Guy on Rocks: Looking for cheap, cute and cuddly ASX graphite project developers? Here’s one.

Pic: Lucy Lambriex, DigitalVision/ Via Getty Images

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions

Gold closed the week up marginally at US$1,717/oz for a 0.40% gain for the week while silver reversed earlier slides finishing up 4.5% to US$18.80/oz.

Gold investors will be watching the US Consumer Price Index (Tuesday) and inflation expectations from the University of Michigan this week. August US retail sales will follow later in the week. You would think weak economic data would have to put pressure on the USD.

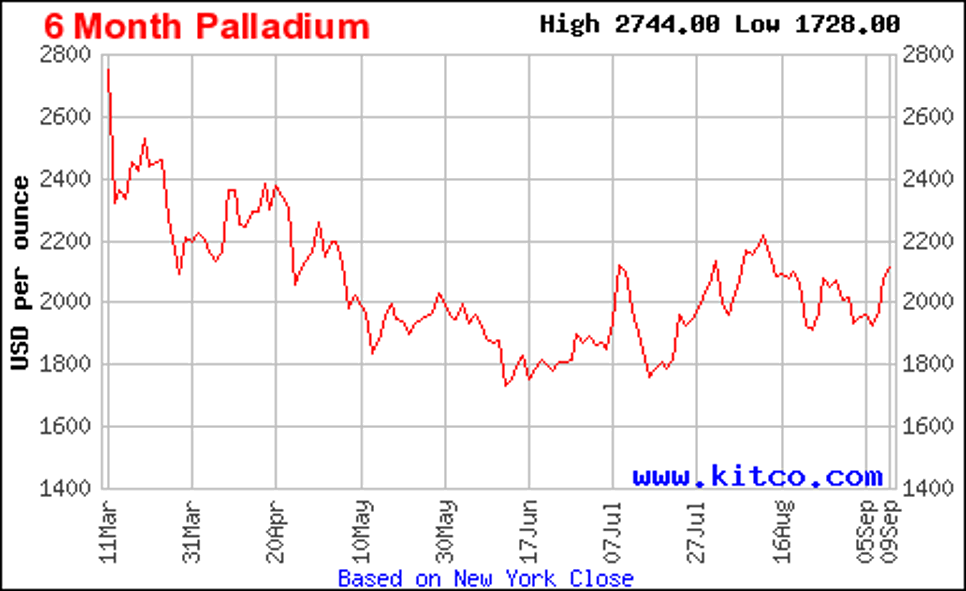

The big movers however in the precious metals space last week were platinum which finished at US$880/Oz, a 5.5% increase and palladium (figure 1) which surged 8.3% to finish at US$2,106/oz; its highest close in over a month.

With Russia producing 40% of the world’s palladium there are certainly going to be questions regarding ongoing supply security while automotive demand for palladium in China is forecast to hit a record high of more than 2.5 million ounces in 2022 (Heraeus Precious Metals, September 2022).

The biggest threat to further palladium price appreciation is clearly platinum substitution by automotive producers.

US futures are now pricing in an 87% probability of a 75-basis point interest rate increase in the US this month as Federal Reserve chairman Jerome Powell confirmed that heading off inflation remains the top priority.

At the same time the US treasuries yield curve continued to invert further providing more ammunition for many of an impending recession. Two-year yields traded up to 3.575%, the highest since November 2007, with 10-year notes last 3.321%.

The US dollar index however returned its first decline in four weeks closing at 108.35, down from 108.96 last week. This still represents a 24-year high against the yen and a 37-year high against the British pound.

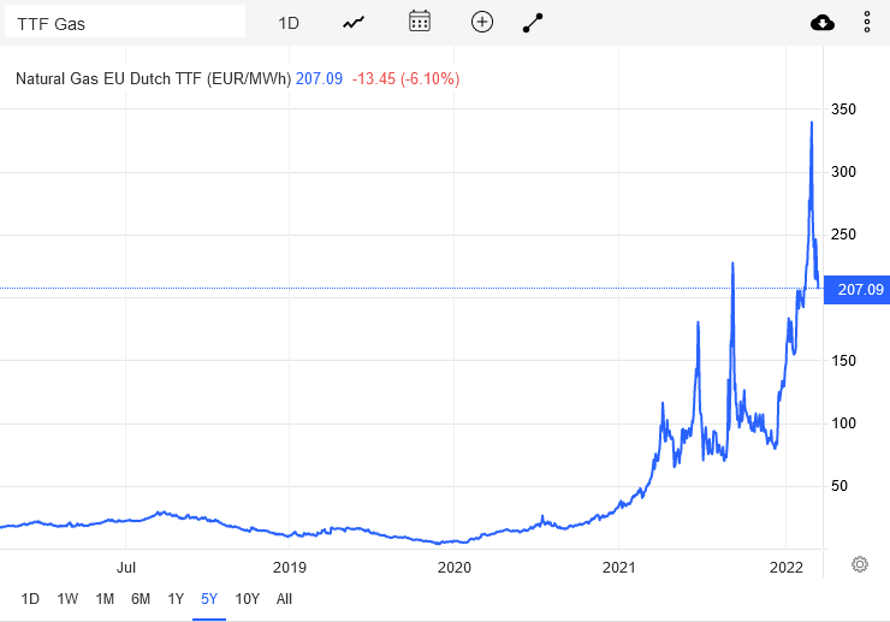

Germany remains in turmoil with the government agreeing to bail out energy supplier Uniper, Germany’s largest gas importer, with a 15-billion-euro (US$15.24 billion) rescue deal as the closure of Nord 1 carrying gas from Russia took its toll.

The bailout will see the German government take a 30% equity stake in Uniper. According to one of the major shareholders, Fortum, the German government may be required to provide additional support in the event that Uniper’s losses exceed 9 billion euros.

Natural gas was trading around 207 euros/megawatt-hour, over 300% higher compared to the same time last year. Not surprisingly Germany’s two-year bond yield hit its highest level since 2011 for a second day in a row.

On the base metal front copper managed to stage a 4.7% gain to close at US$3.56 in spite of growing signs of an economic slowdown, possibly mitigated by reducing inflation and a slowdown in the pace of Federal Reserve rate hikes.

WTI crude touched US$82/bbl and closed at US$86.27 down 0.80% from last week, wiping out all of the gains for FY 2022. As mentioned in this column last week there is some confusion between longer term supply issues in 2023 as the new methane rules are likely to put a major dent in the amount of US oil and gas.

New ideas: Triton Minerals (ASX:TON)

Triton Minerals Ltd (ASX:TON) recently came back on the boards after an $8.50 million capital raising that included $5 million from Chinese metals trading company Shandong Yulong Gold Co. RM Corporate Finance (of which I am a director and shareholder) was the Lead Manager for $3.5 million of this placement.

A 2017 Definitive Feasibility Study on its Mozambique Ancuabe Graphite Project (figure 4) was based on a JORC Ore Reserve of 24.9Mt @ 6.2% TGC and contemplated production of 60,000 tonnes per annum of high-purity large flake graphite over a 27-year mine life. Economics at the time were attractive, returning an unlevered US$298 million Net Present Value based on pre-production CAPEX of just over US$100 million with a 38% internal rate of return.

Since the completion of the DFS, the business model has changed with Shandong and Triton looking to complete a Stage 1 scoping study based on a smaller scale Commercial Pilot Plant (CPP) targeting 100 to 125ktpa of ore, producing 5 to 8ktpa of graphite concentrate.

This will hopefully establish the product in the marketplace before launching into Stage 2 along the lines of the original 2017 DFS (table 1).

A Binding Offtake Agreement has already been signed for Stage 1 production with Chinese graphite products company Yichang Xincheng Graphite Co Ltd, one of the world’s largest producers of high value expandable graphite.

Graphite from the project is suitable for both the flame-retardant materials industry and the lithium-ion battery market.

Both markets are expected to experience very strong demand in the medium to longer term.

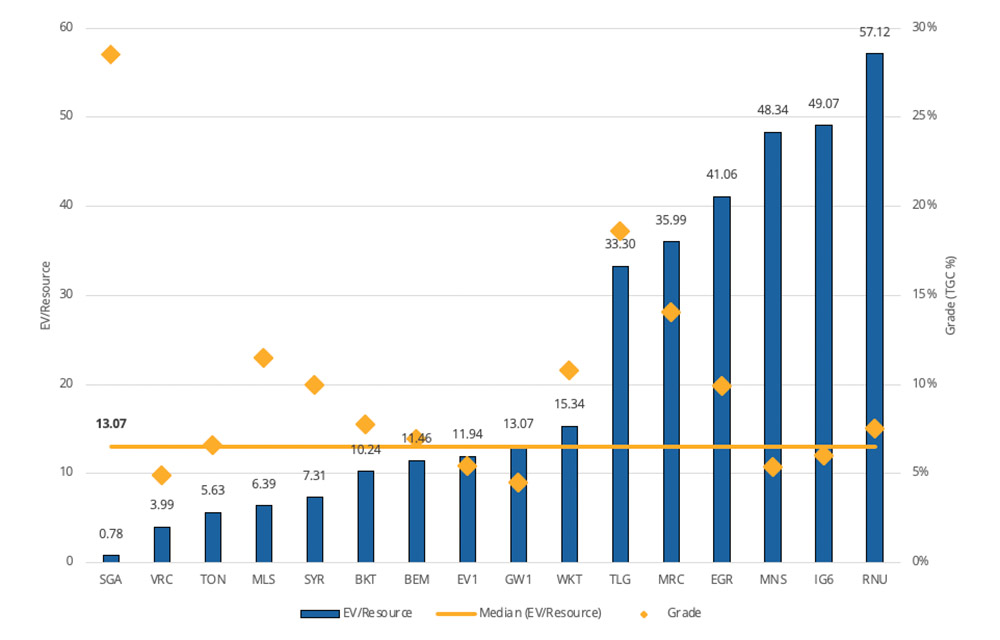

Figure 5 shows TON is trading at a modest EV/Tonne of contained TGC, however the above graph isn’t comparing “apples with apples” due to the different stages of project development and different products and production profiles.

Having said that, at an EV of around $30 million and a strong demand outlook, I am thinking there is a little more upside in TON as it moves down the development pathway and ultimately looks to pursue its Stage 2 production ramp-up.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.