Guy on Rocks: Mine strikes are putting 7pc of global copper supply at risk

Photo by Steve Eason/Getty Images

Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions

A fairly rough week across precious metals in particular, with gold off US$70 to US$1,761 per ounce on the back of rising bond yields (up to 1.3% by late in the week from 1.19% last Monday) and a strong jobs report in the US (adding 943,000 jobs in July against consensus estimates of 870,000).

Add to that further talk of tapering by the Federal Reserve.

Platinum was also down 6.5% to US$974 per ounces and palladium down US$24 or 1.5% to close at US$2,563 per ounce.

The Kitco News gold survey of 15 Wall Street types found 13 — or 87% — calling gold lower, with only two analysts suggesting a sideways trading pattern for the medium term.

The Main Street polls covering 1,128 votes saw 603 participants (53%) forecasting a rise in gold this week, 305 (27%) lower while 220 (20%) thought gold would be unchanged.

Copper closed at US$4.31/pound on the back of virus concerns in Asia, with China locking down 46 cities and the lockdown spreading to Indonesia and Japan.

Uranium also followed the broader metals market down, finishing off 1.5% to US$31.88/pound.

Looking forward, copper futures remain strong, perhaps spurred on by strike action in Chile after unions at Codelco‘s 200ktpa Andina mine, Lumina Copper’s 150ktpa Caserones mine and BHP‘s 1Mtpa Escondida operation.

Workers went on strike after knocking back collective contract offers. This has put around 3.75kt Cu output per day or 7% of global supply at risk.

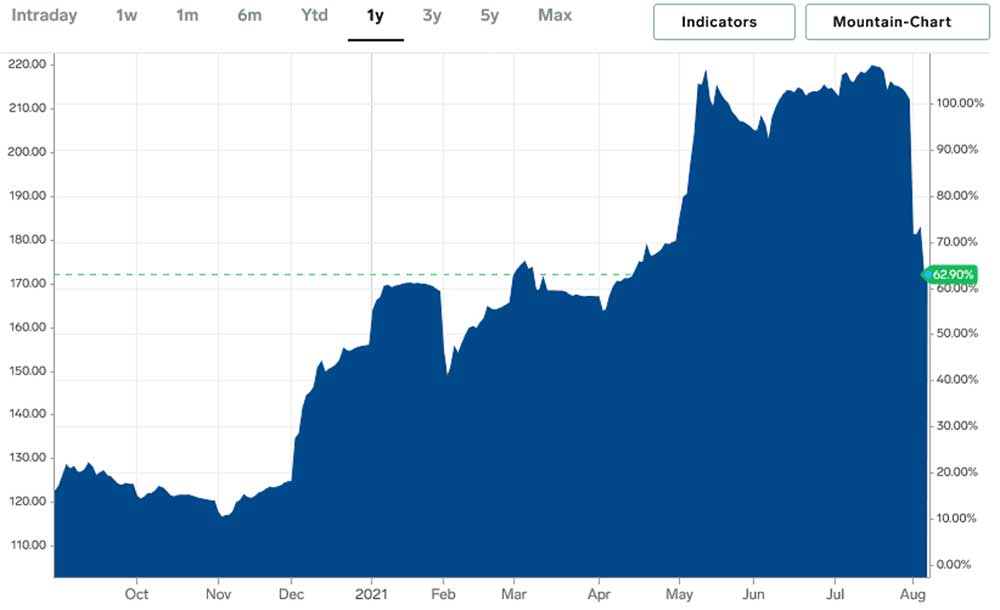

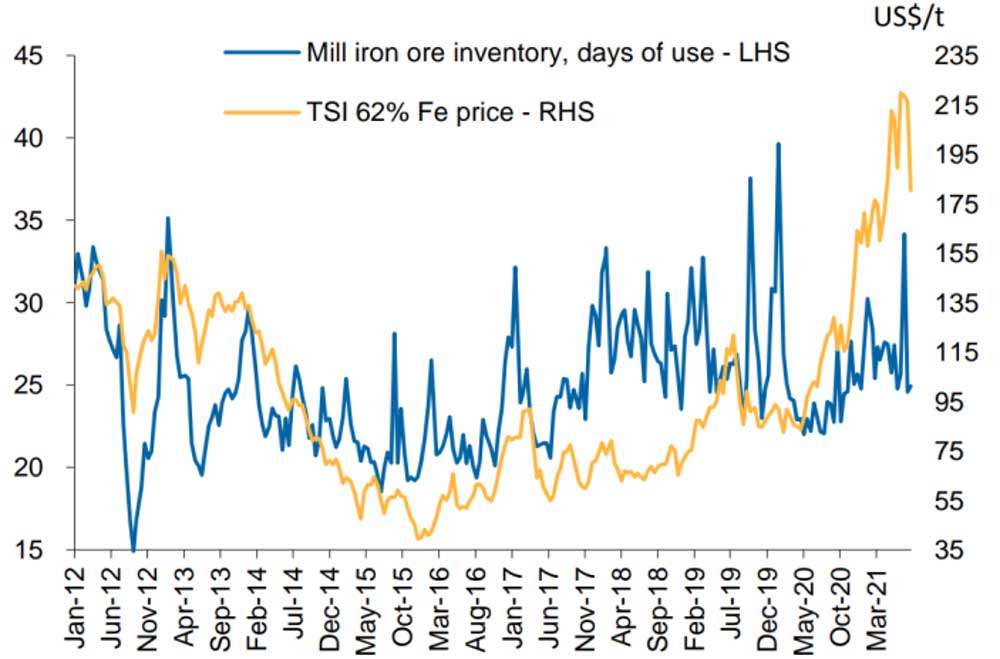

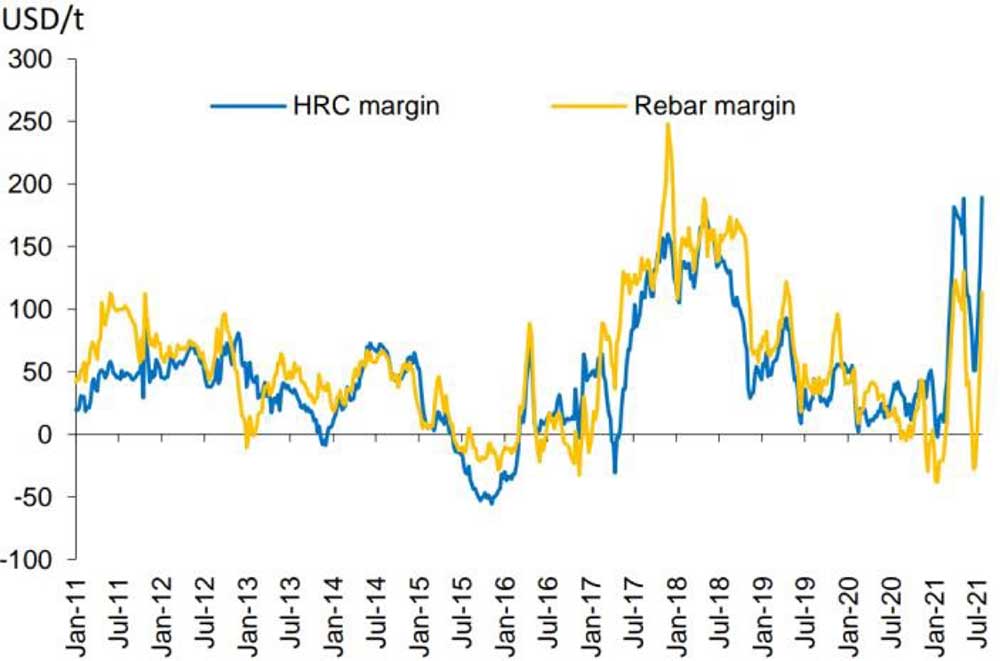

The last week or so has seen Chinese steel margins improve (figure 4) with HRC and Rebar margins touching multi-year highs with iron ore sitting at around US$172/tonne (figure 3).

Steel mills kept fairly flat iron ore inventories over recent weeks (figure 5), with volumes at approximately 1.1% (Macquarie Research, Global Iron Ore Miners, 2nd August 2021).

The declining Australian dollar, which has come off from US$0.797 to US$0.735 over CY 2021, has cushioned Australian producers who are still receiving $234/tonne (62% fines), down from its peak of just under A$280/tonne.

How aggressive the Chinese will be with regard to enforcing production cuts remains to be seen.

Company News

Diggers and Dealers concluded as it started — with a heavy emphasis on battery metals, ESG and sustainability with a few gold and uranium plays.

Gold stocks presenting included St Barbara Mines Ltd (ASX:SBM), who are looking to grow operations through the open pit projects at Atlantic, lifting underground mining rates (and open pit optionality) at Gwalia and bringing the Simberi Sulphide project on line.

Gold Road Resources Ltd (ASX:GOR) is moving to 350Koz per annum at Gruyere through the upgrade and various processing improvements. A resource upgrade is due out late in CY 2021.

Kim Massey from WA gold producer Capricorn Metals Ltd (ASX:CMM) provided a compelling presentation highlighting +110-125k oz per annum operation over a 10-year mine life at Karlawinda which was commissioned in June 2021 and is targeting steady state gold production in September 2021.

Well done to Independence Group Ltd (ASX:IGO) for receiving ‘Dealer of the Year’ as it transitioned to more of a battery metals player, divesting its 30% interest in Tropicana Gold project and forming a new lithium JV with Tianqui Lithium Corporation at the Kwinana lithium hydroxide refinery and its purchase of a 24.9% interest in the Greenbushes lithium mine.

West African Resources Ltd (ASX:WAF) won the ‘Digger of the Year’ award based on their excellent work at the Sanbrado gold mine in Burkina Faso which poured its first gold in March last year, producing at more than 250,000 ounces per year throughout the COVID-19 pandemic.

Overall a bullish sentiment at Diggers this year, with plenty of exploration and development activity as the tailwinds of the bull market take the miners to the next level.

I think the conference was also good practice for when WA splits from the rest of the country as the Diggers attendees proved they could have a successful conference without any outside pollution courtesy of the Australia-wide and global travel restrictions.

Maybe the new Australia (sans WA) could sell Tasmania and South Australia to New Zealand (or China) to replace some of the iron ore revenue from the West.

(Ed: *cough* six-quarter streak)

A ground-breaking idea that I am sure will gather momentum at Cigar Social, where the intelligentsia gather…

I picked up Aldoro Resources Ltd (ASX:ARN) (figure 8) in early February 2021 at around 26 cents which closed up 14% on 9 August at 54 cents on the announcement of the second hole at the VC1 target within the Narndee Igneous Complex hit massive nickel-copper sulphides.

A third hole is due to be drilled around 85m south chasing further massive sulphides up-plunge from the 2nd hole.

Azure Minerals Limited (ASX:AZS) (figure 9) has completed 62 holes for just under 29,000 metres at the Andover Ni-Cu Project with recent drilling appearing to confirm continuity of mineralisation over a 550m x 300m zone including massive sulphides at VC-07 West.

Better results included ANDD0045 with 4.5m @ 3.95% Ni, 0.80% Cu and 0.16% Co from 486.6m downhole, and 7.5m @ 1.39% Ni, 0.45% Cu and 0.06% Co from 601.6m downhole.

Strike Resources Ltd (ASX:SRK)(figure 10) is about to commence shipping iron ore from their high grade (65% Fe) Apurimac Premium Lump DSO operation in Peru with estimated operating costs of US$80/tonne and a planned ramp-up to 250,000 tonnes per annum.

In addition, the Department of Mining, Industry Regulation and Safety (DMIRS) has approved the 1.5mtpa mining plan at the Paulsen’s East Iron Ore Mine (Western Australia) with the first shipment targeted for early CY 2022.

SRK is also finalising port allocations and offtake agreements ahead of a financial investment decision in late 2H 2021. Let’s hope the iron ore price holds up, but at current levels (A$233/tonne for 62% fines), there is plenty of margin to play with.

New Ideas

Pantera Minerals Ltd (ASX: PFE) (figure 11) is a recent float (2 August 2021) on ASX raising $7.0 million at 20 cents managed by PAC Partners. The company has an enterprise value of around $17 million (undiluted).

The main interest is the Yampi Iron Project covering 620 sq km that sits on the contact between the Elgee Siltstone and Yampi Formation known to host high-grade hematite mineralisation at Koolan and Cockatoo Island.

Numerous outcrops of haematitic sandstone and massive hematite have been identified around this contact grading from 40 to 68% Fe.

A contact between the Warton Sandstone and the Elgee Siltstone also occurs on the tenement and is known to host strataform and gossanous copper and the Hart Dolerite that is known to host magmatic Ni-Cu deposits.

Early days but I think the company is going to hit the ground hard so expect some pretty good news flow in 2H 2021.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.