Guy on Rocks: Mining uptick still has a lot of road left

There's a long way to go in the current mining cycle says Guy Le Page. Image: GettyImages

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week.

Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market ructions

Hints the US plans to roll out more fiscal stimulus is likely to buoy the market.

“The extent of the fiscal stimulus looks like it’s going to be increased in the US so that would probably give the US market a lift, obviously increasing the deficit and increasing the overall risk,” Guy Le Page told Stockhead.

The Australian dollar has also strengthened in the last few weeks in line with the rising commodity prices.

“I think that is a trend that looks to continue,” Le Page said. “I think the outlook for the Australian dollar is to probably march back towards 80c in the next few months.”

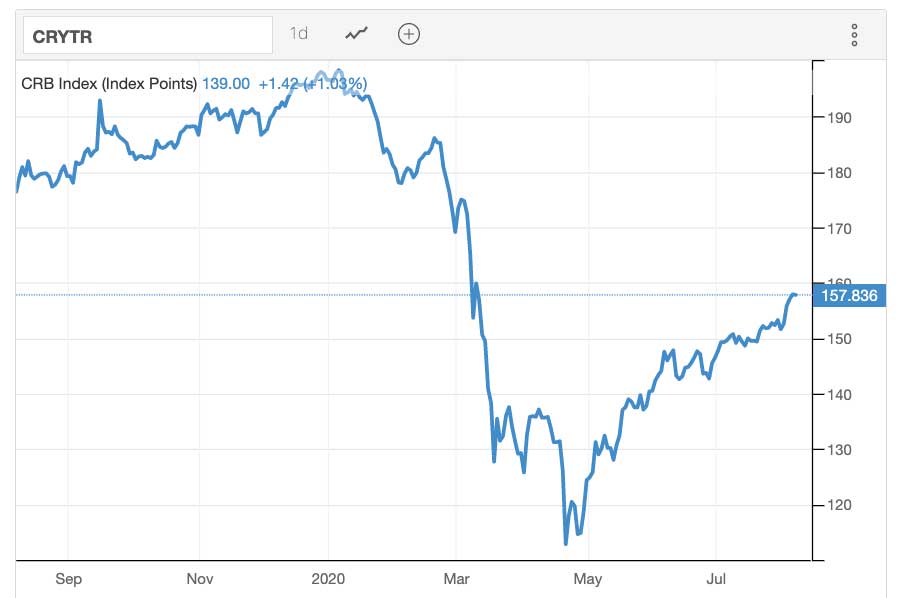

The CRB Commodity Index, which comprises 19 commodities, meanwhile has started to head back up after dipping to around 124 points at the peak of the COVID pandemic. It has since risen around 27 per cent to over 157 points.

“If we look at the last cycle, we had a 33 per cent lift from November 2015 to June 2018 and I think we’ve had a fairly modest lift in that index recently,” Le Page said.

“I think what that’s telling us, and we’ve been saying it for a while, is that there’s a long way to go in the cycle.”

In the previous cycle, the index went from around 212 points in early 2009 to 370 points in April 2011.

The other big news this week was the gold price smashing through a new record to over $US2070 ($2851) an ounce.

“There’s no end to that at the moment,” Le Page said.

Hot stocks to watch

Le Page believes the next phase of this mining boom will firmly place the focus on good base metals plays, but like their gold counterparts, good value base metals stocks are “looking very hard to find”.

One Le Page thinks is “unloved” but “quite interesting” is Cobre (ASX:CBE). The stock made an impression on its ASX debut earlier this year when it listed at 20c and gained 33 per cent, but has since dipped as low as 14c. It’s trading around 16c at the moment.

Le Page says Cobre is “pretty well cashed up and starting to get some pretty decent results”.

Cobre has its foot on a volcanogenic massive sulphide (VMS) copper-zinc-gold-silver target in Western Australia.

Recent drilling at the Schwabe prospect has delivered hits of 6m at 8.39 per cent copper, 3.52 per cent zinc, 30 grams per tonne (g/t) silver, 0.14 per cent cobalt and 3.1g/t gold from just 49m below surface.

“They’ve got more drilling happening right now, continuing to get more high-grade results. But the thing I like about it is most of the money was set (in the IPO) at 20c, so it’s trading at a 25 per cent drop. The market hasn’t really picked up on these sort of polymetallic VMS stories at the moment,” Le Page explained.

“Most of this drilling is in the oxide zone from what I can work out, so it will be interesting to see what the fresh rock brings. But they’ve had pretty impressive results, and a fairly lacklustre response from the market.”

Le Page says preliminary drilling indicates the prospect is open along strike and at depth but has never previously been drilled.

“There have been some small shafts put down in this mineralisation before but never any serious exploration,” he noted.

“They had about $7m in cash at the end of the quarter with a cap of just under $10m. So a pretty unloved stock. I think it’s very cheap.”

Cobre (ASX:CBE) share price chart

Caeneus Minerals (ASX:CAD), meanwhile, is in a trading halt pending a corporate update.

The company has ground adjoining De Grey Mining’s (ASX:DEG) landholding in the Pilbara region of Western Australia.

“De Grey has had some more impressive results at Aquila – 16m at 3.7 grams, 16m at 2 grams,” Le Page said.

“On the back of those results we’ve seen a bit of a lift in De Grey. But I also noticed that Caeneus who has the adjoining ground to the northwest is in a trading halt pending an update. So we’ll await that.”

Le Page said Venture Minerals (ASX:VMS), one of his earlier picks, is also still looking “cheap” at around 3c.

He sees the company climbing to around 6-7c, particularly after this week announcing potential extensions to its Golden Grove copper-lead-zinc-silver-gold project in Western Australia, as well as the potential for near-term cash flow from the small but high-grade Riley iron ore project in Tasmania.

CAD, DEG, VMS, share price charts

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada and the United States.

At Stockhead, we tell it like it is. While De Grey Mining is a Stockhead advertiser, it did not sponsor this article.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.