Guy on Rocks: Now this is a proper over the shoulder golden boulder holder

It's a ring shot! Picture: Getty Images

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: What happened last week

Copper (US$3.89/lb) and nickel (US$10.46) were slightly weaker last week as we saw a number of banking bailouts and wild volatility in bond markets. The VIX has also had a wild ride hitting just under 30 on Wednesday before pulling back to 22 on Friday.

Mid-week the 11 US banks stumped up US$30 billion for First Republic Bank and US$54 billion was advanced by the Suisse Central Bank to prop up Credit Suisse. Earlier in the week it was the US’ 16th largest bank, namely the Silicon Valley Bank (SVB) with US$118 billion under management collapsing after a classic run on the bank as depositors raced to withdraw funds; the US government later committed to step in and underwrite depositors’ funds.

The failure of SVB, according to Matthew Piepenburg, author of Gold Matters: Real Solutions to Surreal Risks, was due in large part to its poor management of interest rate risk in the wake of 450 basis points over the past 12 months. This increased the opportunity cost of holding bank deposits when depositors could earn a better and safer yield by holding US Treasuries.

“As these depositors started to take their money out, banks like SVB or Silvergate were forced to sell assets to meet depositor demands,” Piepenburg explained.

For those looking for a pause in interest rates it looks like the SVB collapse, together with the First Republic and Credit Suisse bailouts (and now, buyouts), has given Federal Reserve Chairman Jerome Powell all the ammunition he needed. Powell had previously signalled a hike of 25 to 50 basis points in March, however that looks more like a donut is coming up; a big sigh of relief for struggling mortgage holders. Concern about the contagion effects of SVB’s collapse are likely to compel the Fed to pause its rate hikes.

On the back of the unfolding banking liquidity crisis, Piepenburg believes that gold will continue to rise (and therefore act as an effective hedge) as the US dollar declines. Gold is therefore set to “rip”, and indeed, yesterday we saw it hit an AUD all-time high. This is in contrast to 2022 where gold was inversely correlated with the USD index.

Unlike previous bailouts it appears that the Federal Deposit Insurance Corporation, are guaranteeing all SVB and Signature Bank’s depositors. This contrasts with the usual practice of insuring depositors’ funds of up to US$250,000. A further US$25 billion has also been provided by the Bank Term Lending Program (BTLP) from the US Treasury to shore up liquidity in the US banking system.

Important economic news out last week included the CPI which was running at an annualised rate of 6.0% down from 6.4% in January so at least it is heading in the right direction.

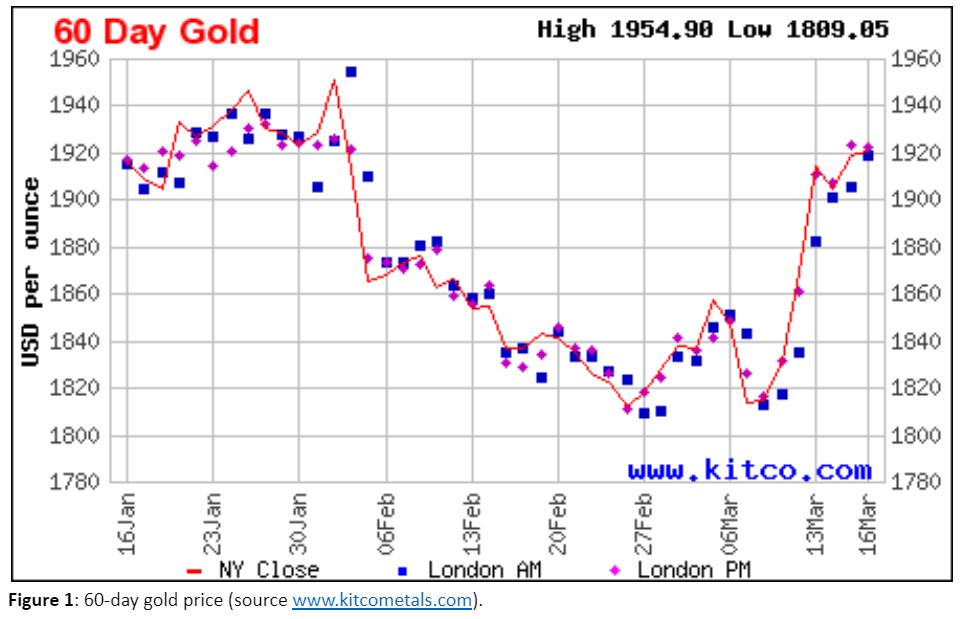

In response to the unfolding liquidity crisis in the banking sector, gold prices rallied to a six-week high Monday (figure 1) to US$1,913 before pushing through to US$1,969 at the time of writing. Gold crashed through a record high of A$2900/oz yesterday; good news for the Australian gold producers who have been under immense cost pressures over the last 12 months or so.

All eyes on the FOMC meeting next week followed by a statement from Chairman Jerome Powell on 22nd March.

New Ideas: Buy gold and hold

Great Boulder Resources (ASX:GBR) is a Western Australian based gold explorer led by exploration manager and geologist Daniel Doran (I think Due Diligence was his real name but Dan Doran seemed a better stage name; I would have gone with Bobby Darin, after the great singer).

It’s about to commence an aggressive RC and diamond program at its 100% owned Side Well and recently acquired Gnaweeda Projects near Meekatharra in the northern Yilgarn Province. The company has just come out of a trading halt after raising $1.5 million at 8.2 cents ahead of a 1:10 rights issue to raise $3.5 million on the same terms.

The projects (figure 3) are situated not far from Westgold Resources’ (ASX:WGX) Bluebird mill (1.6Mtpa) and Superior Gold’s (TSX.V:SGI) Plutonic mill (1.8Mtpa). The company has outlined around 66.2Mt @ 2.6g/t gold for 518,000 ounces and believes it is well on its way to 1Moz.

Meekatharra, as the Stockhead faithful know, has been a prolific producer with past production of around 4Moz of gold and remaining resources of around 2.8Moz.

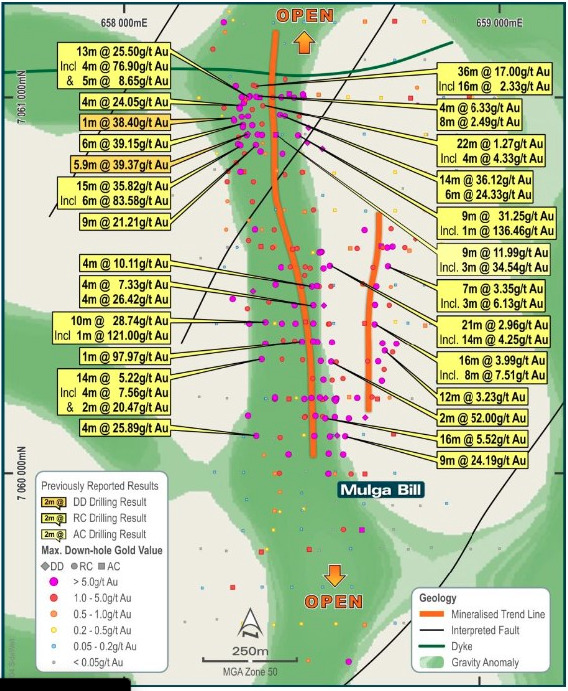

There are a number of highly prospective prospects within the tenement package including Mulga (figure 4) which has returned multiple high-grade hits including;

- 14m @ 36.12g/t Au from 91m incl. 3m @ 149.89g/t Au from 91m

- 15m @ 35.82g/t Au from 88m incl. 6m @ 83.58g/t Au from 92m

- 8m @ 54.60g/t Au from 120m

- 6m @ 39.15g/t Au from 101m incl. 3m @ 74.51g/t Au from 91m

- 5.9m @ 39.37g/t Au from 84.3m incl. 3.6m @ 63.79g/t Au from 85.4m

- 13m @ 25.50g/t Au from 96m, incl. 4m @ 76.9g/t from 100m

You can see a bit more merger and activity around the Meekatharra region and I think GBR could be front and centre of that if it can deliver on its 1Moz JORC Resource target. At a market capitalisation on just under $40 million, yet another good quality WA gold explorer to accumulate as we prepare for a golden year here in the West.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.