 per cent iron JORC resource (table 1) to 58 per cent fines (currently trading at a 25 per cent discount to the 62 per cent fines price) and then transport the ore by road 234km to the Port of Eden.

The company recently completed a placement/rights issue at $0.008/share and currently has about $2m in cash.

Based on the current spot price of iron ore, I think the numbers are going to look pretty good, and with a low enterprise value (EV) around $7.5m and potential to generate in excess of $1bn in revenue over a seven-year mine life (based on the 2014 study), there could be a bit of upside left here.

Elsewhere other junior iron ore producers such as Fenix Resources Ltd (ASX: FEX) and GWR Group Ltd (ASX:GWR) have come off the boil somewhat (figures 7 and 8), reflecting some uncertainty regarding iron ore prices in the short to medium term.

Talk of China replacing 60 per cent of its supply from existing Australian producers however is just that, talk!

Hot stocks to watch

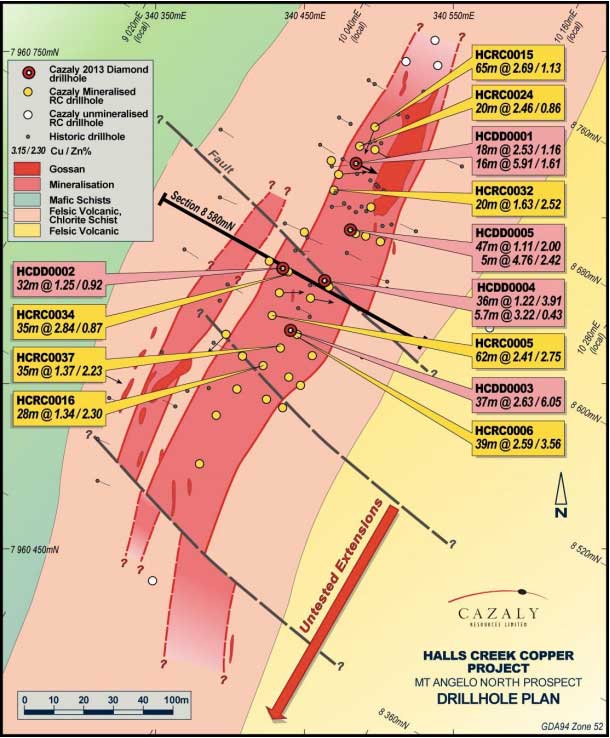

Cazaly Resources (ASX:CAZ) (figure 9) is cashed up with around $9m in the tin (EV of $13m) and looking to take a big swing at this Halls Creek Copper project (figure 10) situated in the Kimberley (Western Australia).

(Source: CAZ ASX Announcement, 27 May 2021)

Drilling contractors and geophysical ground crews have been secured, with reverse circulation pre-collars starting this week followed up by diamond tails.

The 10-hole program will test a strong downhole EM (DHEM) conductor (along with other targets) at the Mount Angelo North prospect including possible volcanogenic massive sulphide (VMS) strike extensions to the north. A previously identified induced polarisation (IP) anomaly will also be followed up.

The project has scale, covering about 45sqkm, and includes the Mount Angelo copper-zinc deposit.

Previous exploration by CAZ returned some encouraging intersections, including 64m at 2.72 per cent copper (1.13 per cent zinc), 62m at 2.41 per cent copper (2.75 per cent zinc), 37m at 2.63 per cent copper (6.05 per cent zinc), 16m at 5.91 per copper and 18m at 2.53 per cent copper.

CAZ has a portfolio of other projects including a 30 per cent interest (Pathfinder Resources ASX:PF1 70 per cent) in the Hamersley iron ore project (JORC inferred and indicated resources of 343.2 million tonnes at 57 per cent iron) and applications covering around 2,600sqkm in the Ashburton Basin (Western Australia) prospective for gold.

Managing director Nathan McMahon is an experienced geologist and company director who also doesn’t mind taking on the big end of town if required – in 2008 CAZ finally lost its bid to secure Rio Tinto’s (ASX:RIO) Shovelanna iron ore deposit). Let’s hope he comes up with the big prize this time.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.