Guy on Rocks: Lithium, rare earth markets still buoyant despite all the doom and gloom

Pic: Khaichuin Sim, Moment/ Via Getty Images

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: More metals pain

Precious and base metals have been hit hard by a rising US dollar in response to warning signs of an impending US recession.

According to the Federal Reserve Bank of Atlanta’s GDP, the US economy is expected to contract by 1% in the second quarter, alarmingly down from the June 27 forecast of +0.3%.

The yield curve between the 10- and two-year bond yields is starting to invert which would also support a recessionary outlook. All supportive for gold longer term in my opinion.

The S&P/ASX Gold index (XGD) is approaching a four-year low (figure 1) while nickel (US$22,500/t) and copper (US$8,070) could edge lower towards the 90th percentile operating cost figures of US$18,000/tonne and US$7,900/tonne (Wood Mackenzie, June 2022) respectively.

The operating margins are clearly tightening however I believe we must be nearing the bottom for both of these metals.

I don’t expect any firm direction on gold until we have confirmation that inflation has peaked; this could be a while off.

The Euro Zone inflation figure of 8.6% for June represented another record high (driven primarily by energy and food prices), so peak inflation could be months off. Inflation excluding food and fuel prices in the Euro Zone accelerated to 4.6% from 4.4%.

China’s manufacturing activity, on the other hand, expanded at its fastest in 13 months in June with a solid rebound in output.

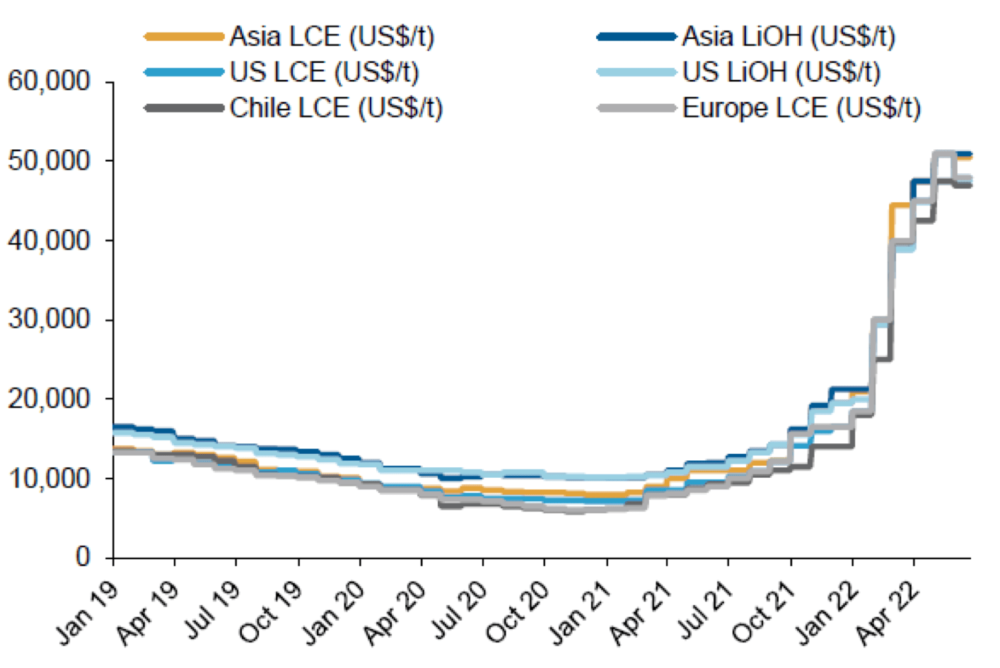

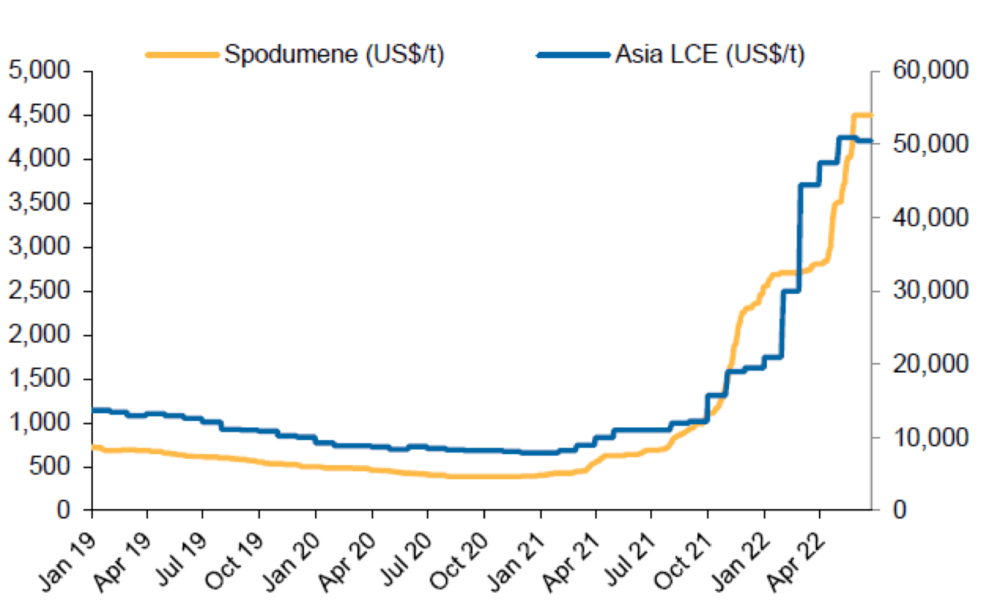

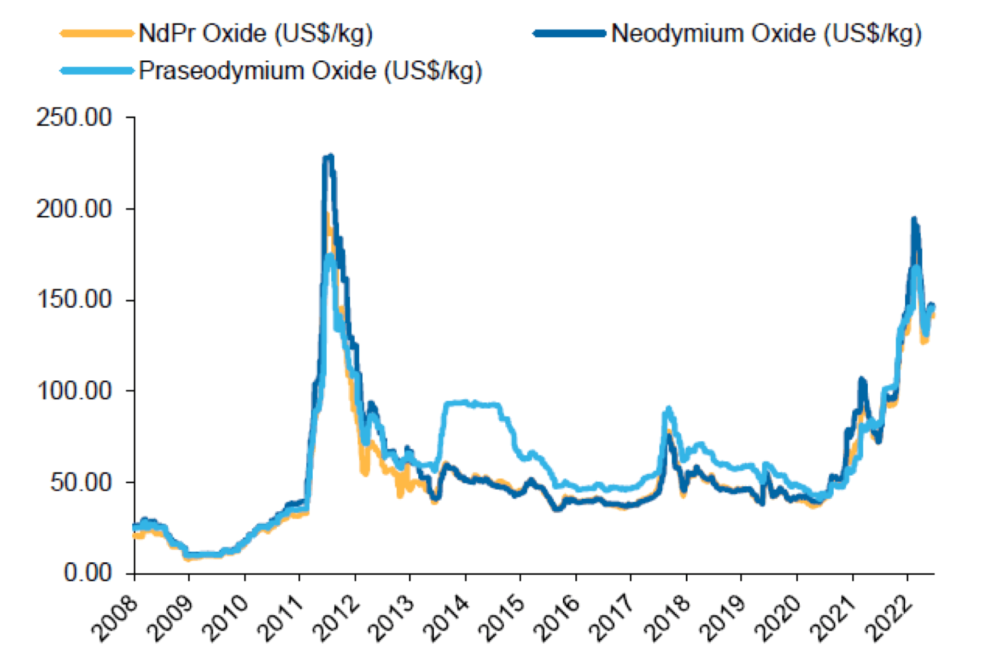

Despite the gloom and doom, lithium (figures 2 and 3) and rare earth (figure 4) markets have remained relatively buoyant.

The lithium market remains very tight with a strong bounce in EV sales as China emerges from the recent lockdown.

Year on year growth in China has been an impressive 113%, 60% in the US and 9% in Europe.

In response to high prices, it seems that mining companies are now looking at alternative processing pathways including direct lithium extraction (“DLE”) and extraction from lepidolite. Both of these processes are unlikely to have much impact on near term supply and do have some technical challenges.

Macquarie (June 2022) is projecting spodumene to remain buoyant and coming off between 8-13% with a peak near term forecast of US$4,900/tonne.

Rare earths have also remained fairly strong with NdPr prices rising to over US$175/kg earlier this year before a sharp decline in response to the China lockdown. Macquarie’s longer-term forecasts remain at US$95/kg.

New ideas

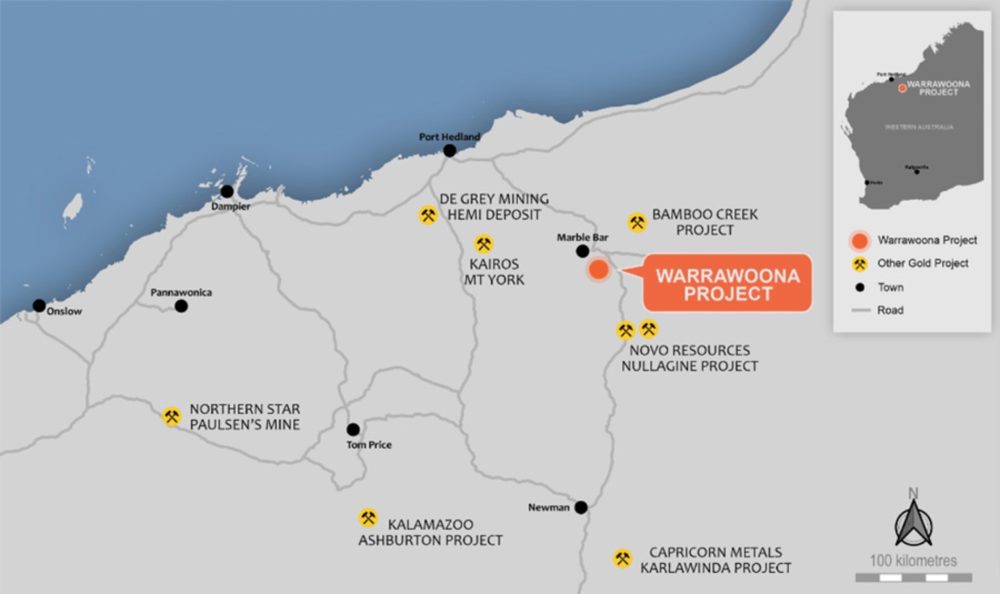

I brought gold developer Calidus Resources (ASX:CAI) to the attention of the Stockhead faithful in May last year as it was commencing earthworks at its 100% owned Warrawoona Project in the Pilbara.

Fast forward to July 2022 and the stock finds itself back around 60 cents after hitting over a dollar in April before an aggressive sell-off in gold shares.

The company is in the process of ramping up production to 90Koz as part of its Stage One development plan and is targeting steady state production by Q3 CY 2022.

Expansion to Stage 2 targeting 2.4Mtpa (gravity and leach circuit) and producing around 110,000 ounces of gold per annum is likely to commence in Q1 2023 on the back of a 547K ounce Reserve and 1.7Moz Resource.

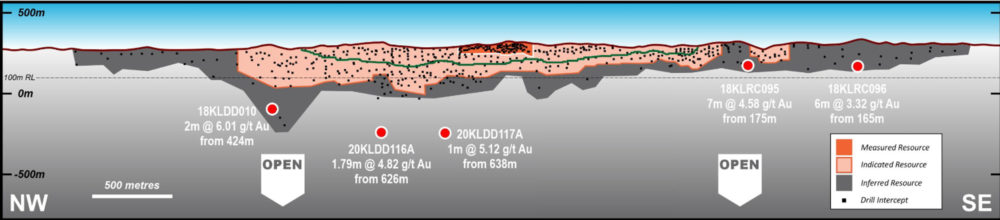

There are excellent prospects of extending the current mine life beyond eight years (figure 7) at Klondyke with very little exploration below 250m depth. Deeper drilling indicates mineralisation persists to at least 450m below the surface.

Euroz – Hartleys valued the stock at A$1.20/share back in May of this year assuming a gold price tailing off to US$1,700 by 2026 and an exchange rate of 73-74 cents.

Given the A$ has come off to around 68 cents I think that valuation has, if anything, ticked up a little.

For those looking at taking a contrarian view to those non-believers in gold, CAI might be a good fit. There are certainly risks associated with any mine commissioning so the market will be taking a very close look at production reports over the next six months…

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.